How will the New Lease Accounting Standards impact my view of retailers?

Joab is a regular visitor and commentator on my Insights blog and he’s a Value.able PHD graduate. Joab has put together an elegant summary of the impact – on retailers particularly – from the proposed changes to accounting standards for reporting lease liabilities to better reflect the contingent liability that is an operating lease.

No need to thank Joab. He’s delighted to help and I am delighted he went to the very great effort and time to contribute.

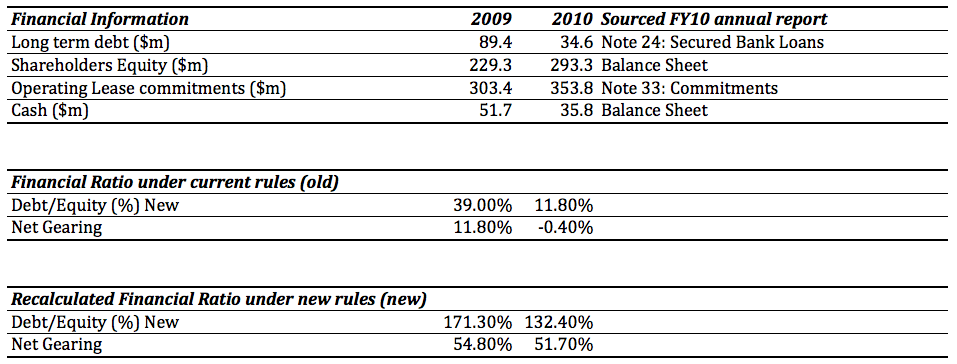

Why are the changes important? The impact of a bigger asset and a bigger liability will have no change on equity, but when you compare a bigger debt to the same equity, you will get a higher Debt to Equity figure. This will impact my Montgomery Quality Rating (MQRs) next year.

So here are Joab’s thoughts (with the community’s thanks):

Current State:

A draft proposal on accounting standard for leases was issued recently. This proposal could still be subjected to change as it is not yet finalised. That said, the principle of what it is trying to achieve is not expected to change.

Estimated timing:

Target date is to issue a finalised standard in 2011.

Key changes:

The information below focuses on the lessee’s perspective and has been simplified to highlight key impacts.

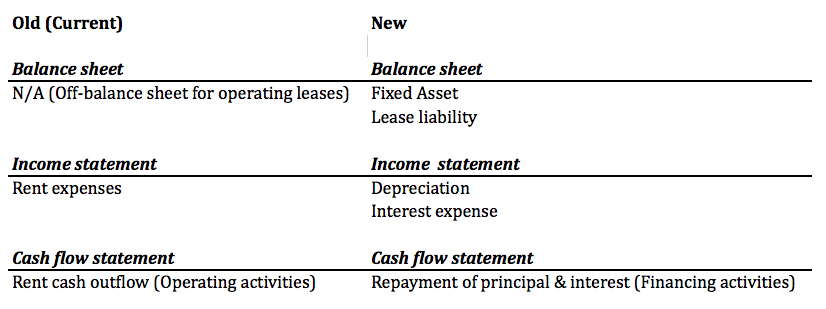

1. Operating leases will be on balance sheet as a lease liability (there will no longer be a distinction between operating and finance leases);

2. A corresponding asset will be recognised, separately on balance sheet, which offsets the operating lease liability;

3. Rent expenses will be replaced with depreciation and interest expenses;

4. Operating cash flow will no longer include cash outflow on rent. Instead, rental cash flow will be in the Financing Activities category as ‘Principal and Interest repayment’.

The table below compares the current and the new accounting rules on the financial statements.

Standard setters are open to feedback before end of this year.

Key Impacts:

– Financial ratios on gearing will suffer with more debt on balance sheet. For example: debt/ equity ratio, gearing ratio, interest cover ratio.

– Cash flow from operating activities will improve because rent will be presented in financing activities

– EBIT or EBITDA will improve as rent expense is replaced with depreciation and interest.

– Operating earnings will have a slightly different profile. Rentals expenses will no longer be a straight line expense.

Using JB Hi-Fi as an example

Note:

– I have excluded discounting on Operating lease commitment to simplify the calculation

– Debt/ Equity = Debt / Equity

– Net Gearing = (Debt – cash) / (Debt + Equity)

Posted by Roger Montgomery, on behalf of Joab, 29 October 2010.

Hi Roger,

Thanks for the wonderful explanation.

I was wondering In your opinion do you think retailers with significant and long-term lease liabilities are

likely to be more affected by the new accounting standard for leases.

Roger,

Does this accounting standards change have the potential to trigger a technical breach of the loan covenants entered into by some businesses?

If so, does it not potentially confer additional power over such businesses by the lenders, at least in the short term and what, if any, is the opportunity for stock investors that arises in such cases?

Regards

Lloyd

Thats a question that has to be put to each company and their lenders. Its one worth exploring and I am sure given the number of commentators that read this blog, will soon gain some traction. I thinks someone earlier here mentioned Prov 22:7 “the borrower is servant to the lender”.

G’day Roger and fellow bloggers,

I would just like to say that reading your book and watching you speak on TV has been a life altering event for me; a thousand thank you’s.

After holding several stocks for a decade (yes including Telstra, Qantas and AMP for example) I have come to the conclusion that the professional advice I received when purchasing stocks was not really helpful. I have never had advice to sell any stock from my advisor so I had never sold any stock in the last decade until recently on my own advice. I know you do not give advice, so I have starting working out buy and sell decisions myself as I think I will get much better returns as opposed to the returns (losses incurred) I received from professional advice.

Are you going to hold any workshops in the future? I would love to attend.

I hope you are going well and you find time in your very busy schedule to get some free down-time to unwind and spend time with your family. Often my work schedule gets very hectic so I have scheduled down time to try and keep sane as well as planning time each week to spend with family. I hope you don’t find this too personal, but in the spirit of asking a fellow Aussie how he is doing I thought it wouldn’t hurt to ask, seeing that you give out so much of your knowledge and time to help educate investors. I think this is a part of investor psychology that is missed in most discussions – life balance. If the psyche isn’t in balance, then I believe that other areas of your life will suffer – including investing as well as your general health.

As Alan K. says every Sunday, “thanks for your Company”.

Serenity now,

John M

Too kind John. Thank you for that feedback and those caring and encouraging words. I am very fortunate to be able to invest and take plenty of time away from the office with my family and friends. I also wanted to share Ken’s recent comments, which I thought were equally encouraging for me:

Hi Roger,

I’ve just finished reading Value.Able. Thankyou. I am now indeed more

Value Able! You have written a book which will become an Australian

investment classic. I have read nothing like it – straightforward,

rational, well-grounded, practical and, throughout, each point

well-argued. You have brought all the missing bits together for me.

Having today’s Australian companies as examples makes the read

particularly exciting and relevant. Value.Able has now officially knocked

off Philip Fisher’s “Common Stocks and Uncommon Profits’ as my #1

investment favourite! (I love this stuff!)

Just did a rough IV on apple using data from their annual report and forecast EPS figures from Reuters.

Using a RR of 11% (which is what I use for some of the well established tech companies in Aus), I arrived at $419 for the year just passed (based on Septembers results). I also added an extra 15 million shares per forecasted year – as management has a track record of adding alot of shares.

F2011 I arrived at $433 and F2012 at $409.

Whats interesting to note is that based on analyst estimates – the return on equity is declining sharply in the future – from around 35% down to 23%.

Interesting to see that its trading at a large discount, but possibly the future will be challenging to keep such large amounts of equity working at such high rates!

Hi Joel,

You should find a post on Apple here from earlier in the year.

Hi Room,

How are some of my calculations on intrinsic values, of course seek professional advice

JBH ………2010…$ 16.00 2011….$ 19.00

WOW……..2010…$ 24.00 2011….$ 27.00

DWS……..2010…$ 2.00 2011…$ 2.50

ORL………2010…$ 8.50 2011…$ 9.50

What do you think…Roger…any good or back to the lab for me?

Hope some one WON on the cup…$$$$$$$

Hi Fred,

Your valuations look reasonable. Perhaps using too high an ROE for ORL and DWS valuation is higher than mine. Otherwise ok. Seek and take personal professional advice of course. Yes. Won on the cup. Don’t fear, not a gambler by any stretch. I have a friend who has tipped me the winner every year and this year was no exception. I received a one word text message 1/2 hour before the race and voila! I managed to tell one friend who was home sick and my building manager. Of course they didn’t believe me, which is entirely appropriate given my complete lack of any competitive advantage in that arena.

Hello Room,

Bit of scuttlebutt,

Don’t know if this is happening in all regions but the former Bankwest customers are leaving the CBA in droves in this area.

Something to keep an eye on I think

Thanks Joab for the example.

I haven’t read the draft proposed changes, but I am interested in knowing how interest is calculated on this?

Hi Ben

If I may Joab,

Looks like the rate of interest will be somewhere between the incremental borrowing rate of the company and good quality corpate bond rates of the country.

The exposure draft has lots written about this but I fear it will go like the joke I have listed below about adding 2 and 2 together.

The Joke

There once was a business owner who was interviewing people for a division manager position. He decided to select the individual that could answer the question “how much is 2+2?”

The engineer pulled out his slide rule and shuffled it back and forth, and finally announced, “It lies between 3.98 and 4.02″.

The mathematician said, “In two hours I can demonstrate it equals 4 with the following short proof.”

The physicist declared, “It’s in the magnitude of 1×101.”

The logician paused for a long while and then said, “This problem is solvable.”

The social worker said, “I don’t know the answer, but I a glad that we discussed this important question.

The attorney stated, “In the case of Svenson vs. the State, 2+2 was declared to be 4.”

The trader asked, “Are you buying or selling?”

The accountant looked at the business owner, then got out of his chair, went to see if anyone was listening at the door and pulled the drapes. Then he returned to the business owner, leaned across the desk and said in a low voice, “What would you like it to be?”

OK Ash LOL

I actually got a smile from my wife. By the way thats not an ad for you practice is it?

Hi Craig,

Laugh out load mate,

Strictly by the book here 2 plus 2 equals 4 where I work

Smiles

Hi Ben,

According to the draft standard, interest is calculated either using the lessee’s incremental borrowing rate (i.e. the borrowing rate for lessee’s new funding), or the rate the lessor charges the lessee (i.e. rate in the lease).

The standard setters has introduced materials and webcast to inform the accounting community about the details if you are interested.

Again, I think what’s important for is that we know it’s coming and that we understand that the economics of a business doesn’t change. Just the accounting language.

Joab

Hi Ashley,

For some reason, I responded before realising you have posted the respond. Thanks!

To your joke… who says accountants are boring people. Like any other accounting standard, there’s always “judgement” involved in the numbers.

Joab

Hi Joab,

Yes very true

Keeping score (accounting) is way more subjective than most people think.

Only problem is that some of our judgements get a bit blurred from time to time.

Thanks again

Thanks Joab and Ashley.

I knew this change was coming (they’ve been talking about it for years), but I guess I better get on top of it!

Cheers

Ben

Hi Roger and all,

Just re-reading your cashflow chapter and just looking to see if i am working out the calculations correctly. As mentioned in an earlier comment, cashflow has been an area i have struggled with when analysing.

Using the example of David Jones as it is the nearest annual report to me i get the following figures for 2010.

Company Cashflow i get the following figure:

Net operating cashflow of 203,923 minus Net investing cashflow of 79,663 for a total company cashflow of positive $124,260

Free cashflow i have been getting my head around:

Net operating cashflow of 203,923 less dividends of 117,826, payments for PPE of 78,757, payments for software of 1,464 and also added the proceeds from the sale of PPE of 558 which gave me a figure of $6,434.

Any help would be appreciated as i am really trying to figure this bit out.Have i incorrectly added an input or missed one?

Hi Andrew,

The Company cashflow number of $124.3mln is the same as my figure. The rest sounds like you have let a little subjectivity creep in (sometimes appropriate). Let me come back with another post on the subject this week (along with a new list of valuations and MQRs).

Sometimes I think we can make the investing process too complicated. What I liked about Roger’s first edition was that it had simple equations that everyone could easily use. But, the more i read these posts the more I think the process seems to be getting too complicated for me. I will stock to the valuations I obtained from the first edition and have a significant margin. By the way Roger, I really enjoyed last weeks “your money you call” program.

Thanks Es,

I agree the process is simple and this insights blog is all about answering queries and offering insights into businesses and industries (and not to forget new floats!). It is here that you have the opportunity to apply and check what you have learned from the book. Keeping it simply really can work so thanks again Es for resetting the compass. I am sorry I edited some of your post to maintain independence and avoid the perception that we are favouring a particular service provider.

As I’m studying leases this semester, its a subject thats close to my heart (I think i need to go out more).

Nice work Joab. As for Ken’s question as to whether this is an exercise that is being employed else where; My belief is that some entities are already in the process of conversion- our cousins over in Canada appear to be placed within transition.

My main concern is with the overall cost implementation plans.. from what I read the operations of the business mainly those pertaining to the specific controls and information systems involved with leases would need to be changed/overhauled to account for the reassessment of lease liabilities at each reporting date. Whether this will have a resonating effect on expenses or not..that answer is absent from me. Just be cognisant of the fact that as stated above- the economics of the business hasn’t changed…

Also, maybe a tax expert, Roger or Joab could shine some light on this, will there be a possibility of a impact on tax liabilities?

Leases seem to be quite systematic within Australian businesses and the listed entities.. It should be interesting to see how the panic will effect prices especially those like JBH (thanks Joab).. the situation may provide some opportunities to capitalise on other’s fearfulness.

Hi Ben,

Tax returns already reflect a very different picture to the annual reports because of many differences – hence the need for Tax deferred assets and liabilities. It is a particular bug bear of mine that despite shareholders being owners of companies, we don’t get access to the tax returns.

Roger,

I would be interested to hear your opinion on the various methods of assessing company financial strength – or more correctly, likelihood of bankruptcy. I have just finished incorporating it into my database, and it has thrown up some interesting results. Of course, it is not valid for banks, insurers, utilities etc, but for industrials it seems very good.

Regards, Ken

Hi Ken,

I have spent a great deal of time investigating these sorts of credit worthiness frameworks. Speak to a corprate finance exec or loan/credit officer and you will quickly discover their limits. If it was so easy Moodys and S&P wouldn’t exist. There are much better alternatives available so rather than have everyone perhaps wasting time running off in the wrong direction, go and have a look at the methodology discussions for Moodys and S&P (the most recent stuff of course).

Roger,

I must say I am a little disappointed. I realise it is not the only answer, and it is merely an indicator, not a predictor of certainty. (Moody’s & S&P won’t even provide their ratings to an individual investor, much less disclose their methodology – at least not that I could find in my search.)

Regards, Ken

Hi Ken,

No need to be disappointed. We each have our preferences. I think there are superior methods that your searches haven’t uncovered but irrespective of our personal preferences go with what you are comfortable with. Having once worked with Mark Mentha I would be interested in knowing if he applied his methodology to listed or unlisted businesses. But no matter, I am extremely happy to continue using my approach and of course you are free to continue using any approach you find works for you. The wonderful thing about investing is that we don’t have to all agree on every stock, every ratio or even every method to all do very well. As we get deeper into the detail of our individual approaches we are bound to have differences and thats great. Its what makes the process enjoyable and a didactic experience! Keep up with the posts Ken and your clearly very firmly held views. I have enjoyed reading your thoughts on companies and valuations.

As you mentioned there are weakness with every approach and one that you highlight is the inability to apply it to financial and insurance companies – these form a very substantial part of our index and economy. You will also discover other weakness with a bit of digging that arguably represent an even bigger part of our economy. I get an A4 for the NAB an A2 for the CBA an A3 for IAG and QBE. What do you have for these?

From experience I have learned that it is important not to jump on the first thing we like and believe that digging up supportive data confirms we made the right decision. There is bias in such an approach. It is better in such circumstances to “invert” and search for ‘what is wrong’. Then if we turn up empty handed, we have something superior. Additionally and in 100% support of your approach, I believe it is essential to use what we are comfortable with otherwise we won’t stick to it and consistency is the hallmark of all great investors.

If you like something, are comfortable with it and believe that it works, then go for it. I am doing just that so cannot contradict it and there’s certainly room for more than one approach!

Thanks Ken.

Roger,

First I should point out that the score system that I was referring to in my original post is only a small part of my database. I had already devised a scoring method of my own (fingers crossed). Using that method, which awards a score of anything from 0 to 25, I get a 21 for QBE and a 13 for IAG. (These are based upon the last annual reports.)

By my reckoning, that would be the equivalent of A3 for QBE and B3 for IAG. I mark IAG down because of high debt to equity, high intangibles, low interest to profit ratio and ROC higher than ROE. I also happen to think that QBE is a significantly better managed business than IAG, but that doesn’t come into the scoring process.

The banks are a much more difficult task using my method, because of its weighting toward debt assessment and interest cover. Nevertheless, Both CBA & NAB get a score of 22 on my method, which is roughly equivalent to A3.

I didn’t expect to line up perfectly with your MQR but I think I am in the ballpark. That being said, the other scoring system is just another thing to add when considering investment.

Regards, Ken

Good stuff Ken,

I hear you. I think you are on the right track with your scoring system. The difference is that I use industry specific KPI’s. A retailer is not the same as a contract driller etc etc… I will check out the link and repost.

All,

Agree with all the comments. Accounting is the language used to tell the story for businesses. Similar to any language, words may have different meaning to different people. What’s worst, this “language” changes over time by standard setters.

What I have learned from this exercise is that the factors of finding great businesses with high return on equity, low debt and positive cash flows doesn’t change. What will change is the specific ratios and criteria I use.

Joab

Joab,

Thanks for the insight. I agree that “specific ratios and criteria” will need to change: if the refiddling, er, restating of accounts is as your example, there will be big DECREASES on simplistically calculated ROE: of course that’s why discretion is always required when looking at headline numbers.

It will be interesting to see if adoption of these standards mean there are more opportunities for those prepared to look, as headline ROE plummet and debt ratios shy-rocket leading punters to panic, even if the businesses haven’t changed.

Thanks again

Thankfully Ian, its all relative too. As we have observed here several times already, the true economics are unchanged and its is the economic performance of the business not its accounting performance that matters. To be forewarned is to be forearmed.

My first reaction is that this is a slightly pointless exercise, so I ask is this being done anywhere else in the world like this ?

Regards, Ken

Hi Ken,

I’t going to be an international accounting stadard

Thanks Joab and Roger, excellent post.

Staying up to date with the lingo is important. Accounting is the language of business.

Investing though, is the art of reading between the lines.

The effect on the economics of a business is nil – How it may affect people’s perceptions though, is another matter.

Roger,

Thanks to Joab for bringing this up. Even though it has a very good intent of reducing the manipulative capabilities of companies whereby they are inclined to structure leases in a complicated manner to make them stay off balance sheet i.e. operating(for the obvious reasons that you point out of D/E, Gearing to which I will only add ROA – One of my first metrics for assessment), Is this really a 2edged sword?

What possible economic value would it have for someone say like Jb hifi.? (Except probably getting excited at the first glance of claiming Dep. and interest payments due to this change.) It is in the business of retailing and having a very huge operating lease structure IMO is one of the contributing factors to its stellar performance. Why would speculate on property assets when you could say lease 15 of them for the same figure and yet have more bargaining power and retail presence.

BTW I would also point out Operating leases are primarily funded by OCF (or at least are intended to be). Where does the interest payments fit in?

As you astutely point out this will distort traditional ratio analysis and the impact of it will be dependent on how any individual company structures its operations. I guess it justifies of the geeks at AASB and its international peers to be doing something while adding nothing?

Those are my views on it anyways!!

ALl the views so far are fantastic. In formulating your views use a framework that says the economic position of the business hasn’t changed. Its the economics of the business, not the accounting that we are interested in. The accounting is merely an attempt to reflect the economic reality. The economics are the same every day, whether someone decides to use a red pen or a blue pen to write their observations down doesn’t matter if you are focused on the business’s economics and its relative position in its industry. Also, its prospects don’t change either. It is a great lesson in understanding what is meant by focusing on the business rather than the stock.

I agree with Joab’s analysis. Not only will this new standard affect the key financial ratios as noted above, it will also change the expense profile as the assets will be depreciated on a straight line basis and the interest charge on the lease liability being recognised on an amortised cost basis (i.e. more interest charge upfront over the lease period). Hence also impacting other income statement ratios like interest cover etc.

Nice Work Joab

Yes It certainly changes the gearing ratios of the retailers.

And this is with a company disclosing no debt at the momnet.

I have restated the reject shop 2010 figures just to see the impact. Makes a big difference.

The biggest difference I think is in the current ratio. I believe that operating leases due in the next 12 months have to go into current liabilities with no correspoding entry into current assets.

I have also looked at the effect on Qantas. This is not a pretty site.

I am currently looking at the effect it will have on Leightons. Haven’t finished yet but it is not going to look a pretty site when it’s done.

Losers out of these new rules are retailers and businesses using high cost plant and equipment financed via operating leases.

Depreciation and Interest are higher in the initial years so expenses are in fact sucked forward to earlier years.

I have actually fully restated the balance sheet of TRS using an 8% discount rate (making a few assumptions and guestimates) and Roger I am very happy to make this available to the Blog for discussion purposes and to see if my interpreations of the new accounting standard are accurate.

Just let me know.

Once again Nice of Joab

You got me think about the cashflow statement as I had not considered the inpact on that.

well done

Go right ahead Ashley. Before you do have a read of the 67 pages describing the proposed changes from the Standards Board.

Hi Roger

I actually did this a few months ago,

i have been working on this for awhile.

My pet project

Spent several days working it all out, If you want it I can email it in excel now our provide PDF format on monday

Great stuff Ashley,

Send it through and thanks for sharing it.

Hi Ashley

Qantas currently discloses debt/equity including operating lease as additional information. So it seems it’s not an entirely new concept. I was told that Rating Agencies have their own methodology to deal with this. What the new standard may do is to align these methodology.

Joab

so in plain english is this good for jbh?

Hi Costas, What is interesting is that the economic position of JBH hasn’t actually changed at all, just the way that position is reflected n the accounts. The issue will gain media attention when it starts to get close to implementation and perhaps predictably some will panic. Ultimately retailers have always had this contingent liability it is just that it hasn’t been reported that way.

Thanks for this Joab. When i was reading the article I thought not a big change, but your example clealry catches the attention! This significantly changes how we perceive the risk related to debt/equity for IV analysis.

I would be interested in your’s (and others) opinions if this helps align the true D/E across sectors?

Thanks again Joab and thanks Roger for keeping this forum populated with amazingly helpful information!

Kind Regards,

David V

Indeed, Thanks Joab!