Will new LNG import terminals cut the price of gas?

Australia has more than 257 trillion cubic feet (TCF) of gas resources and 885 TCF in prospective resources.* And we’ll soon be the largest gas exporter in the world. But, somewhat shockingly, new gas import terminals are about to be built on our east coast to cut the price of gas. I hate to be a doomsayer, but I don’t think this is going to work.

As I have written previously, the main reason that Australia has high wholesale electricity prices is the high price of gas which sets the marginal price in the electricity market. (The main reason retail electricity prices are high is the historical gold plating of the networks.)

It is therefore no surprise that projects looking to capitalise on high domestic gas prices are starting to pop up. Unfortunately, some of them continue to represent a misallocation of capital away from productive investments towards investments looking to extract a rent on a limited resource.

One prime example of this is the four Liquefied Natural Gas (LNG) import terminals that are currently under consideration for the east coast of Australia. The most public and seemingly well advanced of these is the Andrew Forrest backed Australian Industrial Energy (AIE) who is looking to build a gas import terminal in Port Kembla, 1.5 hours drive south of Sydney. AGL is also reasonably well progressed on its proposal to build a gas import terminal in Crib Point just outside Melbourne.

In my view, just the situation that LNG import terminals are even being considered at all for Australia represents a very damning indictment on the state of Australian energy planning and policy. Australia is one of the world’s largest exporters of LNG, both from Western Australia and Northern Territory and from the east coast. Something must surely have gone seriously wrong for such a country to have to even contemplate importing LNG?

As a quick recap, four things went wrong that enabled this situation to occur:

- Three competing LNG exporters got approval to each build their separate liquefaction capacity with associated other infrastructure just next to each other on Curtis Island outside Gladstone in Queensland. This was from a macro perspective a significant overinvestment as it would have been much cheaper to build the same capacity as one larger plant meaning that the cost base of the combined capacity is much higher than it could have been.

- Out of the three exporting companies, Santos in particular had not secured enough controlled gas resources the fulfil the export volumes they committed to, so the total export capacity were short on gas which had to be fulfilled by the exporters buying gas in the domestic marketplace.

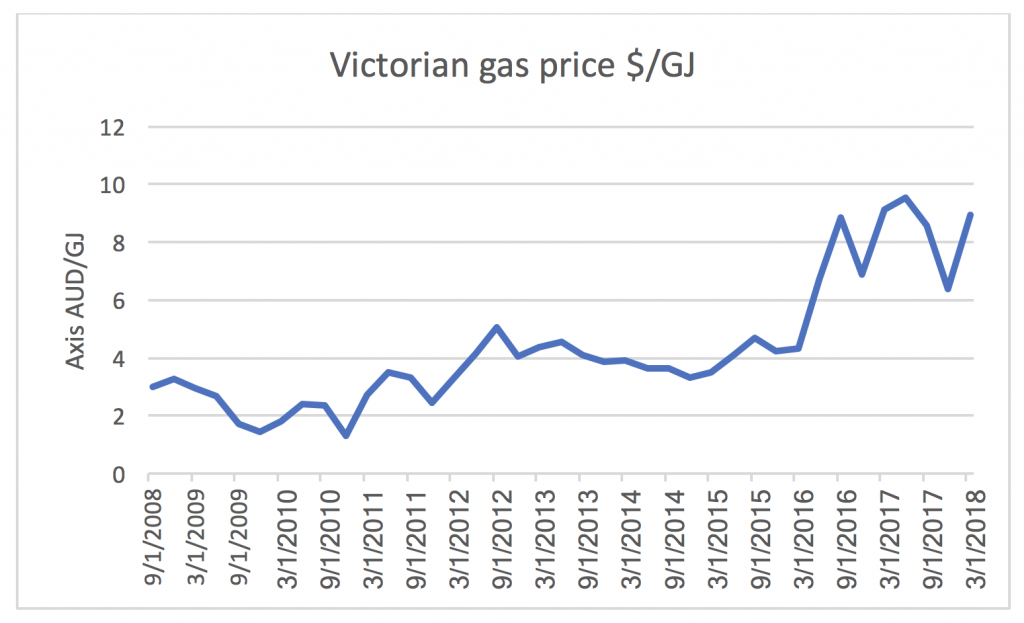

- As domestic producers now have a choice whether to sell domestically at the prices they had traditionally done or to sell to someone looking to export the gas, the domestic price has reset to LNG netback prices (i.e. the international price of LNG minus the cost of liquefaction and transport) and this is what has driven up the east coast gas prices from the long term historical level of $3-5/GJ to the current level of ~$9/GJ (the chart below shows the average Victorian prices but the picture is the same for the whole east coast given that it is interconnected).

