After its price dip, is Telstra now good value?

Telstra (TLS) is not high on the list of businesses we would most like to own. Having said that, it is not a terrible business, and at the right price it makes sense to own it, particularly given its steady dividend stream. So, with TLS’s share price down around 20 percent over the past year, we decided to assess its value.

One of the appealing features of TLS is its stability. Over many years, the company has delivered consistent revenues at consistent margins for consistent earnings. On the face of it, this should allow us to value the company fairly readily.

However, for several reasons the future for TLS looks different to the past: Firstly, migration to the NBN will take a large bite out of TLS’s fixed-line business, offset somewhat by a series of one-off and recurring payments it will receive from NBN Co. for handing over its copper and HFC networks. Secondly, there is the matter of TPG Telecom (TPM) planning to become Australia’s fourth mobile network operator.

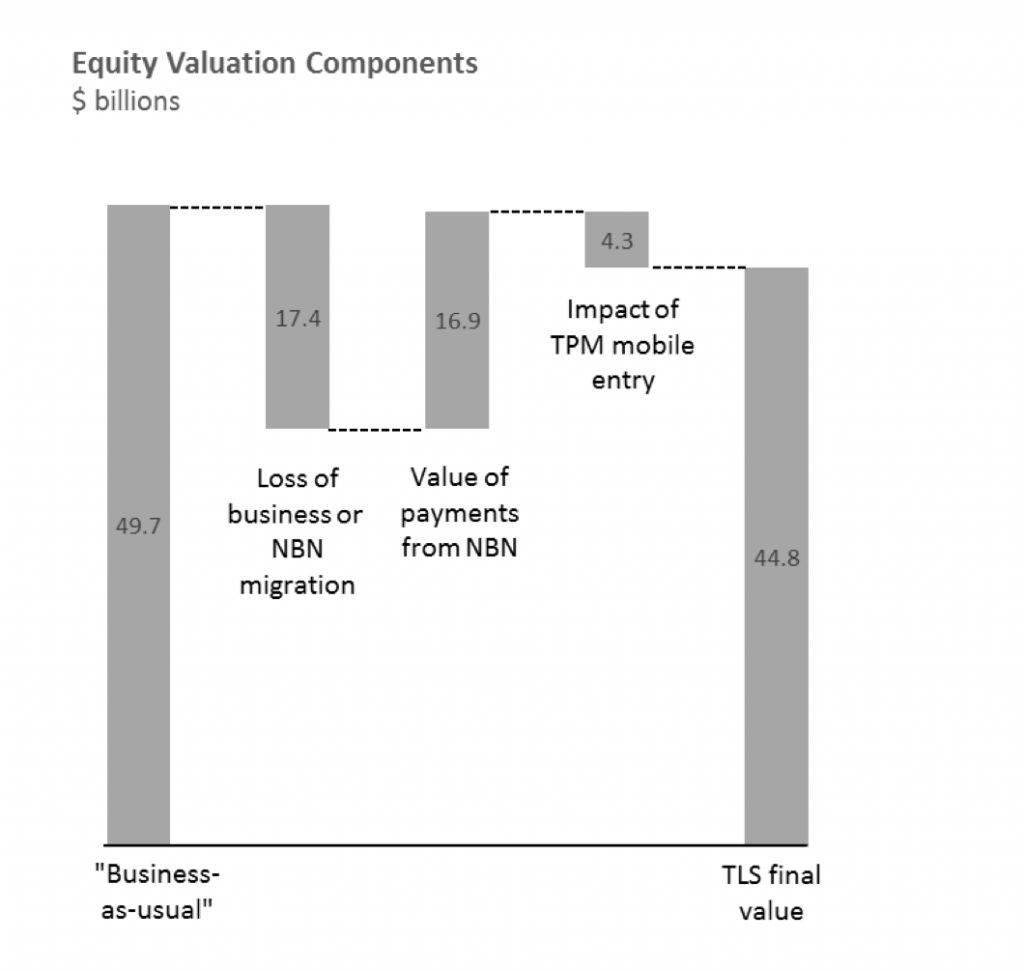

Given this, we think it makes sense to split the valuation into four components:

- A “business-as-usual” valuation of TLS based on historical financial metrics;

- A valuation of the earnings “hole” left by the migration to NBN;

- The present value of payments TLS will receive from NBN Co; and

- An adjustment for the impact of increasing competition in mobile.

We consider each of these in turn.

“Business-as-usual”

As noted above, TLS has historically been a very stable business, and the “business-as-usual” valuation is a relatively straightforward extrapolation of historical financials. Using an 8% cost of capital and a 1.5% p.a. growth rate, we arrive at an estimated value of just under $50 billion for the equity in TLS, or around $4.20 per share.

NBN earnings hole

We then come to the NBN earnings hole. TLS has provided guidance as to the EBITDA impact it expects when the migration is complete, and our “business-as-usual” valuation gives us an implied EBITDA multiple with which we can capitalise this impact. We estimate that this amounts to a fairly meaningful $17.4 billion of equity value, equivalent to around $1.46 per share.

Payments from NBN Co.

Happily, this earnings hole is largely compensated for by one-off and recurring payments it expects to receive from NBN Co. TLS has provided estimates of the value of these payments, but we believe the discount rate applied to these payments should be lower than the one TLS has used (which is generally 10%). We have evaluated TLS on the basis of an 8% WACC, and we see these payments as having somewhat lower risk than the overall TLS business, and so we apply a 7% discount rate. On this basis, we estimate the value of payments yet to be received from NBN Co at around $16.9 billion after tax – a larger figure than quoted by TLS, and one that substantially makes up for the value lost from TLS’s fixed line business.

