What are your Twelve Stocks of Christmas?

I have an assignment for you.

Before we start, two things…

1. If you are looking for a gift that keeps on giving in 2011, give your loved ones a copy of Value.able. To guarantee your gift makes it into Santa’s sleigh, you must order before 5pm next Monday, 13 December.

2. Put Thursday 16 December @ 7pm in your diary. Sky Business has invited me to appear on their Summer Money program.

Within Summer Money, Sky is running a series called The Twelve Stocks of Christmas and I have been asked to present one of the twelve stocks. What I would like to do is let everyone on Sky Business know about you – the Value.able Graduate class of 2010!

You have been instrumental in contributing to the knowledge and awareness of value investing and I would like to say thank you by reviewing your suggestions on air.

So, what will it be? You can nominate one of the companies we have already discussed. More points can be earned by contributing a company of which you have industry-level knowledge. Think about your industry or business:

– Who is the strongest [listed] competitor in your industry?

– Who would you like to see out of business because they are an emerging threat?

– What are their competitive advantages, their opportunities for growth and why do you think they will sell more of their product or services in the future or at higher prices?

– Perhaps they are out of favour in the share market, but you believe it’s a case of a temporary set back being treated like a permanent impairment?

I encourage you all to post your contribution. There are just two rules:

1. One stock (your best pick) per Value.able Graduate. The more detailed your information, the better; and

2. Ideas must be submitted by Wednesday 15 December

Before the live show at 7pm next Thursday, 16 December, I will run my valuation eye over every suggestion and give each my Montgomery Quality Rating (MQR). But the list will be yours – a contribution from the Value.able Class of 2010.

Whilst only one stock will make it to the show, EVERY SINGLE STOCK contributed on this post with sufficient supporting detail will be subsequently listed in my final pre-Christmas post for 2010, complete with MQRs, current valuations and prospective valuations (I have decided to called these MVEs – see below).

Embrace this opportunity to practice what you have learned over the past twelve months, and get the official Montgomery Quality Rating (MQR) and Montgomery Value Estimate (MVE) for your favourite stock. You never know, your stock may just be the one I contribute on national television to The Twelve Stocks of Christmas.

Post your suggestion here at the blog by Wednesday 15 December 2010.

I look forward to reviewing your insights and hearing what you think of your classmates’ suggestions. Simply click the Leave a Comment button below.

Posted by Roger Montgomery, 9 December 2010.

Postscript: thank you for your kind words and birthday wishes. I’m thoroughly enjoying my time away and am very much looking forward to reading and replying to your comments when I return to the office next Monday.

Postscript #2: Steven posted his own Value.able 12 Days of Christmas at my Facebook page last Friday – brilliant!

On the twelfth day of Christmas,

My independent analyst’s blog gave to me

12 A1s humming

11 valuations piping

10 C5s a-sleeping

9 forecasts prancing

8 capital raisings milking

7 floats a-sinking

6 CEOs praying

5 golden A1s!!

4 C5 turds

3 emerging bubbles,

2 editions of Value.able

And a market leader with a high ROE!

