Are investors giving up?

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

If your portfolio still has some rubbish in it, then being able to identify it is a key part of preparing for cheaper prices if they eventuate.

I recently wrote a column for the ASX and pondered the possibility of a climactic event coinciding with a complete throwing in of the towel by equity investors who are simply fed up with poor medium term returns and increased volatility recently.

The ASX200 hasn’t generated a positive capital return since 2005 but quality companies have. The ASX200 contains stocks that are rubbish so it is no wonder that an index based on that rubbish has gone nowhere. Step 1 then is to clean up the portfolio and step 2 is to be ready for quality bargains when they arise.

This is just one of many scenarios and frameworks I am operating with and I wonder what would transpire if the poor returns or the recent heightened volatility continues for a little longer? Will investors simply throw in the towel, leave equities and believe all those advisors offering their own brand of ‘safe’, ‘secure’ and stable investments? On the one hand, I hope so. It would mean certain bargains.

Here’s the Column:

As global sharemarkets decline, remain volatile and produce poor historical returns compared to other asset classes, it will be easy to be swayed by the latest investment trend – to move out of shares. I believe the trend away from shares will gather pace soon as more and more “experts” use the rear-view mirror to demonstrate why sharemarket investors would have been better off somewhere else.

In 1974 US investors had just endured the worst two-year market decline since the early 1930s, the economy entered its second recessionary year and inflation hit 11 per cent as a result of an oil embargo, which drove crude oil prices to record levels. Interest rates on mortgages were in double digits, unemployment was rising, consumer confidence did not exist and many forecasters were talking of a depression.

By August 1979, US magazine BusinessWeek ran a cover story entitled ‘The Death of Equities’ and its experts concluded shares were no longer a good long-term investment.

The article stated: “At least 7 million shareholders have defected from the stockmarket since 1970, leaving equities more than ever the province of giant institutional investors. And now the institutions have been given the go-ahead to shift more of their money from stocks – and bonds – into other investments.”

But be warned. The time to get interested in share investing and make good returns is precisely when everyone else isn’t.

Your own once or twice-in-a-lifetime opportunity may not be that far away and Labor’s promised tax cut on interest earnings may sway even more to give up shares and put their money in a bank, providing the opportunity to obtain even cheaper share prices.

If prices do fall further – and they could – you will need to be ready and will need some cash. The very best returns are made shortly after a capitulation. Cleaning up your portfolio becomes crucial and this article looks at how to do that.

Rule one: Don’t lose money

The key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently. Sure, good companies will see their shares swing but the poor companies see the downswings more frequently.

Therefore, the easiest way to avoid losing money is to avoid buying weak companies or expensive shares. One of the simplest ways I have avoided losing money this year in The Montgomery [Private] Fund has been to steer clear of low-quality businesses that have announced big writedowns.

These are easy to spot using Skaffold.

Not-so-goodwill

I have often seen companies make large and expensive acquisitions that are followed by writedowns a couple of years later. Writedowns are an admission by the company that they paid too much for an asset.

When Foster’s purchased the Southcorp wine business in 2005 for $3.1 billion, or $4.17 per share, my own valuation of Southcorp was less than a quarter of that amount. Then in 2008 Foster’s wrote down its investment by about $480 million, and then again by another $700 million in January 2009 and a final $1.3 billion in 2010.

When too much is paid for an acquisition, equity goes up but profits do not and you can see that too much was paid because that ratio I have worked so hard to make popular, return on equity (ROE), is low.

These low rates of return are often less than you can get in a bank account, and bank accounts have much lower risk. Over time, if the resultant low rates of return do not improve, it suggests the price the company paid for the acquisition was well and truly on the enthusiastic side and the business’s equity valuation should now be questioned. If return on equity does not improve meaningfully, a large writedown could be in the offing. This will result in losses if you are a shareholder, and you have also paid too much.

Just remember one of the equations I like to share:

Capital raised + acquisition + low rate of return on equity = writedown.

When return on equity is very low it suggests the business’s assets are overvalued on the balance sheet. That, in turn, suggests the company has not amortised, written down or depreciated its assets fast enough, which in turn means the historical profits reported by the company could have been overstated.

Scoring bad companies: B4, B5, C4 and below…

These sorts of companies tend to have very low-quality scores and often appear down at the poor end of the market – the left side of the screen shot in Figure 1 below.

Figure 1. The sharemarket in aerial view (Source; Skaffold.com)

Each sphere in Figure 1. represents a listed Australian company and there are more than 2000 of them. The diagram is taken from Skaffold. Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.