Increasing competition

Finally, we consider the impact of TPM’s entry into the mobile market. As a point of reference, we note the impact of the 2012 entry into the French market by low-cost operator, Free mobile. In that example, ARPUs for the leading player, Orange, declined by 10-15% over several years, as the new entrant moved to take market share of 15%.

This sort of outcome would imply a very material loss of value for TLS. However, for a range of reasons, we expect TLS to experience a less dire outcome. These reasons include:

- Free benefitted from a roaming agreement with Orange. However, the ACCC has indicated it does not support roaming in Australia. This is an important constraint on TPM which plans to spend relatively little on its network build and will achieve relatively limited population coverage;

- Approximately 53% of TLS mobile subscribers are outside the major cities, and therefore less vulnerable to competition, as TPM focuses its network spend on the major cities;

- A large part of TLS’s mobile revenues are derived from business subscribers, who would also be less susceptible to a TPM offering; and

- Across its entire customer base, TLS maintains a price premium position in the Australian market due to perceptions of coverage and quality. TPM’s low-cost offering will more directly impact Optus and Vodafone (and is thought to potentially be a strategy to pressure Vodafone into a consolidation).

Our valuation of Telstra

Taking these factors into account, we anticipate a couple of percentage points of lost market share for TLS, and perhaps a 5% decline to ARPUs. On this basis, we estimate that the value of TLS falls by around $4.3 billion, or around $0.36 per share – still a material impact.

We then assemble the different valuation components into an overall picture, as follows, to arrive at an estimated value for TLS equity of around $44.8 billion, which equates to around $3.77 per share.

Against today’s share price of $4.42, this makes TLS look around 15% expensive, although it should be noted that we consider large sections of the Australian equity market to be expensive, so this conclusion perhaps comes as no surprise. It is also worth noting that different judgements around discount rates might lead other analysts to a different conclusion.

The Montgomery Alpha Plus Fund – which is fully-invested and uses a machine learning model analysing many different variables to drive investment decisions – holds a modest position in TLS in its long portfolio. For The Montgomery Fund, however, we are particular about valuation and are happy to hold cash when value is scarce. Accordingly, TLS does not find its way into our long-only funds at the current price, regardless of its dividend-yielding appeal.

Tim

I really liked the way you have dissected the issues and thrown light on each.Being a surgeon myself, we strive for meticulous dissection in our jobs.That said, we should lend our ears to Ian’s comments above – reality means many Australians in that age group want real money to get by on a daily basis.They may not outlive to see Telstra’s great growth strides in the future, lest it happens.All the niceties of clever stock analysis by sharp men like yourself is fantastic but my feeling is, having practiced medicine so long, there definitely is a x factor that should be thrown in all facets of life-stock investing included-call it gut feeling, luck,”too big to fail miserably thing”-I don’t know.

Lot of Ian & my generation people will continue to have good feelings about Telstra…..

Elephants may not gallop but they do not give up.

Cheers for a great article Tim.

Good point, Kumar. I can’t really argue with that.

Hi Tim, you’ve phrased the comments that Telstra’s steady dividend and ‘dividend-yielding appeal’ are good reasons to hold Telstra – could you elaborate on why you think this factor makes it a more appealing investment? I’m not following your reasoning here, i.e. the dividend itself isn’t improving an investor’s overall return. If anything wouldn’t the fact that Telstra has continued to pay its level of dividends be a negative thing?

Hi Michael. As you’ve recognised, we favour businesses that retain earnings and invest at good rates of return, and so a company like TLS is not really our cup of tea. Having said that, we understand why some investors are attracted to a steady dividend stream, and businesses like TLS certainly have value, even if they don’t have much growth. To give an extreme example, if TLS shares were being given away for free we couldn’t label that a bad investment.

I agree with most of your analysis Roger , but I do think $3:77 is a bit high , $3:00 -$3:20 is better , there’s not a lot of growth potential in it , sorry !!!

I am predisposed to your suggestion Ashley.

Not a lot of growth potential?

Telstra is investing billions into 5G right now, which has the potential to leapfrog the NBN. No-one else is investing nearly as much. I’m surprised this was not mentioned in Tim’s analysis.

This is actually an interesting (and complex) topic that we are keeping an eye on. The 5G capital spend is similar to previous network investments, and we’re yet to be convinced that it can change the growth outlook materially, particularly given potential NBN response, but certainly something to watch.

I can recall back in 2010, when Telstra was trading under $2.70, I considered buying a lot of them but was put off by Montgomery’s very negative articles about them at the time. I very much regretted listening to Montgomery at that time. It was low risk investment that would have been very profitable plus the 11% fully franked dividend.

I have nearly 400000 shares in Telstra and have retired Telstra pay excellent dividend even if they fall a little I will still keep buying them I am not talking paper money as most of you do I just want real money to live off owned interstate transport many years and only used Telstra as others do not have the coverage I have a lot of experience with investment advisers lost me over $600,000 now run my own with esuperfund hardly and cost

Thanks for the article Tim. Always enjoy your contributions.

Thanks, Lester.

Agree

A nice job of kicking them while they are down.

Clearly TLS is not a business that MontInvest would be interested in

This is clear from past articles and further reinforced by this article

What’s next a assessment of Qantas?