The U.S. economy is teetering on stagflation’s edge

The U.S is careening toward a potential recession, propelled by a dramatic escalation in trade barriers, including unprecedented tariffs on imports from China, one of its largest trading partners.

Economists believe the sweeping “Liberation Day” tariff initiative could trigger a sharp economic contraction by summer, and the fallout is already evident across corporate earnings, consumer behaviour, and global trade dynamics.

Dire economic projections

Goldman Sachs projects U.S. Gross Domestic Product (GDP) growth at a meagre 0.5 per cent for 2025, narrowly skirting a recession if tariffs rise in aggregate by 15 percentage points. However, with the current 20 percentage-point increase already in effect, the firm anticipates a mild recession, akin to the 2001 downturn following the dot-com bust. That recession saw declines in employment and corporate investment but avoided the severe financial dislocations of 2008-09 or 2020.

Loomis Sayles, another prominent forecaster, predicts zero GDP growth for 2025, emphasising the economy’s underlying strength as a mitigating factor.

Meanwhile, Torsten Slok, chief economist at Apollo Global Management and formerly Deutsche Bank’s chief economist, assigns a 90 per cent probability to what he terms a “voluntary trade reset recession”. Slok, who, like us, correctly dismissed recession fears in 2022 when pretty much everyone else was bearish, now believes recession is a likely outcome.

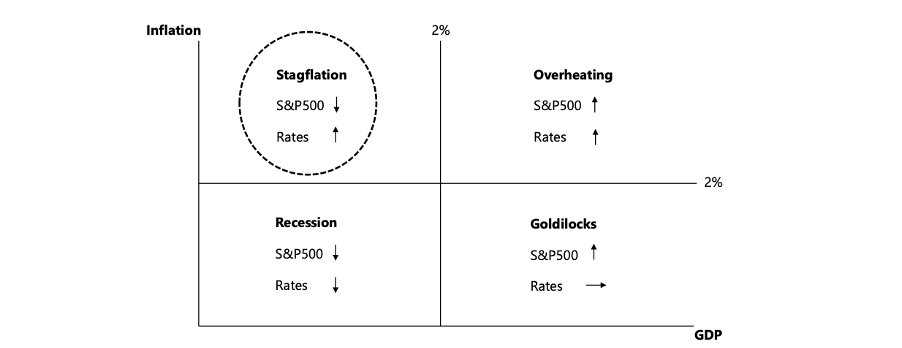

Figure 1. Tortsen Slok calls a stagflation shock

Source: Apollo Global

Keen readers of this blog will recognise Torsten Slok’s matrix in Figure 1. It’s the very same we have published here at the blog many times, and the same as that first published by Gavekal Research in 1978 (Figure 2).

