Macquarie offers three reasons to be optimistic

With so many economies and businesses on their knees, numerous market commentators are pessimistic about the near-term future of global share markets. But Macquarie Bank’s Chief Economist and Global Head of Macro Strategy, Ric Deverell, is not one of them. He’s just released a chart pack that offers three reasons to be optimistic.

In Deverell’s chart pack, The Great Services Recession of 2020, a sharp rebound in activity is recorded during the third quarter of calendar 2020. This is despite the fact that, at a global level, there is little sign of the pandemic abating. Indeed, at the time of writing, the world has recorded 307,930 new cases, its highest number of daily infections since the pandemic began. There have now been almost 29 million confirmed cases globally and almost 920,000 deaths.

Since the Coronavirus pandemic began, stock market indices have sold off and recovered sharply. But behind the performance of the market averages, a meaningful shift in capital flows from old-world to new-world sectors has occurred. Some sectors have thrived while others have been gutted.

A variety of scenarios may yet play out with much depending on whether a vaccine, treatment or accurate test for COVID-19 is developed. In the absence of a vaccine, many will continue to work from home and buying trends already witnessed may continue. The adverse impacts on government budgets from the provision of ongoing financial support and diminution in revenues from, for example, taxes and public transport will also continue.

In the absence of a vaccine western liberal democracies would suffer more acutely and are at greatest risk of a slow and halting recovery, due to the tension between individual freedoms, the health crisis and economic survival.

Deverell’s chart pack however provides some reason for optimism. And a few charts stand out.

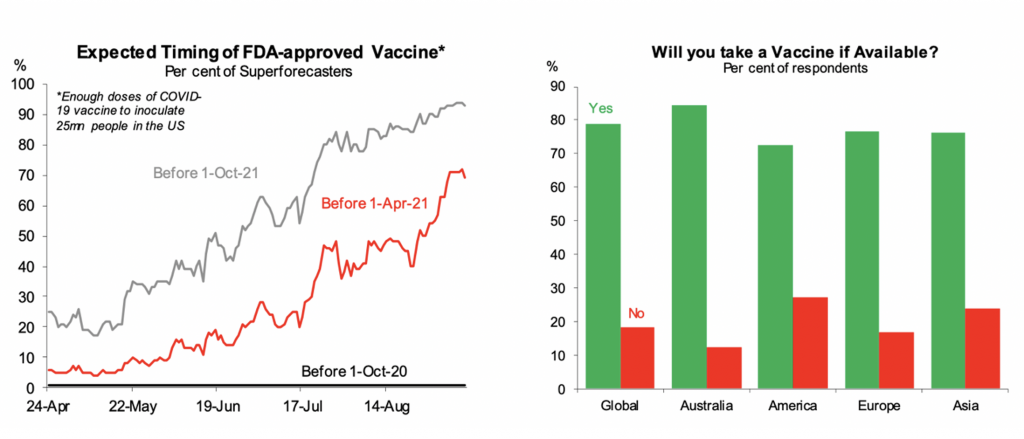

The first (Figure 1.) is that more than 90 per cent of ‘superforecasters’ expect enough doses of COVID-19 vaccine to inoculate 25 million US citizens by this time next year, and most people around the world are prepared to be vaccinated.

Figure 1.

