Is there more upside potential for Avita Medical?

Avita Medical (AVH:AU) is a regenerative medical device company that produces the RECELL device for the treatment of burns. It is a company I have written about previously and whilst being a recent addition to the Montgomery fund’s portfolios, it has been one of its better performers. Given the share price appreciation in a short period of time, it’s worth reviewing the company’s operating performance and potential for further upside.

Avita’s recent share price run appears to be driven by increased enthusiasm from investors around the longer-term potential of the RECELL device, rather than current profitability levels. Avita’s September quarter update has shown some encouraging signs in terms of the initial RECELL roll-out. While a quarterly sales figure is unlikely to materially change the longer-term thesis, it is useful to monitor given the potential impact to the near-term sales trajectory, especially during the ramp-up phase of a company.

Some key points from the update include:

- US Sales of $4.6 million is up 60 per cent from the June quarter $2.9 million (up 57 per cent on a constant currency basis). There are no year-on-year growth comparisons given AVH commenced commercialisation in the December quarter.

- The 57 per cent growth rate is an acceleration from 29 per cent growth in the June quarter versus March quarter, which followed a broadly flat sales result in March quarter versus December 2018 (on a pro-rata basis).

- Penetration is now at 56 burn centres out of a total 132, which is up from 41 in the June quarter. This shows impressive product acceptance and penetration within a short timeframe with these hospital’s Value Analysis Committees.

- Over 50 per cent of US burn surgeons and centres are trained on the RECELL system.

- Orders per burn centres appears to have increased quarter on quarter (from approximately 7 to 8 per centre) – this is a commendable outcome given the increase in burn centre numbers in September quarter versus June quarter. This suggests increasing penetration within the burns centres – i.e. an improvement in depth, as well as breadth of coverage.

- A drop in international sales from $591k to $176k. The company has indicated the main focus continues to be the US burns market, and so we expect some fluctuation in these figures going forward. Longer-term, we expect International sales to grow given recent collaborative efforts (e.g. COSMOTEC) and potential for product development and geographic expansion.

The company has advised the FY20 pipeline includes:

- Trials for early intervention on paediatric scald burns, as well as soft tissue reconstruction and trauma indications

- Pilot studies for vitiligo in anticipation of advancing to clinical trials in FY21

- Securing marketing approval and reimbursement for COSMOTEC in Japan.

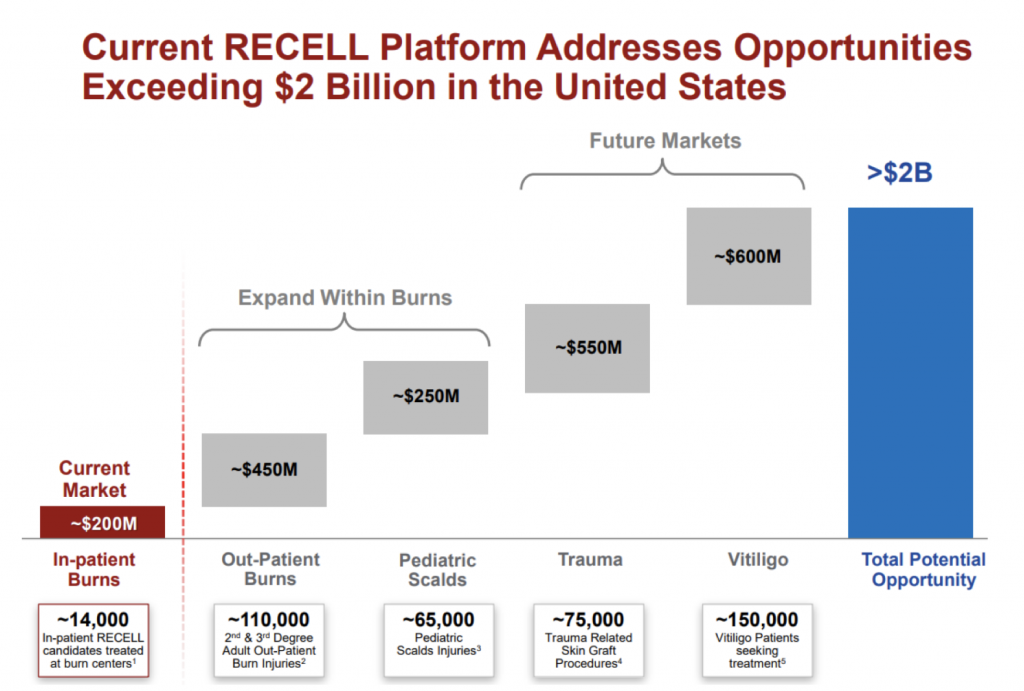

Addressable markets

Over the past 6 months, the company has provided a number of updates in terms of the size of addressable market opportunities beyond in-patient burns, which we outlined in a previous blog post. A snapshot of this is provided from the company presentation released in August below:

Source: Company presentations

While it is still early days for RECELL as a commercialised product, we are encouraged by the progress the company is making in developing these opportunities while also providing a cost benefit to hospitals and improved outcomes for burns patients in the US. AVH remains a core holding in the The Montgomery Fund.