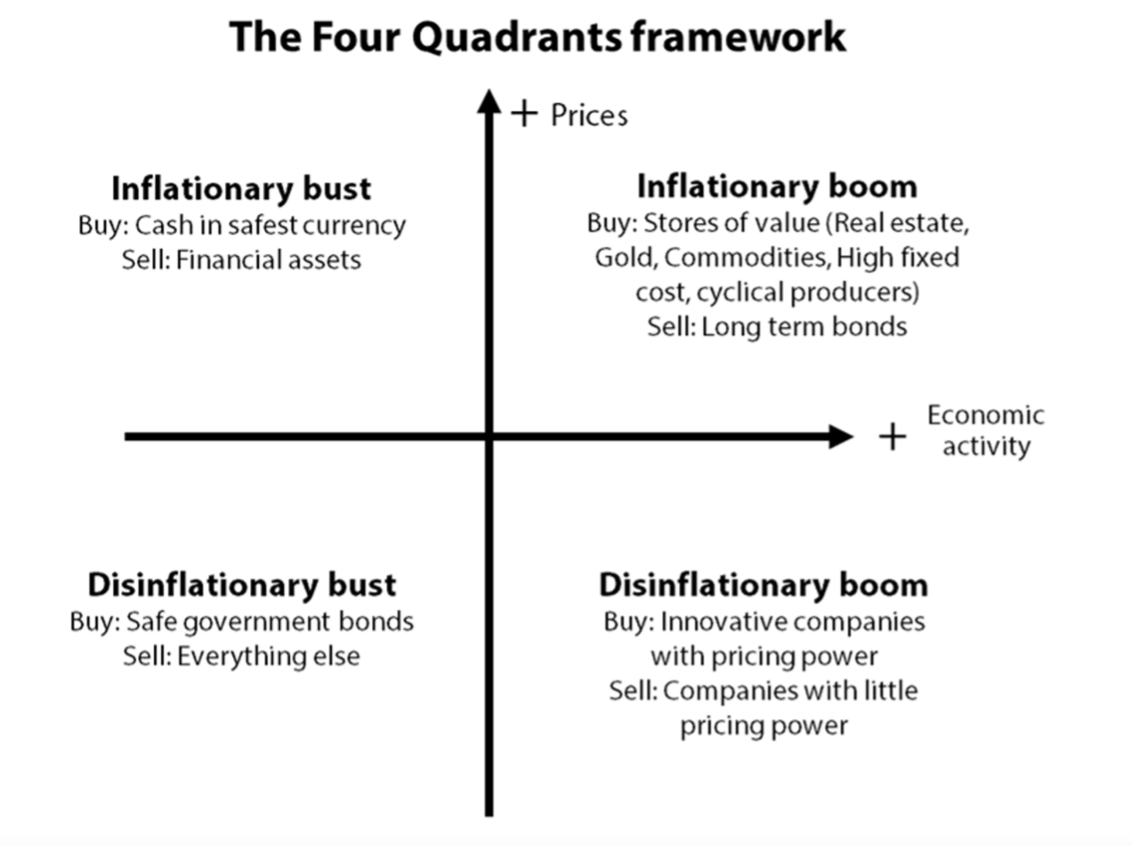

Figure 2. Gavekal Research’s where to invest matrix.

Source: Gavekal Research, 1978

The horizontal (X) axis denotes economic growth, with positive growth to the right of the vertical (Y) axis. The Y-axis denotes inflation, with everything above the X-axis describing accelerating inflation and everything below describing slowing inflation, also known as ‘disinflation’.

For nearly five decades since 1978, and almost without exception, innovative companies with pricing power have done well whenever positive economic growth coincided with disinflation. By late 2022, throughout 2023 and during 2024, despite frequent forecasts of recession by economists and commentators, economies grew (albeit anemically) and disinflation persisted. And Gavekal’s matrix revealed investors would do well investor in assets described in the lower right quadrant.

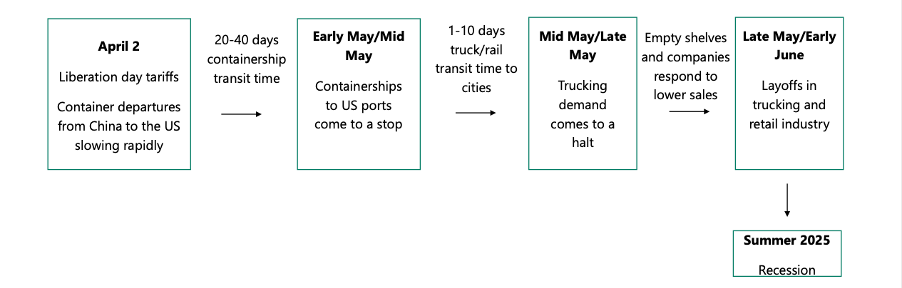

Today, however, Slok believes the U.S. economy is headed deeply into the top-left quadrant – a zone where few assets thrive, signaling a stagflation shock combining stagnant growth with rising inflation. Slok’s April investor presentation, entitled “The Voluntary Trade Reset Recession,” underscores the severity of the trade war’s economic toll. Figure 3, illustrates Slok’s path to ‘the voluntary trade reset recession’ and stagflation.

