How will franking credit changes impact your investments?

At Montgomery, we have a large number of self-funded retirees invested across our suite of investment strategies. Like many others in our readership, they too are nervous about the proposed changes – should the ALP be elected – surrounding the treatment of franking credit cash refunds for those in retirement.

Many have asked us to comment on whether these changes will go ahead, and if they do, how will they impact our investment suite, should the ALP proposal in fact legislated. Whilst we don’t have a crystal ball to predict the outcome of the upcoming election, the balance of power in the Senate or the probability of proposed changes being actually legislated, I have put together some key observations on how we are thinking about the debate.

What are the proposed changes?

The ALP would effectively like to unwind the dividend imputation scheme amendments under the Howard/Costello government, and cancel the cash refund for any excess dividend imputation credits (or franking credits) for most investors with low or zero taxable income. More specifically, this will “return to the arrangement first introduced by Hawke and Keating – so that imputation credits can be used to reduce tax, but not for cash refunds” when the franking credit is larger than the tax obligation by the individual or entity. As a result, the greatest impact will be to self-funded retirees who build an investment portfolio through their SMSF that is heavily weighted towards higher yielding listed businesses that in turn pay out higher proportions of franking credits.

Which Montgomery strategies will be affected?

The first thing to note is this, franking credits are only unique to companies listed in Australia. As such, any impact will be to Australian listed companies or direct investment strategies (unlisted managed funds, ETFs, LICs, etc.) that invest primarily* or exclusively in Australian listed companies.

In the case of Montgomery, this would be our domestic strategies, The Montgomery Fund and The Montgomery [Private] Fund. Although our global strategies can invest in listed companies in Australia, this only makes up a small proportion of their overall portfolio (in the Montgomery Global Fund, this is less than 10 per cent, and in the Montaka Global Fund, this is less than 1 per cent as at 31 March 2019).

If we focus on The Montgomery Fund, it is important to note that the proposed changes will not impact the after-fee returns of the Fund or its wholesale equivalent. What it may impact is the after-tax return of the Fund, which is dependent in the context of this discussion, on both what per cent of the bi-annual distribution is franked and the tax circumstances of the individual (or entity) receiving them. If we focus on the franked component, although The Montgomery Fund has averaged a 6.26 per cent yield since its inception as at 31 March 2019, not all of this has been franked. In fact, the franked component of the distribution since the Fund’s inception has been less than a third of total income paid.

*More than 50 per cent weighting to domestic equities.

Will it impact our investment process?

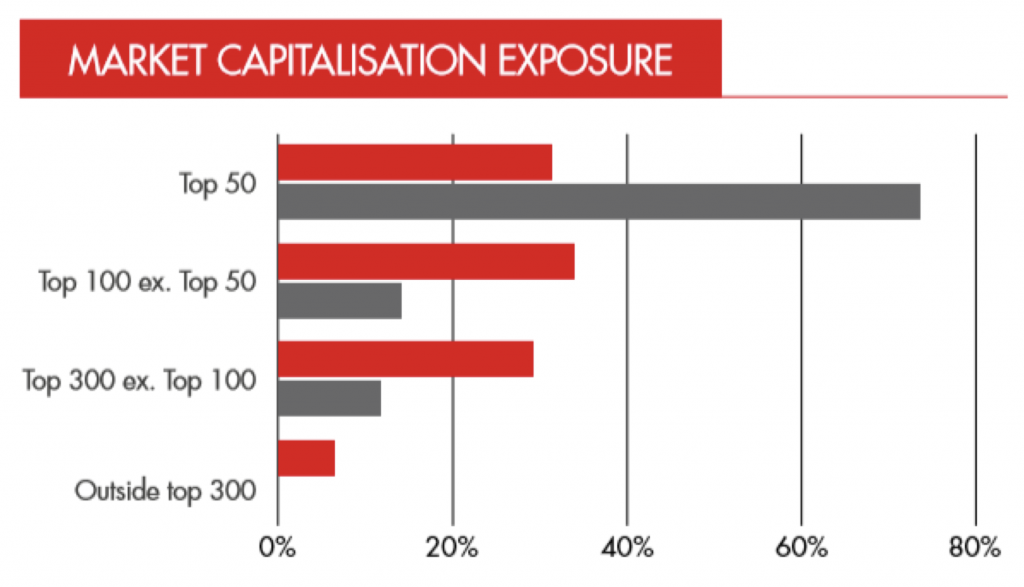

In our investment determination for the inclusion of a business in The Montgomery Fund and The Montgomery [Private] Fund, there are broadly three main considerations for our domestic equities team: i) the business quality, ii) the business prospects, and iii) valuation. If we look to quality first, the team have 12 metrics in which an analyst scores and ranks the quality of a business. These include pricing power, growth potential and capital intensity (or return on incremental capital). Importantly, the ability for a business to provide a consistent dividend yield (with a high franked component) is not a factor that ranks in our quality assessment framework. As such, our funds have sought businesses that have a higher reinvestment rate back into the business itself, and these tend to be those that sit well outside the top 50 listed companies where approximately 70 per cent of our portfolio currently lies in The Montgomery Fund as below:

Source: MIM

Taking this a step further, as of market close 23 April 2019, the top 20 stocks on the ASX had an average dividend yield of 5.15 per cent versus the next 80 up to the ASX 100, which had an average dividend yield of 3.75 per cent. Of the top 20 stocks on the ASX with higher yields, The Montgomery Fund’s currently only own Macquarie Group (ASX:MQG), National Australia Bank (ASX:NAB), Telstra (ASX:TLS) and Westpac Banking Corporation (ASX:WBC), all of which are small in weight relative to the broader market index.

