Will the non-major banks follow the big boys in lifting rates?

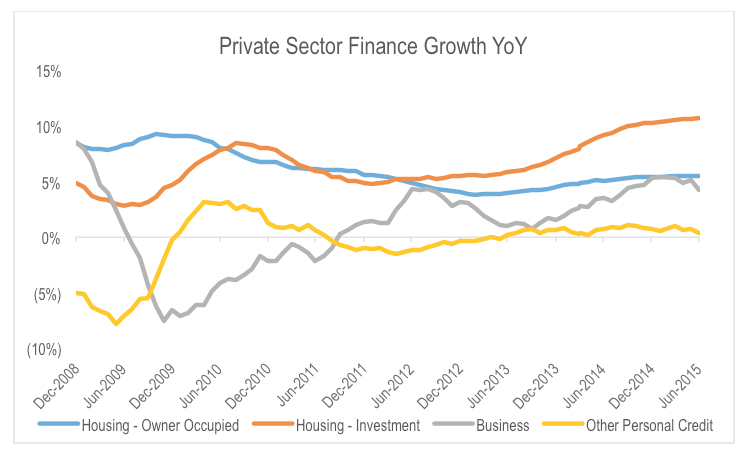

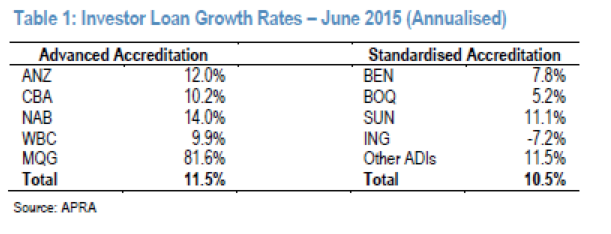

The Reserve Bank of Australia released its June credit data last week. The data continued to show strong growth in investment mortgages, with outstanding loans increasing 10.7 per cent on the same time last year. This remains above APRA’s targeted ceiling growth rate of 10 per cent and represents a slight acceleration in the rate of growth relative to the May data.

At the same time, business credit growth appears to be losing momentum after progressively improving from mid 2013. Similarly, other credit growth (ie. non-housing or business) has remained almost non-existent over the last 4 years, and also appears to be weakening. Both of these represent negative signals for the economy, with weak business credit growth implying continued soft investment growth and anaemic household credit growth implying soft consumption trends.

As we know, the major banks have recently moved to increase their variable rates on investment loans by 25-29bpts, while leaving their variable rates on owner occupied mortgages unchanged. The banks suggested this was to slow the growth rate in their investment mortgage book to bring it down below the 10 per cent level.

We note that WBC’s decision to wait a little longer before announcing an increase in its variable rate on investment mortgages could be a response to slower mortgage market relative to its major bank peers in the June quarter.

As we have suggested previously, the repricing of not only new investment loans, but also existing loans will lead to a widening of net interest margins, increasing bank profitability, and partially offsetting the impact of the dilution of bank Return On Equity’s (ROE) resulting from increased core equity requirements by APRA.

Given the proportion investment loans make up of the overall mortgage book, the 27-29bpt increase in variable rates would recoup around 30-35 per cent of ROE dilution from higher risk weightings on mortgages for ANZ, WBC and CBA and around 60 per cent for NAB. This assumes no change in the amount of discounts given the customers. However, there is some evidence that the major banks are providing increased discounts on headline owner occupied mortgage rates. This would offset the net benefit of the recent mortgage rate increases on major-bank ROEs.

The question then becomes, what will the non-major banks do in response? The non-major banks could increase their own mortgage rates, resulting in an increase in earnings. More importantly, it would increase their ROEs given they do not face the rising capital adequacy requirements of the major banks.

Alternatively, they could look to use their increasingly competitive capital position to gain market share.

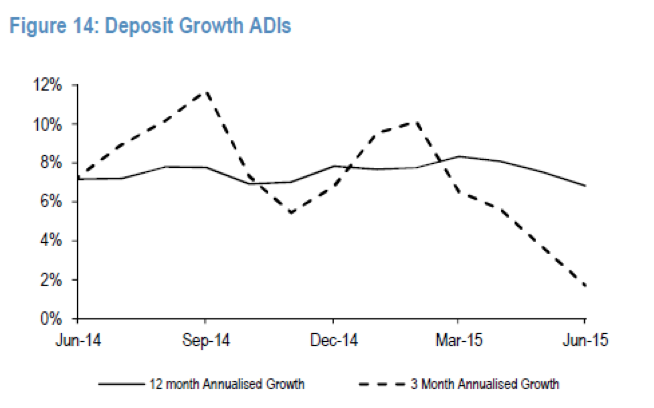

The decision between price and share is likely to be partially determined by the availability of funding. Interestingly, APRA’s recently released deposit growth data for the June quarter indicates that system-wide deposit growth rates slowed to just 1.7 per cent on an annualised basis. This is despite deposit rates remaining at the same discount to the RBA’s target cash rate.

With deposit growth slowing, the market will be more dependent on wholesale markets to fund loan growth. There are 2 issues with this. First, it negatively impacts the net interest margin, requiring further increases in mortgage rates relative to the cash rates just to hold earnings steady. This acts as disincentive to pursue volume growth given the lower net interest margin on new loans resulting from higher average funding costs on a marginal basis.

Second, wholesale markets remain less liquid than normal as a result of a hangover from the Grexit issues. This is reflected in a slight increase in wholesale funding spreads over the last 6 months.

Given that the funding side of the equation is an increasing constraint on loan book expansion, we believe the non-major banks are more likely to follow the major banks in raising mortgage rates rather than pursuing an aggressive strategy to grow market share.

The relative value of these strategy options depends on the trade-off between the incremental ROE against the increased share and growth. However, we note:

- Increased volume growth requires increased equity capital, and

- Repricing generates higher earnings across the whole loan book as opposed to just new loans only and requires no incremental capital.

Therefore repricing is likely to result in a better outcome for non-major bank shareholders.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

As I understand it, repricing of investor loans only affects new loans going forward, not existing loans.

If so, this will take time to show up in margins, but will hit volume quicker (all things being equal!)

Hi Norman, The repricing of investor loans has actually been applied to each bank’s entire loan book not just new loans. This will help recover some (but not all) of the decline in bank ROE from the change to mortgage risk weights.