Figure 3. The voluntary trade reset recession

Source: Apollo Global/Torsten Slok

The mechanics of tariffs

The economic impact of tariffs is complex due to their role in GDP calculations. Imports are subtracted from GDP, meaning a reduction in imports could boost GDP. However, high tariffs increase input costs and introduce uncertainty, prompting domestic corporations to curtail investments in capital expenditures and hiring. Tom Porcelli, chief U.S. economist at PGIM Fixed Income, argues that even a 54 per cent tariff on Chinese goods is sufficient to “thrust people to the sidelines” and delay corporate decisions. The jump to 135 per cent may have limited additional impact on trade and inflation, as the initial shock already disrupts economic activity. Porcelli questions whether the distinction between a 50 per cent and 100 per cent tariff is meaningful, given the scale of disruption.

The 135 per cent tariff on China is unprecedented, dwarfing historical trade barriers and rendering standard economic models inadequate. The effects are further muddied by the potential for Chinese exports to bypass tariffs by entering the U.S. via third countries with lower rates, a practice that could mitigate but not eliminate the economic strain. The sheer novelty of such high tariffs however complicates forecasting, leaving economists grappling with uncharted variables.

Corporate America under siege

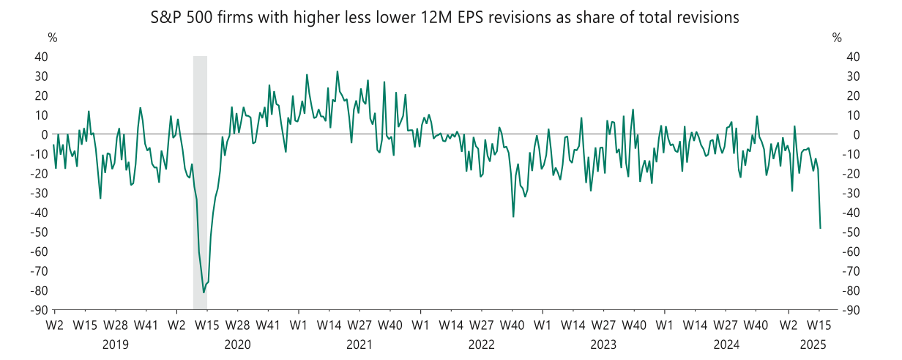

Corporate earnings season is already painting a bleakening picture, with S&P 500 earnings expectations undergoing their sharpest downward revision since 2020. Industry leaders are sounding alarms. Southwest Airlines CEO,Robert Jordan, declared “I don’t care if you call it a recession or not, in this industry that’s a recession,” reflecting the airline sector’s struggles. Chipotle CEO, Scott Boatwright, cited economic concerns as the primary reason consumers are reducing restaurant visits, with “saving money” being the overwhelming driver. PepsiCo CFO, Jamie Caulfield, admitted, “Relative to where we were three months ago, we probably aren’t feeling as good about the consumer now,” signaling a rapid deterioration in sentiment.

