Which 15 companies receive my A1 status?

As you would all know by now, I like to invest in great quality companies when they are cheap. Nothing too special about that because that is true of a line of value investors from Buffett and Munger, all the way down to us. For me, ‘quality’ is not difficult to ascribe to a company, provided you remove the subjective elements. You can decide, for example, to simply look at the return on equity, but of course that alone will not be enough to separate two companies that each share the same return on equity. One company could have more debt, or two retailers with the same return on equity could have very different inventory turns or different cash flows from working capital. One retailer’s inventory management may be improving and the other declining. The absolute value of many ratios and their trends can all help to determine quality in an absolute and relative sense. That is how I arrive at my A1 ratings (not to mention A2, A3….C5 etc) – ratings that you have seen me discuss on the Sky Business Channel and heard me chat about on 2GB.

Perhaps the simplest way to think about quality is the way that Buffett has done it using his subscription (complimentary for life one presumes) to Value Line, which was launched in 1931 in the United States.

Applying Buffett’s approach to an Australian company is delightfully simple. Start by having a look at the profit some time ago – lets use ten years. Compare that ten year-old profit to the most recent one, or even next year’s expected profit. Is it up or down? In his 1996 Chairman’s letter to shareholders Buffett said; “Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards – so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.”

So the first step is to compare the change in earnings over a reasonable period of time. Ideally you would like the profits to be “marching upwards” and be confident that the future holds the same pattern.

The next step is to look at the change in the contributed equity. The reason you want to do this is explained with a simple example. Lets say I start a business with $10 million and in the first year I earn $2 million. The next year I earn $4 million and the year after I earn $6 million, and so on. I suspect you would be as thrilled as me with the decision to start this business. What if we started another business that produced the same profits over time as the first example, but in addition to the initial $10 million to get things started, we were required to inject many millions more in equity back into the business, annually? My guess is that you would be far less excited.

Airlines are particularly adroit at performing these riches-to-rags economics. But having harped on about that for a decade, you already know my thoughts on airlines.

How about we take a look instead at Incitec Pivot (IPL)? Here is a business that in 2002, after two years of losses, reported a profit of $18.3 million. Equity contributed by shareholders amounted to $65 million at that time and retained earnings (profits that shareholders had not received as dividends) had built up to $84.4 million. Now fast forward to 2010 and Incitec Pivot is forecast to earn about $400 million. So in just 8 years profits have grown more than 20-fold!

As an owner of the whole business, you would be pretty happy with this result, particularly in light of Buffett’s comments about “marching upwards” and all. The real questions however are 1) have you had to contribute any additional money to the business or leave any in there? and 2) How much?

While profits have grown by $382 million, the amount of money the shareholder/owners have had to contribute to produce this result is even more startling. Imagine owning a business that grew profits from $18 million to $400, but required an initial investment of $65 million and then an additional $3.2 billion! And we haven’t yet mentioned that borrowings have increased from $120 million in 2002 to $1.6 billion at the end of 2009.

These sorts of economics do not receive my A1 accolade. The only A they get is the one for ‘Agony’. By comparing the increase in profits to the increase in equity, you can get an understanding of the returns the additional capital has generated. In the case of Incitec Pivot that number is about 11%. If the debt is included, the return on additional capital is 8%. Not as shockingly low as other companies (I can think of half a dozen off the top of my head), but not anywhere near the 30% rates achieved by Woolworths, for example.

At the 1998 Berkshire Annual Meeting, Buffett said: “Time is the enemy of the poor business and the friend of the great business. If you have a business that’s earning 20%-25% on equity, time is your friend. But time is your enemy if your money is in a low return business.”

He was perhaps referring to Graham’s own metaphor about the market being a weighing machine over long periods. Over long periods of time, prices tend to track the underlying performance of the business. If returns in the business are low, so will be the returns be from owning the shares.

