Making sense or losing cents?

If you’re a smaller shareholder in either Westfield Group (ASX: WDC) or Westfield Retail Trust (ASX: WRT), then you might be forgiven for thinking you’re in the middle of World War Three.

As a smaller WRT shareholder, the probability is that you didn’t bother to vote ahead of last week’s meeting but perhaps, armed with the information that follows, you might be better informed and be able to make a determination about which way to go.

In essence, if you are a WRT shareholder, the questions are:

1) Should you accept Plan A – proposing to bring all the Australian assets under one roof – the meeting for which was adjourned last week? Or;

2) By doing nothing or voting against Plan A, should you effectively accept Plan B? This option sees WDC demerge its 50 per cent interest in the Australian properties and WRT does not assume it, effectively creating two separate listed Australian companies owning the same assets but with WRT earning a lower return on equity, paying much higher costs, and being competitively disadvantaged.

It Begins

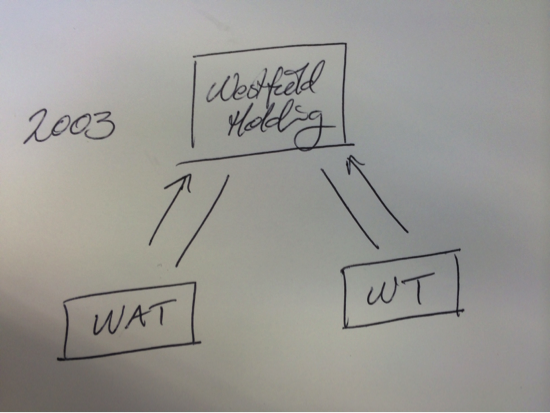

It all started a decade or so ago, a more innocent period when everything seemed simpler. Westfield Holdings was the master of the property universe and had we been running The Montgomery [Private] Fund back then, we can be almost certain that we would have been shareholders. You see, Westfield Holdings was simply a management company and returns on equity were off the charts. It had no capital of its own and merely collected fees for undertaking every aspect of planning, developing, constructing and managing Westfield shopping centres. (As an aside, that was the nearest thing to a “perfect asset” and it looks nothing like WRT which one big superfund says is the closest thing to their perfect asset). In 2003 there were three, separately listed, Westfield entities; Westfield Holdings – described above, Westfield Trust – owners of Australasia’s “premier” retail property portfolio, and Westfield America Trust – owners of the US property portfolio.

Figure 1. A simple mud-map of the 2003 structure

Investors who wanted stable income from property ownership could own the trusts, and those interested in the growth from management fees could own the management company. But that was in 2003.

And then, in the same year, Centro Properties Group made a bid for AMP Shopping Centre Trust – also known as ART – the owner of shopping centres such as Warringah Mall in Sydney and Garden City in Brisbane.

While Westfield counter-bid with its own offer and won, it was arguable that the fee income enjoyed by shareholders in Westfield Holdings might have ultimately been threatened, and a proposal was suggested to change the structure.

As a result, in 2004, the Westfield Group was born when Westfield Holdings, Westfield Trust and Westfield America Trust merged in the company’s most significant corporate restructure, creating the world’s largest retail property group by equity market capitalisation. By leveraging the combined balance sheet Westfield, it was argued, could adopt far larger projects than the old trusts could manage independently.

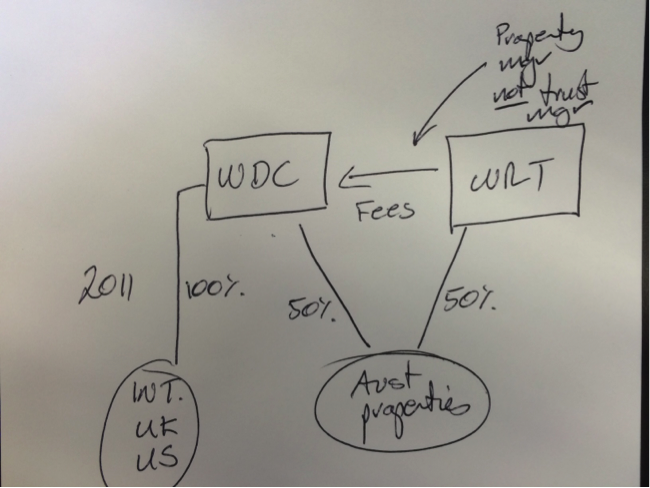

Fast-forward to 2011 and Westfield completed another restructure, which in my opinion was incomplete.

