Which retailers have weathered the market storm?

In response to recent trading updates, the share prices of many listed retailers have been hit for six. With retail sales falling short of expectations, supply chain disruptions, and the risk of excess inventories, some investors have been spooked, and have headed for the exits. Happily, the price falls have not hit every business, and it’s interesting to see which retailers have won the market’s approval.

A number of retailers have released trading updates in the last couple of weeks. It has been a volatile period for retailers, with the 6 months starting with lockdowns in New South Wales and Victoria. The opening up of these regions was greeted by the market with an expectation of a surge in consumer spending heading into Christmas.

Then the Omicron variant took hold, with self-imposed lockdowns severely reducing foot traffic in stores during the later parts of December. This was complicated by its impacts on staff availability and supply chain capacity, adding increased costs and stock availability issues to what was already going to be a period of lower than expected sales.

With sales not meeting expectations, on top of a lengthened supply chain due to disruptions, the risk of excess inventories has also increased for the retailers over the last month.

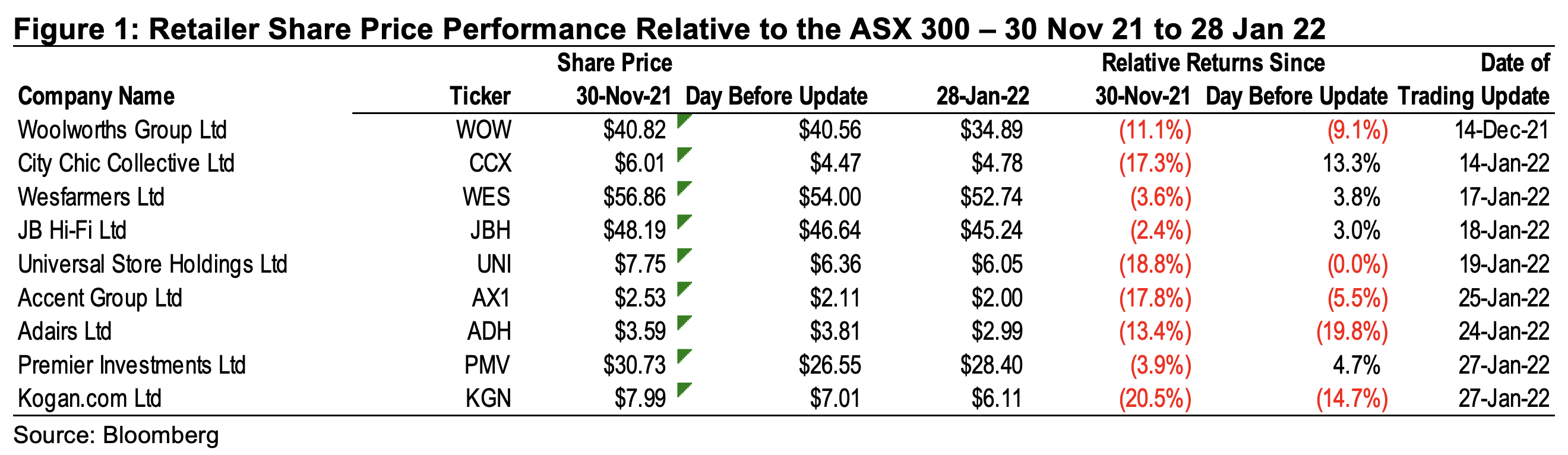

Looking at the performance of the retailers that have reported trading updates since mid-December, most have underperformed the market since the end of November. However, most of the underperformance occurred prior to the release of the update, highlighting that the market had already started to factor in a weakening outlook as a result of the Omicron wave. Almost half of the companies have outperformed the broader market since the release of their updates, while the larger companies have generally outperformed the small retailers.

Of course, these impacts are likely to be temporary, but the duration remains unknown at this point and the market does not like uncertainty.

The City Chic and Premier Investments trading updates were better than the market feared, with sales holding up better than competitors and more limited disruptions to their supply chain to date.

JB HiFi’s performance through this period has been better than the market had expected with robust demand for appliances and consumer electronics, while gross margins remained well managed despite increasing freight costs.

Wesfarmers noted a material impact on its Kmart and Target operations, while Catch had been impacted by inventory clearance and slowing sales growth as it cycles a difficult comparable period. There has also been a material step up in costs to manage the pandemic adding to the increased investment in the digital part of the business. Sales at Officeworks were also negatively impacted by the combination of lockdowns and omicron in the period. While the performance of these businesses was materially worse than market expectations, the other businesses within Wesfarmers’ portfolio offset this deterioration, in particular its chemicals and Bunnings operations, with overall group earnings meeting market expectations. As a result, Wesfarmers has been one of the better performing retailers since the end of November.

What is happening to small cap retailers?

The share prices of the smaller retailers have been relatively poor performers. This is likely due in part to the more momentum driven nature of the small cap market.

The trading updates from The Universal Store and Accent Group indicated that after an initial jump in sales upon reopening in November, sales in December progressively deteriorated. Like for like store sales growth was negative for both companies in December. Universal performed better than Accent through this period but conditions are likely to remain tough through January.

The positive was that inventories were in line with normal levels despite the weaker sales outcome. This could deteriorate in January, but the balance sheet of both companies remains in good shape, and a pipeline of strong new store roll out reduces the risk of a build-up of excess and ageing stock. The greater risk is likely to be a shortage of stock if supply disruptions continue through the year.

Adairs had been expected to hold up through December given the apparent strength in the hardware and other home categories. It reported sales that were slightly weaker than market expectations, but of greater concern was the dramatic reduction of margins in the period as a result of rising supply chain and freight costs as well as increased discounting to clear stock. Higher staff and warehouse costs created additional operating leverage along with the step up in marketing investment for the digital businesses.

The market had not factored the same degree of risk into the Adairs share price. Consequently, the market reaction to the miss was far greater than for other retailers. The question is whether this overstates the medium to long term risk given that at least some of the cost increases that caused the margin miss, such as running the old distribution centre in parallel and elevated staff and freight costs, are temporary.

The Montgomery Funds owns shares in Wesfarmers and Universal Store. The Montgomery Small Companies Fund owns shares in City Chic and Adairs. This article was prepared 31 January 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY