Australian superfunds driving growth in private debt

At the end of 2021, Ernst and Young in an annual paper exploring the private debt market in Australia estimated its size to be AU$133 billion and growing 21 per cent year on year.[1] Whilst at a record size for Australia, it remains vastly immature when compared globally where the private debt market is estimated to be as large as US$1.2 trillion which has grown by 13.5 per cent annually over the last decade.[2]

While there is some way to go for Australian private debt as an alternative asset class, 2022 was a year which saw the largest Australian superfunds really take notice of the attractive risk-adjusted returns on offer. In this article, I will explore the reasons behind and scale of the rapid growth in private debt exposures by the Australian superfunds throughout last calendar year.

Why are Australian superfunds investing in private debt?

The answer is a very simple one, demand. Post the GFC, global banks had increased capital requirements placed on them under the “BASEL III” regulatory standards with the aim of making them and the sector more resilient to any future market crises. In short, banks had to reduce the amount of leverage on their balance sheets, which was achieved by scaling back their lending. This constraint on bank lending has created a significant structural opportunity for non-bank lenders in Australia to fill this funding void. While there are now over 600 non-bank providers in Australia, they still only account for seven per cent of total debt financing.[3] One prominent non-bank lender, Judo Bank, estimated the funding gap for Australian SMEs seeking capital to be AU$120 billion and widening.[4]

This opportunity for non-bank lenders will only grow stronger in the coming years as two key pieces of pandemic stimulus, the RBA’s “Term Funding Facility” (TFF) and Federal Government Coronavirus SME Guarantee scheme draw to their conclusion. You can read more on this subject in a recent post: A $9 billion Opportunity for Non-bank SME Lenders. In short, the twin stimulus packages provided banks access to ultra-low funding (fixed at just 0.10 per cent for three years) and saw the Federal Government serve as 50 per cent guarantor on eligible SME loans. These attractive conditions enabled the banks to write AU$9 billion worth of SME loans throughout the pandemic. The conclusion of these stimulus benefits between now and June 2024 significantly changes the economics and relative attractiveness of SME lending for the banks and will impact their appetite to fund new SME lending. As the banks step-back, the non-bank lenders stand poised to capitalise and provide funding to the steady wave of bank-quality SME borrowers seeking alternate financing.

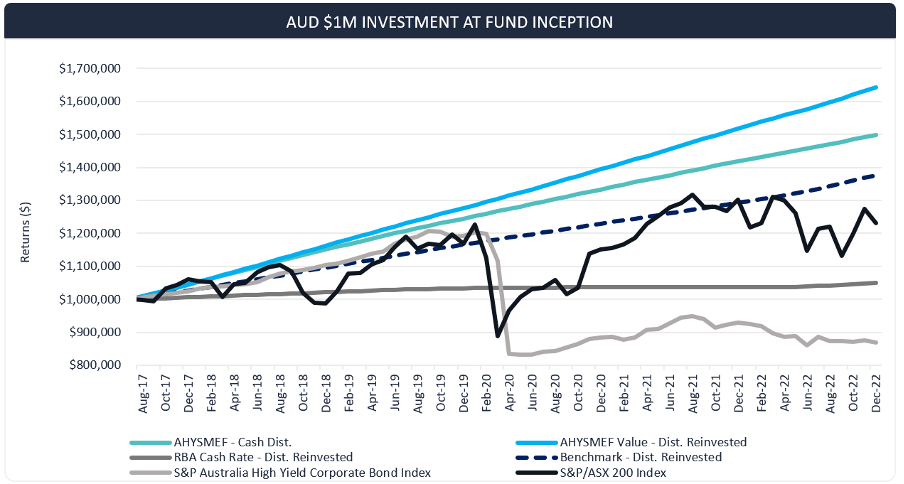

The very evident demand for alternate sources of financing and the lack of providers in Australia has led to a solid yield premia being able to be generated in accessing private debt markets in Australia. This certainly has been the experience for Brett Craig’s Aura Private Debt team, whose flagship offering the Aura High Yield SME Fund has outperformed the S&P Australia High Yield Corporate Bond Index since its inception in August 2017 as captured in the chart below.[5] In a year which saw both equities and bonds record a negative annual return for only the third time in almost 100 years, the diversification benefits of an allocation to private debt is an outcome the Australian superfunds have sought out. Further to this, the majority of private debt is written at floating rates, offering investors a rare hedge against movements in the underlying cash rate. This is obviously a very attractive outcome in today’s uncertain rate environment.