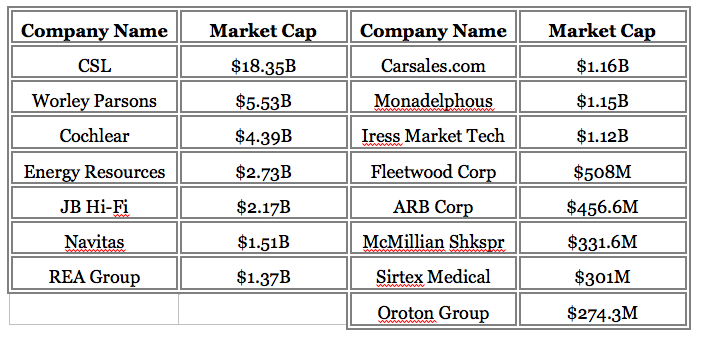

And thats why I like to stick to A1s. And there’s not that many. So who are the A1’s? Well, here is fifteen. They’re ranked in order of market capitalisation (biggest to smallest). And don’t forget, this is a purely didactic exercise. Its educational, so you must seek and take personal professional advice before doing anything. Also remember I am offering no assessment about whether the shares will go up or down. The shares could all halve (or worse). I have no way of predicting what the shares will do.

One of the most frustrating things about having high standards is that the pond gets very small. There just aren’t as many “fish in the sea” as your parents may have led you to believe. But as John Maynard Keynes said in a letter to F. C. Scott on August 15, 1934: “As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits one’s risk by spreading too much between enterprises about which one knows little and has no reason for special confidence… One’s knowledge and experience are definitely limited and there are seldom more than two or three enterprises at any given time in which I personally feel myself entitled to put full confidence.” My quality ratings can and do change. Not often, but they will. Recently, for example, quite a number of companies raised capital to pay down their debt. Even before they report their full year results, I can see that the raisings will dilute return on equity and dilute intrinsic value, but I can also see that the balance sheet will be stronger and so, the quality rankings will rise. Importantly however for me, my A1’s are those companies in which ‘I personally feel myself entitled to put full confidence’ (in terms of quality, not share price direction or prediction!).

If you have a list of companies in which you have full confidence and are happy to share, feel free to leave a comment.

Posted Roger Montgomery, 20 June 2010

Hi team – notwithstanding the current crisis the “portfolio” here might be worth a 10-year follow up post (which you may already have done and I’ve missed it). I still have my signed copy of Value.able after all these years.

Hey John. Really good idea. I will look into it.

Hi Roger,

Based on your “A1 company suggestions” back 2.5 years ago (24.6.2010)

completed backtested resulted in a +46.83% return. or had you invested $15k in each company, for a total investment of $150k – market value as of (26.1.2013) would be $220,144 or an increase of $70,210 which excludes dividends. this compares to the ASX200’s 26% during same time period reviewed.

80% or 12 the 15 companies share price increased in value – 20% or 3 of 15 decreased

the following is an overview – (company shares purchased 1.7.2010 or close)

MMS +190.11%

SRX +125.42%

CRZ +123.10%

ARP +108.17%

MND +103.50%

REA +91.75%

CSL +58.12%

WOR +14.72%

ORL +9.28%

COH +6.21%

FWD +6.11%

NVT +5.40%

IRE -1.06%

JBH -48.02%

ERA -90.62%

2.5 years down the track, which of the 15 companies would you continue to own and buy?

It would be interesting to gain your insights on the following

WOR A2

ORL A1

FWD A2

JBH A2

IT would also be ideal for you to release a Feb 2013 edit or update of your “stand out / Top 15 – A1”

Many thanks for sharing your powerful & genuine knowledge, the nation and in particular the financial services sector needs more people like you.

Best regards

Peter

Thank you peter for keeping track. I’d be delighted to put together another list (this time using Skaffold) and will indeed do something special like that in the next week or two. Thank you again.