Companies that are poor quality (I call them B4, C4 and C5 companies, for example) are found on the left of the screen and if they have an estimated negative margin of safety, they are estimated to be expensive and will be located towards the bottom of the screen.

Highlighted with blue rings in Figure 1 are eight of the companies that announced this year’s biggest writedowns. Notice they tend to be at the lower left of the Australian sharemarket, according to my analysis.

If your portfolio contains shares that are red spheres and on the lower left, you could also be at risk because these companies tend to have low-quality ratings and are also possibly very expensive compared to their intrinsic value.

As is clear from Figure 1, this year’s biggest writedown culprits were all already located in the area to avoid.

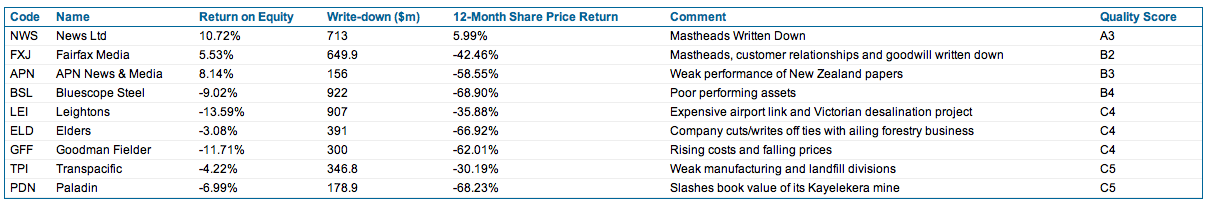

The impact of owning such a business outright would be horrendous. Table 1 below reveals the size and details of these writedowns and as you can see, collectively the losses to shareholders amount to $4.6 billion.

Table 1. Predictable losses?

Warren Buffett once said that if you were not prepared to own the whole business for 10 years, you should not own a piece of it for 10 minutes.

Clearly you would not want to own businesses that pay too much for acquisitions and subsequently write down those assets. If you are not willing to own the whole business, don’t own the shares. Although in the short run the market is a voting machine and share prices can rise and fall based on popularity, in the long run the market is a weighing machine and share prices will reflect the performance of the business. Time is not the friend of a poor company, and companies Skaffold rates C4 or C5 are best avoided if you want the best chance of avoiding permanent losses.

Look at Figure 2 below. Those big writedown companies not only performed poorly but so did their shares. These companies (shown collectively as an index in the blue line below) produced bigger losses for investors than the poorly performing indices of which they are part. And that’s just over one year.

Figure 2. The biggest writedowns compared to the market

Take a look at the companies in your portfolio. Do they have large amounts of accounting goodwill on their balance sheet as a portion of their equity? Have they issued lots of shares to make acquisitions and are they producing low and single-digit returns on equity? If the answer to all these questions is yes, you may have a C5 company.

Cleaning up your portfolio not only lowers its risk but will produce cash that may just prove handy in coming months.

If you have made it this far then here’s evidence of the giving up I referred to in the column: http://www.smh.com.au/business/investors-turn-to-term-deposits-in-shift-away-from-equities-20111219-1p2ir.html

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

On write downs.

If you truly know your companies, and dig into them deep understanding their economic performance you should understand the true value of that companies assets right away.

With that in mind, the Accounting write downs should not impact your valuation at all.

In many cases they are very obvious, as companies have so many reasons (mostly irrational) to avoid write downs they are usually posted about 2-3 years late (unless significant).

I find them as great indicators on what management think about performance. Where one is honest and states we got it wrong, acquired a company we shouldn’t have etc etc Those are companies who are probably looking at their economics. On the other hand, companies who write down 2-3 years late and blame it on macro conditions or other things they ‘had not control of’, is a good sign these guys really love their accounting profits and all the silly things that go along with it.

Like lots of things, you learn the most about things when times are tough. Write downs are tough.

Good thoughts Mark. Thank you.

As night follows day; new CEO = write-downs on previous CEO’s purchases = performance bonus met. prbly too cynical for 2 days before xmas…

You are not cynical enough – what about increased provisions and generous procurement of anything that can be expensed in that first overlap year. Many years ago I had a newly-appointed MD ask me to invoice his firm as much as we could in the first June of his reign. Naturally, he was able to demonstrate a good turn-around for his first full year at the helm.

Cynical but true!