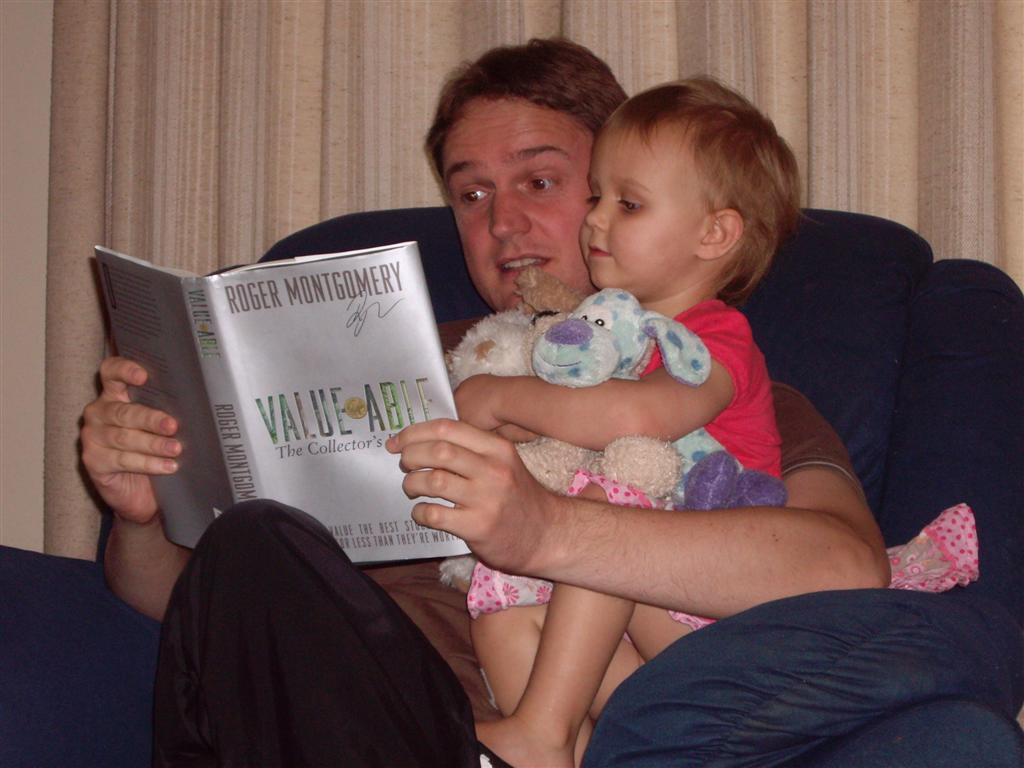

Here is Steven with his daughter Sophie.

Roger, you were good enough to sign my book…

“To Steven, Your guide to avoiding the dogs you told me you were so worried about, RM”.

Here I am reading Value.able to my little two year old Sophie at bedtime, holding her toy dogs. The moral of the story for Sophie? Roger shows dogs make fun toys and pets but must be avoided at all costs when investing in great businesses!”

Steven

oops I will not mention the ROE

Hi & Merry Christmas to everyone and indeed happy birthday Roger.

It was good to see you present yesterday at the ASX Hour.

One of the things you discussed early on in your presentation was being invested in the good companies as opposed to the bad ones.

Well, one of my observations has also been that some industries perform better that others and also have improving prospects for the future.

For example, if you didn’t include the last few years, the mining & oil index has underperformed the industrial index historically.

So in that vein I’d like to nominate the healthcare industry as a standout. You see, no one plans to get sick or injured it’s just a statistical occurance. And with the aging population, adding to that the growth of the middle class in developing countries such as India and China who can now afford better healthcare and you have an almost perfect scenario for well managed scalable healthcare business. My stock pick CSL.

Also, as a father of 3 teenage children who listen to thei Ipods at maximum volume I can see the where the future growth for companies like COH will come from. But also as my parents age I’m noticing the fact that I have to repeat myself and speak louder more often, something that’s perhaps waiting for me in the next 10 or 20 years. So, I clearly see the cause and effect.

Also, at some point companies like IVC will come into their own and although it’s a bit early, they are positioning themselves to take full advantage of the aging population.

The companies I have put up are all overpriced but they have;

1. Proven succesful track record

2. Good management

3. Growing business

4. Defensive industry

5. Profitable

6. Excellent future prospects

As the Oracle of Omaha somewhere points out, an important rule is preservation of capital and also be invested in the good businesses. All 3 I would want to own outright.

By the way, I do own all 3 diractly or inderectly.

It would be good to hear your viewpoint on this Roger.

Be well…Rad

Thanks Rad. Great thoughts and I agree with you on the hearing issue. Stats are already coming through that the average age of people requirement hearing assistance is falling.

Riversdale Mining Limited….A look at the fundementals says it all

and coal will be a much needed commodity in the short & long term.

Hi Roger – My stock for the new year is CCV (Cash Convertors). I have just got your Value.able a few weeks ago and crunching some numbers on a spreadsheet (I tell you, this is addictive.. I am thinking of doing valuations whenever I have spare time :-) ) , CCv came out to have an IV of 76cents based on 06/2010 FY. With IV going upto 1.02 by end of 2011 FY. I noticed another blogger (Jason ) has also selected this stock. Hope you are right Jason (for both of us). Are these your IV’s as well.

