A short history of predictions

In January this year, a veritable conga-line of economists and strategists were publishing their forecasts for the year ahead, as they do every year. Now, safely at the other end of the 2023 calendar, we have the luxury of testing the prescience of these clairvoyants. Here at Montgomery, we play the ball rather than play the man, so we won’t be naming any of the forecasters, but rest assured, these are all prognostications that were published and distributed in January this year.

Forecast 1: Donald Trump re-emerges as the leading Republican presidential candidate.

An early win for the forecasters. Much to the chagrin of rational democracy-loving humans the world over, Trump emerged as a leading candidate. At the time of writing, however, the breaking news is that in an unprecedented 4-3 ruling, the Colorado Supreme Court has removed former President Donald Trump from the state’s 2024 ballot, ruling that he isn’t an eligible presidential candidate because of the 14th Amendment’s “insurrectionist ban”. The ruling will be placed on hold until 4 January, pending Trump’s appeal to the U.S. Supreme Court, which could settle the matter for the nation.

Forecast 2: Bitcoin will fall to $3000 by the end of 2023 as more and more investors realise that cryptos are nothing more than a giant Ponzi game. More countries ban crypto mining and trading.

This forecast only requires a Bitcoin chart to explain how accurate it was.

Forecast 3: Putin ends his war abruptly. The war is not going well for President Vladimir Putin, with the Ukrainian troops having launched successful attacks on the Russian forces, killing hundreds of Russian soldiers. Two weeks ago, the U.S. announced it would send more Patriot missiles to Ukraine, neutralising Russia’s air superiority. Europe is having a very warm winter, weakening Russia’s energy leverage. Putin, reportedly in poor health, seeks a truce with Kyiv this year. A peace deal between Russia and Ukraine crushes oil prices, but global equities skyrocket.

The conflict remains unresolved. A year ago, Ukraine’s President Zelenskyy was met with applause at the U.S. Congress, along with pledges of substantial financial support for combatting Putin’s invasion. During that time, Putin kept a low profile, dealing with internal dissent and his forces losing territory.

However, this week presented a different picture. At a Defense Ministry event, Putin exuded confidence and a sense of triumph, in stark contrast to Zelenskyy, who appeared pressured at an impromptu end-of-year press meeting.

Putin’s speech at the briefing radiated optimism about Russia’s military endeavors, flanked by senior military officials. This was a significant shift from six months prior when internal unrest and Kyiv’s anticipated counterattack, which was expected to push Russian forces back towards their border, seemed to threaten his leadership and the military’s command structure.

Forecast 4: The European economy surprises on the upside, continuing to weather the energy crunch well. The eurozone equity markets take off, with the German DAX gaining 25 per cent and the euro shooting up to 1.30. Better valuation and a stronger Chinese economy are two bullish factors for German stocks.

Not really a surprise on the upside, gross domestic product (GDP) increased by 0.2 per cent in the euro area (EA-20) and remained stable in the EU during the second quarter of 2023, compared with the previous quarter, according to an estimate published by Eurostat. In the first quarter of 2023, GDP remained stable in the euro area and had increased by 0.1 per cent in the EU.

Compared with the same quarter of the previous year, seasonally adjusted GDP increased by 0.5 per cent in the euro area and by 0.4 per cent in the EU in the second quarter of 2023, after an increase of 1.2 per cent in the euro area and 1.1 per cent in the EU in the previous quarter.

The prediction of a 25 per cent gain in the German DAX equity index was reasonably close, even in the absence of the forecast GDP surprise. The German Dax began the year at 14,069.26 and, at the time of writing (December 20, 2023), was trading at 16,733.05, producing a year-to-date gain of 18.93 per cent.

Forecast 5: U.S. core PCE inflation plunges to 1-1.5 per cent by the end of 2023 and the S&P 500 continues to outperform the global average on a capitulating Federal Reserve, a depreciating dollar and falling energy costs.

Annual personal consumption expenditure (PCE) inflation sat at 3.0 per cent in October, having fallen from 3.4 per cent in September and from 4.0 per cent in May. Higher than desired inflation persists.

