Why I’m cautiously optimistic about 2023

A number of commentators are calling the current rebound in global markets a ‘dead cat bounce’. Veteran fund manager, and famous ‘perma-bear’, Jeremy Grantham, has even warned that stocks could plunge a ‘stomach-churning 50 per cent’ from here. But I’m not so sure. I think there are plenty of reasons to be cautiously optimistic about the year ahead.

Equity investors endured a torrid year in 2022 as U.S. interest rates climbed, from marginally above zero at the beginning of the year, to 4.5 per cent by the end of the year. Relatively few professional investors or advisers operating today were working in markets the last time interest rates rose at that pace.

Unsurprisingly, the spigot of free money rapidly turned off, funding for profitless start-ups vaporized, and the more speculative the investment, the greater its subsequent collapse. Author C.S. Lewis, in his highly regarded novel The Great Divorce, might not have been referring to misallocations of capital and high-flying profitless stocks when he noted: “It is a stronger angel, and therefore, when it falls, a fiercer devil”, but the metaphor should not be lost on those who survive 2022 to participate in future market bubbles.

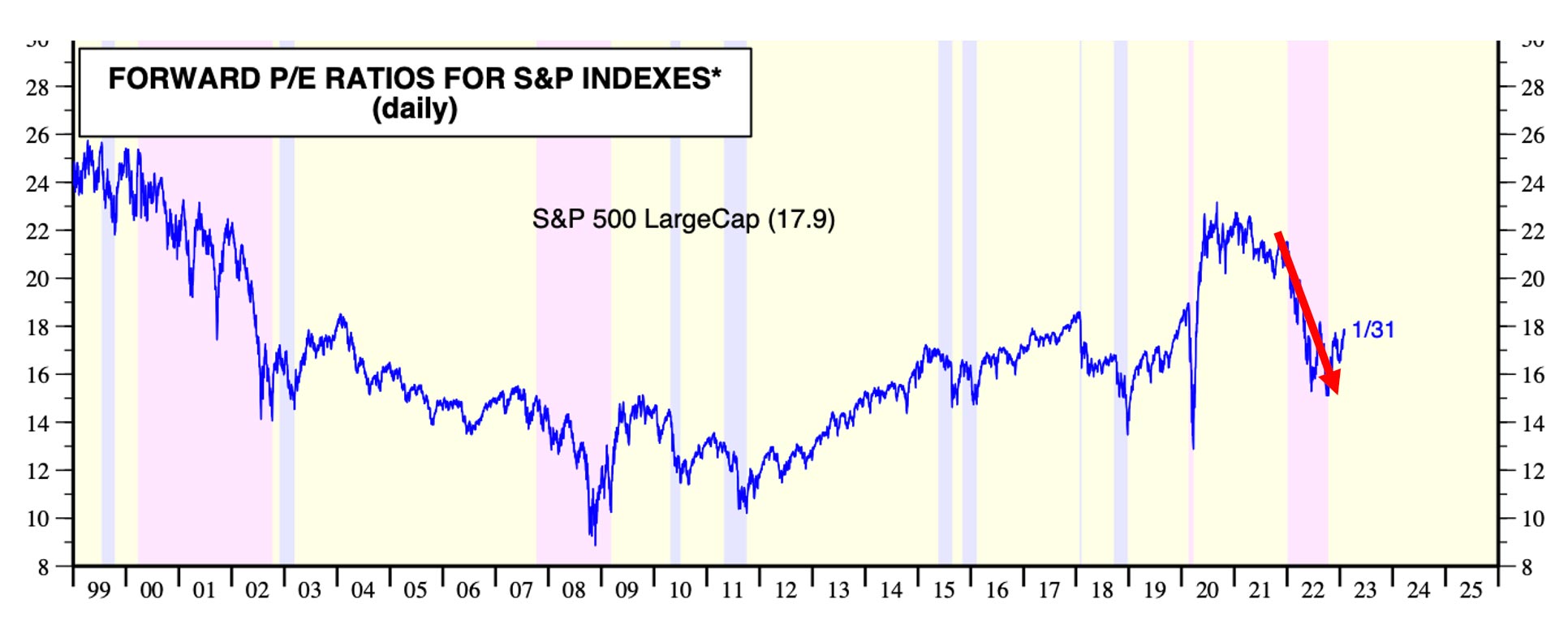

Phase 1 of the market’s decline was caused by a derating in Price-to-Earnings multiples (P/Es). Figure 1. reveals the extent of the compression in P/Es.

Figure 1. P/E ratios for S&P500 large cap index (2022 P/E compression highlighted)

Source: Ed Yardeni, updated to 1 February 2023

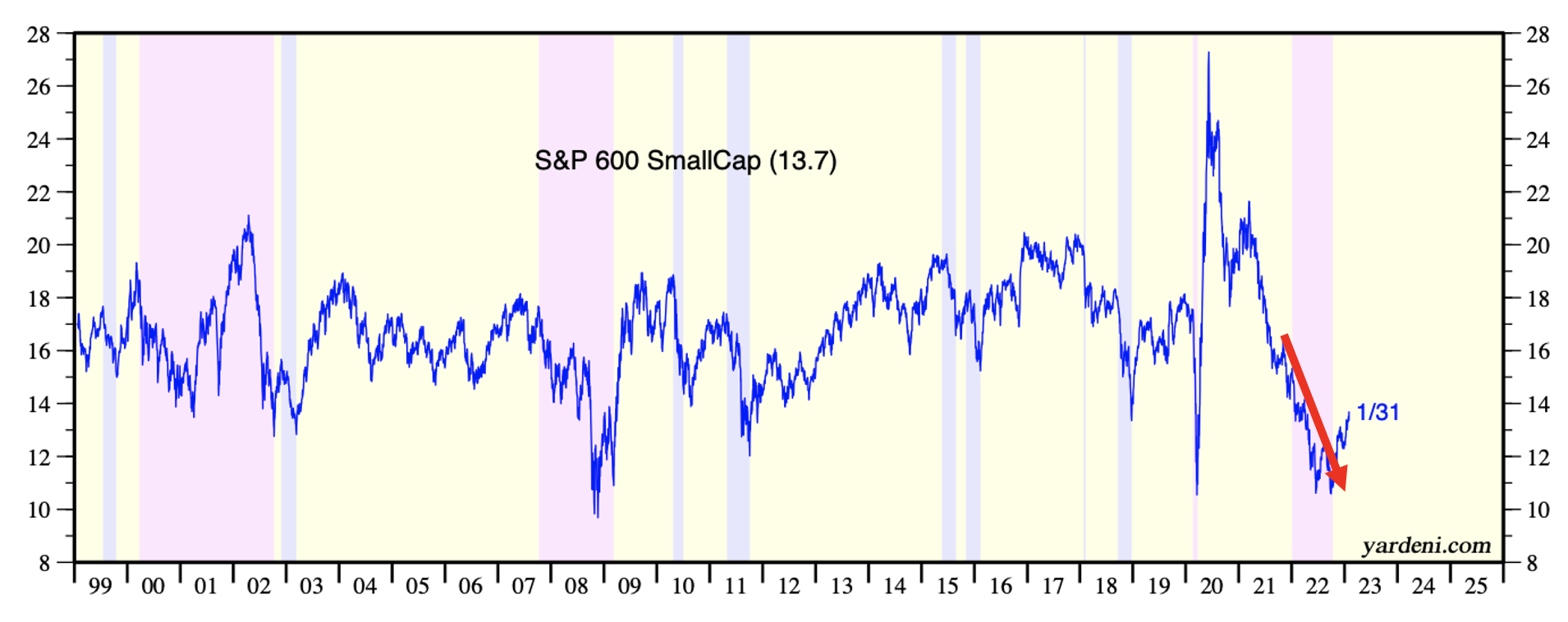

The compression in P/Es for small capitalisation companies was even more acute, pushing P/E ratios ultimately to some of the lowest levels in a quarter century, as Figure 2. attests.