Figure 2. A simple mud-map of the 2011 structure

Westfield emerged (or demerged, if you like) with two entities. There was Westfield Group (WDC) – the owner of 100 per cent of the international property portfolio and 50 per cent of the Australian properties, and there was Westfield Retail Trust (WRT) – owner of the other 50 per cent of the Australian properties. WRT also paid fees to WDC but importantly, WDC received fees for managing the properties not for managing the trust. This has important implications for the arguments being made today.

You cannot make a baby in one month by getting nine women pregnant, and in my opinion, Westfield or its advisers were hasty and erred in 2011. Why didn’t they complete the strategy by demerging all of the interest in the Australian properties? Did their advisers, for example, consider that WDC might underperform global peers (in a total return sense) if a stake in mature/low growth assets were retained?

But in 2014, Westfield has the opportunity to complete the strategy. A fight has ensued because some investors in WRT have purchased a minority interest in a vehicle that could now change – I might add, not unlike the situation any investor finds themselves in when purchasing minority stakes in listed companies.

If not for the ‘folly’ of 2011, many shareholders would not be harbouring the suspicions towards the Lowy family that are being reported by the media today.

After more restructures than someone addicted to cosmetic surgery – suspicion is understandable. How can you trust someone touting the benefits of a new structure when it was only a few years ago those same people were advocating an entirely different proposal?

I believe however that the suspicion is misplaced and in the absence of the 2011 restructure, the reported trust towards the Lowy family would today be much higher.

The reality is that the international assets Westfield owns are prime, world-class properties. A further reality is that Westfield Group (WDC) trades at a discount to its global peers probably because the Australian assets are perceived as low growth, and let’s face it, Tony Abbott and his team is not doing a great deal to change that global perception. So if you can’t change global perceptions, fix the structure.

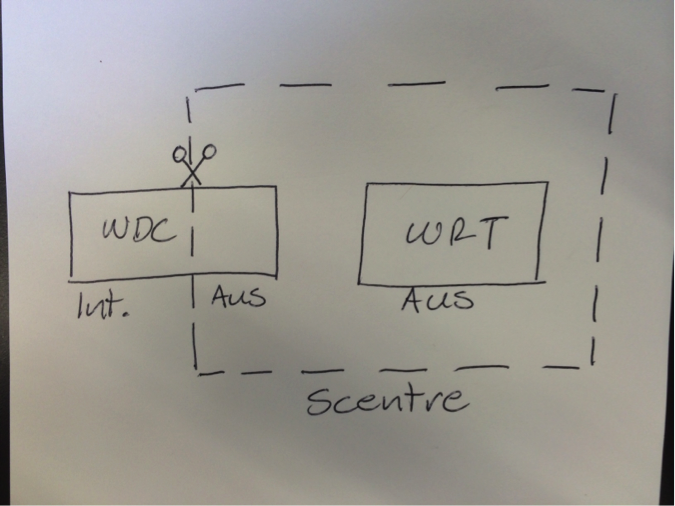

What has now been put to shareholders of both WDC and WRT is a proposal to demerge WDC’s 50 per cent stake in the Australian properties and merge them with WRT’s 50 per cent holding in those same assets.

Figure 3. A simple mud-map of the 2014 proposed structure

Some of the largest shareholders however do not want the demerger of the Australian property holdings from WDC, and merger of those same assets with WRT, to proceed. Importantly, while some larger shareholders have had a lot to say about the matter, relatively few retail investors are likely to have voted.

It is, of course, important that you do vote (whether you agree with the arguments presented here or not) firstly; because even big industry super funds are not immune to Paul Keatings’ observation that you should “always bet on self-interest”, and secondly; only when a large majority of shareholders vote can both parties be sure the matter has been put to bed under the warm duvet of democracy.

Shareholders in WRT will get another chance to vote on the proposal, and armed with some insights and all the arguments (here and elsewhere) you may just be in a position to make a knowledgeable election.

WDC can of course do whatever it wants with its assets, so if WRT shareholders do not want to buy the other 50 per cent of the property holdings, currently held by WDC, WDC can sell them, thereby creating another listed entity that would arguably be commercially and competitively superior to WRT.

So why don’t some of the big industry super funds want the plan to go ahead? Perhaps Paul Keating was right all along. By stymying the merger, it could be argued that WRT’s share price might fall. This might be a great outcome of course for big industry super funds with billions of dollars in cash pouring in from mandated super contributions – they can buy more stock at a cheaper price. But it’s possibly not so great for smaller shareholders who care a great deal about the market value of your portfolio and may not be flush with oodles of cash to add to holdings. And let’s face it, there are plenty of better looking companies available with more attractive growth prospects in which to invest the limited cash available to secure one’s retirement.