Since I am new to this, I have a quick question. Since we need to use the previous years equity to calculate ROE (as per the book) i.e. ROE = NPAT / Previous Yr Equity . This in some situations results in very high and most likely incorrect IV. This mainly happens when shareholders have been tapped for more funds but it might only be a one off. For e.g. when working out IV for MIN (Mineral Resources ltd) using data from comsec, I got an IV of 53 ( ROE was 67%). Obviously this is not correct. This happened because comsec data showed that the shareholder equity went from 144m (in 2009) to 460m (in 2010). In such situation how would we calculate a close to accurate ROE. Is it worth for calculation purposes only, in such a scenario, to increase the 2009 equity to a higher amount (but by how much and how?).

Regards

Manny

Hi manny,

Delighted you are enjoying the process. Regarding your question, there has been some discussion about that and some creative thought. In essence some value.able graduates are suggesting some divergence with my idea in the book about using an average or time-weighted average equity figure. Instead they propose a technique that results in using the higher of the two equity figures. I am not averse to this idea but thought still needs to be put into what the likely pattern of ROE will be in the future. High and stable or high and growing is best and thats why understanding whether a sustainable competitive advantage exists is key.

I would like to add

CELLESTIS (ASX:CST)

Startup biotech companies can have huge promise. Unfortunately, in the end very few live up to their promise. Investors need to be very choosy about which biotech investments they risk their capital on. ASX listed Cellestis is one of a very few such companies, unlike many biotech?s, it has developed past the research and development stage, selling its product (TB blood test) here and overseas. Cellestis has gone from a start up to a profitable business, a fact that only a handful of Australian biotech companies achieve..

✔ A potential market of ~ $800m – $1bn

✔ Cash flow positive, Profitable

✔ Paying Dividends increased dividends by 100% this financial year

✔ FDA approved (twice), Centre for Disease Control USA. (CDC) guidelines accepted June 2010. All regulatory approvals are in place, clinical data required to support sales has been generated.

✔ Recurring and largely compulsory market

✔ Strong and lengthy IP protection until 2023

✔ Extensive product pipeline CMV, Leishmania, Lyme disease etc. new product development represents the future growth of the company

✔ Honest and competent management with integrity

COMPANY OVERVIEW

Cellestis owns the patented QuantiFERON (QTF) methodology for medical diagnosis (originally developed by the CST Directors whilst employed at CSIRO back in the 1990?s). The technology is an Intereferon Gamma Release Assay (IGRA) which has the potential to revolutionise the diagnosis and treatment of a wide range of conditions that are otherwise difficult or impossible to effectively diagnose. Potentially, QTF could be used to diagnose Tuberculosis, Cytomegalovirus, Lyme Disease and many forms of cancer. The company has elected to concentrate initially on the huge potential of a diagnostic for TB.

The company was floated on the ASX in 2001 and has spent the subsequent time in refining the diagnostic and developing a consensus acceptance in the medical community. With over 400 independent peer reviewed studies, the QuantiFERON technology is now well recognized throughout the medical community. The methodology now has full FDA approval in the USA and the CDC has released positive guidelines for its use. For the Investor, CST now presents an exposure to the exciting biotech field with an unusually low risk profile. Ten years of solid building has the company making profits, currently paying a modest dividend and intends to give dividends in line with the company?s profits.

TUBERCULOSIS

Around the world, every year, around ten million people are diagnosed with active TB and two million die from this curable disease. One of the main reasons for this appalling and unnecessary loss of life is the lack of an effective diagnostic for TB infection. After 100 years of this state of affair, only one company, Cellestis, has developed a clinically practical, whole blood serological diagnostic for TB ? QuantiFERON-TB Gold is superior in accuracy and specificity to the current test and delivers better value for money. Tuberculosis itself exists in two states. Many people are unknowingly infected with TB but show no symptoms (latent TB or LTBI). It is only when their immune system is unable to contain the latent infection that this TB becomes active and communicable. Many conditions can cause this conversion, including other diseases, HIV, immunosuppressive therapies (eg arthritis treatment) or ageing. Once latent TB becomes active it is highly communicable.