Figure 2. P/E compression for S&P600 small cap index (highlighted)

Source: Ed Yardeni, updated to 1 February 2023

The second stage of the reappraisal of investment intentions is a review of earnings and this is where the subject becomes interesting, if not compelling.

Without question, a ‘baby and bathwater’ dynamic played out last year; higher quality companies were thrown out along with the rubbish. At the same time, consensus earnings were adjusted lower by analysts predicting a recession for 2023.

While the jury remains out on whether a recession will transpire, the effect on P/Es from a downward revision in earnings can be seen at the end of each chart in both Figure 1. and Figure 2.

When earnings fall and prices cease declining, the P/E rises – as it has so far this year. A rally in prices also adds to the pace of the P/E appreciation. This is something we predicted would eventually transpire.

Despite the rally in P/E ratios and prices, they remain materially below their all-time highs. And in the absence of further P/E rerating, investors’ returns must rely on earnings growth. By that I mean to say, if an investor purchases and sells a stock on the same P/E ratio, their return will simply match the per-share earnings growth rate the company produces.

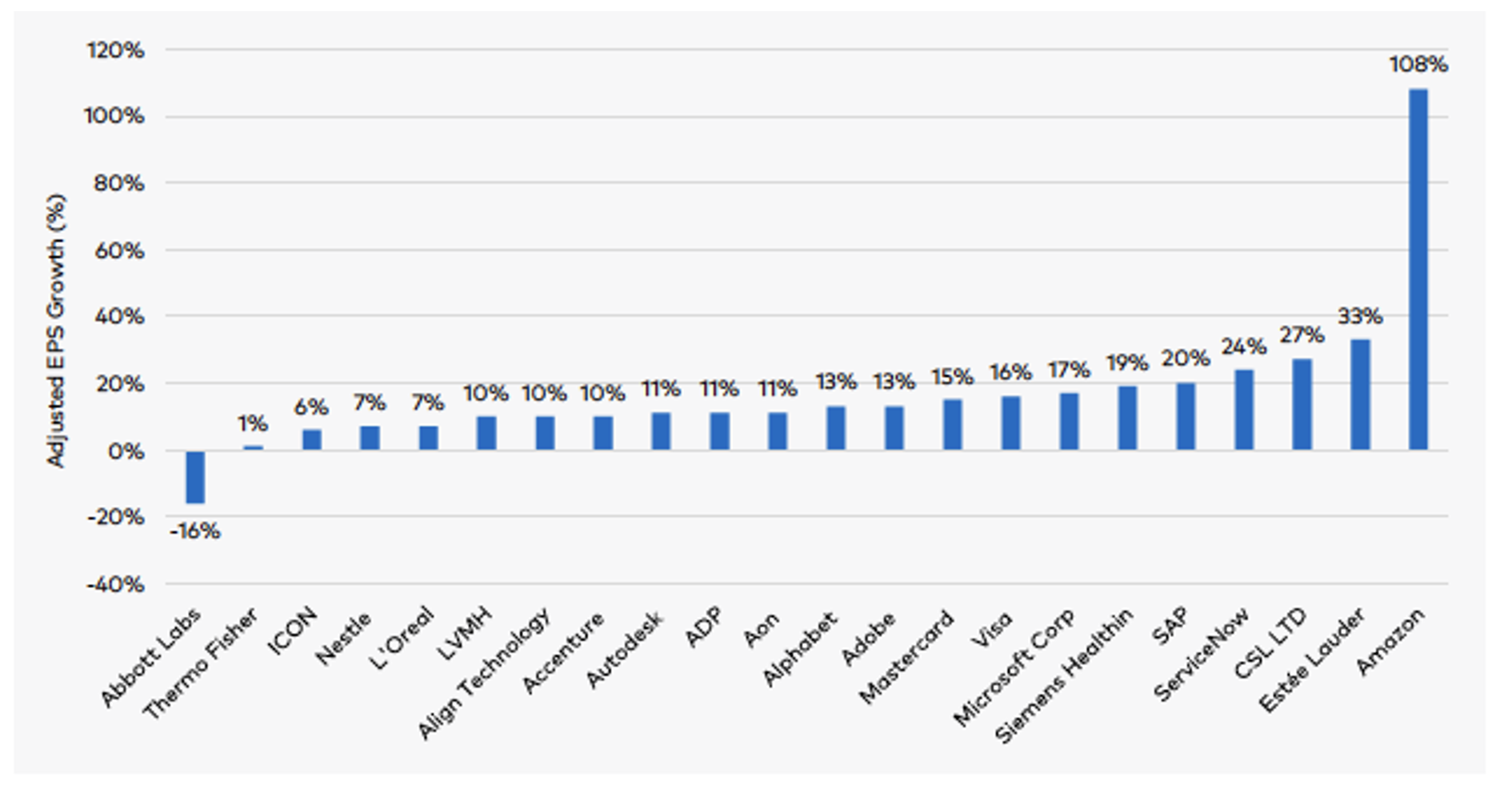

Meanwhile, predictions of recession leave investors in fear about aggregate company earnings growth. But a simple examination of consensus earnings growth for individual company earnings reveals a surprising picture.

While prone to revisions at any time, Figure 3. reveals many companies in the Polen Capital Global Growth Fund are expected to generate double-digit earnings growth in 2023.

Figure 3. Bloomberg consensus estimated 2023 adjusted EPS growth (%)

Source: Polen Capital

The median expectation for portfolio holdings earnings growth in 2023 is 12 per cent. Remembering if P/E ratios stay the same, an investor’s return will equal the earnings growth rate of the company, investors can assume a 12 per cent return in 2023. The return will be lower if EPS growth is revised lower or P/Es compress (they have already compressed a great deal), but returns will be higher if P/E ratios rerate or earnings are revised up, or both.

