Where’s the debt?

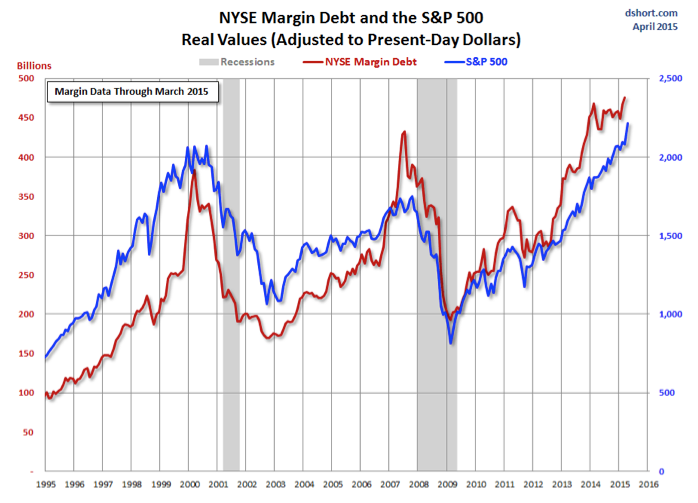

The New York Stock Exchange has recently released data on margin lending through to March 2015. What it shows is margin lending at a new all-time high – above the levels seen at the height of the tech boom and prior to the Global Financial Crisis (GFC). As you might expect, the data shows that margin lending tends to be popular when markets are hot. The build up of debt when equities are expensive no doubt exacerbates the pain of a subsequent market downturn.

Margin lending also appears to be implicated in the recent strong run in Chinese equities. In recent months, concerned about runaway markets, Chinese regulators have taken steps to restrict the use of lending to fund equity investments.

Margin lending also appears to be implicated in the recent strong run in Chinese equities. In recent months, concerned about runaway markets, Chinese regulators have taken steps to restrict the use of lending to fund equity investments.

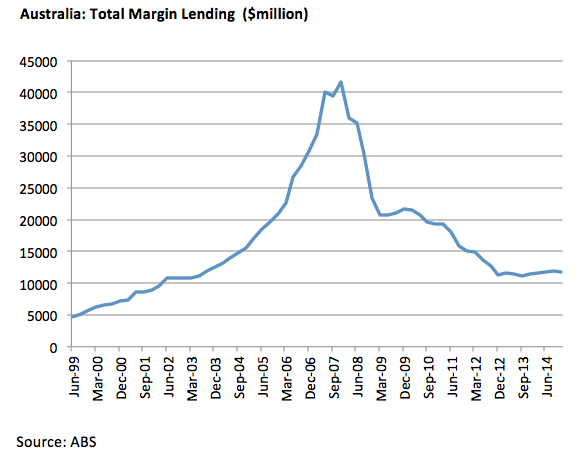

What is a little interesting is to see how this compares with the data from Australia, shown below:

As you can see, Australians have been reticent users of margin debt since the GFC.

Of course, it may just be that we have found a cheaper source of funding for our share purchases in the form of mortgage debt. Mortgages attract favourable risk weightings in the calculation of bank capital requirements, and strong competition to lend to homeowners means that mortgage debt now represents a large slice of the balance sheet for most Australian banks.

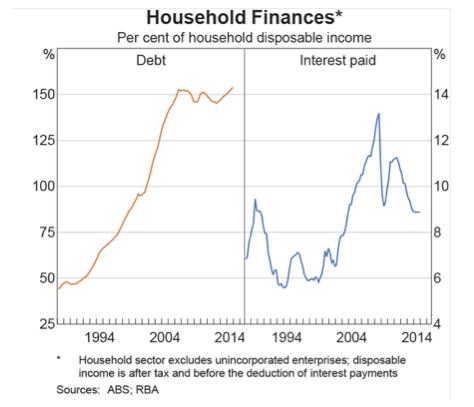

Australians are certainly not reticent users of debt overall, as you can see below. Total household debt levels remain at record levels, having not fallen at all since the GFC. Low interest rates have made the debt more affordable, but the savings have not been used for debt reduction.

Viewed in this way, the picture is a little worrying, and on some measures, Australia now sits in the top quartile globally in terms of household indebtedness.

While margin lending may not be ringing any alarm bells, one suspects that Australian investors are as vulnerable as any to the next market or economic shock.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To learn more about our funds please click here.

I wouldn’t invest in the stock market anymore, it is full of white collar crime from top to bottom, ceo’s using share holder money to buy expensive products and getting kickback’s from it. Financial adviser’s/stock brokers getting kick backs for recommending stocks from ceo’s that lead investors to lose huge money. Financial advisers/stock brokers, getting kick back’s for getting clients to get margin loans, in the form of a percentage of the interest charged on the loan. White collar crimes are destroying this country and must be punished and people jailed the victims are everywhere.

Hi Gerry-ball, I hear your frustration but also see broad generalisations and unsubstantiated accusations. It’s right to demand a fairer system but also important to separate emotions from fact.

Hi Tim,

I do know of a few people using their home equity to invest in shares.

Many people with margin loans during the GFC were severely burnt when the sharp market declines made margin calls a regular occurrence.

Obviously with home equity, they don’t have to be forced sellers due to these calls, but sometimes these calls can save people from further sharp losses if they are forced to sell and the market declines further. Especially when you had many stocks going to (near) zero during the GFC,

So let’s see who’s swimming naked when the tide eventually goes out.