Figure 4. S&P 500 earnings outlook – sharpest decline since 2020

Source: Bloomberg, Macrobond, Apollo Global

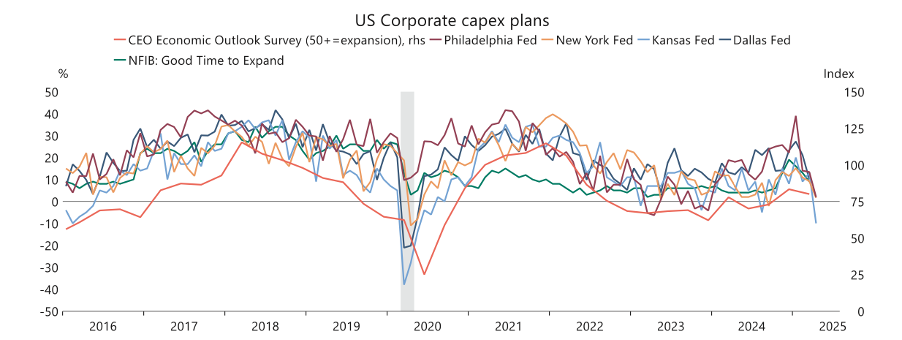

Businesses are responding with drastic measures. New orders are plummeting, and container ship traffic from China to the U.S. is projected to “come to a stop” by mid-May, according to Slok. Trucking demand is expected to collapse by late May, triggering layoffs in trucking and retail by early June. Heavy truck sales in March hit their lowest level since the pandemic, and corporate capital expenditure plans are contracting (Figure 5.). The Bloomberg CEO confidence index, measuring expectations for the next year, has cratered to its lowest level since the 2008 financial crisis.

Figure 5. Sharp reversal in corporate capex spending plans

Source: National Federation of Independent Business, Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of Philadelphia, Business Roundtable, Macrobond, Apollo Chief Economist.

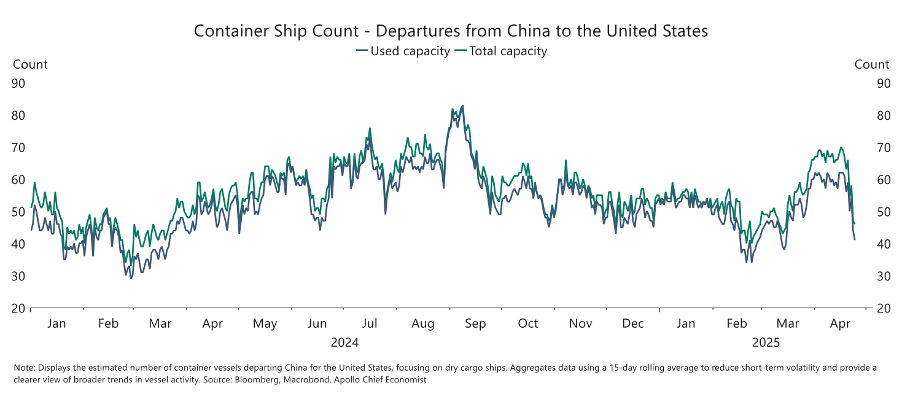

Small businesses, which account for over 80 per cent of U.S. employment and capital expenditure, are particularly vulnerable. Unlike large corporations with the resources to absorb tariff costs, small enterprises must pay tariffs upon the arrival of imported goods, straining their working capital. Slok warns that “well-run generational retailers” may face bankruptcy as ships sit offshore and orders are cancelled (Figure 7).

Figure 7. China-US trading plunging

Source: Bloomberg, Macrobond, Apollo Chief Economist

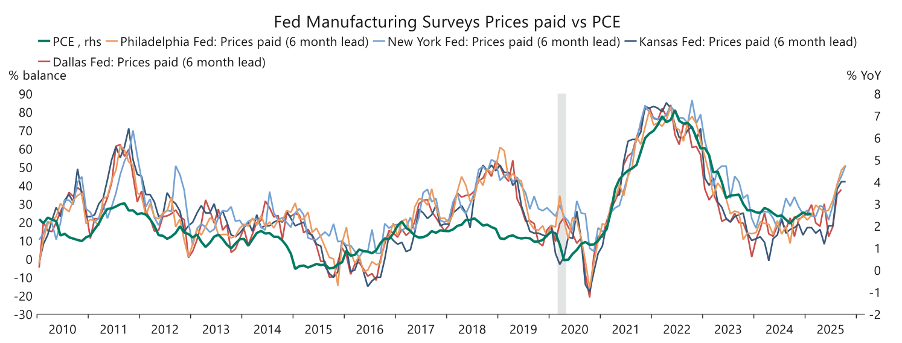

The Federal Reserve’s Manufacturing Prices Paid survey (Figure 8.) reveals a spike in input costs, exacerbating cost pressures. While inventories rose pre-tariff as firms front-loaded imports, new orders have now entered contraction territory, signaling a broader slowdown.

