A 2012 Report Card

At this time of year, many of us are inclined to take stock of highlights and lowlights of the year gone by, and perhaps to consider what we might wish for the year ahead. Accordingly, we thought it might be interesting to look at the best and worst performing ASX stocks during the past 12 months, and see what sort of story they tell.

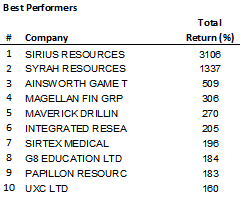

The list below sets out the top performers according to Bloomberg. We have limited the analysis to stocks with a market capitalization of at least $200m.

Included in the list there are of course some minerals explorers resources that hit paydirt. We are unlikely ever to be beneficiaries of these types of success stories, but we congratulate investors lucky enough to be in the right place at the right time. We caution however, that for every success story in this space there are many disappointments.

Other names on the list are more our style. The Montgomery Fund and/or the Montgomery [Private] Fund have been investors in 4 out of the ten this year. Specifically Ainsworth, Integrated Research, Sirtex, and UXC have been pleasing investments for us.

Another name on the list – Magellan – is close to our hearts. The team at Magellan are well known to us, and in fact are part owners of Montgomery Investment Management. We have been delighted to see the success they have enjoyed this year with their funds management operation, which is focused on international equities.

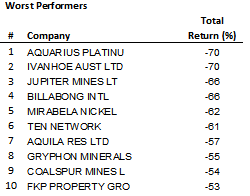

On the other side of the ledger, the table below sets out the worst performers for the year.

Once again the resources sector is well-represented. In fact 7 out of 10 on this list are from the resources sector (recall the comment earlier about disappointments relative to successes).

Some of the other culprits we have spoken or written about in several forums, so I won’t go on about them here. I’m pleased to report that none of the companies on this list appeared in any Montgomery portfolio during the past 12 months, and if you are familiar with our adherence to strict quality and performance criteria you’ll know why.

So, they were some of the highlights and lowlights of 2012. Hopefully your own experience included some of the former and none of the latter. For next year, we are working now to try to identify who might be on 2013’s top ten list.

We will keep you posted here with our thoughts along the way.

Roger, Never say never. It leaves you no room to move. I appreciate your insights.

Richard

Thanks Richard, but I have been there before and have no desire to to return.

Thanks Roger, I have the worst 10 and none of the top 10. Hope 2013 will be better, but doubt it greatly

have a great Christmas and NY

Xmas Greetings Roger!

Considering the tie-up with Magellan and your recent launch of global stocks with Skaffold, have you any intentions of launching separately, or including, international stocks within The Montgomery Fund? Roger.

On the to-do list Roger but some time off.

Roger, given the success of Magellan as a floated company, do you have any intentions to float Montgomery Investment Management?

NO. Hang on…let me thing about that…No never.