Aura High Yield SME Fund: Letter to Investors 19 May 2022

This week we saw the final piece of the RBA’s long-awaited evidence released. The Australian Bureau of Statistics (ABS) Wage price index for the quarter up to March 2022 showed, as expected, a rise in the seasonally adjusted wage price index.

Wage Price Index – March 22 Quarter1

In the March quarter, the seasonally adjusted wage price index:

- Rose 0.7% this quarter;

- Rose 2.4% over the year;

- The private sector rose 0.7%; and

- The public sector rose 0.6%.

The annual rate of growth for the wage price index has rebounded since the low of 1.4% recorded in the December 2020 quarter, with a reported rise in each of the last five quarters. The annual rate rise was the highest recorded since December 2018, prior to the pandemic.

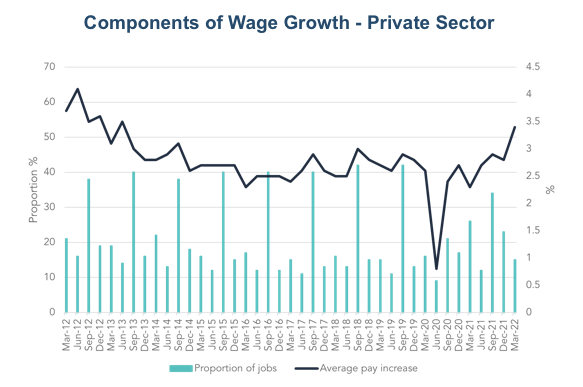

The increase in private sector wages was largely driven by regular annual wage and salary reviews, with a small number of larger increases paid in order to retain and attract in-demand, skilled workers. The public sector rise was as a result of changes occurring in a select number of enterprise agreements.

In this quarter, the average size of wage rises for private sector jobs was the highest seen since the June quarter of 2013. This shift is partially due to a small number of in-demand, market sensitive jobs recording large increases in addition to average wage increases returning to pre-pandemic levels and wage freezes and reductions no longer being required.

The industries demonstrating the largest rises were administrative and support services, education and training and arts and recreational services, all recording the highest quarterly rate of growth at 0.8%.

NSW, VIC, SA and TAS recorded the highest quarterly rise of 0.6%, whilst the NT lagged well behind only achieving a 0.3% rise.

These recorded increases in the wage price index across the board is as the RBA predicted and supports their decision to increase the interest rate. With the leading indicators all released and at the RBAs disposal, the RBA will continue to withdraw the extraordinary monetary support that was provided over the past few years. With the economy proving to be resilient, inflationary pressures holding firm and continuing and wage pressure also increasing, the RBA now sees it as the opportune time to normalise the monetary conditions and pull back the support.

Portfolio Management Commentary

The release of the wage price index this week was the final piece of the puzzle that justified the RBA’s decision to begin lifting interest rates. As explained by the RBA in their recent statement outlining their monetary policy decision, they had strong reason to assume that the wage price index for the March quarter would increase, in line with persistent inflationary pressure and low unemployment rates. As such, the RBA made the decision to begin hiking the interest rate prior to the release of this final piece of data. With the continual increase in the wage price index, we believe there is further pressure for the RBA to continue to lift the interest rate in the coming months. As shared in the monthly report, we anticipate another rise to come in next month’s RBA meeting.

We are pleased to announce that this week we have executed another deal with one of our new lenders, with the initial drawdown to come in June.