Money Me: from $2.20 to $0.08 in 15 months

One of the reasons our business partners, Australian Eagle Asset Management, Montgomery Lucent and Polen Capital, focus on higher quality companies with relatively strong and enduring cash-flow is they rarely suffer such crashes often requiring highly dilutionary capital raisings.

Last Friday, Money Me (ASX: MME) – which had seen its share price decline from over $2.20 at the beginning of 2022 – announced a $37 million raising by issuing 462.5 million shares at $0.08 each. In addition, the Company is offering beaten up shareholders a Share Purchase Plan also at $0.08 each for up to $5 million of working capital via a further 62.5 million shares. If the latter is successful, Shares on Issue will nearly triple from 283 million to 808 million.

Of the $37 million raising, $32 million will be used to pay down corporate debt, whilst much of the balance will be set aside for accrued interest and fees. Total Assets of $1.37 billion less Total Liabilities of $1.22 billion will see Equity of around $150 million (or around $0.19 per share). Corporate Debt of $50 million compares with Cash of $19 million, however Payables slightly exceed Receivables at $1.17 billion. Any relative delay in collecting those Receivables could quickly put MME on the backfoot….again.

Money Me is a digital non-bank lender focused on personal loans, credit cards, car finance, credit scoring and bank accounts. Earnings have been exceptionally volatile with recorded losses of $8 million in Fiscal 2021 and $50 million in Fiscal 2022, and this was largely attributable to the blow-out in impairment expenses.

CEO Clayton Howes is arguing the worst is over. Total operating expenses to average receivables has declined from 25.5 per cent in Fiscal 2022 to 17 per cent in the first eight months of Fiscal 2023. The Company has indicated a statutory net profit of $16 million for the 8 months to February 2023, or an annualised fully diluted 3 cents per share (on the 808 million shares on issue).

At the placement price of $0.08 per share, Money Me could be a bargain, but there is very low predictability of future earnings given the difficulty in ascertaining the quality of the average customer loan of $17,000 with an average term of four years. I have written extensively about the Australian consumer’s podium position in terms of indebtedness to net income ratio, and the aforementioned “average customer” probably represents lesser quality receivables.

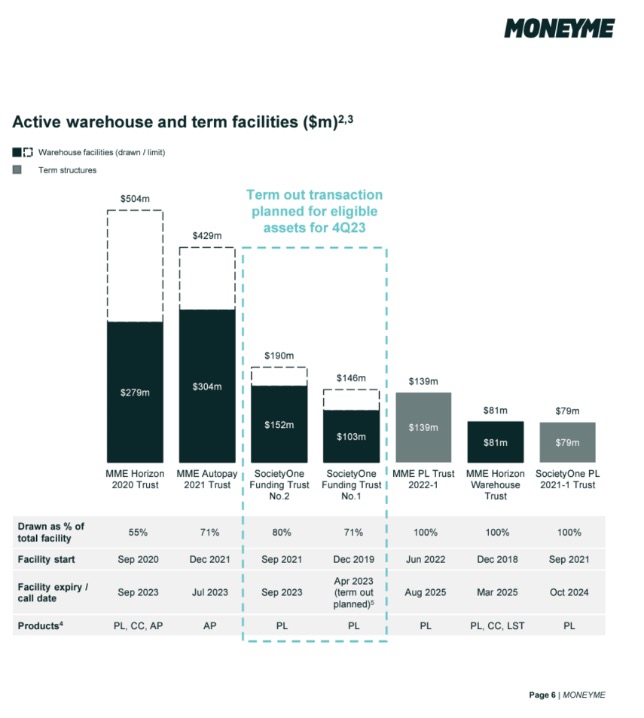

Money Me management will be crossing their fingers that discussions with warehouse lenders for extension, renewal and/or refinancing of facilities expiring in the calendar 2023 year are successful.