TB is endemic in much of the world and is an issue of extreme concern in every country. The combination of HIV and TB is particularly deadly and it has been estimated that one-third of the deaths of HIV patients can be attributed to TB.

In more recent times drug resistant forms of TB (MDRTB, XDRTB) are becoming more common.

The treatment of these forms of TB are very expensive and are not always successful.

All experts agree that the only way to ultimately control TB is to diagnose and treat the pool of latent TB.

The only existing test for latent TB is a more cumbersome skin test that has been in use for well over 100 years. The skin test is notoriously inaccurate, not specific enough to differentiate between those vaccinated against TB and those with latent infection. As a result it gives a large number of false positives. It has often been referred to as “the most hated diagnostic” amongst medical practitioners.

MARKETS

Cellestis have defined their initial markets for QuantiFERON-TB Gold as the developed world, currently more than 50million skin tests are carried out each year.

USA. In the USA, QTF-TB Gold has received full FDA approval and more importantly has had full guidelines for its use, published by the CDC. These guidelines permit the use of QTF-TB Gold in all circumstances. Furthermore, in many situations it is recommended as the preferred test (over the skin test). These latest guidelines were released in June 2010 and will accelerate market take-up. It is estimated that the total market potential in the USA is 15 million tests per year.

Cellestis markets in the USA through a wholly owned subsidiary. Currently the Quantiferon-TB test sells for US$22.00 with a granted health rebate.

JAPAN. Japan has an enormous problem with TB due both to their social structures and the fact that their population is almost 100% BCG vaccinated (rendering the skin test ineffective). The use of QTF-Gold TB has been approved by the MHLW (similar to FDA) and has been incorporated into the Japan TB control guidelines. QTF-TB Gold is marketed in Japan by the largest TB control organization in Japan, Nippon BCG. The market for TB testing in Japan is estimated at around 12 million tests per year.

EUROPE. QTF-TB Gold has full CE-Mark approval in Europe. Many European countries have now adopted QTF-TB Gold into their TB control programs. The estimated market in Europe is 10 million tests per year. QTF-TB Gold is marketed in Europe through a wholly owned subsidiary based in Germany and qualified distributors.

Currently the QFT-TB test has around 3% of the developed world market.

RISKS

Every investment has potential risks. Cellestis has minimized most risks with a conservative management style and an aggressive approach to ensuring medical acceptance. This approach has resulted in a lengthy process but investment grade outcomes.

NON-ACCEPTANCE. The medical profession is inherently conservative and is often hesitant to change established procedures. With our health in their hands this is an understandable attribute. Cellestis have taken on the task of moving this market through the accepted approach of independent, peer reviewed trials. This approach has rewarded with even the most conservative of the medical community now publically stating their belief in the improvements that QTF-TB Gold brings to TB control. The risk of non-acceptance is now minimal ? the only question yet to be answered is the rate of adoption.

COMPETITION. The main competition is the incumbent skin test. This is a well known test and therefore has a certain market inertia. On the other hand, its deficiencies are well known, returns many false positives.

Another IGRA (T-Spot) has been developed but it is at a significant disadvantage to QTF-TB Gold because it cannot be used on whole blood, is far more complex to perform and much more expensive.

FINANCIAL RISK. The company has no debt, $20 million in cash, is cash flow positive and is making a profit,

The risk of failure through financial event is extremely minimal.

INTELLECTUAL PROPERTY (IP). Through a combination of patents and licensing the QTF-TB Gold product is well protected until at least 2020. Patents over the In-Tube technology used in the diagnostic further provides protection for other products through to at least 2023. It will be difficult for a generic test to just copy. Another company would have to go through the same process as Cellestis has undertaken (around 6 years), expensive process, cannot get me too approval, not many companies are going to do this when there is an incumbent.