Hi Roger

Speaking of when to jump in, I have decided to buy some MCE today for the first time ever. I am not a fanboy of this stock, as I know some had become, and have a healthy respect for it’s ability to tank further in the short term – but I was won over by last night’s ASX announcement of a recurring contract at $35-50m revenue per annum. Although it is only a small percentage of the necesary overall revenue, on top of the work in hand and last month’s $60m+ in new orders there seems now to be some basis for the CEO’s confidence in the new plant and at least more prospect of his full year forecast coming to fruition. What do you think? Too optimistic on my part? I bought in at $3.10 and given it was flat throughout the day I seem to be on my own in attaching much significance to last night’s announcement. (I know there was vague mention of a contract of this kind at the AGM but thought having it cemented might have made some impact).

Anyway, thanks for a year of hard work trying to point us all in the right direction.

Kind Regards

Thanks Peter, We are always watching it too.

It was an interesting announcement, Peter. It alluded to MCE’s primary advantage over its rivals – the quality of its product and its whiz-bang new facility at Henderson.

MCE has gone from market darling to the exact opposite with the market in the past 9 months or so which is probably why the share price didn’t really move. It will take some improved results over a period of time for it to be forgiven, and showing their owners a little more respect wouldn’t hurt either. I wouldn’t be surprised if your purchase bore some fruit in time all the same.

I still hold some MCE.

And popping into my inbox today..

http://equmail.equ.com.au/t/ViewEmail/r/5BE67C7B95EB1BFB/8D9729BBF86A34E262AF25ACF5E3F0AC

It looks like they’re certainly trying to keep their current investors informed at least. Perhaps they’re more focussed on them than potential future investors now. This seems to be a bit of a turnaround from not so long ago when Aaron & Co were out there selling MCE hard to anybody that would listen. Perhaps now, it’s damage limitation – or trying to get the investors who are left holding the stock to not lose faith and sell (which would drive the SP down even further). It would be nice if everybody had the same access to the same information.

I should note that there is quite a bit of info available on their website, so perhaps it IS all available to everybody, if they want to look for it. Personally, I intend to stay clear of MCE until they have a few good years behind them. I haven’t been overly impressed with this last one, and would want to see a little more consistency before sinking any money into MCE. I’ve noted Roger’s comments about fixed costs, and I believe that with Henderson, they are now comitted to high fix costs if the plant does not run to full capacity. When the plant is producing to capacity, those costs will be lower and the cost base will become one of their competitive advantages, but only if they can maintain high production. Gaps in production (insufficient orders) can cost them dearly, and significantly affect their profitability. It’s tricky. Companies need to plan and expand to allow themselves to grow and meet future demand, but at the same time, they have to try to avoid making their fixed overheads so high that significant periods of reduced production may result in a lack of profitability that can overshadow the higher profits made during periods of high production. Ideally, you want to keep your plant producing something, anything, whether it is (higher margin) riser buoyancy modules, or well construction products, or both at the same time preferably. There is no doubt they are using their technology to expand their product range and service offerring, and that’s all good. However, they need the orders to keep the machinery running and the employees productive.

I hope that MCE in a year or two find themselves in a position where they can NOT meet customer demand, are selling everything that they can produce, can raise prices, without losing significant market share, because they are the best at what they do, and can maintain their competitive advantages in the face of struggling competition. That would be a nice little Aussie success story, and would reward those true-believers here on the blog that will have held MCE right through the roller-coaster ride all the way down and right back up to higher than their last capital raising (and perhaps, just maybe, much, much higher than that too). The conditions seem to be precident for all this to occur. However, the time-frame for them to get from here to there is the biggest unknown quantity for me. In the meantime, if high fixed costs (due to low or interupted production) starts biting into profits, the time frame gets moved out a bit further. For me, it’s a watch and wait stock. I don’t own any and wouldn’t expect to be having a serious look at them before mid 2013 at the earliest. But I’ll keep them on my watchlist in the meantime because I’m interested in them as a case study.

When investors are walking away from the sharemarket it is generally the time they should actually be jumping back in. We are a strange lot us humans.

it’s definitley been an interesting year, 2012 looks very much like it will be too. Who knows what will come up but hopefully some bargains do.

Also been a good year on the blog, the quality of comments and posts has been outstanding.

With thanks especially to you Andrew!

Roger,

Which value is being used in the general info/margin of safety. I would like to see a better explanation in Skaffold.

regards

Peter

“Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.”

Great suggestion Peter. We are going a couple of steps further than this. Its now in the development pipeline. Thank you again for helping make Skaffold even greater. Regarding your previous message, not sure why it wasn’t posted. Nothing was deleted at this end.