So a lower WRT share price may represent a desirable outcome for industry super funds, but perhaps your interests aren’t quite aligned with theirs. So should you be voting with them? Or should you be voting for the merger of the assets and management rights with WRT to proceed? These are the questions that, along with your adviser, you should come to a conclusion on (after weighing up all the arguments of course)

Once again, if you don’t vote and the merger of the assets with WRT doesn’t proceed, there is expected to be a new listed entity created. This new entity will hold exactly the same stake of 50 per cent in exactly the same assets as WRT. The difference, however, is that it won’t be paying circa $200 million in fees for the management of the properties. WRT will be paying those fees and the new company will be receiving them! The other difference is that the Lowy family will still have an 8 per cent stake in the new company (and no stake in WRT) and if anything, the Lowy family is known for its ability to generate wealth ($1000 invested when Westfield began is now worth something north of $200 million).

As a result of this fee and ownership arrangement, the new company will have a higher return on equity, and it can be argued, will be commercially and competitively superior. Over the long run, you would reasonably expect its share price to perform better. I would expect to eventually see smaller shareholders selling their WRT shares and buying the new company’s shares, further entrenching the market underperformance of WRT and the outperformance of the new company.

The industry super funds are also arguing that under Plan A, WRT will have to accept a higher level of debt, but consider the following. If Plan A does not go ahead, it could be argued that under Plan B, the newly created company could easily accept the debt, sell off half its holdings in the assets (allowing it to continue to own 25 per cent and be entitled to the management rights and fees) raise funds to reduce debt and produce an even more attractive balance sheet and earning profile at the expense of WRT investors.

The big question might simply be: is the loss of capital – under a hypothetical underperforming WRT share price scenario – greater than the fees being paid to WDC for the management rights?

As a WRT shareholder, if you vote for Plan A, you are voting to buy the property assets and pay out WDC shareholders for the management rights to those properties. Some are arguing this is inferior to the status quo because, while the value of the properties is not in dispute, too much is being paid for the management rights.

If however you don’t vote for Plan A, you are, in effect voting for Plan B (assuming WDC’s announcement of the plan comes to fruition) – and Plan B may just mean a lower relative return to you if the mooted new company attracts more investors.

Thanks for the easy to understand synopsis Roger. I have been busy in other areas and have not had a chance to find out what the fuss is about.

As a fan of Australian soccer and a person interested in Australian business, Frank Lowy’s name is one that will always pop up. For the most part he seems like a decent person and is obviously a talented businessman as anyone would be turning a patch of land in Blacktown to a global shoping centre brand.

The frequent restructures make it a more difficult sell like you mention, especially for retail investors who may not understand what the change is actually about.

I do think that Frank Lowy can get it wrong sometimes, luckily for Westfield shareholders those times that led to this belief were due to mistakes i think were made in relation to the foundation of the A-League and not its shopping centre portfolio.

The above from what you have written makes sense for me.

Westfield are basically saying, if i understand it correctly, there is no point in having two businesses own the same property especially when for one the focus is overseas. So let us sell you the remaining 50% of those assets so we can have the businesses focus on the specific geographic area. Otherwise if you don’t accept it, we still don’t want the Australian properties in the international division so we will split them off and you can pay them fees.

Anyone feel free to correct me if i got the above wrong? As, i said i am still trying to get my head around this current event.

I don’t necessarily see a situation either way in which WRT comes off too well but you could argue that for a business perspective it is better for them for the deal to go through as they are really disadvantaged if plan B happens.

Either way i would be thinking that the WDC vehicle is the more attractive one. They do have great aussie assets (of which my local big shopping Warringah Mall is a great example) that would offer a reasonable stable income.

I do hold a bit of a negative bias to shopping centres future returns as i believe there will be a decreasing demand for floor space (especially as big anchor tennants move more online) and the CAPEX and risk needed to change this by making them more integrated entertainment precints. My opinion only and could well be wrong, wouldn’t be the first time.

Apologies, the comment regarding Warringah mall and the Aussie assets was aimed at the WRT. I think WDC is the better vehicle but WRT still has attractive assets.

Thanks Roger for your clear and concise explanation of Westfields poorly “sold” restructure.Investors had every right to be sceptical following the 2011 version!