Where will Value.able appear next?

We have seen Value.able being applied on an offshore oil rig, in a deck chair on one young man’s private island and also a plunge pool in Bali. Here are two more stories from Graduates showing how they are applying Value.able in practice.

Roger,

I was recently in Galle, Sri Lanka, and was able to share some of your insights with a local spice trader, Yasiru. He was particularly interested in your comments on quality businesses and was happy to say that he maintained a competitive edge by controlling costs – he grinds and mixes the spices himself. I can report that his product is excellent and sells at bargain prices (I have no shares or other interest in his business).

Justin

And from Michael…

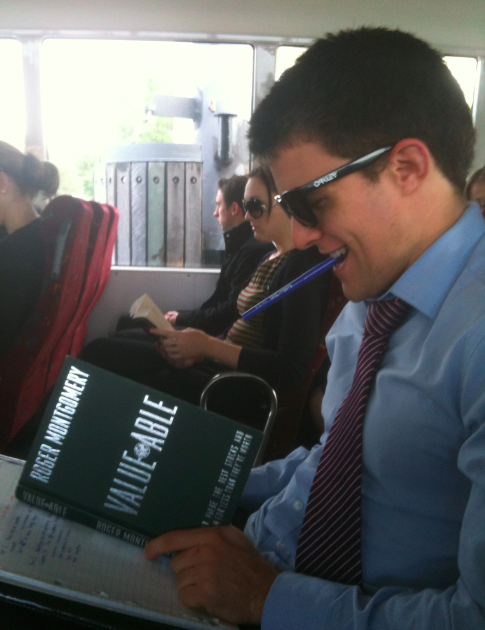

I felt compelled to shine light the legion of your followers that are not simply reading Value.able while sitting in lazy pacific island deck-chairs, exotic pools-with-a-view or even far reaching oil rigs. I give you the Montgomery Aussie Battler: An 8am-6pm, 5-day-week worker, traveling to and from work via a crammed and smelly public transport system (namely Brisbane’s CityCat). Who smiles to themselves knowing ‘the final salvation’ is possible – an early retirement thanks to Value.able, intrinsic value, margin of safety and high ROE to name a few. Thanks for starting a revolution!

Michael

P.S. Note the studious working scribbles underneath Value.able.

Please keep sharing your Value.able adventures with our community. We are enjoying the journey.

Posted by Roger Montgomery, 11 October 2010.

UPDATE: 13 October 2010

Here is another pic from Matt I received today… ‘Operating Value.Able’

Hi Roger, I don’t have a tropical or relaxing environment from which to share my experience of Value.Able – I send you this picture from the Trauma theatre at 2am after an emergency operation on a car accident victim. Not a place normally associated with relaxing thoughts. However, you may not know how good an operating theatre can be for reading. After all, it has the two most important ingredients: very good lighting and plenty of fresh air (via the ultra clean ventilation systems of course). Your book has been an excellent addition to my investing education and I look forward to meeting you at one of your upcoming presentations.

Cheers, Matt

P.S. the patient is doing just fine

UPDATE: 14 October 2010

I was just reading up on the “formula” when some of the guys were curious. Then, just before the game started I was trying to explain to my team mates the difference between a company’s yeild, PE and ROE. Told them to just get the book.

Cheers….Rad

Firstly, congratulations on the success of your book, it was a fantastic read! My journey into the world of value investing began where most do; Benjamin Graham’s ‘The Intelligent Investor’. You have done a great service to this nation by delivering the Australian equivalent!

As i near the end of my Commerce degree I am amazed at how the major emphasis has been placed on the study of multiples, the efficient market hypothesis, black-scholes and beta & other greek-riddled formulas. My only hope is that they continue this for many years to come, providing us with the opportunity to take advantage of market folly!

If I may, I would like to ask a question:

In Warren Buffett’s chairman letters, as well as in Berkshire

Hathaway’s “Business Principles”, he states “Regardless of price, we have no interest at all in selling any good businesses that Berkshire owns”. I am curious as to why this would be the case, and if you agree? (possibly there are exceptions to the rules in your “getting out” chapter, or is this a rare occasion in which we might disagree with Mr Buffett?)

Hi Ben,

Thats indeed a very great compliment and thank you for your kind words.

It sounds like you need to read the 2003 letter to shareholders where Buffett states; “..I made a big mistake in not selling several of our larger holdings during The Great Bubble. If these stocks are fully priced now, you may wonder what I was thinking four years ago when their intrinsic value was lower and their prices far higher. So do I.”

Print all the letters out. Don’t cut corners and read each one. I hope that helps.

Hi Roger,

Finally finished reading your book 2 weeks ago when I was holidaying overseas. Could not contain my joy that a book on such a serious subject could be so easy to follow in both the theory and the numbers. One day I will go back and do a 2nd reading to lap it all up. Been applying the methodology and working out the IV’s. My biggest problem was coming up with estimated “Shares Issued” for future years, until I read your demo on where to collect the numbers. Now realise I do not need it because you pointed me to “Book Value per share” being equal to “Equity per share”. Calculating the IV’s is now a breeze. Many thanks again for such a wonderful book.

Thanks for that feedback Charles. I am delighted to hear it is having a positive impact on the way you think about investing. May I just reinforce something I have been saying here recently; be sure not to let the pursuit of calculations (IV for example) get in the way of understanding whether the business has sustainable competitive advantages and solid cash flows as well.

Hi Roger

Firstly. Congratulations on your book, however I hope you do very poorly in sales of the second edition, I don’t want too many people discovering the benefits of value investing. Value.able is ‘THE’ most valued book on my bookshelf!