What about MIN. Good growth. Is run partly by those who turned around MND. Very impressive. FWD is on the slide and has been very disapponting in recent months.

Hi Roger,

Just received “Valueable,” and thank you for it. Congratulations on the achievement. By the way, I have recently returned from touring China and visiting the World Expo in Shanghai. The Chinese exhibit itself must be seen. One section showed a typical home every ten years for the last thirty years. It was like going from the late eighteenth to the twenty first century in Australia. However, the highlight of the China exhibit is a tapestry, extending the full length of the exhibit building, with innumerable moving images depicting life in ancient China. Apart from the exhibit, China today is a world in transformation, moving with unstoppable force and determination. Wherever one looks there are tall appartment blocks, roads and bridges springing up like mushrooms, usually quite aesthetically pleasing, and often displaying solar pannels and wind turbines, even on the buildings themselves. The vision and scale of development is extraordinary. It seems that the Chinese are a lot more active about doing things for climate change, improved water management and alternate sources of energy than we are here in Australia. After the devestating earthquake a few years ago, the entire region affected was rebuilt within just a single year. One leaves China with a very favourable impression of progress for the nation and a better life for its people. Cheers, Chris

Thank you Chris for that very articulate summary of your insights! Very useful. Thanks again.

Hi Roger,

CAB has moved down significantly. Court case coming up in relation to anti competive behaviour and possible competition through new technology – is this a buy now? you’ve got it as an a2 business

Hi Peter,

Have a look at the comments from me early in this thread or on another recent post and you should find a discussion about CAB.

hi roger

i think you have CAB as an a2 -price has moved down considerably due to pending court case on anti competitive behaviour and possibly future high tech competition -i’m considering buying back in -as the y say buy in fear.

do you think future technologies will be a problem -what aboutthe courtcase – cheers. Really enjoying your research – this is how i invest – look for great companies that are undervalues- will probably buy you book

cheers

peter

Hi Peter,

Thank you for the suggestion. You should find some discussion about CAB in the earlier comments in this thread or another relatively recent one.

Hi Roger, what do u think about Count Financial (COU) ??

Thanks.

Hi Roger,

What do you think of 1300Smile (ONT) I brought it in 2008 at $2.50 and have held on sinces the dividends has over time risen, shares are tightly held and they have surplus cash at hand.

Similarly I recently snapped up some Connxion (CXN) shares around 3 cents thereabouts whats your thoughts regarding Connxion Ventures. They had a restructuring last year in june and the company looks like its going to turn around this comming financial year 2011. Base on my assumptions my intrisic value is around 8-10cents by 2011 if they acheive their targeted projection. Ive loaded up heaps over 1 million shares, so it would be nice to get some support as the market doesnt seem to like it every much at the moment even when the economics for this business looks very promissing. Perhaps time will tell, Eamon!

Hi Eamon,

I am having a good look at 1300 smiles right now. CXN needs to demonstrate a decent track record first. If the numbers start looking better so with the valuation which currently is zero because there have been no profits.

thats the hard thing about valuing companies thats lossing money each year, as what spits out is 0 sadly its makes my job very hard, as Im constantly quoting to my father that “it will go to 8 cents next year dad, trust me, im a good speculator”

I am sure he sees the irony.

What about ARB? I first invested in this company in 2003 as a classic Buffet company and it just keeps looking better – good ROE, little debt, riding earnings, dominant position in its market and directors who do not appear greedy.

Its an A1 John. My list is not exhaustive.

Hi Roger,

I am looking forward to having a read of your book.

There are a lot of companies in the ASX and it would take a very long time to go through all the data. Can you please tell me if you use any software to help speed up your analysis?

Cheers

Adam

Hi Adam,

There are indeed a lot of companies and many are simply a waste of your time. It is useful to have a device that can be applied consistently over every company, making the sifting easier and shorter. If I nominate any single software here however, I will be making a decision to change the very independent nature of the blog. I am not employed by anyone to promote their services nor do I own any business that currently sells any such product. I am thus NOT associated with any such service that is currently available in the marketplace. If you have been incorrectly led to believe that I am associated with a product or service and have purchased that product or service because you thought I was, then let me know immediately.