Source: Australian Energy Regulator

- Given that the price the LNG exporters receive is tied to the oil price, this also means that domestic prices are also tied to the international oil market, creating significantly more volatility than before.

Now, lets think about the proposition of an LNG import terminal for a bit and it is easy to conclude that for it to be worthwhile to import LNG into Australia, an importer has to be able to sell the gas for a price that is above the cost of buying the gas, transporting it to Australia and making a return on the infrastructure required to get it into the Australian gas market.

In turn:

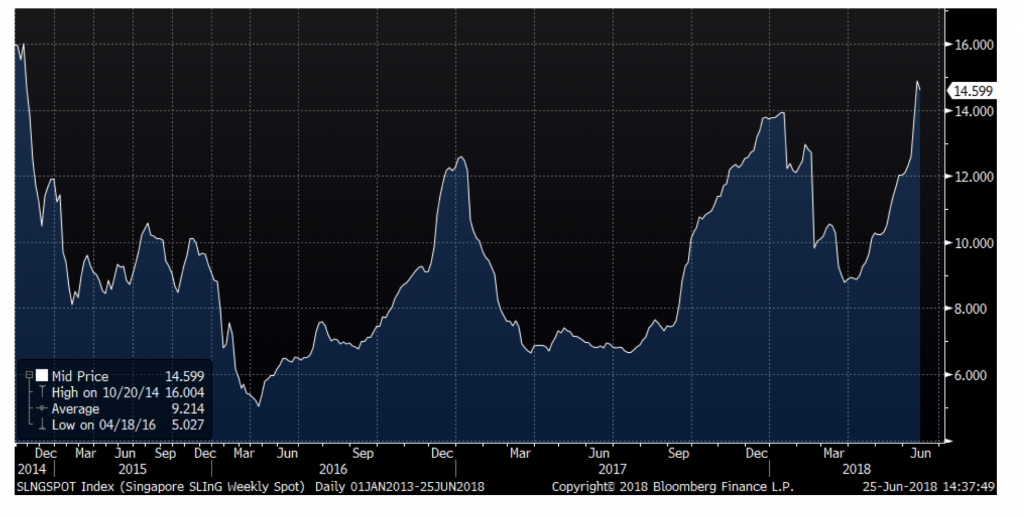

- Buying gas in the international market means most likely that they would have to buy LNG on the North Asian spot market. The chart below shows the historical cost of doing this (note that the scale is in AUD/mmBTU and not AUD/GJ as the international gas market works on a BTU basis. The difference is only about 5 per cent so just take the scale on the right and divide by 1.05). Currently, it costs about 13.9AUD to buy one Gigajoule of gas on the spot market. As can be seen from the chart, this is close to an all-time high but the average over the last couple of years is ~10 AUD/GJ.