The takeaway is: P/E ratios have compressed amid fears of a recession and rising rates. A recession is not a foregone conclusion and rate rises are beginning to slow. Portfolio companies are generating double-digit earnings growth, which corresponds with investor returns amid stable P/E scenarios. And finally, history reveals after very poor years in markets, better years tend to follow.

I am looking ahead with cautious optimism for 2023.

Hi, Roger,

You penned this article on 6 February. Who would believe the turmoil we’ve witnessed since with UBS buying Credit Suisse for a pittance this morning?

I have no idea where the markets are going but your article and what’s occurred since serve to highlight the incredible volatility of the money markets.

Cheers,

Peter

I know you didn’t use it in this context but when a company director uses “cautiously optimistic” it invariably means investors should head for the hills.

And yet now the market is higher than it was.

Hi Roger

I agree with you that growth in Earnings will drive future returns and the risk of no growth makes current PE’s turn out to be too high requiring a downward revision to adjust for the lower Earnings growth.

I have always preferred Companies that pay a Dividend yield of about 3% to 4% ( excluding franking credits) and which ideally offer Earnings and Dividend growth in line with at least GDP growth rates. I think these Companies are generally easier to value and less risky compared to high growth Companies whose Free Cash Flows may not turn positive until many years into the future.

Regular and consistent growing Dividends are the low hanging fruit and the fully franked imputation credits that attach enhance the yield. In your articles you seldom talk about the Dividend side of returns and I have often wondered why . What are your views on Dividends?

Nice one Max. Yes there is merit in the idea that companies paying dividends (especially in Australia where the franking credits have no value to the company) indicate free cash flow and profits.