Hi Roger,

Thanks for your reply. I have not been lead to believe you use any particular software. I appreciate that you cannot promote anyone in particular. My question is more of a general one. I have heard that Warren Buffett does all his calculations without a computer and wondered if this was the case for you.

Cheers

Adam

Hi Adam,

I suspect few people have Buffett’s memory.

Hi Roger,

Looking forward to recieving my copy of your book. I have watched with interest your passion for buying a stock below its intrinsic value. However in all the time I have been watching you on Sky, i have never heard you mention when and why you would sell a stock the you had purchased.

Cheers

Robert

Hi Robert,

I had a chat with Peter Switzer some time ago about that very subject. You should be able to find it on my Youtube channel. If you miss, don’t worry there is a chapter dedicated to the five reasons why you might consider changing your mind.

Hi Roger,

With recent volatility and share price movements, wondering if you may consider a future post on, say, the 5 A1’s that are currently farthest below, or closest to, your calculated intrinsic value? Thanks Roger.

Regards,

Craig.

Hi Craig,

A definite candidate for another post. Thanks for the suggestion.

Hi, Roger

which one I should choose? JB Hi-Fi or Harvey Norman. Both companies project healthy growth and show the effective management. Although, JBH shows the higher ROE, but HNV shows the more diversified business segment. which one shows the sustainable growth for the long term investors.

Regards,

Hi Grace,

Thanks for sharing your thoughts about JBH and HVN. Generally, I concur with your assessment and comparison – JBH is the better performer ‘currently’ and Harvey Norman has diversification (including property ownership which is one of the reasons why its ROE is lower). I cannot however make a recommendation to you about what you should do. That is the reason why you need to seek and take personal professional advice. Most brokers have analysts covering retail stocks and producing research to which they will stake their reputations. Be sure to get some advice from them about which way to go and make sure you get it before you go.

To add my 2 bobs worth on A1 businesses, I believe CCV, CXP, PME & WWA could all be added to that list. Only PME is selling under intrinsic value at present though from my calculations.

Hi Craig,

Thanks for adding those companies to the list. Not a bad selection by any stretch either. On the A,B,C scale, thats 3 from 3 so well done! All ‘A’ listers but they’re ‘2’s’ rather than ‘1’s’. Excellent companies all the same.

PME is also trading below its intrinsic value by my calculations but one thing we need to ask ourselves is where will the business be in 5, 10, 20 years. Looking retrospectively at the numbers, PME have not been able to significantly increase earnings over the past 5-10 years although the words of management would have us believe the business is on an exponential growth curve. Maybe on potential it is, but although one can promise the world, you will soon be found to be delivering an atlas when the numbers are ultimately revealed.

Brings to mind another company that has traditionally traded below its intrinsic value. Infomedia (IFM) has a solid ROE (similar to PME) but traditonally there has never been the growth in the business to warrant investment.

I can only assume this is one of the reasons that A2s, 3s and Bs come about instead of A1s. I’m sure all will be revealed and I eagerly await my copy of the book Roger.

Regards

Allan

Hi again Allan,

It is a great idea to print out the message from the CEO from the last five or ten annual reports. Staple them together like a book and read them from cover to cover. Its amazing the picture that emerges about the company. I remember doing that with a company that a swimmer had been given shares in. It would have been quite clear to anyone what the result would be.

I done that for Connxion Ventures for one year and it seems promising, as thats all I have to work with! Damn…. Eamon

(please take personal financial advise before buying any stocks I may mention, as you could lose all your money)

Exactly

Hi Roger,

Australia has a small number of very profitable listed internet companies.

In addition to those you have mentioned (REA and Carsales), I have salivated at the numbers behind Seek (SEK) and Wotif (WTF).