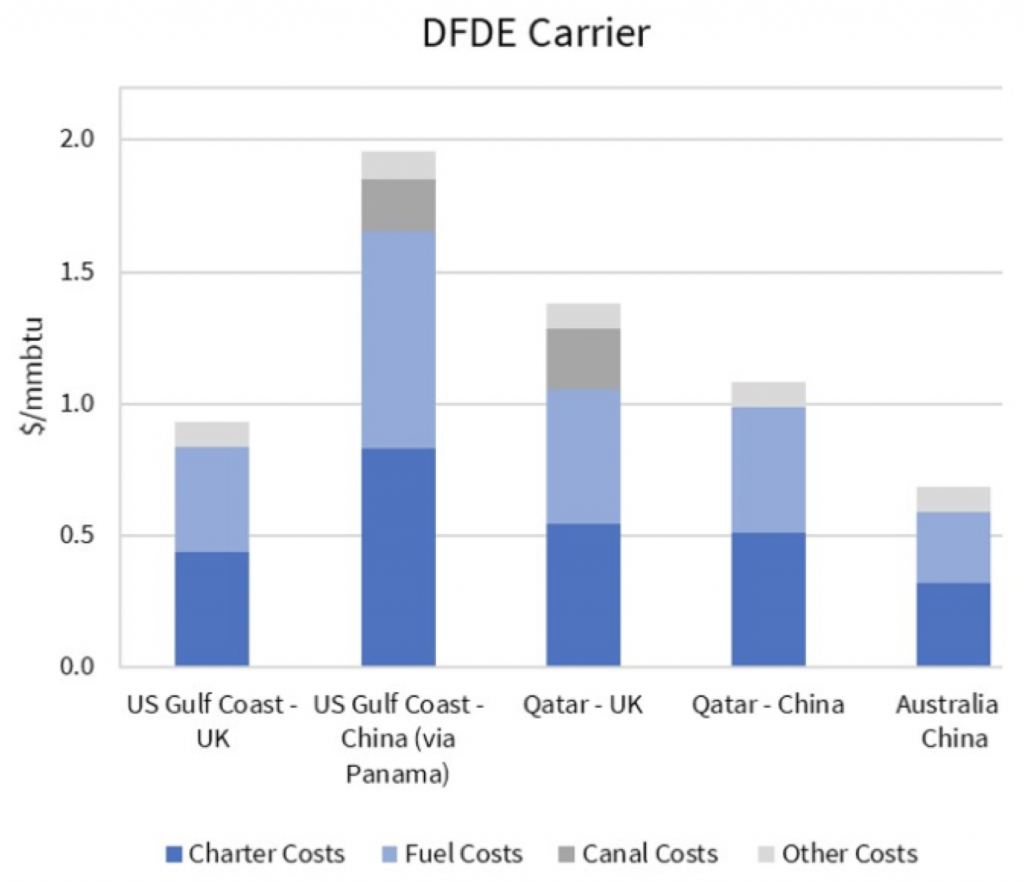

- To get gas from Australia to China currently costs about 0.65 USD/mmbtu or about 0.82 AUD/GJ. I guess it would be fair to assume that importing gas to Australia should cost about the same (if not more as the export facilities are further north than the proposed import facilities).

Source: Timera Energy

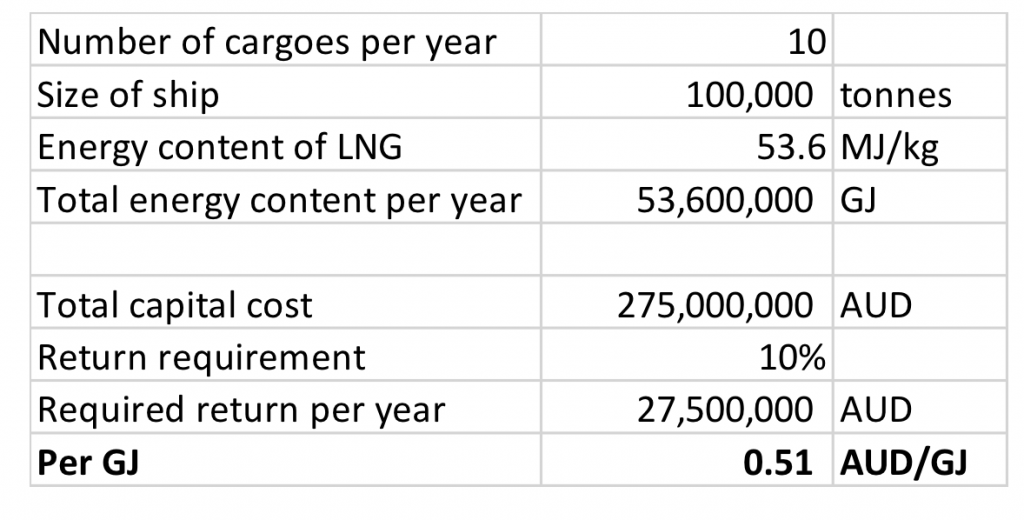

- Finally we have the cost of getting the gas into the Australian market which will be achieved through an LNG import terminal. There are two different principal designs for import terminals, onshore or offshore. All the currently proposed solutions involve an offshore solution which is basically a permanently moored LNG carrier with extra regasification equipment which other LNG carriers can tie up to an offload their cargoes. In addition to a ship, a jetty for mooring and a pipeline for connecting to the gas grid is required. The total cost for the proposed solutions are in the range of AUD250-300m. AGL in their proposal describes using a ~200.000m3 ship and as the density of LNG is about 470kg/m3and with an energy content of ~53.6MJ/kg, we arrive at the following calculation using AGL’s estimated 10 cargoes per year and a very simplified return requirement of 10% per year. This shows that an importer will have to add at least 50 cents/GJ to recover the infrastructure cost alone and that is completely ignoring any operating costs from running the terminal (salaries, energy for the heat exchanger, security, lost gas in connection with the regasification, maintenance etc.).

If we add 1, 2 and 3 above together, we see that we arrive at a minimum price of gas delivered to the Australian gas grid of 13.9 + 0.82 + 0.51 = 15.23 AUD/GJ and if we use the average historical North Asian LNG gas price 10 + 0.82 +0.51 = 11.33 AUD/GJ. This is (unsurprisingly) significantly higher than the current east coast gas prices of about 9 AUD/GJ.

Hence, we can safely draw the conclusion that building import LNG gas terminals on the east coast of Australia is a capital destroying exercise in macro terms.

