Why it’s time to get on board cruise ship stocks

The COVID-19 pandemic has hit the cruise industry hard, with hundreds of ships forced to sit idle at docks around the world. Needless to say, the market valuations of cruise ship firms have plunged. But all that is about to change. Bookings are surging once again as global travel reawakens. Which is why I think cruising businesses, like Carnival and Royal Caribbean, could be a once-in-a-generation investment opportunity.

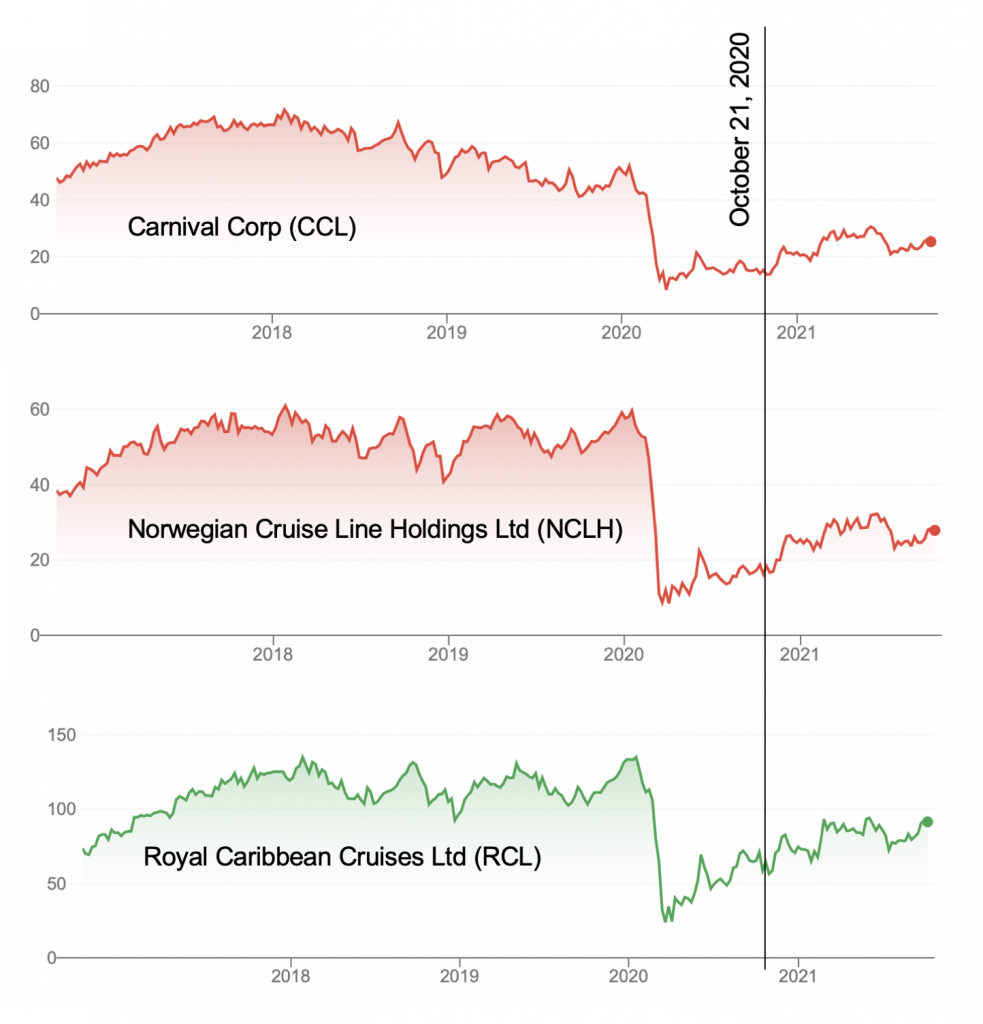

Despite the rebound in US and European domestic air travel, as well as the reopening of the transatlantic route, global cruise line stocks remain materially lower than their pre-pandemic prices. Meanwhile an industry recovery appears to be emerging.