My question is a little off topic. After identifying a stock that is undervalued and invest worthy, do you at all consider the current price compared to the 52 week low before your purchase? Or do you just jump in and look at any downside in the price as opportunity to buy more?

Regards

Hi Jarrod,

Firstly I am delighted to hear you like the book and don’t worry too much about the book selling well. Buffett has been teaching value investing for five decades and it hasn’t really caught on. Regarding your question, I am the world’s market timer – up there with Jim Rogers and James Chanos I am afraid. Like them I expect to ultimately get it right but price can move a ways against me in the meantime. I am not sure what relationship you have observed regarding 52 week lows but if there is one, let us know. If I have assessed IV to be well above the current price and the company ticks all my boxes, then I buy. If the price falls then thats great and I may buy more. Of course one is always reassessing but I am looking at the business rather than the price. The only exception of course is if the prices rises above intrinsic value has Decmil has done recently. Then I employ some of the thinking I describe in the chapter called ‘Getting Out’ in my book.

Roger, love Michael’s post. For those of you who take public transport – myself included – just take a look around you when next on the tram, train, plane or bus.

There will be a lot of people who will use the downtime productively to do work. Nothing wrong with that. But there will be some commuters who will whip out a trashy woman’s mag, some mass market fictional ‘best-seller’ or something similar. These people are far more common.

Me ? I read AFR, Smart Investor, BRW, API magazine, Your Mortgage, Money and whatever else I’ve got.

I’ve noticed that when I quietly read them at lunch, whoever I’m sat near gets a mixture of a little uncomfortable, curious and jealous all at the same time ! (meanwhile, they are reading the trash mags and usually accompanied with an equally unhealthy food diet of high fructose corn syrup, colours, high sugar, high salt, high fat – brain “food”, soul “food” and body food seems to go hand in hand).

In my car, I listen to audiobooks on business, finance and leadership or AM radio.

If more people used all that downtime to read something of merit, they might have better relationships with their family or spouse, or make more money, or pay their mortgage off faster.

You can tell who the serious ones are. They don’t waste time. Michael – you win a gold star, my friend ! :)

Hi Chris,

You are right to congratulate Michael’s studiousness. Do keep in mind however that many people use their time on public transport for reflection and relaxation in an otherwise very hectic life. I can understand that too. Without different strokes the world would be a very boring place.

Just finished reading your book and also tried some calculation. I have following questions,

1. My expect return is 15% but the table is the book is only up to 14%. It would be great if you can provide the formula and let the worksheet do the calculation instead of checking the tables.

2. When a company have a loss in the year, how to calculate its intrinsic value.

3. When we are in any period of the year not close to the annual report date, How to calculate its current intrinsic value. for example, in another article, you indicate that CSL is at $33.55.. I base on the data from comsec and the Jun 2010 data tells me the intrinsic value is at $21.83 with expected earning growth at around 24%. Base on this assumption, how to find out its current intrinsic value if their growth forecast is on par.

Hi Donald,

If a company loses money consistently, its intrinsic value is very easy to work out. Its zero. If the loss is a one off, then your job as an analyst is to determine what a sustainable rate of return on equity might be and use that. Regarding your question three, if you are referring to differences in intrinsic values; that will be due to different data (Commsec can produce data inconsistent with the annual report). If your question is about the date to change the intrinsic value, it could change either once a year or twice a year based on the full year and half year results. Alternatively you could update it quarterly or monthly, or you could do as I do and update every time there is new information about the company.

Matt, did you need to re-scrub after that picture was taken? I’m sure it was worth it.

Greg Mc – a hospital colleague may be? The picture was after the case but before I changed. I took my outer gloves off – I didn’t want to stain the book!

A bit late but just re-ran the numbers on carsales.com and got the following:

Based on the 2010 fin report

09 Equity of 76,005

10 Equity of 88,974

NPAT of 43,235 (ROE= 52.41%)

Dividends of 33,408 (POR of 77.27%)

With these figures in mind and then the comsec forecasts i have the following: (10% RR for all)

2010 IV $3.27 (52.5% ROE)

2011 IV $3.99 (57.5% ROE)

2010 IV $4.96 (60% ROE)

Thanks for your work with this blog Roger, trying to talk my dad into reading your book. Might save me some effort when trying to persuade him to stay away from certain businesses. He is currently basing his decision that QR is a good investment due to Asciano’s shre price. Not sure how that works or the logic behind it. I told him that Asciano is hardly a good measuring stick.

Keep at him Andrew, but remember you can only lead a horse to water…On behalf of everyone here, send him our regards too.

Hi Roger

Just landed at your web blog via your ASX Investor Update in October 2010.

Pleased to see that your post “Where will Value-able appear next” is truly futuristic. Note: date of posting is “11 October 2011”.

Good luck with you sales.

Neil

Hi Neil,

Well done. You found it! Thank you for letting me have some fun with it.

Hi Roger,

I have read your book and follow your columns, but cant say I have any exciting pictures to share with you sorry!

My question is about the payout ratio. From looking at the maths of it, the payout ratio is a pretty big variable in the equation. A 10/20/30 % swing could make a huge difference in the IV. I have noticed you use a few methods from the examples you do to calculate the payout ratio, sometimes going by the guide in the annual report and sometimes going dividends/earnings for the previous year. I was wondering what was your favoured method for coming up with the payout ratio,

Sorry if this question has been answered previously, I did look.

Aaron

Hi Aaron,

Regarding the payout ratio, the number to use is the one that you estimate will represent the foreseeable future. There’s really nothing more to it than that.

Cant wait for it to arrive here