The thing that strikes me about WTF in particular, is that it has some defensive qualities. I like the idea that when needing to get rooms booked (i.e. in lean years) advertisers will turn to the likes of WTF, for a cheap and efficient channel to market. The web has taken over (mobile is the next wave).

I also think their UX (User eXperience) is way better than competitors. I’m not sure if you’ve tried Webjet for example, but I find it frustrating to use. Along these lines wotflight.com seems to be well executed at a glance.

I also presume that if the Aussie dollar tanks, we will likely be experiencing a weaker economy but will, at the same time, be a more attractive tourist destination.

Just glancing over WTF’s most recent presentation to analysts, I find their presentation to be clear and very well presented. Now this doesn’t necessarily translate directly to investment merits, but in my mind, it’s a good sign that there is a well communicated strategy that seems engaging (especially for a company that markets itself, mostly online, to a consumer audience).

Do you have any thoughts regarding Wotif? I’m interested in your take, valuation wise, they appear slightly overpriced, but (as a disclaimer) I have taken a small position in this little gem today.

Regards,

Andrew

Hi Andy,

WTF is an A2 so very very high quality and while I agree that the clarity of a presentation is not a direct reason for investing, I also agree that it tells you that management are able to clearly articulate what they do, where they are going and how they are going to get there. This is important, because if management cannot articulate that to you, they can’t articulate it to staff. If staff are confused their go-to-market strategy will be in disarray. So indirectly it is vital. I also agree that valuation-wise it is not currently a bargain.

Hi Roger

Long time watcher and first time writer. It’s great to finally liaise with like-minded investotrs. Another very interesting post Roger and once again it has got the blog in action.

Sirtex Medical is an interesting choice as they seem to have been only profitable for the last year which of course can be a significant turning point for Biotechs and a possible 10-20 bagger in the making – Fortunes have been made on COH and CSL…

Once upon a time I used to speculate on biotech stocks in an attempt to get in on the ground floor but soon learned (along with my discovery of Buffett, Graham and Fisher) that potential is far removed from probable.

I was enlightened when I read Peter Lynch’s One Up on Wall Street where he mentions that you have ample opportunity to make significant gains on smaller companies (in any industry) once they are profitable without any need for speculation. Just have to take a look at Pharmaxis’ (PXS) potential in recent times but the share price tanked on a 50-50 chance of FDA approval. Will they succeed? I have no idea but all we can do is wait and see when they are profitable and can be valued.

Still too early for me on Sirtex Medical which is just opinion of course. One I would love you take a look in this space is Cellestis (CST) if you have any time. It gets my tick for the ‘what it’s worth basket’.

Cheers

Al

Hi Allan,

Thanks for sharing your thoughts, ideas and experiences. This is the right place to do that and I am sure everyone reading these posts from CEO’s and CFO’s to first-time investors will appreciate it. Cellestis gets a very high quality rating on its 2009 results and a strong increase in valuation to $1.47, but you will need to look at the half yearly and 2010 full year results and forecasts to gain more comfort about whether there are many margins of safety today. Do you have any forecasts that you are comfortable sharing?

Looking at the half-year results and projection for FY10 I have CST on a valuation of around $2.20. This has the potential to shoot the lights out in coming years.

They operating in a very attractive space (simple tuberculosis testing – a disease which claims one life every 17 seconds) and the expenditure strategy can now focus on marketing and sales in the US and Europe along with a launch into Asia and beyond.

Potential vs Probable. It is what we all continue to grapple with as we attempt to hold out for that perfect pitch.

Cheers

Allan

Hi Allan,

We have some very highly qualified people in various fields of medicine reading this blog. I hope they might offer you a reply with their thoughts.