We first mentioned the idea of investing in global cruise lines about a year ago, on 21 October last year, noting;

“One of the sectors that produces high average returns on positive vaccine news days and has been beaten up since the beginning of the year (and may therefore offer some value) is the Hotels and Leisure sector.

Cruise lines fall into the Leisure sub-category and, prior to the pandemic, growth was accelerating. According to the Cruise Lines International Association (CLIA), the world’s largest cruise industry trade organisation, cruise ship passengers grew from 17.8 million in 2009 to 30 million in 2019, an annual growth rate of 5.4 per cent.

Importantly, cruise industry revenues have grown faster than passenger growth, with approximately US$15.7 billion generated in 2010 and US$31.5 billion forecast for 2020 before the pandemic hit.”

It’s worth re-reading last year’s post as it provides some useful background information for interested investors: Why cruise lines could be worth buying again

The cruise industry was the industry arguably hit hardest by the outbreak of the COVID-19 pandemic with the industry forced to shutter 278 ocean cruise line ships across 55 cruise companies.

Today, market valuations still remain roughly half of what they were prior to the crash. While operators have commenced sailing.

Figure 1. Cruise line share prices

Mimicking the surge in domestic air travel bookings earlier this year, several cruise lines are now reporting a record pace of future bookings. Cruise lines are understandably also preparing their fleets for an anticipated surge in demand.

At this stage the industry believes the northern hemisphere spring (second quarter CY22) will mark a return to full capacity operations. Perhaps optimistically, or perhaps realistically, industry commentary suggests the emergence of the Delta variant, which has seen bookings slow, is merely a speedbump on the road to a full recovery. If they’re right, revenues could rocket not only from the surge in volumes but also thanks to materially higher ticket prices compared to pre-pandemic 2019 levels.

According to Carnival Corporation, 42 ships – approximately half its fleet – will set sail by the end of this month. US health officials have given the green light for Carnival and its rivals to restart operations from U.S. ports.

On September 30 this year Carnival also reported a two-week cruise to Greenland from Baltimore in 2023 sold out in 24 hours at approximately US$3,000 per person for eight days.

Meanwhile, on 24 September CNBC reported Carnival Corp’s “cruise bookings for the second half of 2022 were ahead of pre-pandemic levels” adding “voyages for the third quarter were cash flow positive” and “Norwegian Cruise Lines’ ticket prices are 20 per cent higher than 2019 levels”.

After peaking in July at 70 per cent in response to an easing of restrictions, occupancy rates for Carnival Cruises averaged roughly 59 per cent occupancy in August. And while this was well up on the 39 per cent reported in June, the lower than July number reflects concerns surrounding the outbreak of the Delta variant of the virus.

Elsewhere, on its most recent earnings call, Carnival rival Royal Caribbean’s reported near-term demand had been hampered by COVID-19, while demand for future bookings was recently above 2019 peak levels.

Norwegian Cruise Lines’ brand, Oceania Cruises, reported a single-day record for bookings for cruises sailing in 2023, with the company also following the industry wide slowing in bookings in recent months.

Shutting down has not been a cheap exercise, and therefore an investment in cruise line company equity is not without risk. Carnival reported a third-quarter adjusted loss of US$1.99 billion. The company’s monthly average cash burn was US$510 million during the third quarter.

Impressively, operators have not discounted prices – which are significantly ahead of 2019 levels – despite the recent Delta-inspired slowing in bookings.

With an industry revival beginning to form, the remote possibility of a newer vaccine-evading strain of the virus is perhaps the only black swan event that could knock share prices off their current recovery path. The Delta variant has been a setback reflected in recent booking trends but future bookings at higher ticket prices suggest revenues are heading in the right direction.

International Cruise line stocks may represent another way for investors to gain exposure to a global reopening of travel. And if correct, investors could look back on the pandemic as a once-in-a-generation opportunity to buy these businesses at depressed prices even well after the pandemic and its effects on economies and industries is well understood.