Altium – a big jump up in value

Last week Altium Limited (ASX: ALU) provided its full year results for the 2015 financial year. Below we make a few notes on its progress.

For those unaware, Altium designs software which allows engineers to create plastic circuit boards (the very same running your computer, mobile phone, tablets etc). It earns revenue through sales of licences to use the software, and annually paid subscriptions for maintenance and updates. As we’ve discussed previously, sticky recurring revenue streams building up create substantial value over time.

Altium plays in the PCB design ‘middle market’ which it has had great success with its ‘Altium Designer’ product. Altium Designer is typically cheaper than most of its competitors and is well known to be an efficient piece of software.

In terms of the result, we note a few points:

- Full year revenue, EBITDA & underlying Net Profit After Tax grew by 13 per cent, 24 per cent and 38 per cent respectively for the underlying full year result.

- Revenue growth in constant currency terms was actually 19 per cent. With Europe comprising circa 38 per cent of the firms revenues and the company reporting in USD, the falling euro has muted some areas of growth

- Subscriber base grew from 26,000 to 28,000.

- Management don’t provide annual guidance however have reiterated their FY17 target of $100 million in revenue grown organically (revenue in FY15 was $80.5 million). The CEO noted that the firm might achieve 30 per cent EBIT margins (currently 27 per cent) in FY16 however this will be subject to growth requirements (i.e. if the right opportunity appears the company will investment/spend for long term value creation as opposed to the short term). Both factors will be highly value accretive should they eventuate.

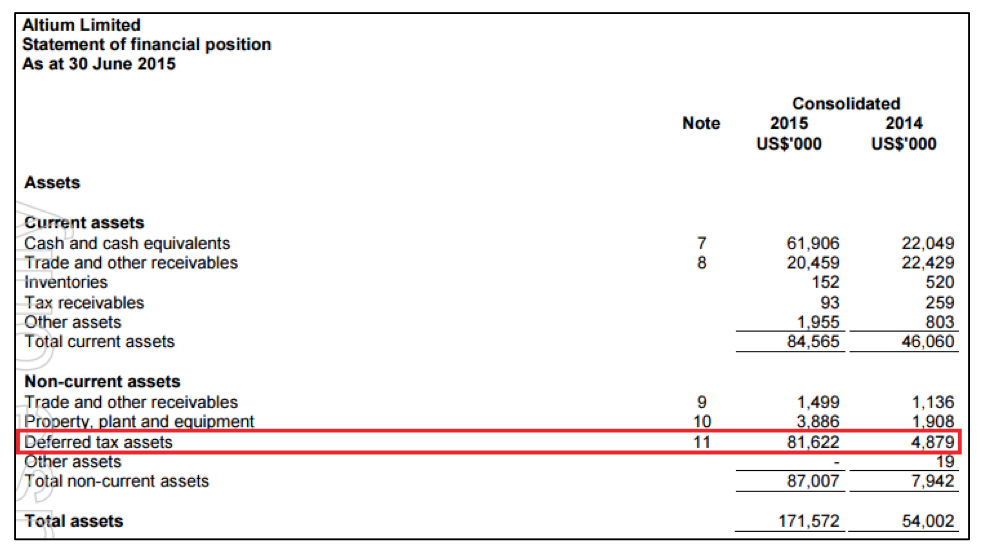

One item we noticed on the firm’s balance sheet was a line titled ‘deferred tax assets’ which rose significantly over the last year. If we look into what drove this, it appears that the firm has gained a sizeable tax asset as a result of moving its operations to the United States (and hence rebasing its assets in that country). Effectively the company can offset its tax against this asset each year (the asset will be written down by the tax saved each year accordingly). The asset is actually larger than the report recognises due to accounting rules which only permit a determined per cent of the total asset to be recognised (the remainder will be reviewed at a later date).

Effectively the company can offset its tax against this asset each year (the asset will be written down by the tax saved each year accordingly). The asset is actually larger than the report recognises due to accounting rules which only permit a determined per cent of the total asset to be recognised (the remainder will be reviewed at a later date).

Notably, we’ve confirmed this interpretation of the relevant accounting standards with the company and also its auditors. Each confirms that it is legitimate. By our numbers, the tax asset increases the firm’s value by around 20 per cent.

Further value may be realised should Altium begin to take share from industry leaders Mentor & Cadence in the ‘upper market’ (which includes firms such as Apple & Google etc).

At current prices, Altium looks very cheap and appears to have bright prospects. We remain holders of the stock.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

This was one of those highly pleasurable annual reports to work through, particularly the tax effect of rebasing to the USA. Who ever said accounting wasn’t fun?

Thanks Scott for your post on Altium. With regards to the deferred tax asset, this asset will take a number of years to realize and in the meantime, dividends paid will be unfranked. Does your valuation methodology factor in the value of these “lost” franking credits and if not, why not. Now Instead of receiving a $70 fully franked dividend from Altium I will now receive a $100 unfranked dividend (due to the realization of the deferred tax asset). When I pay tax on this unfranked dividend, at the end of the financial year, the net result will be the same. I’m interested in your thoughts on how to value tax assets as an investor as it can be quite tricky.