Hi Roger,

This morning I was interested to learn that and ASIC has recently started reporting aggregated short positions. JBH was forth on the list of shorted companies this past week. What do you make of the terrible sentiment toward JBH? FXJ topped the list, and apparently because of this, its share price dropped – becoming a self fulfilling prophecy, so to speak. And for or anyone interested in the list, you can find it here: http://www.asic.gov.au/short-position-reports

Hi Robert,

Thanks for sending the link through. Shorting is a tough game because you have to be right in direction and – depending on the depth of the pocket – time as well. Some do it very well. I have studied at length the thesis of Jim Chanos, for example and watched and listened now to many of the presentations he has given at Columbia University and elsewhere. We could speculate about the reasons why JBH is the 4th most widely shorted stock and the reasons may include; betting with the departure of Richard, betting against the ability of Smart, betting that retail is slowing, betting that retail stocks will do poorly in Act II of the GFC and a host of other reasons, but they would all be speculation about the direction of the share price, which of course I have always said I don’t do. Moreover, to react negatively to this information may also be presuming that the short sellers must be right and we should all agree with them. That would be folly. Finally, their timeframes are completely different to my own. They may be interested in profiting from a 20% decline in the next month or two. I am too, but only insofar as the decline presents an opportunity to buy for the next two or three years. Remember this blog is all about studying and discussing the theme of buying great quality businesses at large discounts to intrinsic value.

Hi Roger

Thanks again, one question ..with all rise in the gold price, how does that affect the forward valuations of successful groups like Newcrest or Kingsgate or is the gold price a risk factor when calculating discounted cash flows for these groups. In other words, are these guys overpriced ?

Rex

Hi Rex,

You have managed to hit on the very reason its so hard to come up with a valuation for commodity based businesses. The maths is simple and actually deriving a valuation is easy but what commodity price to use to estimate future profits? It is one of the reasons that Buffett has talked about having difficulty investing in ‘fast changing’ industries. Commodity prices are most definitely ‘fast changing’.

Hi Roger

Very interested in your view on Oroton – have been a happy investor in this one for a couple of years.

My query is – where do they go from here? They are excellently managed, have terrific product and investment criteria but must be close to saturation point (distribution wise) in Australia.

I know they are talking about expanding overseas. This would be excellent as their goods are definitely world class (have recently returned from Tokyo and Oroton (in its market) would compete with the best there.

But how do you value this potential? Fashion is an interesting industry as it crosses borders easily. Therefore Oroton deserves a premium for its intellectual property. What do you think?

Hi Peter,

Great to hear you have had some success investing in Oroton. I have difficulty valuing something that is not demonstrated. Sally told me on air that ‘there is more to come’ so we can deduce that she is optimistic about the company’s potential and it may mean that the company is not close to saturation locally. Overseas expansion is always risky but I agree the product is world-class. The Polo licence has recently been renewed and as long as the Lane interest remains there is little reason to expect that it won’t be renewed again. None of these things can be ‘valued’ in the traditional sense, but they produce some added comfort to the present discount to intrinsic value. None of this of course is a recommendation. Be sure to seek personal professional advice.

Hi Roger,

I was wondering if you have any thoughts about WTF? I don’t have much experience with tech companies, besides watching carsales.com.au with envy. I notice WTF has a good track record of a very high ROE, though their debt seems quite high. I suspect their price is still way above intrinsic value even its recent decline?

Hi Chris,

If you have a look, the best businesses online are quite simply, lists. Lists of cars for sales, lists of search results, lists of homes, lists of friends. Pardon the pun, but the list goes on…WTF also offers a list. As long as people prefer it to another offering, the list will remain the best place for suppliers to offer their wares. And as long as it has the most wares on offer and.or at the best price, people will prefer it to another. Its one of the sources of competitive advantage and it can be measured by return on equity. So keep an eye on the ROE and its components. For what it is worth, WTF gets a ‘B’ rating on my quality scoring and its trading at a price that equals my estimated value in 2012 but remember the company could announce a surprise increase (or decrease) in profits and those estimates could change dramatically. Not a recommendation, be sure to obtain personal professional advice before transacting.

