Adairs and Kogan benefit from COVID-19-inspired themes

In addition to the acceleration of e-commerce in Australia, COVID-19 has produced several themes that are generating retail winners; some are benefitting from the Do-Up-Your-Home-Because-You’ll-Be-Spending-More-Time-There theme, there are those benefitting from the boost to income from JobKeeper, JobSeeker and early Superannuation withdrawals, and there are those that will benefit from the additional A$45 billion spent locally that was previously spent on, or during, overseas holidays. And many retailers of course are benefitting from all three themes.

We wrote here prior to reporting season; “The shock of a hard stop on economic activity and its impact on business models, will mean…There will be companies that surprise on both the upside and the downside but ‘surprises’ will be the feature of this reporting season.” And this week’s start to reporting season has certainly validated that prediction.

Adairs (ASX:ADH)

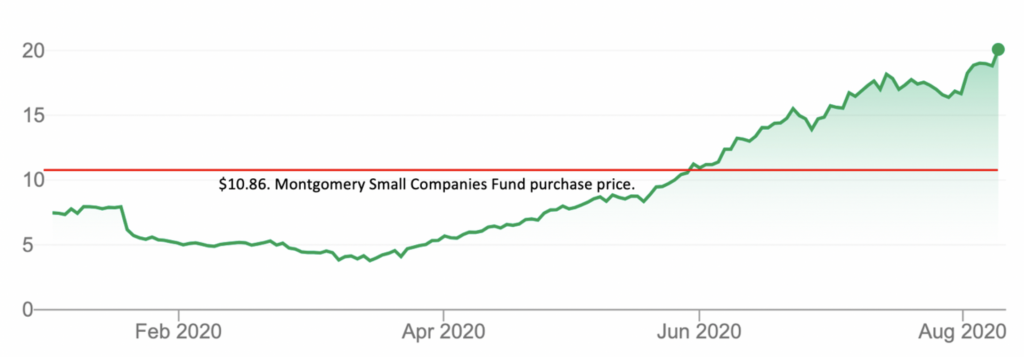

Figure 1. Adairs share price, 10 August 2020

Yesterday, Adairs (ASX:ADH) released its FY20 result. The results were due on 26 August but the numbers were so strong that the company couldn’t allow uninformed trading to continue. Earnings before interest and tax (EBIT) for FY20 was about 16 per cent above consensus estimates but more impressive was the strength of cash flows which allowed the company to significantly reduce its net debt, strengthening its balance sheet and allowing for the payment of the dividend.

So dynamic are COVID-affected economic conditions the company remained unable to provide FY21 guidance but an update on trading for July revealed Adairs like-for-like sales up 16 per cent, online up 103 per cent and newly acquired Mocka up 47 per cent. Total sales for July were up by a third.

Kogan (ASX:KGN)

Adairs isn’t the only retailer benefitting from the COVID-19-inspired themes. Ahead of its full year’s results to be released on 17 August, Kogan has also updated the market yesterday with current trading experience.

Figure 2. Kogan Share price, 10 August 2020

Kogan reported Active Customers grew by six per cent or 126,000 people over July to 2,309,000 as at 31 July 2020. July Gross Sales grew more than 110 per cent year-on-year and Gross Profit grew by more than 160 per cent YoY. Adjusted EBITDA was more than $10 million.

Upside or downside?

There is no doubt that government support measures are boosting trading conditions for many retailers – that was the whole point, to keep the economy chugging along. On the downside, there is also no doubt that these measures will eventually be tapered, at which point a not insignificant of number of support recipients could be without work and on Jobseeker (aka the Dole), earning materially less than they are currently. This is the fiscal cliff that many bears point to as a reason for their reticence buying consumer discretionary stocks.

But there are positives and they include the fact that not all of the boost to spending is coming from government support. Consumers are also spending domestically a share of their wallets that would otherwise have been directed overseas during holidays and business trips. For as long as borders remain closed to international travel (itself potentially dependent on a vaccine) a greater level of spending overall will be redirected domestically.

Further, Australians spend $100 billion per year on ‘recreation and culture’ and another $72 billion on ‘hotels, cafes and restaurants’. With much of these subsectors shut down or under restricted trading conditions, a meaningful proportion of this spend will be redirected to clothing, footwear, furnishings and furniture, benefitting companies that specialise in these latter categories.

Taking this idea further, sell side analysts have not been willing to capitalise current growth rates because they are predicting those growth rates to slow, perhaps materially. But if a greater – albeit semi-permanent – level of domestic spending results in growth rates remaining elevated for longer than analysts currently predict for 2021 and 2022, upgrades will flow through to stock re-ratings and the current boom seen in consumer discretionary share prices could continue.

By way of example, Adairs noted that it expects the robust trading conditions to continue while the pandemic remains a ‘threat to communities’. As can be seen in the share price today, consensus estimates have to be upgraded and the price to earnings multiple re-rated.

Inevitably there are other retailers that will benefit from the same realisation.

The Montgomery Small Companies Fund owns shares in ADH and KGN. This article was prepared 10 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.