Science that benefits people

Strong investor sentiment and positive macroeconomic conditions saw the volume of initial public offerings (IPOs) rise to 61 in the first half of 2021. One of those listings was small-cap Trajan Group, who raised $90 million in June at $1.70 per share.

Headquartered in Melbourne, global analytical science and device company Trajan Group Holdings (ASX:TRJ) was founded in 2011 with a goal to build a scientific business that could deliver impact and benefit people.

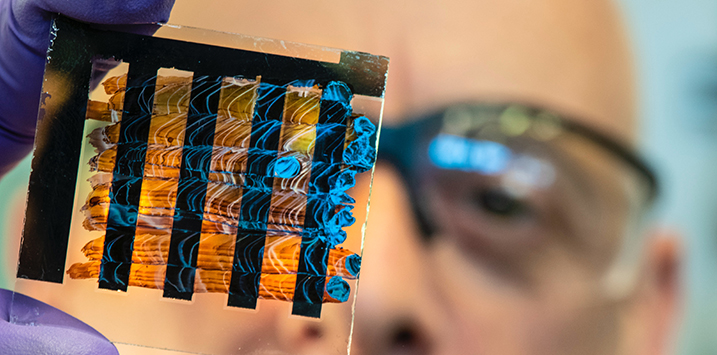

The company develops and manufactures analytical and life sciences products and devices used in biological, food and environmental analysis. The company’s products protect the integrity of samples and minimise result variation, leading to more informed decisions and treatments.

Trajan derives revenue from the sale of products, devices and solutions to its customers. The company’s long-term customers and partners include global blue-chip companies including original equipment manufacturers (OEMs), pharmaceutical companies and contract research organisations.

Since listing on the ASX in June 2021, Trajan’s share price has risen significantly to $3.57 per share, giving the company a market capitalisation of $462 million as at 31 August 2021.

Trajan is a global business with operations in Australia, the US, Asia, and Europe with around 90 per cent of Trajan’s $77 million of revenue generated outside of the Oceania region. The company has four dedicated precision manufacturing facilities in Australia, Malaysia, and the US, and a workforce of more than 450.

EBITDA for the year to June 2021 significantly exceeded forecast at $9.95 million, up 89 per cent on the previous year, and 13 per cent of revenue.

Trajan has a specialisation approach, focusing on targeted segments of the industry where analytical products or components have the potential to significantly impact data quality. Trajan’s research and development (R&D) begins with traditional in-house R&D and the business employs more than 80 scientists and engineers.

The ultimate end‑users of Trajan’s products are analysis and research laboratories performing testing for the food, beverage, water, environmental, biological, pharmaceutical and pathology industries.

Trajan’s point of difference is that they develop analytical and life science instruments, devices, and components to enable more specific measurement and analysis of biological, environmental and food samples. Trajan’s scientific products and services enable critical improvement in the analytical workflow for laboratories worldwide, leading to a profound impact on human well-being through more informed decisions and treatments.

Among Trajan’s products is a blood collection device called the hemaPEN®, a microsampling tool that enables the collection of four volumetrically fixed, accurate and precise, blood samples from a single source. From being used in metabolic studies to support injury recovery in athletes, to detecting antibody response to understand the safety and efficacy of vaccines, the use case is vast.

A long runway for growth

Trajan has experienced significant growth and for the year to June 2022, expects to deliver at least $82.6 million of revenue, and assuming EBITDA margins are constant, an EBITDA of $10.7 million.

The company has a strong acquisition record, having completed eight complementary acquisitions which have all been self-funded. The most recent was MyHealthTest, completed in May 2021.

The fundamental growth drivers in the industry include the increased demand for testing for food and beverage contamination, safety and process quality control, testing of water quality, and increased public awareness and regulatory steps to test for environmental contaminants.

The company is entering its next phase of growth, with a deep technology commercialisation pipeline and globally identified acquisition targets, providing significant upside potential to the strong underlying existing consumable and components business.