Oh and sorry to chime in yet again Roger. Please believe me that I don’t have enough invested here to be suffering commitment bias.

How does a company sporting (for the last 5 years no less), ROE north of 60% [admittedly declining from 100, 80!], Profit margin maintained above 50%, cash-flow increasing, and debt virtually nowhere to be seen in their history.

I imagine it might come down to quality of management and / or sustainability of competitive advantage? We have a well known and heavily invested founder/owner/manager, who appears to be executing a fairly pragmatic strategy (reminiscent of the Flight Centre founder). We also have no shares dilution so far, it’s been stable at 200million shares. I admit, I haven’t yet looked into options outstanding, which is a very important aspect. As for sustainability, well 4-5 years at these margins with no debt seems to be as good a litmus test as any.

And all of this gets WTF a B rating?

I’m thirsty to learn what else I need to look for. And yes, I’ve got your book on order :)

Keep up the great work on the blog, first one in a while that’s piqued my interest.

Hi Andy,

Now that would be giving too much away but take a look at the short term liquidity picture for 2009.

Hi Chris,

By my reading WTF has practically no debt. Am I missing something?

Regards,

Andrew

Great article as usual.

Personally i would like a complete list of all A-grade (A1-A5) and all C-grade (dont really care about the 1-5, just the ‘C’).

Why?

because focusing only on A-1 limits the investment pool of stocks to too narrow a range. I look at the relationship between discount to intrinsic value and quality of the stock. The lower the quality the greater the discount required. However this also needs to be weighed up against Warren Buffett’s quotation: ‘it is often better to buy a great company at a reasonable price, than a reasonable company at a great price.’

From your previous posts, ‘any ‘A’ grade company deserves further investigation, not just the A-1’s.

Conversely i am also very happy to hear when you discuss a ‘c’ grade company.

Why?

because i keep a check list of these companies as well, an ‘avoid at all costs’ (for investment purposes anyway). A bit like that special phone number Warren Buffett keeps by his desk for those times he is tempted to buy airline stocks.

Hi hear you Rici Rici,

As you can imagine, there are vastly more C’s than A’s. Let me think about how to deliver that to you.

Hi Roger,

Do you have any concerns over the fact that CarSales.com has only been listed since Sept 2009?

What’s to stop a competitor from taking business away from CarSales.com?

Also, on Sirtex Medical, I can’t find any consensus forecasts for this company, and I notice that Net profit jumped substantially in 2009, compared to previous years. Do you think this trend is likely to continue? Before 2009, its financials look fairly ordinary to me, including its ROE (5%, 7% and 10% for 2008, 2007, 2006 respectively)

Cheers

Mike

Hi Mike,

Both great questions hence the reason for prompting you to use the list to go and do further research. Based on the numbers I have and the estimates I have, both companies are “A’s”. As results come in, quality can change and so the ratings will change. Some will leave the list and others will join – one of the great joys of investing. Very few companies in such a small market as Australia are permanently in one class. Perhaps I should put a list together of those that have been A-rated the longest. A good idea for another post.

Hi Roger,

Given that Australia doesn’t have a “ValueLine” equivalent, how hard do you think it would be to start up an equivalent service in Australia?

I’ve often thought that something like that would be very useful to investors, and bemoan the lack of a similar service.

Love to hear your thoughts on it.

Cheers

Mike

Hi Mike,

A thought that has not escaped me!

Does Buffet put more emphasis on capital appreciation or income (dividends) from a business?

Hi Dean,

I believe neither. Have a read of James Walter’s work – on which I believe Buffett’s thoughts on the impact of dividend policy on valuation is based.

Roger u have changed the way i am investing in the market.

cant wait to get that book and read more of you.u have mentioned all these 15 companies but which of them trade below there intrinsic value?

Hi Kostas,

They way the market is going, I expect more and more. In all seriousness, I will leave that for another post. Sorry to keep you waiting but there is quite a bit to discuss on that subject.