Source: The Good Judgement Project, Macquarie Bank

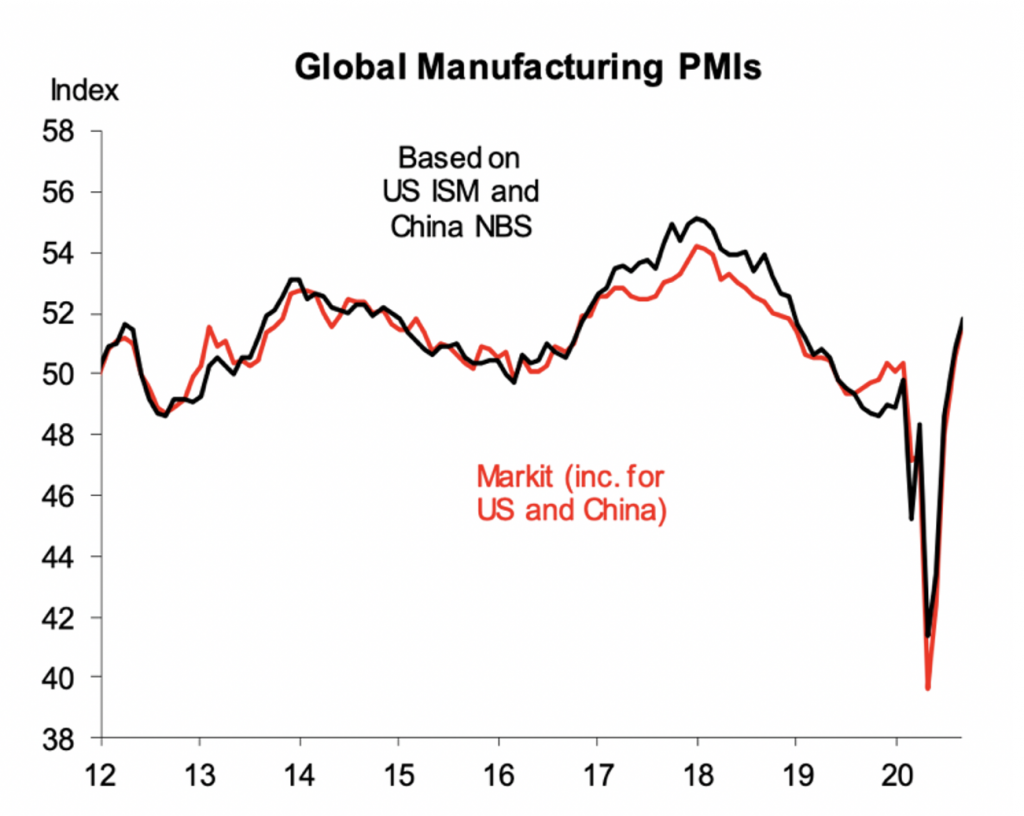

The second source of good news is that the shift in spending towards goods has meant the associated strong demand is driving manufacturing and trade (Figure 2.). Consequently, global industrial production in August is estimated to have returned to pre-COVID levels.

Figure 2.