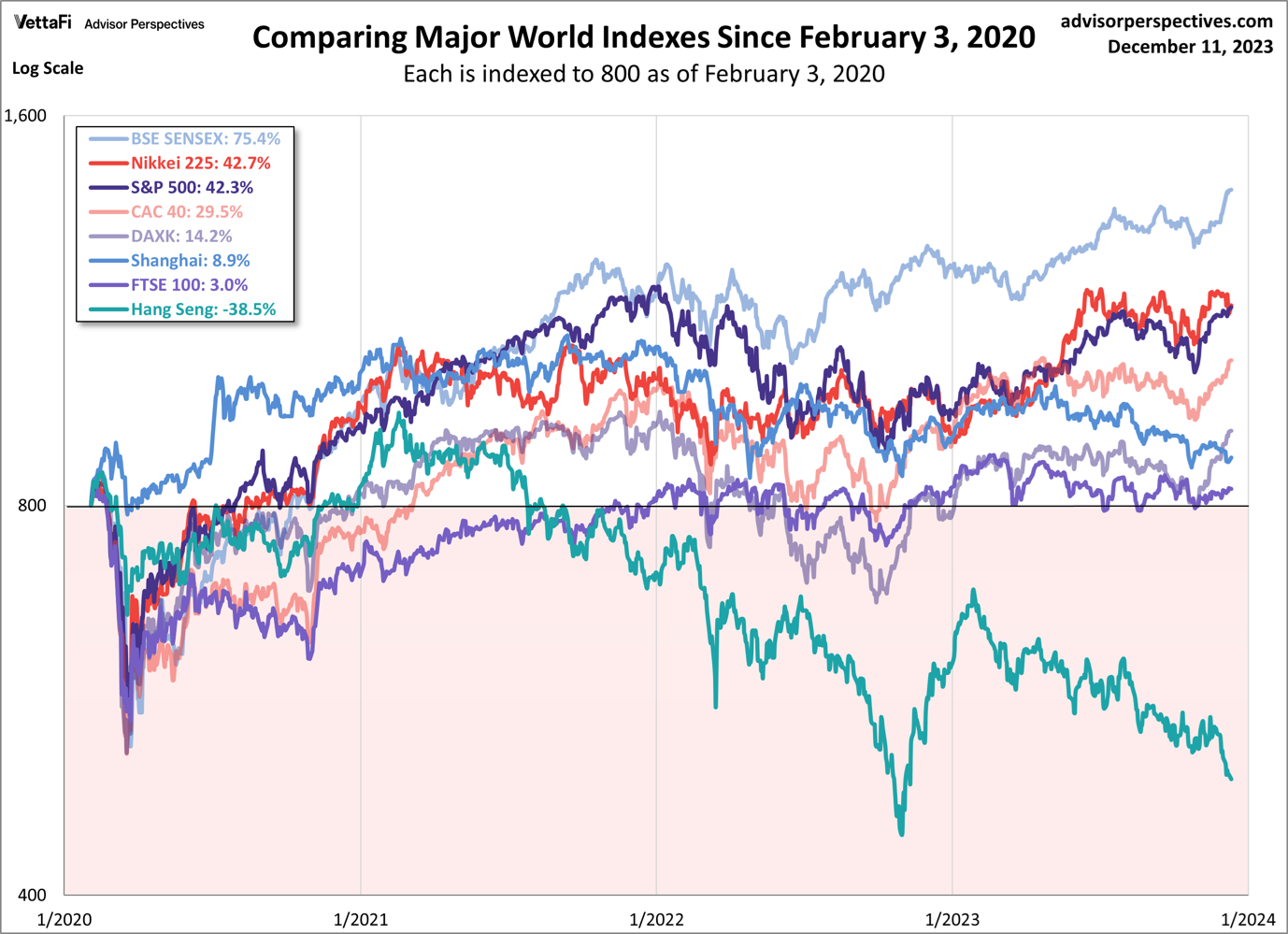

However, despite the absence of good news on the inflation front, the S&P500 appears to have outperformed most major global indices.

Forecasts would be incredibly valuable if they were accurate. But they aren’t, so they aren’t. Fortunately, however, especially for those who enjoy reading predictions, there will be a fresh tidal wave of prophecies in early 2024.

paul norris

:

To be fair how is your forecast scorecard. To name one, in an ABC interview you forecast share prices would be lower in 4 months following the initial Covid crash.

Roger Montgomery

:

As I have said many many times Paul, we’ll get these big picture forecasts wrong as often as right!