Source: Aura, December 2022. Past performance is not a reliable indicator of future performance.

The Fund is available to wholesale clients only.

What do the Australian superfunds have invested in private debt?

According to Bloomberg, Australian superfunds have less than one per cent of their portfolios on average invested in private debt.[6] This is again in stark contrast to the US, where many pension funds are for the most, full in their allocations to private debt domestically. Consequently, there is plenty of room for this allocation to grow here in Australia. The extent of which was apparent in 2022. Although many of the larger superfunds in Australia, namely UniSuper, Colonial First State, REST, HESTA and CBUS do not disclose their underlying allocation to private debt, Australian Super, the largest in the land, does. As at 30 June 2022, their allocation to private debt in their “Balanced” fund was 3.2 per cent, or close to AU$5.5 billion.[7] They are in the process of tripling their exposure to north of AU$15 billion by the end of next year.[8] Another large player, Australian Retirement Trust, are quoted to have an exposure closer to 5 per cent as at last year end.[9] Similarly, HostPlus has tripled their exposure in private debt in the last couple of years which was 1.6 per cent in their “Balanced” fund as at 30 June 2022.[10] Many of these superfunds have in-house specialist credit teams who do their own private debt deals. Outside of this, they gain exposure through a unitised fund structure, particularly for offshore allocations.

Is it too good to be true?

Whilst private debt boasts promising risk-adjusted returns and diversification benefits, like any form of investing it does not come without the age-old risk versus return trade off. Although the return premium above public markets is an attractive feature in private debt, this is partly due to the illiquidity of the asset class when compared to public markets. In the case of unitised funds, most private debt investments are not priced daily as the underlying assets are re-priced infrequently. Similarly, while floating rates are an attractive element of private debt, the end borrowers still need to be able to service the loans particularly in light of a challenged global economic picture. As such, the key as always lies in risk management. Namely, the ability to identify high quality lending candidates, embed better lending protection through covenants or warehousing, and build out a diversified loan pool especially in lieu of private debt not being covered by ratings agencies. This diversification is sought at the sector level, specifically for SME lending, or in terms of the duration of the loans themselves.

Other points of contention for retail investors are both limited access to and inherent complexity of private debit opportunities. Whilst the larger Australian superfunds have the luxury of scale and the ability to co-lend very large sums of money (north of AU$100 million), the average SMSF in Australia does not. They also don’t have the benefit of the very large specialist debt teams who understand and specialise in the asset class, and can source exposure directly. The good news here is the growth of the private debt asset class also entails growth in the number of investment solutions coming to the retail market, such as the Aura Core Income Fund which we launched in partnership with the Aura Private Debt team late last year. Regardless of your opinion on private debt one thing is for certain, you will be hearing more and more about the asset class going forward. In fact, Preqin Global estimates private debt will grow to be as large as US$2.7 trillion globally by 2026.[11] Watch this space!

If you would like to learn more about the Aura Core Income Fund, please visit the fund’s web page to learn more: Aura Core Income Fund

If you would like to learn more about the Aura High Yield SME Fund (wholesale clients only), please visit the fund’s web page to learn more: Aura High Yield SME Fund

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

[1] Source: Ernest & Young, March 2022

[2] Source: Preqin Global, January 2022

[5] Fund inception date 1 August 2017. Returns calculated to 31 December 2022 with all returns calculated net of fees and expenses. Benchmark is RBA Cash Rate +5%. Past performance is not a reliable indicator of future performance. Returns and distributions are not guaranteed.

[7] Australian Super, June 2022

[9] As above

[11] Source: Preqin Global, October 2022 & Preqin Global, January 2022

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.