Source: IHS Markit, Macrobond, Macquarie

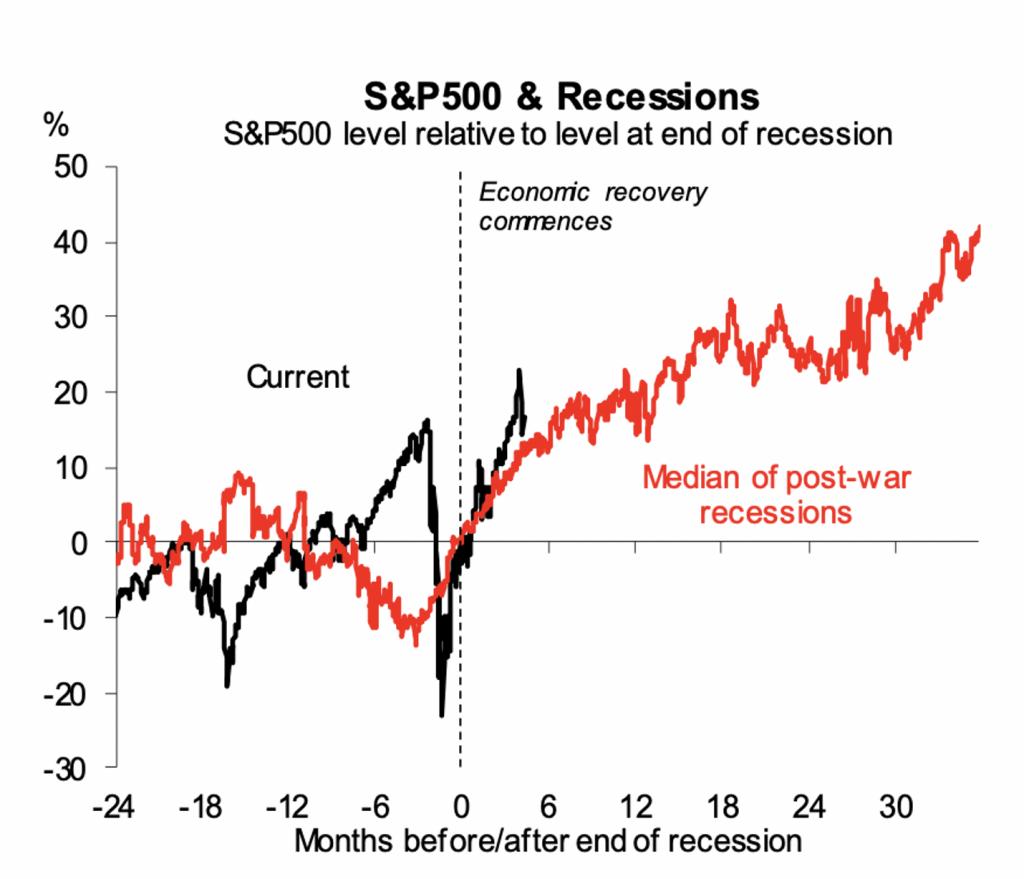

Perhaps most interesting, potentially optimistic but controversial, is the argument about whether stock market optimism is either misplaced or disconnected from the real world. Deverell applies the problematic technique of overlaying the current market with the median (middle) of past post-recession performances (figure 3).

Figure 3.

Source: Macquarie

While Figure 3 suggests the stock market rally could continue, it’s worth noting the median is the middle performer from Deverall’s sample of post-recession stock market performances. There were as many that did worse as did better. We have previously written about the limitation of such comparisons in this video.

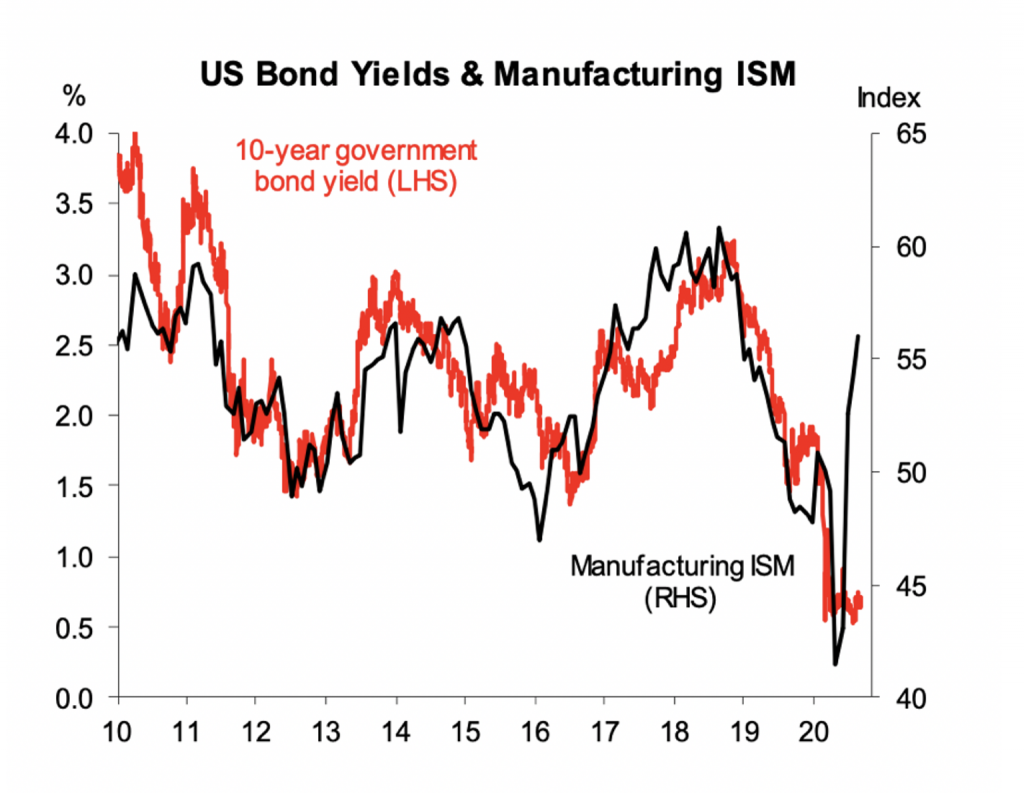

One comparison however that we hope is actually wrong is the relationship between the Institute for Supply Management’s (ISM) Manufacturing Index and the US Treasury Bond rate.

Figure 4.

Source: Bloomberg, Macrobond, Macquarie

Source: Bloomberg, Macrobond, Macquarie

A sharp rise in bond yields today would spell disaster for stretched equity multiples.

In essence it appears that there is a long way to go before we reach 2019 revenue and income levels for all sectors and businesses. Indeed, there will be many businesses and sectors that are never restored, and while the global recovery continues, it seems the most rapid “snap back” phase of the recovery is ending.

With so many economies and businesses on their knees, market commentators are pessimistic about the near-term future. Read why Macquarie's Ric Deverell offers three reasons to be optimistic. Share on X