Altium: Great results and more to come

As we mentioned last week, we have recently added Altium Limited (ASX: ALU) to our portfolios and we are pleased by the company’s first half 2015 results. A brief summary of my thoughts and notes are below.

Headlines:

- Revenue is up 17 per cent to US$33.8m

- Sales are up 9 per cent to US$33.7m

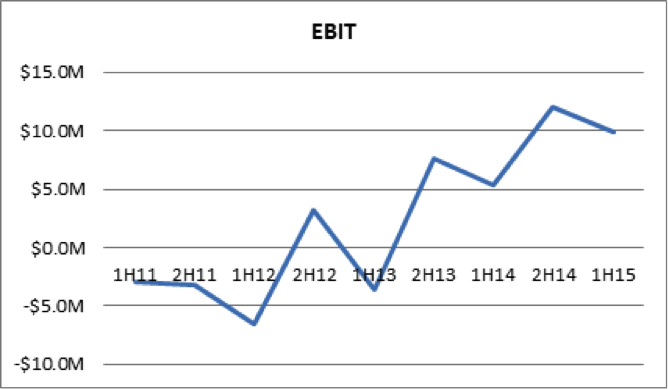

- Earnings Before Interest and Tax up 84 per cent to US$9.6m

- Earnings Before Interest and Tax margins up to 26 per cent (16 per cent in the first half of 2014)

- Net Profit After Tax 102 per cent to US$6.8m

- Dividends up 50 per cent to 8 cents per share (record date is 25 March 2015)

- 2,230 new subscribers, 1,330 re-joins and 2,700 lapsed subscribers (subscriber base up to about 27,000)

- Renewal rates up to 84.6 per cent for countries in developed nations (up from 81.6 per cent in financial year 2014)

- Renewal rates up to 30.1 per cent for countries in less developed nations (up from 23.4 per cent in financial year 2014)

Comments:

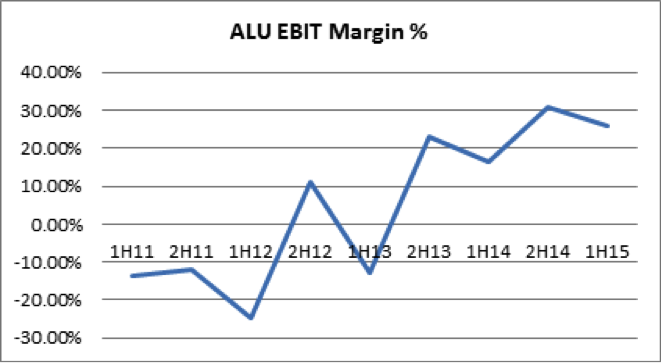

The company’s operating leverage shows continued impressive growth, driven by both the scaling up of licence sales and subscription revenues over the years. A picture (or graph) tells a thousand words:

- Subscription revenues now represent 51 per cent of revenue (up from 47 per cent in the second half of financial year 2014). However, new subscription sales have fallen from $15.08m in the first half of 2014 to $14.8m in the first half of 2015. This is a result of incentives for the sales team to prioritise reducing churn.

- Given the firms overall churn rate is about 18 per cent (perhaps lower now), this policy makes sense for the short to medium term. When new subscriptions become the priority again, the ramp up in growth will be greater because less customers are churning.

- Montgomery’s investment team was also lucky enough to have a meeting with the company’s management. We were happy to hear that the firm is pursuing a capital management policy whereby earnings would be reinvested in business lines with attractive returns with the excess returned back to shareholders – a value of management that we find attractive.

- At under $4 per share, we continue to believe that the stock of this company is undervalued (however perhaps not as undervalued as when it was below $3 only a few weeks ago).

Please note that our opinions and positions in this company may change as new information becomes available.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Struggling a bit with 3 pieces of information from Montgomery. The FB post on ALU says at $4 the stock is undervalued. Skaffold puts it’s share price at $40%+ above its intrinsic value. A recent article on Cisco described how paying too much for a good business can be a bad investment. I suppose the answer might be that you see the intrinsic value of ALU also on an upward trend but how should I reconcile these bits of info?

Montgomery and Skaffold are two entirely separate businesses, with their own offices (in separate suburbs) and teams.

The quality and performance scoring developed for Skaffold (A1-C5) are also part of Montgomery’s investment process – although we have had to subscribe to a different data vendor’s data for the inputs (which could produce some variation in scores).

Of course, being a professional funds management firm, Montgomery also uses a large number of its own proprietary tools and it is these tools that are also producing the variations you mention.

Skaffold is entirely automated and therefore must use sources of information that it can reliably access consistently. For that reason it sources, as an input, the consensus analyst forecasts for earnings per share.

At Montgomery however we calculate our own forecasts and research each opportunity qualitatively as well. We meet with management and may diverge greatly from the consensus analysts numbers. Over the long run, I expect both estimates will produce winners and losers. Importantly Skaffold displays the consensus number as well as the most bullish and the most bearish analysts’ estimates, so that you can determine a range of possible valuations.

The only other point I will make is that no tool can be solely relied upon to produce a perfect investment track record. That is why at Montgomery, we employ a variety of tools and analysts and build our own models. There is no escaping the fact that you must understand a business, and its prospects well, before investing in it. If this is not something you are prepared to do yourself, and even if you are, you should always seek and take personal professional advice. Obviously some investors prefer to spend time with the kids and grandkids and so have employed us to do the work. Others do it themselves and some split the job between us and themselves.

Thanks, Roger. That makes perfect sense.