Bubble watch #9

We’re a self-deprecating bunch, us Aussies. Anything from the US is just that little bit better than what we have here, surely. At a finance seminar, you listen that little bit harder to anyone with an American accent, but should we be undervaluing our own abilities so harshly?

According to Sam Ro from Business Insider, the average US stock is in a bear market. Ro notes that while there are no perfect stock market indices providing a complete picture of the state of the market, “the fact that the S&P 500 is down just 1 per cent from its all-time high of 1,897, belies the fact that many stocks in the index, and in the market as a whole, are way down.”

Ro also cited observations from J.C. O’Hara, of FBN Securities.

According to a May 9 article in Business Insider, O’Hara’s research revealed the average S&P 500 stock is down by more than 12 per cent from their recent 52-week highs. The average stocks in the Russell 2000 and Nasdaq Composite are down by more than 20 per cent, which means you can say they are in bear markets.

The conclusion O’Hara reaches is that divergence, as evidenced by these weak stocks versus the S&P 500 being at all-time highs, bodes ill for “the longevity of a market’s upward inertia.” O’Hara went back and examined periods where the market made a new high and looked at where the median stock sat compared to its high. His conclusion is that the current lack of breadth behind the market’s rally is “very unhealthy”.

Ro notes: “Not only are new highs diminishing, but we are seeing many stocks making new lows. This breadth divergence is a major concern.”

In classic fence-sitting fashion, O’Hara says this isn’t necessarily “a screaming sell signal” but claims that it’s a powerful message that something is wrong, and it “should not go unnoticed”.

When we read articles like this, it’s easy (not to mention lazy) to simply believe that because the research has come from America, it must have some authority.

We decided to dig a little deeper, and found Mr O’Hara’s job description online. Now, none of this is saying anything untoward about the man or his role. He is, we suspect, a perfectly polite, respectful and decent fellow.

To help you put the ‘insights’ quoted by Business Insider into context however, we thought you might also find it useful to meet Mr O’Hara – albeit through a digital profile – and to know that his title is Chief Market Technician. He was previously also a Technical Analyst at Man Global for a year, and then Chief Market Technician at Phoenix Partners for another two.

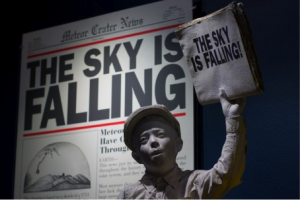

And as you know, we don’t follow technical analysis. Whenever the market falls, they will scream from the rooftops that the market broke its trend line and they “knew” it was going to crash. Of course, for a market to fall it must cross any upward sloping line – no matter whether it was drawn by a technical expert, or a 5-year-old with a crayon. What the technical analysts won’t tell you is how many times a trend line was broken and the market didn’t fall.

So while O’Hara may ultimately be proven right, all he has to do to ensure success is forecast often. Whether those forecasts come from the US, or anywhere else, should make no difference at all.

We note that history suggests failing ‘breadth’ can be early, frustrating and deceptive. In the late 1920s and late 1990s – periods when the advances became narrower and narrower in terms of breadth – the leading indices rose to levels arguably above even the most optimistic expectations for the bulls.

Postscript: We do believe risks to the Australian stock market and economy exist – they always do – from the slowdown in the US, and more importantly China, and these risks for investors in FMG, BHP and RIO cannot be overstated. On the flipside however, great quality companies – like many of those owned by both The Montgomery Fund and The Montgomery [Private] Fund – are expected to grow their profits by an aggregate 15 per cent or more for at least the next 18 months and they aren’t, in aggregate, significantly overvalued.

For more information about investing in either The Montgomery Fund or The Montgomery [Private] Fund, please visit montinvest.com.

Roger,

I’m convinced that Ben Graham’s way and by extension Warren Buffet’s & your way to invest is the correct way. However, I don’t have access to $25K to hand over to you to invest at this time (I’m saving for that).

In the meantime is there another way I can invest small amounts of money regularly into a fund (mutual or managed) that you manage? Thanks.