A Biased map

“Only when you combine sound intellect with emotional discipline do you get rational behaviour” Warren Buffet. It is in the pursuit of such rational decisions that outside of bottom up company analysis, I spend a lot of time exploring and understanding cognitive biases.

These are the simplifying assumptions our brain makes when thinking fast – I like to think of them as little blind spots in our thoughts.

Whilst in some instances these thoughts are designed to help us get out of trouble and allows us to make quick gut decisions – in investing it can lead to wrong turns and naïve choices. Thus, studying these potential pitfalls and being constantly vigilant about identifying and reducing them is prudent in investing – or any other complex decision you approach.

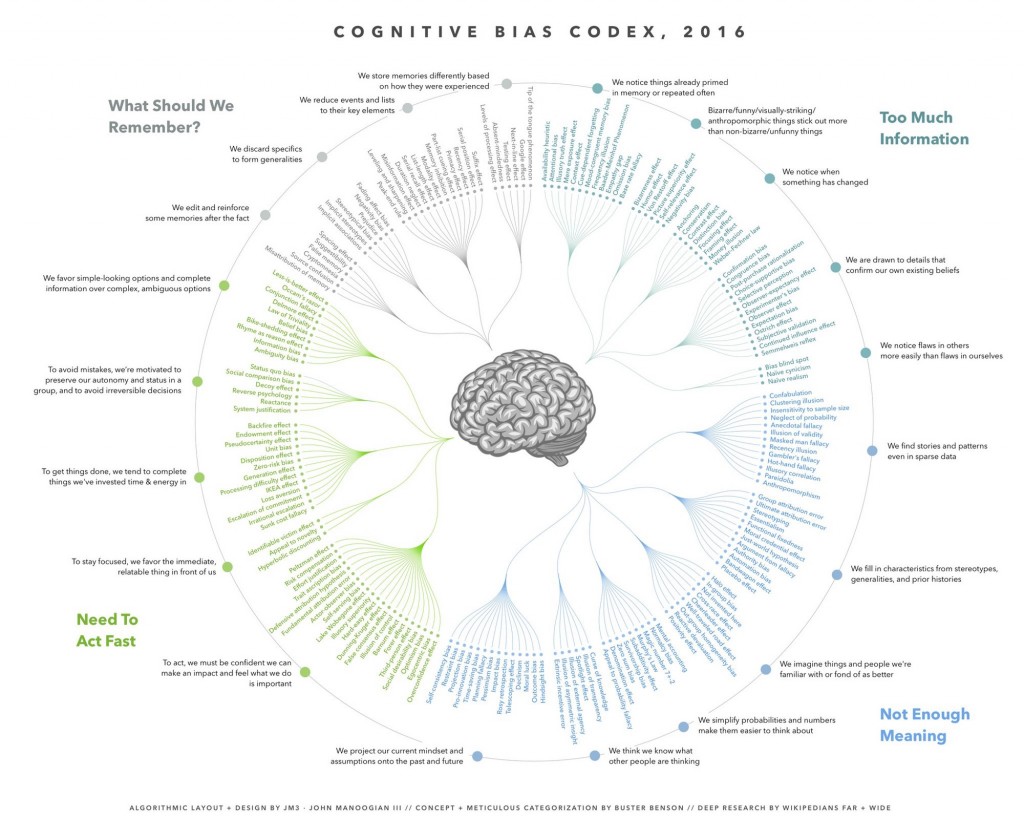

In my research I stumbled upon a wonderful summary of identified biases which was worth sharing. [Note, clicking in the image opens a full screen version][1]:

This chart indexes cognitive biases into four categories:

- Too much information

Our minds have shortcuts for which information to focus on when it is overwhelmed with data. This makes us susceptible to biases such as anchoring (being fixed on a recently referenced number) and confirmation bias (focussing on information that supports our case). I’ve previously talked about how anchoring and confirmation bias can affect investing decisions here.

- Not enough meaning

Conversely, when we don’t have enough information our minds still like to find meaning and are subjected to another set of biases. We extrapolate patterns when they’re not there e.g. Gambler’s fallacy (thinking that after 10 heads in a row the next toss will be a tail), or feel things are obvious in retrospect with the hindsight bias. We wrote about these here.

- Needing to act fast

In time pressured circumstances our minds resort to default options – like what is familiar (this can lead to the disposition effect – holding on to something which has reduced in value or selling early when it has increased), or what we are confident in, leading to the overconfidence effect. We wrote about both here.

- Imperfect memory recollection

Ever compared your version of an event to that of a friend? Or noticed how your own recollection can change in time? Our memory is biased by how we experienced something and we tend to focus on particular elements.

Whilst knowledge of the biases doesn’t grant you immunity – it does help you identify when they may come up. In times where you could be predisposed it’s important to look at both sides of the argument and measure ten times before you cut/ buy/ sell).

Are there any new biases on the list for you? Any you have caught yourself doing?

[1] Credit to John Manoogian III for the layout and Buster Benson for the categorization.

Cognitive biases – I like to think of them as little blind spots in our thoughts. In some instances these thoughts are designed to help us get out of trouble although in investing it can lead to wrong turns and naïve choices. Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Interesting article Lisa

It would be interesting to apply this idea of bias to the Australian housing market.

it is also interesting to think about bias in relation to the idea of culture/morality.

Again, the Aus housing market seems to be subject to moral ideas as much as much as more objective market forces and indeed morality seems to influence policy which in a more objective sense influences prices – negative gearing, first home buyers grant, unpaid rent on appreciation related to infrastructure development and so on.

Best John