Vehicle demand on the rise

If you are an investor in ARB or any listed business exposed to car sales such as Super Retail Group or Automotive Holdings, you may be interested in the latest Vfacts stats below that were kindly sent to us by our friends at broker Taylor Collison.

February VFACTS Summary

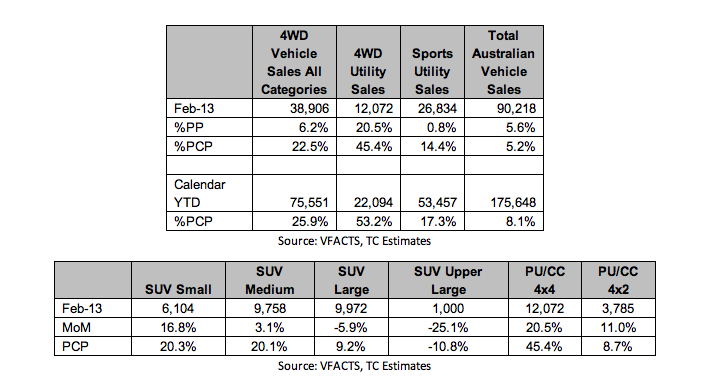

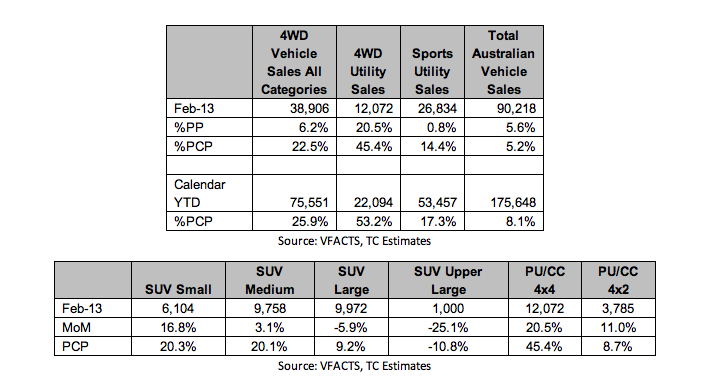

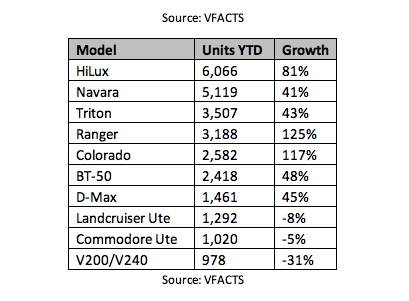

New car sales: February sales up 5.2% yoy and YTD sales tracking 8.2% ahead of this time last year. January and February 2012 were severely affected by the Thai flooding and this is best reflected by the surge in SUV and Ute imports with 2013 YTD registrations for the former increasing 17% and the latter surging 53%. Demand appears to be supported by the private sector with government registrations down 30.2% compared to February 2012. Geographically registrations increased across all regions however WA was the stand-out of the larger states up 10.4% on pcp.

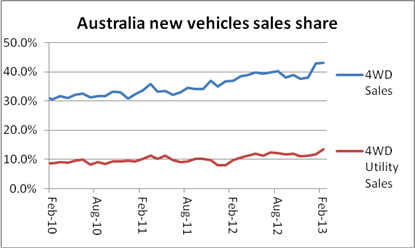

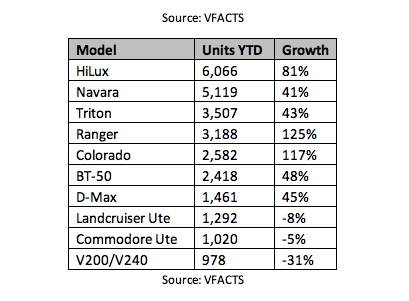

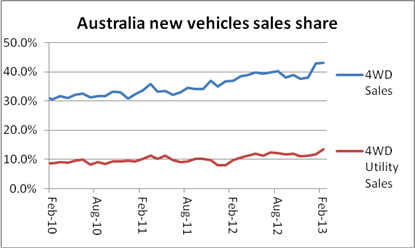

Utes continue to gain in popularity with the 12,072 registrations in February the second highest month on record and 12% ahead of the average for the last 12 months. Interestingly, 4×4 Ute sales comprised a record 13.4% of total vehicle sales for the month and accounted for 4 of the top 10 top selling models whilst 4WD share held steady at around 43% (800bps ahead of this time last year). As 4WD market share edges closer to the ~50% light truck share exhibited in the USA, we have noted an interesting change in tone from ARP with some cautious remarks concerning overcrowding in the ute market and an overexposure to Australia.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Just be mindful that vehicle manufacturers are running on thin margins so any decrease in the value of the $AUD will have an immediate impact on new vehicle pricing and hence reduce demand. However a reduction in new car demand will increase used car sales and be a strong win for automotive online companies like carsales.com.au