Worried about rising rates creating choppy conditions? Not everyone is in the same boat

Investors in the Aura High Yield SME Fund (for wholesale investors) have experienced returns of 9.61 per cent per annum, since inception, earning monthly cash income with no negative months nor loss of capital. *

In a world where the interest rate tide has been rising, savvy investors are sailing towards more stable horizons. The Aura High Yield SME Fund, designed for wholesale investors, has emerged as a beacon of consistent returns, offering a compelling case for investors looking to diversify their portfolios away from volatile seas.

Since its inception on August 1, 2017, the Aura High Yield SME Fund has weathered financial storms and arguably thrived, providing monthly payouts for an unbroken 75 months. This track record reflects the Aura High Yield SME Fund’s investment strategy and its focus on higher-quality lending opportunities within the Australian small and medium corporate sector – a space created by the withdrawal of Australia’s big banks following regulatory tightening after the great financial crisis (GFC).

The proof is in the numbers: a compound annual average return of 9.61 per cent from 01 August 2017 to 31 October 2023, after all fees and expenses, and assuming reinvestment of distributions, has been achieved without any loss to investors’ capital.

Notably, the above return has been generated against a financial market backdrop where yields on traditional investments can often be eroded by inflation or subject to public market volatility.

The Fund’s performance has averaged a monthly payout of 0.77 per cent, and a range spanning from 0.60 per cent to 0.93 per cent over 75 months and with zero volatility of capital.

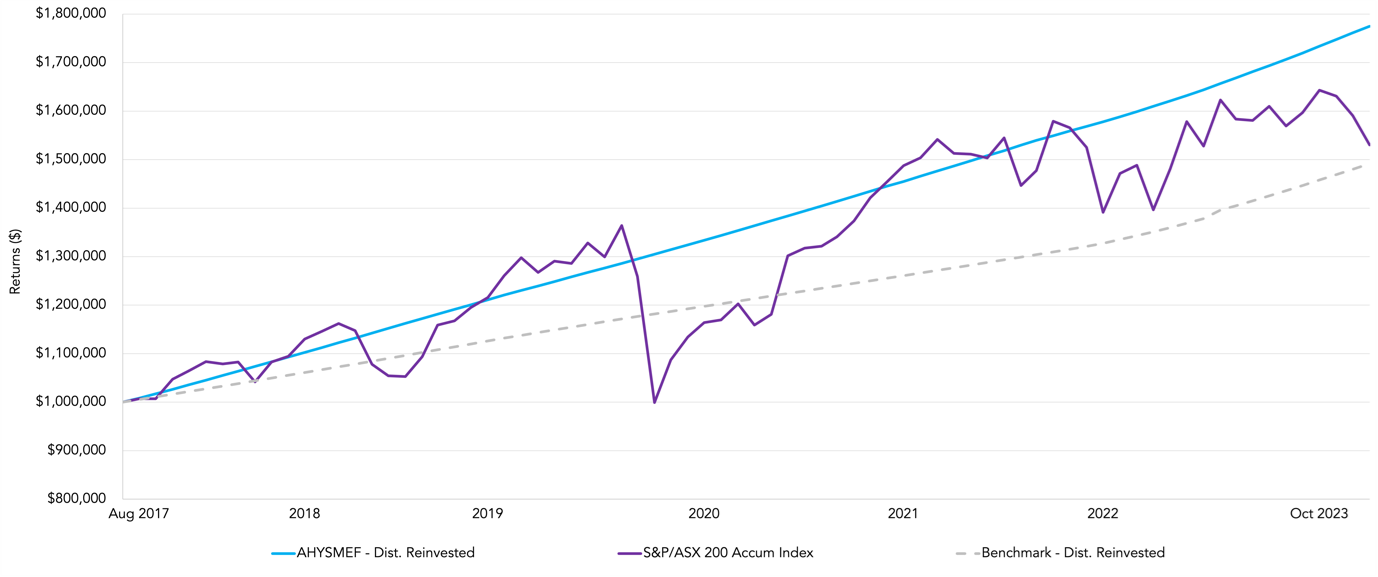

Figure 1. The Aura High Yield SME Fund vs the S&P/ASX 200 Accumulation index (distributions reinvested)

Source: Aura/ Bloomberg

As Figure 1., reveals, when compared to the S&P/ASX 200 Accumulation Index, the Aura High Yield SME Fund has notably outperformed for the period since its inception in August 2017 to October 2023.

To put that into perspective, and remembering the chart compares a private credit fund to an equity index, the Aura High Yield SME Fund with distributions reinvested has outpaced the S&P/ ASX 200 Accumulation Index by 24.99 per cent since its inception on 1 August 2017 to 31 October 2023, translating to a compound annual return outperformance of 2.63 per cent. Importantly, this was achieved during the period without any of the volatility that accompanied the equity market’s return.

Another differentiator is that the loans that comprise the Aura High Yield SME Fund’s portfolio rank ahead of equity in a loss scenario.

Moreover, there exists security backing the investments. Loans within the Aura High Yield SME Fund are accompanied by some form of security or collateral, including possible General Security Agreements, Director’s Guarantees, property, assets, or even invoices. This layer of protection at the deal level aims to help safeguard investors’ capital against the impact of defaults or losses.

A further layer of protection is afforded through diversification with the portfolio containing more than 10,000 relatively small loans spread across many industries, which is unlike some Private Credit Funds whose exposure might be concentrated in a few very large loans across a small spread of industries or within just one economic sector.

With the Fund currently having exposure to loans with an average term of just four months, and with loans primarily offered at floating rates, the portfolio is sensitive to changes in interest rates, more so than funds with longer-term or fixed rate loans whose returns cannot, for example, increase after official interest rates rise until the loans mature and are rewritten.

The Aura High Yield SME Fund also eschews distressed businesses.

The Fund aims to offer another layer of protection through the manager’s requirement that external loan originators – those firms that assess and approve loans, on behalf of The Fund to small and medium corporates – support a proportion of all loans written with their own equity. Originators are required to put their equity at risk first.

In other words, if a loan does not perform and losses are incurred because the collateral cannot be collected, the originator loses their return first and then their equity. Only when the losses are cumulatively so large that all the originator’s returns and equity are wiped out would investors in the Aura High Yield SME Fund see any diminution in their return. It’s a scenario investors should be aware has a non-zero probability but the Fund has not come close to facing such a scenario since its inception in August 2017, including through the COVID pandemic.

As Private Credit emerges as a considered component of a well-diversified portfolio, wholesale investors may consider The Aura High Yield SME Fund.

Rising interest rates have cast a shadow on the returns of many asset classes. The Aura High Yield SME Fund offers investors access to another asset class for their portfolio, one with a history of satisfactory and uncorrelated returns as well as lower volatility, and appealing security at both the deal level and within the structure of The Fund.

*The inception date of the Aura High Yield SME Fund is 1 August 2017. Past performance is not a reliable indicator of future performance.

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura High Yield SME Fund (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery and Aura Group do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.