What to make of KKR’s bid for Ramsay Health Care

As you’ve probably read in the press, a consortium led by US-based investment behemoth, KKR & Co, has just lobbed a $20 billion bid for Ramsay Health Care (ASX:RHC), Australia’s dominant private hospital business. This values each RHC share at an all-time high of $88, well above the previous day’s close of around $64. So it’s potentially good news for RHC investors – including The Montgomery Fund. But what are the chances of the deal going through?

Back in September last year, I published an article looking at Ramsay Health Care’s FY21 results and pointed out the difficulties the pandemic had caused in terms of lost revenues due to elective surgery bans, increased costs due to staff being sick/close contacts and increased costs for personal protective equipment. We were positive on the outlook for a recovery in surgery volumes once the world opened up again. The longer surgery restrictions are in place, the more the waiting lists increase and the harder the doctors will eventually have to work to clear these waiting lists which should benefit the hospital operators as their incremental margins should be high on additional throughput.

Since this time, which was towards the end of the Delta wave of COVID cases, we had the Omicron variant sweeping through Australia and countries in Europe where Ramsay operated hospitals and this resulted in further restrictions on elective surgery. The share price of Ramsay did not recover. From the chart below, we can see that the share price (since the day of our article being published) was down 3.6 per cent up until Tuesday compared to the ASX300 which was up 4.4 per cent so an 8.0 per cent underperformance has been frustrating as we continued to believe in the longer-term story.

Source: Bloomberg

Then, on 19 April, the Australian Financial Review released an article suggesting that a consortium led by KKR, the large global private equity firm, had approached Ramsay’s board with an indicative bid at $88/share and had been allowed to perform due diligence. Yesterday, Ramsay confirmed this and the share price has reacted positively and is at the time of writing trading at $81/share which is up 25 per cent compared to the price yesterday, but still about 8 per cent below the $88 bid price (actually the bid price is $87.515/share as it will be reduced by the dividend of $0.485/share already paid on 31 March). This is an all-time high level for Ramsay and very positive news for investors in The Montgomery Fund.

Source: Bloomberg

So why is a private equity firm interested in Ramsay? I can see a number of reasons why:

- Ramsay owns 48 of their 72 hospitals in Australia. The majority of these have been owned for a long time and have low book values as they have depreciated over time. The value of this land and buildings have gone up significantly and there is therefore a big “hidden” value in the real estate portfolio. Ramsay has been talking about this in their earnings call but as they have no need to release capital, they have not acted on this. It would create capital gains tax issues if they were to sell. A private equity owned entity could potentially be more creative in setting up structures that minimise such capital gains taxes than Ramsay as a publicly listed entity can be, so it is possible that they would look to release value through a sale and lease back of the buildings.

- Ramsay is the only hospital operator in the Australian market that is spending any significant capex currently. When surgery volumes do come back, they should get a disproportionally high share of the “catch-up” volume as they will be the only one with additional capacity compared to pre-pandemic. This is therefore an opportune time for KKR and its partners to get in before this becomes obvious.

- KKR and other longer term focused investors can also see through the current pandemic caused revenue and costs issues better than the public market.

- And finally, KKR and its partners (rumoured to be HESTA, Australian Super and at least one foreign sovereign wealth fund) are also attracted by the underlying demand profile. There is no denying that we are going to have an ageing society which should mean good growth in demand for surgery volumes for a long time to come. The pandemic has resulted in the previously decline trend of private health insurance participation reversing and more and more people being able to use the private system rather than having to rely on the public system where waiting times will be high for a long time to come.

So what will happen now? I see four real possibilities:

- Another bidder could emerge, and we get a bidding war. Ramsay is an asset that a lot of private equity and other long-term investors will have looked at due to the growth prospects and stable nature of demand. The problem is that we are talking about a transaction value of well above AUD20 billion. There are very few players out there with that firepower meaning that we consortiums will come together for a bid. This is complicated to organise at short notice, especially with the geographic footprint of Ramsay being so large. I think there is maybe a 10 per cent chance that we get a competing bid on top of KKR’s.

- The bid is still only indicative, and the bidders could walk away if they discover something during their due diligence. It looks like they have been doing due diligence for a couple of weeks already and Ramsay has relatively good financial disclosure so they should have been able to form a good view of value even before they engaged. I think there is maybe a 30 per cent chance that they will walk away with no other bidders emerging. In this scenario, I would expect the share price to fall but to settle higher than before as the bid will have highlighted the value of the business. Around $70/share would be my guess so around 20 per cent below current price but still about 10 per cent above where it was trading before the bid.