PERSONNEL. The company is driven by the current Directors. Their ongoing involvement would be seen as of great import to the future of the company. There is no indication to date that their commitment to the company will change.

The biotech sector cops flak from attracting spruikers the Directors, Dr Radford and Dr Rothel are the exact opposite, bordering on reticent, they refuse to talk up sales figures or flood the market with boastful but immaterial announcements.

Among the board members is Chairman, Ron Pitcher who is also on the board of Reece and Macmillan Shakespeare also well lead companies.

FINANCIALS.

Cellestis announced a maiden profit in 2007 and commenced paying a dividend in 2008. F/Y sales 06/09 increased 83% to $34.4 million, net profit after tax grew 391% to $8.2 million this is due to the high 62.4% Gross Profit Margin and low overheads. ROE 37%.

EQUITY.

The company has 96m shares on issue, no options, 30% of shares are held by the

Directors and almost 40% are held by the top 20 shareholders.

Wonderful contribution Terry. I hope that you are going to take a holiday after that mammoth effort. Thank you sincerely for taking the time to write your thoughts down so comprehensively.

Hi Roger,

My pick is Specialty Fashion Group Limited (SFH), who operate the Millers, Crossroads, Katies, Autograph, City Chic, and Queenspark branded stores.

Competitive advantages: SFH has is strong brand awareness (I’m sure most readers on this blog have heard of most of these retail outlets) as well as diversity.

Like many other listed retailers (think DJS, MYR, JBH, HVN) the share price of SFH has been knocked around lately – probably just a function of it being in the consumer discretionary sector.

The company has managed to reduce the levels of debt over the years, however their revenues and profits have been rather…lumpy. Consequently, the ROE shows a very lumpy profile, although many years SFH has generated ROE far greater than 30%.

Using Roger’s formula for valuing businesses I get an IV for 2011 that is substantially higher than the current trading price. I do not however own shares in the business.

Merry XMAS to all and thanks everyone for their contributions,

Chris.

Roger please send a complementary copy of your book to Christopher Joyce & Clyde Cameron

Christopher Joyce writes …”NAB’s Cameron Clyne also got it when he told the Senate Inquiry yesterday, “What we are is a solid, dividend-paying stock. Not everything has to be a high ROE if you are able to pay a strong dividend.””

You would be very surprised by who is reading value.able! Thanks David C.

Hi

My choice of stock is EZL Euroz.

Euroz (EZL) is a Western Australian stockbroking house with private and institutional client desks supported by a research arm in addition to a corporate finance and funds management businesses.

EZL has produced excellent, albeit bumpy (due to the nature of financial services) returns on capital through the cycle while maintaining a net cash balance.

These returns are driven by its compeitive advantages of having strong client relationships assisted by its high quality research product and positioning in the booming WA market place.

Currently EZL is undervalued, with a margin of safety in the order of 40%, which is possibly a factor of the low liquidity, lack of institutional ownership and research coverage of the company.

Competitive Advantages:

An efficient integrated investment banking model can generate outstanding returns on capital in prosperous economic periods. The business of generating brokerage, earning fees on capital raisings and funds management generally has low overheads and little capital outlay, as the key assets of the business are fee generating client relationships. The model is synergistic when strong retail and institutional broking desks and generators of value adding research ideas combine with quality corporate deal flow and substantial funds under management.

Euroz has managed to combine the above package of products into a strong WA based franchise leveraged into the mining boom.

In particular Euroz produces a quality research product which introduces thoughtful ideas into the market. This is a contrast to other mid tier sized brokers who often produce reports of little depth to generate capital raising work.

Euroz’ close client ties are evident in its history of repeat business with both corporate clients requiring access to capital and institutional and retail clients. This is likely to generate repeat raising fees (ie: revenue) going forward. Capital raising fees are a factor of capital raised for the corporate client and margin on the capital raised. The margin on capital raised (price) is generally fixed on equity raisings in the order of 3.5 – 5%, with anecdotal evidence suggesting that some WA houses charge as much as 6%. Thus the major driver of increased revenues, and correspondingly, profits, as the cost base is largely fixed, is through generating a greater number and larger size of raising. This is quite quite likely going into CY2011 as market sentiment and commodity prices improve and more mining projects become feasible and require funding.

