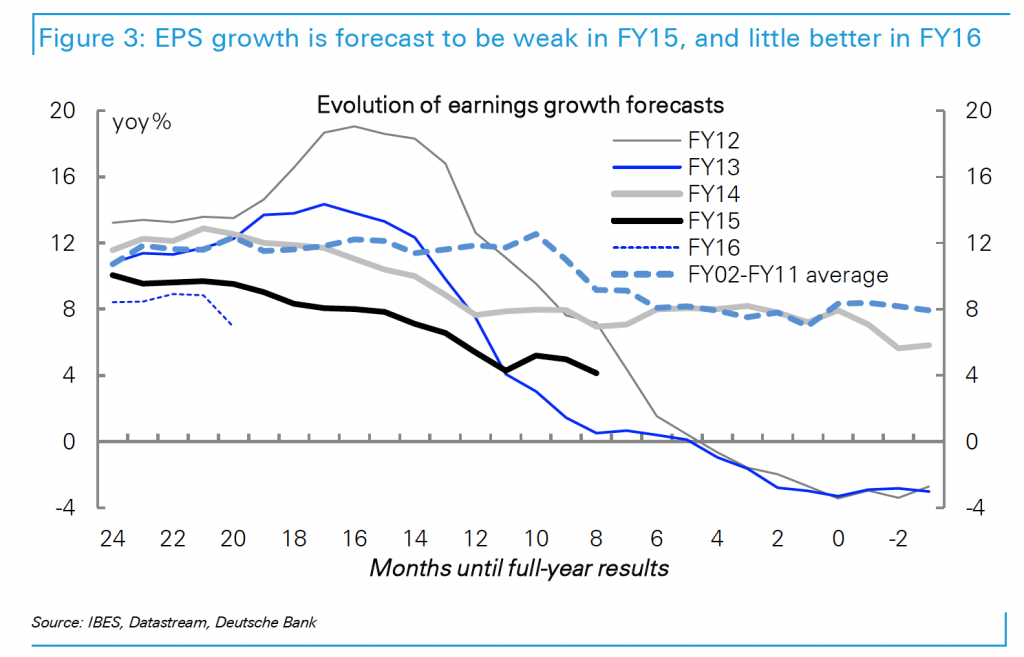

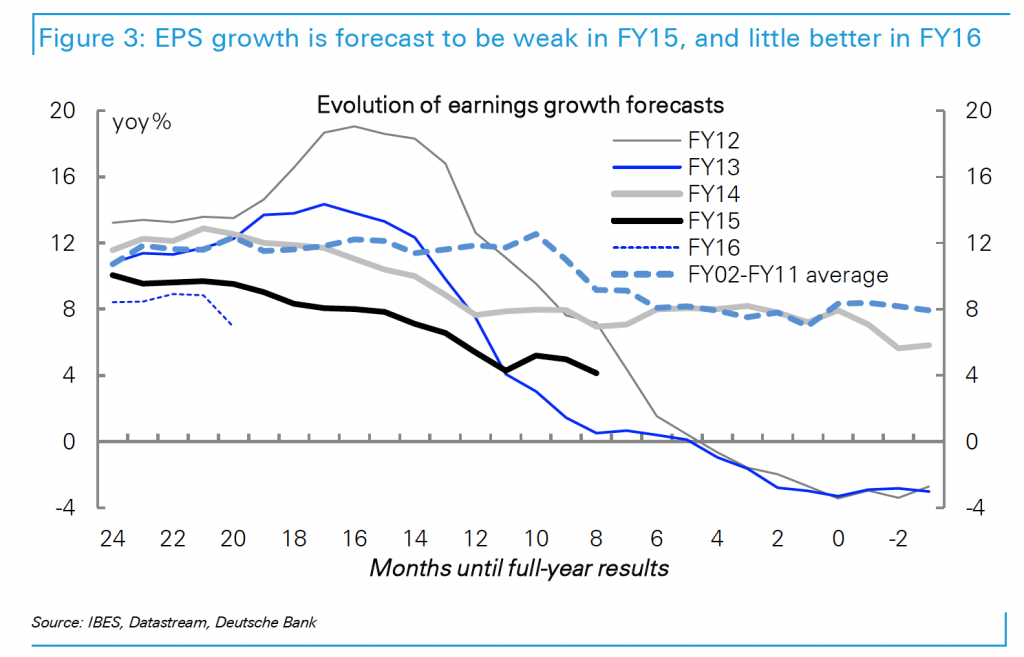

Earnings per share growth forecasts under pressure

With seven months to go before Australian companies commence reporting their results for the year to June 2015, it will not surprise readers to see earning per share (EPS) growth forecasts being cut to sub 5 per cent. According to Deutsche Bank, EPS growth forecasts for June 2016 financial year has also been cut to 7 per cent. The expectations for both years are below the 8 per cent average figure recorded in the 2002-2011 ten-year period.

This graph demonstrates a discernible top left to bottom right trend – that is analysts forecasts tend to be somewhat overly optimistic, and downgrading EPS forecasts is “the rule” rather than the exception.

EPS growth forecasts are being cut to sub 5 per cent, see the bold black line below.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

We certainly hope so Andrew.

The ramifications from the acknowledged end of the resources super cycle will now be playing out.