Hi Roger, Thanks for your your help by giving valuable informations to us, just want to know is it good time to buy BHP?

Hi Bhupraj,

I will put something up about BHP, RIO and FMG in coming weeks.

Hi Roger

Any idea who is Australian “Value Line” ?

Hi Nan,

The closest thing we have is Morningstar’s Shareholder compendium. But its not a patch on Valueline unfortunately.

Hi, Roger,

Book coming soon which is great.

I am mildly surprised by ERA in your list as Buffet hated commodity stock.

No surprises with the others.

I assume WOW does not make the list due to it’s current assets to current liability ratio or maybe it is just getting too big and therefore ROE is harder to maintain. It certainly has an A1 Track record. Like your thoughts on this

.I know we will get it in the book but given the banks are full of debt what rating do they get. I assume A something. The reason I ask is that I have been a long term fan of MQG but sold all stock in the $50 range in the last 6 months or so as may valuation put them on about 2013 to 2014 prices. My MQG Valuation in September 2010 is around $38 rising to $45 and $48 in subsequent year If analysts are right. Given, it is likely to trade with a 3 handle in the very near future I would like your thoughts on it’s and other Banks Quality in the rating scale

Thanks again

Hi Ashely,

Thanks for sharing your thoughts. I have had a few requests for a banking review so I will write something up soon – quality and value.

Hi Roger

Is MMS still an A1 considering that they have used up all their cash & got themselves in significant amount of debt to buy a leasing business of all things? im sure the henry tax review spurred them on to cover themselves in case the review demolished their business model. i think the leasing business will form a substantial part of their business so moving forward we really need to understand how profitable the leasing portion of the business will be. I suspect it wont be anywhere near as profitable as the salary packaging. I am worrying over nothing?

Hi Nick,

Nice to hear from you. Thanks for the post and I am sure everyone reading this will be keen to hear anyone’s thoughts on MMS. The purchase does increase the debt levels which will reduce the quality score. How much will depend on all the ratios they report, which I use for the quality scoring.

Hi Roger,

Thanks for the article.

Can you clarify whether these 15 stocks mentioned represent the only stocks on the market you currently consider to be A1? Or are they just a selection of some of those stocks? I ask this because I notice both QBE and The Reject Shop are not included in this list and I had previously thought (perhaps wrongly) you consider those businesses to be A1 stocks.

Thanks,

Steve

Hi Steve,

Great question as it allows me to clarify. No this is not an exhaustive list. There are others that I have left out. It represents a selection.

G’day Roger,

How about Platinum Asset Management (PTM)? Superb business and miles ahead of any of its competitors. Great financials but pretty expensive at the moment. I have bought your book and am patiently waiting for delivery. The wait is almost over. Great blog, Roger.

Thanks for the affirming comments. I sincerely appreciate all the support and encouraging words everyone has offered. It is certainly stirring. PTM is a very high grade business but it may be an A2 rather than an A1 . Let me check the latest numbers and get back to you.

Hi Roger,

I note that 10 of the 15 are outside the current top 120 stocks by market capitalisation. Is this just the way the cards fall at the moment? Or may it be a pointer to the large caps, some with quite a degree of saturation in the market place, maybe finding it difficult to achieve better than modest growth?

Regards,

Craig.

Hi Craig,

Growth is not a factor in the quality ratings. The list however is not exhaustive. There are others. I am merely offering a list for further study. And yes, the list is based on most recent financials but they of course will change in coming weeks.

Can’t wait to read your book to understand how you come up with your valuations. In the meantime, can you share with us what your current valuations are for the list of A1 companies? That way we can also see if we can come up with those valuations ourselves once we receive the book.

Thanks. I love your simplistic approach. Simple = good.

Hi Joris,

That s areally good idea for a topic for the blog. I will use it, with your permission, as a post topic in coming weeks.