Figure 8. Cost pressures increasing: prices paid rising

Source: Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, U.S. Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist.

Consumer confidence in freefall

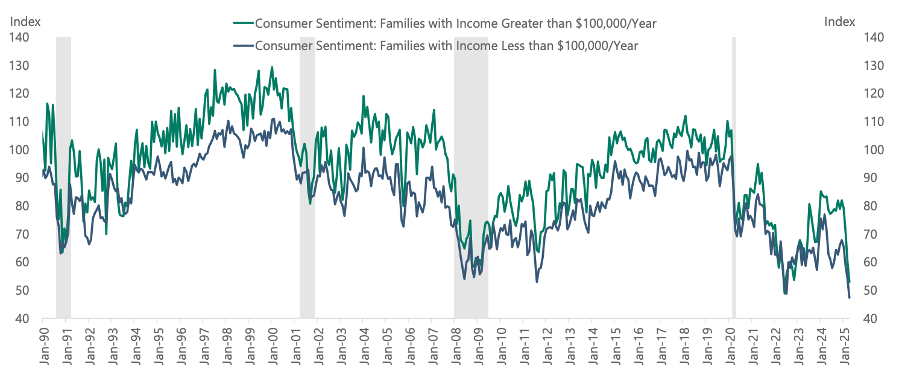

Consumers are reeling from the tariff shock, with the University of Michigan’s consumer confidence survey (Figure 9) reporting an 11 per cent plunge in early April, marking four consecutive months of decline with sentiment now at levels seen during the depths of the pandemic and lower than during the Gobal Financial Crisis (GFC).

Figure 9. Consumer sentiment declining across income groups

Source: University of Michigan, Haver Analytics, Apollo Chief Economist

Sentiment is down 30 per cent since December, driven by fears of job losses (Figure 10.) and deteriorating business conditions. The survey, a near-real-time indicator of public response to trade policy, notes “pervasive and unanimous” declines across political parties, age groups, income levels, education levels, and geographic regions. Consumers are “very worried” about unemployment, with expectations surpassing even pandemic-era levels. A record-high share believes economic conditions will worsen over the next year.

Figure 10. Consumers very worried about job losses

Source: University of Michigan, Haver Analytics, Apollo Chief Economist.

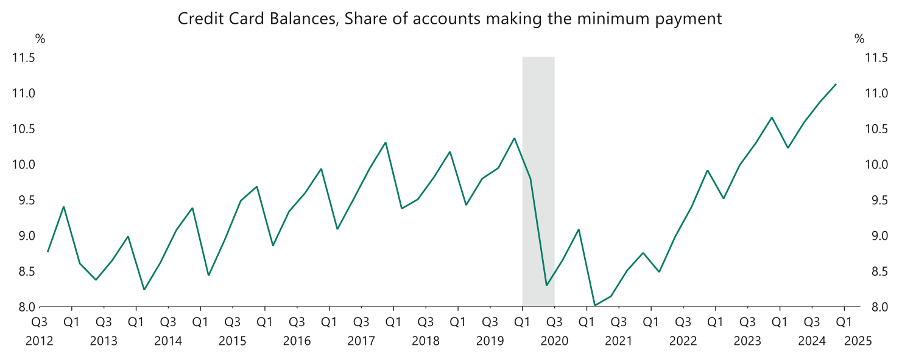

Meanwhile, inflation expectations for the year ahead have surged to 6.7 per cent from 5 per cent, the highest since 1981, reflecting widespread anxiety about price hikes. Consumers are front-loading purchases to pre-empt tariff-driven inflation, but financial strain is evident. The share of credit card accounts making only minimum payments is rising (Figure 11.), as are delinquency rates (past 90 days due). International tourism to the U.S., particularly from Europe, has plummeted, further denting economic activity. The University of Michigan highlights multiple warning signs: deteriorating expectations for business conditions, personal finances, incomes, inflation, and labour markets.

