A small cap gem

Size has its advantages in funds management, especially from a scale point of view. However with the collective Montgomery Funds exceeding $700 million in funds under management, there are many stocks which elude our research efforts due to our inability to buy enough should our investment criteria be met.

Based on a ‘back of the envelope’ review, Integrated Research Limited (ASX: IRI) is probably one of those companies. With a market capitalisation approaching $270 million and $70K-$100,000 worth of stock trading per day, it would take our funds perhaps more than 5 years to accumulate a commercial position!

IRI provides performance management software that monitors business critical IT infrastructure, as well as payments and other products. Naturally, it’s competitive advantage stems from its ownership of the intellectual property of its software as well as the reputation it’s created with its customers over many years.

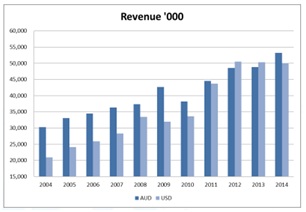

IRI, for those investors lucky enough to be able to invest, has a decent story to tell. Revenue growth over the past decade has been about 5.75 per cent per annum as noted in the company FY14 results presentation.

Revenue growth is important but earnings growth is what really counts, noted at about 6.7 per cent per annum indicating a slight amount of operating leverage inherent in the business.

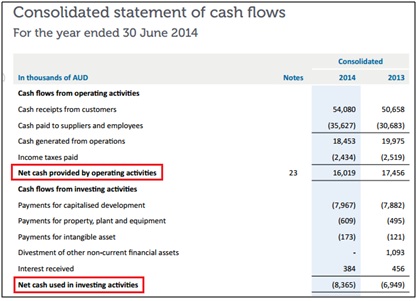

Now a good question to ask is whether the earnings are real – as investors, we’re hardly better off if left with paper earnings with no cash value. A shorthand check is to review the company cash flow statement and subtract “net cash used in investing activities” from “net cash provided by operating activities.” This calculation can be a little volatile for companies with major expansion plans (as for a time period, cash flows used in investing activities will likely exceed cash flows from operating activities, however this does not mean that the firms underlying earnings power is negative).

For IRI however, expansion plans appear stable and cash profit looks reasonable relative to that of statutory earnings.

Returns on equity also look attractive at 28 per cent in FY14. The stock on this front doesn’t appear to be a ‘one-hit-wonder’ either, returns on equity around this level have been observed for many years.

A quick overview of the firm’s balance sheet (1H15) and we note some further interesting observations. No debt, and a large amount of deferred revenue. This latter account is related to the firm’s business model of selling subscriptions whose revenue is recognised over the life of said subscription rather than right away.

It’s not a bad business model to have your customers funding your working capital requirements!

This is not a recommendation to buy IRI, please do your own research and consult a licensed financial advisor where appropriate.

Small cap stocks are an interesting part of the market to research. Typically these firms are less well covered by brokers and investment banks, meaning that the potential for hidden gems can be increased. Liquidity however can be an issue and the amount of work needed to incorporate the firms field into your circle of competence can be high.

If you have a small cap stock you’re interested in hearing about, post in the below comments and over the coming weeks I’ll take a brief review of each one and provide some general comments.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Scott, thoughts on a small company called Traditional Therapy Clinics (ASX:TTC). They own over 300 health clinics in China through own and franchises and are expanding quickly. Skaffold rates them an A2, no debt, ROE over 88%, strong cashflows and are at a big discount to intrinic value. Thanks.Nick

Hi Scott

Could you do On The House for me ,OTH, please.

Hi All

Overwhelmed by the responses – I’ll probably cap it off there however so thanks for the submissions.

Over the coming weeks in blogs I’ll cover briefly over each stock. Note that these will only be short generalised comments and shouldn’t be regarded as investment advice.

3PL – value now emerging in what I think is a very good business in what I think will be a growing sector and global. Also AZV.

Azure (AZV) and Capitol Health (CAJ)

Hi Guys,

Could you please look at VSC and FRM. I understand that FRM is quite small due to the 15 mil cap but their stable debt repayment and solid operating c/flow are promising, and they are top 3 Australia egg producer. Downside – egg industry is going through a turmoil due to the free range egg debate.

Thanks

Bartek

SWL, I see above another request for Seymour Whyte from Campbell. I would like to know more about the CEO’s reason for leaving and why? Also who will be the replacement.

I see this stock as undervalued as does Skaffold which has is closer to $2 valuation. Current price $1.11. I already hold.

I’d be interested to hear your views on Nearmap and Greenearth Energy..Hope you find them interesting..

Adslot ADJ

Great tip – have had them on my radar for a little while. Am interested in your thoughts on Netcomm Wireless (NTC), Orthocell (OCC).

Many thanks for this article, Scott.

I’ve invested a small amount in a company called Reverse Corp (REF). They manage the 1800 Reverse service which is a mature business and have a stake in an online contact lens business that is breaking even now. Based on their current level of profitability, they are trading below a reasonable calculation of intrinsic value.

Thoughts on My net fone and GBST holdings would be much appreciated

Would be interested in your thoughts on GBST holdings and My NetFone.

Cheers

I would like to know your thoughts on Bellamys Au

Codan (Cda)

Hi Scott,

PROPHECY (PRO)

Would like to know about XPD,in the future as the Chinese market isn’t to good at the moment,

Very appreciated

PGC – Paragon Care was mentioned on here a few years ago, great time to revisit it.

IRI has some big tech customers and looks like it is doing well. I have always questioned why there customers don’t have a in house version of the services IRI provide and what happens to IRI if one is developed

Thanks for the post Scott. It’s awesome.

As a fan of your website and a Skaffold subscriber, when I read all of the posts here I like to check them in Scaffold. IRI is showing a current intrinsic value of $0.86 (2015), 1.10 (2016) and future intrinsic value of $1.43. With its current price @ $1.79 and future valuation of $1.43 (2017), it would appear to be offering very poor returns at $1.79. Are you able to tell us why this is not the case? Thanks again.

Hi Scott, Aconex (ACX) if you get a chance

Cheers

Ben

MWR FOR YOUR APPRAISAL

Hey Scott

I’m keen to also hear your views with AZV and their hefty R&D and disciplined approach to expensing this (and the painful approach this has had on their share price)

Senetas shows a more consistent and growing level of profitability in an interesting industry with positive fundamentals. It also appears to still screen with value on DCF modelling

Can you pleas provide some insight into Suda Ltd (SUD). It has a market cap of 30 mil and deals in the speculative healthcare sector. I would say that there is some interest in this stock given the massive volumes of stock traded.

PSQ, WLL

Money3 MNY

Roger. You spoke on ABC radio some time ago about ICar Asia. They have announced an improving situation with sales etc. any need to revisit the stock ?

I would be interested in your opinion on Credit corp (ccp) and supply network (snl). Good steady growth at a decent PE. I imagine with Montgomery funds ethos that the lack of pricing power and intellectual property would exclude these companies from your funds even if they were big enough.

Donaco DNA

GBT?

ISD at current levels ?

Would love to get your thoughts on Seymour Whyte and their recent expansion throughout Australia:) Thanks guys

Thank you for you post Scott, much appreciated.

The salary packaging and novated lease space has attracted new participants over the past year or so.

I am interested in your thoughts on Smartgroup Corporation (ASX:SIQ)

Appreciate if you could provide your views on GLH and AZV.

AZV has updated the market recently on performance remarking that extensive R&D has been expensed. How can one gauge on the benefits of this investment in the future?

Senetas (SEN).

Senetas (SEN).