A GUD deal?

GUD Holdings Limited (ASX: GUD), distributor of the Sunbeam and RYCO brands, recently made a transformational acquisition. Did the Montgomery funds participate in the capital raising to facilitate the deal?

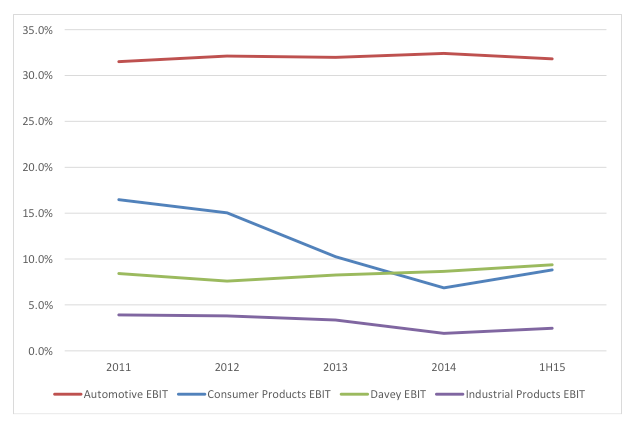

By way of background, GUD Holdings (ASX: GUD) manages a diversified portfolio of brands, including Sunbeam (consumer products), Oates (cleaning products), Dexion (shelving), RYCO (automotive parts) and Lock Focus (security). For many years the company has underperformed with disappointing acquisitions, but management has shown progress in restructuring the business towards its higher-value automotive brands.

On 12 May 2015, GUD Holdings announced the acquisition of Brown and Watson International (BWI), the owner of Narva and Projecta products. We considered the acquisition as transformational, changing GUD from a manager of eclectic, underperforming brands to a focused after-market distributor of high margin and stable vehicle parts and accessories.

BWI is projected to generate sales of $109 million in financial year 2015 and $117 million in financial year 2016, which is comparable to the size of GUD’s Automotive division. BWI’s Earnings Before Interest and Tax margins are around 24 per cent, compared to GUD’s Automotive margins of 32 per cent. Management considers that synergies are not a primary motivation for the deal, though there are certainly benefits from a shared customer pool and combined operations.

We valued the combined entity at $7.62, excluding synergies, and considered that if management can improve margins in-line with the Automotive division then the valuation could be $8.26. Both valuations were above the capital raising price of $7.00.

But while the deal was attractive on paper, there were too many risks which we could not sufficiently quantify on such short notice. We had minimal insight into the fundamentals of the BWI business. In addition, management was still restructuring the company which could involve the sale of the Sunbeam brand.

While the share price has appreciated materially since the deal, we must stay true to our rigorous investment process. If we engage in short-term pursuits of profits without full information, we eventually will become speculators rather than value investors.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Well Ben I just sold all my GUD shares to take part in Montgomery’s new international fund that David Buckland and the team is setting up!