Figure 11. share of credit card accounts only making the minimum payment is rising

Source: Federal Reserve Bank of Philadelphia, Macrobond, Apollo Chief Economist

Notably, many of the surveys predate Trump’s more recent announcement of a 90-day freeze on reciprocal tariffs and negotiations with multiple countries, which may offer some relief not yet captured in the data. However, the broader trend of declining sentiment underscores the Trump’s profound impact.

Policy levers and uncertainties

The Federal Reserve has significant room to counteract the slowdown, and with Goldman Sachs expecting 200 basis points of rate cuts in 2025 – if tariffs persist. However, if tariffs prove inflationary, the Federal Reserve may proceed cautiously, limiting the scope of monetary relief.

Much of Slok’s thesis is based on no change to the current tariff picture. But the Supreme Court and Congress could theoretically strike down the tariffs. No concrete steps have emerged yet.

Trump’s recent overtures toward trade deals with various countries could also lower tariffs, but China’s response – raising its own tariffs rather than negotiating reductions – suggests a prolonged standoff. China appears to adhere to the Napoleonic principle of not interfering with an adversary’s self-inflicted wounds, deepening the trade war’s economic toll.

Contrasting economic indicators

Current economic indicators present a contrasting picture to the pervasive gloom among CEOs, consumers, and investors. The Consumer Price Index (CPI) for March showed overall prices falling, driven by plunging gasoline prices, with the core gauge excluding food and energy remaining benign. Weekly unemployment filings are low, and the economy added a robust 228,000 jobs in March. Of course all of this data predates the full ramp-up of tariffs, limiting their relevance to the current environment.

Avoiding disaster

Somewhat fascinatingly for an economist, Slok offers several solutions, arguing that a recession is not inevitable if tariffs are recalibrated swiftly. For Mexico and Canada, he proposes leveraging the integrated North American economy to negotiate zero-tariff agreements within 180 days, optimising labour, capital, and resource flows. For other countries, maintaining a 10 per cent tariff for 180 days while negotiating non-tariff barriers could pave the way for tariff removal if agreements are reached. For China, Slok suggests a phased approach: retaining tariffs on strategic sectors like autos and solar while gradually introducing others over 18 to 24 months. Such measures could stabilise small businesses, restore consumer confidence, and mitigate the economic shock.

The U.S. economy, long the world’s largest and most open, faces something of a pivotal moment. The administration’s push for fairer trade terms isn’t without merit, given the U.S.’s status as the freest trading market. However, as we have written here previously, the abrupt imposition of high tariffs threatens to unravel decades of economic stability. The 2018 trade war, which raised average tariffs from two per cent to three per cent, reduced GDP by 0.25 per cent to 0.7 per cent. The current jump from three per cent to 18 per cent could slash GDP by nearly four percentage points in 2025, excluding second and third-order effects from heightened uncertainty.

The road ahead

The U.S. inherited a robust economy with 4 per cent unemployment, positive hiring, and tailwinds from investments in infrastructure, next-generation factories, data centres, and the Inflation Reduction Act. Yet, Trump’s tariff shock risks derailing this momentum. Container ships are poised to idle, corporate investment is stalling, and consumer confidence is at historic lows. If Slok is right, the flow of goods from China could halt by mid-May, with trucking and retail layoffs by June. The Bloomberg CEO confidence index and heavy truck sales signal a deepening crisis, while rising input costs and contracting orders also paint a grim picture.

Trump’s bipolar approach to policy introduces a non-zero probability of tariff reversals, but time is running out. Without swift action, the U.S. risks a self-inflicted recession that could reshape its economic landscape, hammering small businesses, eroding consumer purchasing power, and straining global trade networks. As Slok warns, “A trade war is a stagflation shock,” and so long as it persists, the spectre of stagnation and inflation looms large.