The only alternative would be if supply could be secured from the West Australian market where, thanks to a very successful domestic gas reservation policy, domestic gas prices are about 4-5 AUD/GJ. It would though most likely take a lot to convince the WA government to allow this to happen as it would put upwards pressure on the WA gas prices.

So what should be done instead?

It is clear that the government through its Australian Domestic Gas Security Mechanism has already managed to get the LNG exporter to release more gas to the domestic market which has brought down gas prices already. Given that the LNG exporters are suggested to be to blame for not securing enough production by themselves, I do not see any inherent problem with them continuing to be the major part of the solution by forcing them to divert additional gas to the Australian market at reasonable prices.

Victoria and New South Wales should also be put under pressure to drop their blanket moratoriums against gas exploration as there are plenty of gas reserves that can be (most likely very safely) developed to secure additional supply for domestic consumption.

What is clear though, is that building LNG import terminals will do nothing to bring gas prices down on the east coast of Australia…

* Data on Australia’s gas resources is from the Energy Resource Information Centre

Soon Australia will be the largest gas exporter in the world, with 257 trillion cubic feet of gas resources. So why would they be building new gas import terminals on the east coast with the hope of decreasing gas prices? Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Leftist government policy got us into this mess, so you think shareholders should bail us out by forcing them to sell their products at “reasonable prices” .A solution Bill himself would applaud.

Hi Andrew,

Lets not get go into the political debate of who approved what or not but to me it is clear that the whole resource extraction regime in Australia is seriously mismanaged. There is a clear difference between a renewable manufactured value added good (butter, cars, computers etc.) and a natural resource like natural gas.

Natural gas is not a renewable resource and is not produced by anyone, it is extracted from the ground and once it is gone it is gone. The value of a natural resource should therefore be seen as primarily belonging to the country it is found in as it is a value that is not created by anyone per se.

That is not to say that the companies involved in extracting such a finite resource should not be incentivised to invest to extract the resource and help monetise the value (a natural resource is worth exactly zero to everyone if it stays in the ground…) but the rules must be formulated so that a significant part of the economic good flows to the country that the resource belongs to so that the value can be channeled into other productive purposes, hopefully of a lasting nature so that the benefit remains after the natural resource runs out.

I therefore do not agree with you when you say that we should force the companies to sell “their” products here at a reasonable price as it is inherently not “their” products. Their product is the extraction of the natural resource and that is what they sell and should be remunerated for.

If you read the linked article in The Australian, it is clear that Santos committed to and built two LNG trains without having secured enough gas to fulfill their export commitments and hence had to go into the domestic market and buy gas that was originally developed to supply the domestic market and this tipped the supply/demand balance so that domestic prices increased significantly. The high domestic gas prices has negative consequences for Australia as a whole and hence I do not have a problems with them having to release gas to the domestic market at reasonable prices.

The underlying problem is though that the framework was not designed in the right way from the beginning. Western Australia has a much better system for gas extraction policies and the best in the world for natural resource extraction is in Norway (I am from Sweden and very jealous of them…).

I have no issue with royalty’s as I’m guessing your referring to above, but as for “forcing to sell at reasonable prices” i have issue, as does the entire capitalist and democratic world I guess. Markets are the best price discovery mechanism not coercion. I am not even an investor in energy or resources, but I’m aware of the massive investments required to extract and market them, if we are going to descend into Venezuelan methods of price discovery, I’d say further investment will go elsewhere. Why not try the make it easy to do business here method, and prices will take care of themselves.

Hi Andreas,

This looks like a capacity problem. With Bass Straight and Gippsland resources reducing, there will be insufficient supply for NSW/VIC, in particular. I don’t know what the gas pipeline capacities are from Central Australia/ Queensland, but suspect one option is to increase those capacities. Alternatively, build LNG import facilities at Port Kembla/ Crib Point.

While the price of “imported” LNG might be set on the world market, the actual supply could come by ship directly from Curtis Island? Or WA?

So, in my view, the cost equation should be about comparing the various alternatives – a) upgrade the pipelines; b) LNG imports; c) Other ?

However, I do take your point that vested interests are likely getting in the way of rational analysis.

Regards, Mike

Hi Mike,

There is no shortage of pipeline capacity to get gas from QLD/SA to NSW and VIC. Both pipelines from Moomba (to Sydney and to Adelaide and on to Melbourne) have plenty of spare capacity (although they are quite expensive to use, it cost about $1/GJ to transport gas from Moomba in SA to Sydney).

What is being proposed is to build a pipeline to connect Northern Territory to the east coast network. This could help a bit but would be quite expensive.