- The board of Ramsay decides that the bid does not represents the best possible value for shareholders. Given that they have already allowed due diligence to take place, I think this is a low probability and the likely outcome would be that KKR comes back with a small bump in their bid.

- This leaves us with probability that the bid is successful at the $88/share level.

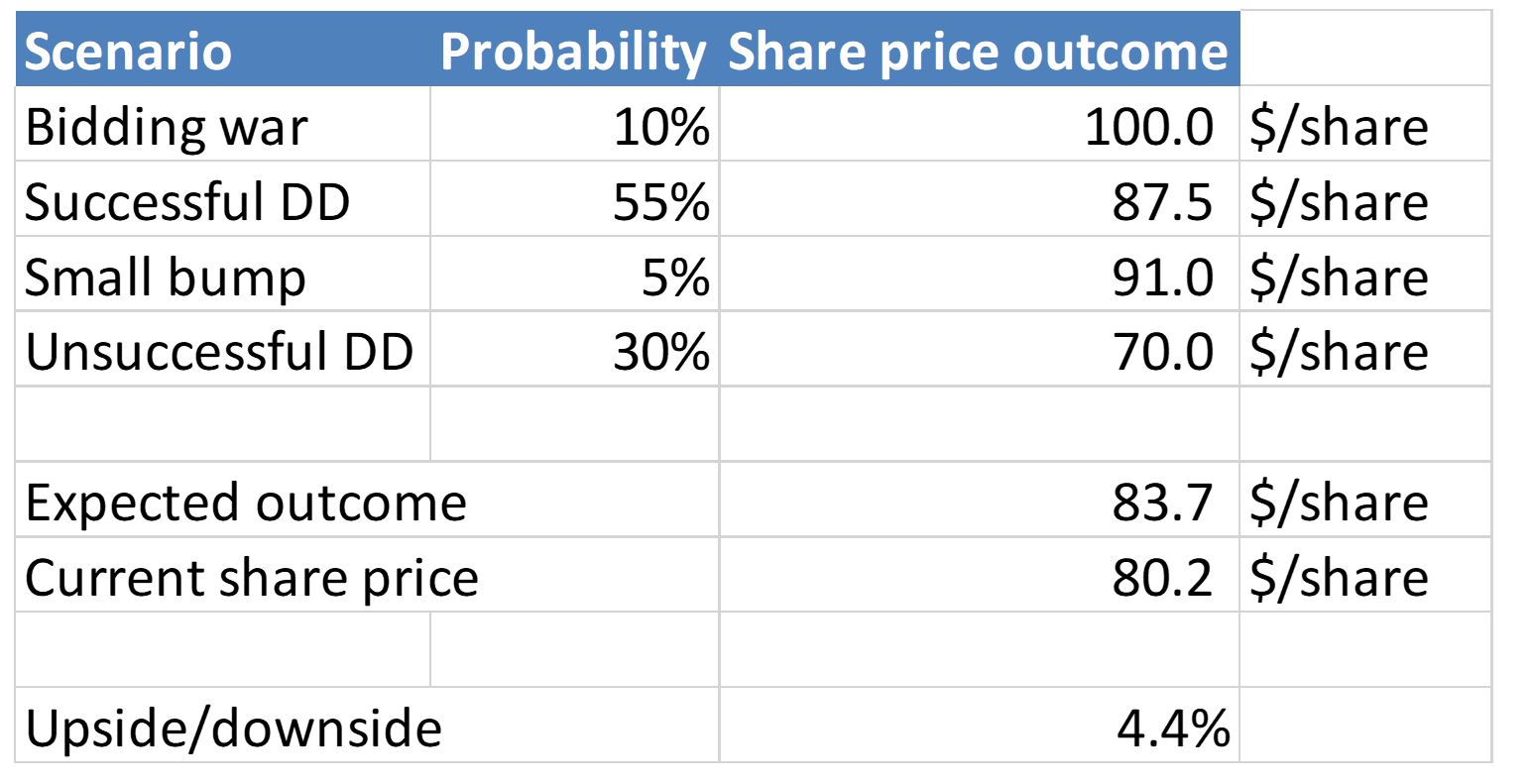

We can summarise this thinking in the following table which shows a probability weighted outcome of $83.7/share or about 6 per cent higher than the current share price. This indicates to me that the market is assigning higher probability on the bidders walking away than I do and therefore we are retaining most of our shares in Ramsay despite the pop in the share price today:

The Montgomery Funds own shares in Ramsay Healthcare. This article was prepared 21 April 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Ramsay Healthcare you should seek financial advice.

The Montgomery Funds own shares in Ramsay Healthcare. This article was prepared 21 April 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Ramsay Healthcare you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY