Kathmandu – Leverage works until it doesn’t

For the past few months we have written regularly about the headwinds facing the retail sector. Numerous retailers have downgraded sales and earnings, which were subsequently followed by share price declines. On Monday however, one listed retailer separated itself from the pack with the most sobering trading update yet. Kathmandu (ASX: KMD) has historically been favoured by Montgomery Investment Management. Yet with a business model that has a high degree of operational leverage, we were quick to exit the position in 2014 as it became clear that the company would not be immune to the deteriorating industry conditions. We have discussed the concept of operational leverage on many occasions. Retailers are subject to high levels of fixed costs such as rent, wages and electricity, which means that any price discounting will have a profound impact on the bottom line: a one per cent reduction in gross margin can often translate into a five per cent reduction in earnings.

So when a retailer reports decent sales growth, investors must always question if discounting has contributed to the top line result and understand what impact this has had on margins and earnings. In their preliminary market update, Kathmandu reported total sales growth of 6.9 per cent and same store sales growth of 2.8 per cent. These would be positive and attractive numbers for a retailer if they were not influenced by heavy discounting, which management addressed in the update: “The levels of sales made in the first quarter at reduced prices to clear excess stock, particularly in Australia, which has brought about a corresponding reduction in second quarter sales and contributed to overall lower gross margins across the full period”.

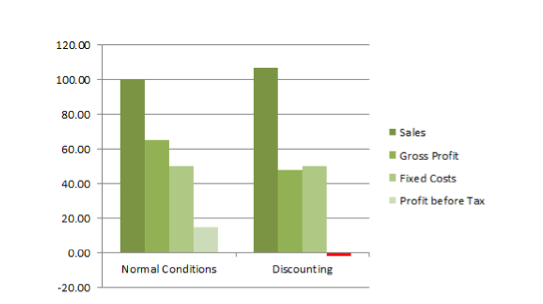

This update marks a further deterioration to the announcement made just 4 weeks prior. Let’s break down the operational issue that KMD currently faces. If, for example, Kathmandu sells $100 million of hiking gear on a gross margin of 65 per cent, this means they make $65 million after deducting only the cost of the gear. Yet this doesn’t include other operational expenses that are largely fixed, such as rent and staff. For this example, let’s assume that fixed costs are $50 million, which means that KMD would receive $15 million in profit before tax. However, a warm climate and increasing competition made it difficult for Kathmandu to sell its full inventory in 2014 and 2015. The longer the excess stock builds, the more generous management must discount to incentivise consumers to purchase dated clothes. But while the sticker price is reduced, the fixed costs remain largely unchanged.

Let’s say that Kathmandu must discount the Gross margin they make on hiking gear by 30 per cent to clear excess stock, which would result in the Gross Margin declining to circa 45 per cent. Even if the company reports increased sales of $107 million, the Gross Profit has actually gone backwards to circa $48 million. But Kathmandu must still pay its staff and its landlords $50 million (its fixed costs), after which the pre-tax earnings quickly collapses to a loss of $2 million.  Operational leverage is very attractive when industry conditions are favourable – yet it can be very punishing when sentiment turns sour – which is what KMD is reporting now. KMD are now guiding for a first half 2015 Net Loss After Tax of $1-$2 million, compared with a healthy profit of $11.4 million in the same period last year. As a consequence, the share price has now fallen by over 50 per cent in the past two months.

Operational leverage is very attractive when industry conditions are favourable – yet it can be very punishing when sentiment turns sour – which is what KMD is reporting now. KMD are now guiding for a first half 2015 Net Loss After Tax of $1-$2 million, compared with a healthy profit of $11.4 million in the same period last year. As a consequence, the share price has now fallen by over 50 per cent in the past two months.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Just a comment as a casual observer on KMD. I have tried shopping there in the past, but most of the goods I bought were of inferior quality, expensive for what they are and did not last long. Niche?… I do not think so. I prefer to shop at KMD’s competitors such as Main Peak and Paddy Pallin. I rarely venture inside the KMD stores no matter how much they discount (they seem to be discounting forever).

Retail is an area i pay attention too. I think i understand it, i can easily observe trends etc. The fact that it is also a volatile industry to me is a benefit as i believe it allows for more opportunities for investors who are able to keep their finger on the pulse. This post is a good guide to understanding the results of retailing companies and thankyou bery much for posting it Russell.

In my opinion, a big thing to pay attention to are operating leases. bringing these onto the financial statements can drastically alter the look of the companies financials you are looking at.

Kathmandu has alway seemed very niche to me and as a result i have been more comfortable with other retail companies that offer products to a much wider audience so i don’t prfess to be an expert on this company. Sounds like you guys made a pretty good call.

The problem with such a niche style business is that there is obviously a very small group of people who are interested in your products. In good times this is great as they value it enough to pay premium prices but if you are faced with a situation resulting in excess stock then you probably need to discount it quite aggressivley to show some type of value proposition to the customer.

Dancing close to the door again Russell – glad there were still taxis to get you home. Perhaps the unseasonal winter (that caused discounting) impacted on KMD’s “brand power”. So glad that you demonstrated good risk management and capital preservation – demonstrates a real powerful team at MIM…