How will it impact the market?

Stuart Jackson, Portfolio Manager of The Montgomery [Private] Fund, shares his views below:

“Eliminating refunds on excess franking credits is likely to shift demand from income seeking retirees away from operating companies that generate franked dividends toward asset-holding trust entities that pay no corporate tax and therefore distribute income as distributions on a pre-tax basis. A pre-emptive rotation of investor demand was evident in March with strong gains generated by real estate investment trusts (REITs) and losses in a traditional SMSF favourite, the Australian banks.

It is also likely to see companies with overseas earnings become slightly more attractive relative to companies that predominantly generate their earnings from the domestic economy, as the value of franked dividends will have declined for some investors. On the flipside, one benefit of the proposed franking credit rebate changes is that it could encourage some companies to retain more earnings for reinvestment, given the reduction in tax benefits of returning capital to some shareholders. In other words, capital allocation could be less tax-driven than in the past.

While our investment philosophy generally focuses on investment in companies that retain and reinvest earnings at high marginal rates of return, we remain cognisant of the potential for a shift in investor preferences in the event of a change in the Federal Government in May. To the extent that the market re-rates companies that reinvest their earnings, we should be a beneficiary. However, if money merely shifts from companies that have high fully-franked yield to those with high un-franked yields such as trusts, our performance should not be impacted.”

The Montgomery Funds own shares in Macquarie Group, National Australia Banks, Telstra and Westpac. This article was prepared 24 April with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

Dean, can All staff please leave your political biases out of this Blog.

Hi Adam, thanks for your feedback. We will endeavour to stick to market commentary going forward. Kind regards, Dean.

I see Dean’s response but it’s our blog Adam. And personally, if I chose to favour any political party’s policy over another, I will tell you here and I will tell you why I favour it. Everyone on the team is encouraged to do likewise. I am equally content whether you agree or disagree. Debating what is and isn’t good for the country must never be ‘shut down’ so it will continue to happen here on the blog, lest we end up with a heteronomous culture. You are welcome to disagree with our views, which is what a true democracy affords you the luxury of being able to do. Finally, its important to remember that it is rare to find anyone with whom you will agree on every issue. Ultimately, in every relationship, you will arrive at a fork in the road and you must decide whether you will respect the difference and thereby value and respect the relationship even more.

Under the ALP proposal the franking system will remain so we will not return to the double taxing of dividends which occurred prior to 1987.

In my opinion, in the longer term there will be plenty of winners in the ALP proposals, and they are Australian companies and their shareholders. My prediction is that Australian companies will invest in their businesses rather than over pay dividends as in the past. We will no longer have companies borrowing money to pay dividends, e.g as Telstra has done. Companies will no longer pay almost all their profits in dividends and not have enough for their own capital expenditure needs. An example is some of our banks, who have not spent enough money upgrading their IT systems and thus are now being challenged by smaller more nimble specialists companies.

In the long term this will mean companies will gain from the reinvestment in their businesses and shareholders will be the big winners. A good example of this with a large company is CSL. For the past 20 years CSL has paid a tiny dividend and has invested a huge amount in its business both here and overseas. The result over the long term is strong growth and a steady ever increasing dividend. Lives have been changed for long term CSL shareholders because of the company’s reinvestment in their business.

Over the long term the ALP policy will result in more companies like CSL and fewer like Telstra, and that will be good for Australian shareholders.

Disclosure: I do not own Telstra, but am a very happy long term CSL shareholder.

Thanks for sharing your views, Peter.

Hi Dean

If TMF has averaged a 6.26% yield since inception and only a third (2.09%) is made up of Fully or Partially Franked Income , then it means the Balance (4.17%) has come from realized Capital Gains. If Labor gets it’s way on Franking Credits and Capital Gains changes should it win the election , then Investors in a Taxable situation would likely be worse off as more of the Capital Gain component of TMF distribution would likely form part of their Taxable Income.

It seems like there are no winners in Labors changes and Unit Trust structures are at a disadvantage to the Company structure in the sense that a Company can retain profits and not distribute them as dividends and use share buybacks as a way of enhancing Investor returns without any Tax consequences to the Investor. You tend to think that the high dividend yield companies such as the Banks would consider cutting back on dividends and use the surplus cash on buybacks – Wouldn’t it make sense to do that?

Hi Max,

Indeed some food for thought there. A Listed Investment Company (LIC) does have the ability to retain profits (franked, realised gains) unlike a unit trust which is required to distribute (assuming CFC status). If a LIC only paid out franked income as a dividend, an investor would then have the choice on when to realise their gains (so CGT is still inevitable). The other important thing to note from a comparison of investment vehicles perspective is ofcourse LIC’s still can trade at discounts/premiums to the Net Asset Value (NAV), whereas an unlisted unit trust will trade at exactly NAV as often as a unit price is stuck. Unfortunately no investment vehicle is perfect!

A quick note on TMF, the other income components of its return also include unfranked dividends, foreign dividends (some NZ companies) and interest from the cash we hold.

With regards to your final comment on share buybacks, we tend to agree and Joe from the domestic team also wrote on this recently: https://rogermontgomery.com/should-you-participate-in-a-share-buy-back/

Thanks again for sharing your thoughts!

Kind regards, Dean.