You can read my previous article here: Where to for Avita Medical?

The Montgomery Fund and Montgomery [Private] Fund own shares in Avita Medical. This article was prepared 31 October with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Avita Medical you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Joseph. What do you think of the application to re-domicile to the US? Simplified financial reporting and reduced costs are always welcome, but the $400k p.a. in saving might be small if the moves exposes the company to increased litigation in the US. How can we estimate the impact of that increased exposure to litigation?

Hi William,

Personally, I don’t believe a re-domiciliation exposes the company to a greater risk of litigation as its operations were already based in the US – it just changes the exchange of primary listing.

However, it’s generally not possible to quantify open-ended risks especially before they happen – so you should try and capture any increase in perceived risk by increasing the equity risk premium (or lowering the multiple paid).

Hi Joseph,

What are your thoughts on the value proposition of AVH after the most recent capital raising?

Thanks,

Matt

Hi Matt,

If you isolate the capital raising as a pure equity for cash swap, and using 59 cents as the “correct” share price (ie the last traded / capital raising price), there is no impact on per-share valuation (aside from fee leakage).

Obviously that’s not how markets work though!

Putting aside sentiment impacts, the $120 million allows them to accelerate development programs that – without the raising – would have taken much longer to self-fund given limited resources.

Should any of these ventures prove to be successful (for example, pursuing market adjacencies in wound care markets and production evolution is a core part of our investment thesis) – this translates to quicker revenue and earnings growth and potential shareholder returns.

In the near-term, price volatility is not unexpected given 1) the new shares on issue (>10% of issued shares); 2) the discount of the raising relative to last close (~15%); and 3) passive buying as a result of index inclusion (AVH entered the ASX200 yesterday). All of these will impact daily price fluctuations, which is understandably greater than usual over the past fortnight.

Spelt ‘marc cohodes’ not coohdes

Joseph have you looked into the scientific studies on this – does this technology work or is this hope being sold? I note a lot of medicine involves selling placebos when all the other options look bad. Also, if this does work is there a moat? What stops Tom, Dick and Harry from scrapping your cells and spraying them on. Also how does this technique compare with skin grafts?

Hi John,

There are plenty of peer reviewed journals of the benefits of the RECELL device – in fact, the company is required to undergo a number of clinical studies that show statistical significance in providing a better outcome relative to placebo (skin graft) prior to receiving US Regulatory (FDA) approval. In the case of RECELL, the device has Pre-Market Approval (PMA) which has a similar requirement to drugs in needing to demonstrate efficacy and safety – as opposed to the less stringent 510k designation.

The moat is two-fold 1) receiving Regulatory Approval by the FDA is a very time consuming, costly and risky process; and 2) patent coverage over delivery mechanisms and components in the device.

Re: comparisons with grafting, the device helps to reduce donor skin requirements, while also minimising scarring and other benefits. Studies by burn surgeons has also shown a cost benefit as a result of reduced length of stay in hospitals – this is a major focus of hospitals, and is part of the reason why the device is priced at this level.

There is plenty of research on the device – the company’s website will assist if you’re interested in more in-depth studies.

Thanks for the detailed response Joseph – you may well be right but I am by nature a little sceptical about new things I don’t understand.

There is a good podcast (The Jolly Swagman) which has an interview with the short seller Marc Coohdes about medical tech – some similarities and differences but it certainly is sobering to listen to and makes one think.

keep up the good work

Thanks John, I will definitely look it up and have a listen.

Did Dominic and Gary help build the investment thesis when you were first looking at this?

Hi Phil,

No, AVH has been a holding in The Montgomery Funds for a few months prior to the launch of the Small-Cap Fund.

Nicely done, congratulations.

Thanks very much Phil.

In your research have you been able to ascertain the depth of Recell adoption at the various U.S. burn centers? Specifically, if a center admits 100 burn patients in a year, roughly what % of them are receiving Recell? And does this stat vary a lot from surgeon to surgeon?

Thanks,

Aaron

Hi Aaron,

Like you suggest, the level of adoption will differ based on the burn center, which will largely be based on surgeon acceptance. We don’t have specific stats but as you would expect, we understand the burn centres that were part of clinical trials and compassionate use (the larger centres) generally have higher usage rates in terms of both surgeon breadth and use cases.