Euroz’ client relationships are supported by its position as a WA “born and bred” house that is as Western Australian as Emu Export. Perth advisors on both sides of the Chinese wall benefit from the sense of parochialism that exists in a town which is often neglected by larger, East Australia centric advisors, who are unlikely to have bodies on the ground.

Risks:

In light of the potential returns on capital listed above in light of the WA mining boom, competitors have been expanding to Perth recently. Macquarie, UBS, Merrill Lynch are expanding their presence in Perth. Market share is not easy to win, given the key assets of the business are relationships with clients which generate future fees. These relationships will always take time and large expense accounts to develop.

Key men risk is present in the potential for star bankers, broker, analysts and fund managers to be poached. The ability to retain staff principally lies in their remuneration, and is mitigated through the high level of employee ownership.

The upside of the above risks is the potential for a well funded global house to gain leverage to WA through buying relationships rather than developing them through an acquisition.

Valuation:

In the last three years, EZL’s mean average return on equity has been 31%, which includes GFC years FY09 and FY10. This is fairly conservative given a five year mean average ROE is 41%.

Using book value per share of $0.83, I conservatively estimate there is a margin of safety of around 40% at current prices.

Note this is derived using a 100% payout ratio, as dividend policy is assumed to be fairly arbitrary.

Dan S

Thanks for that Dan and great to meet you yesterday. Don’t forget to send that material through!

This is my first post ever in this blog. Hope it will add some values.

My favourite company is Forge (FGE). I think many of you are aware of this company so I don’t spend too much time to outline what this company does.

Here is my research findings:

=================

Competitive Advantages

1. The integration of Cimeco and Abesque provides an effective full service model for mining companies. This so-called ‘The Forge Hub’ model allows the group to pool resources and position as a one service provider, particularly between Cimeco and Abesque; and between Cimeco and Webb. (ie. Abesque provides early stage services such as engineering, design and procurement; Cimeco provides the fabrication and construction services. Both can provide ongoing services.) Webb can also access Cimeco’s fabrication facility in Ghana. Cimeco’s fabrication is currently only limited to SW of WA, Ghana and Perth.

2. Cimeco has an established market position in WA and provides multi-disciplinary project management and mechanical construction services to the resource and mining companies. It is positioned as a leading commercial builder, steel and tank fabricator, manufacturer and onsite civil and mechanical contractor. $7.9m has been spent on upgrading equipments in 08/09FY. Cimeco has successfully merged and integrated into the business in 2005 and 2007, so should have no ongoing integration issue.

3. Abseque is structured that critical resources are sourced and controlled internally allowing effective allocation and prioritisation to meet project schedules.

4. Webb has established position in West Africa (over 15 years) by providing construction services to the material sector. It has access to Cimeco’s fabrication facility in Ghana to duplicate a one service provider model.

5. Overall, this integration model allows the company to operate on a lower cost structure and greater costing advantage. While this ‘Hub’ model is not fully matured, it is heading to the right direction.

6. It is believed that to a certain degree these competitive advantages do help the group win more contracts, but a large portion of the revenue growth is explained by the industry trading environment. On average, FGE is awarded a contract in every 3 tenders submitted.

=================

Growth Story

1. The group’s current order book for 2011 increased 50% to $371m. If I assumed Hillgrove project ($50m) continues to be delayed and no other orders to be completed in 2011, we still expect at least 30% increase in 2011.

2. Given the current robust level of capex by mining companies, next 3 years revenue should not be a concern. Further than that would depend on whether the group can develop its competitive advantage.

3. Organic growth expected to continue on its current robust industry.

4. A newly created E&I division under Cimeco is expected to make major contribution in 2011FY.

5. Strategic alliance with Clough may contribute to FGE’s bottom line through: (1) allowing FGE to tap into Clough’s resources and systems; (2) allowing FGE to expose to oil and gas industry (ie. widen revenue base); (3) allowing FGE to have stronger capital base ($20m more) to support larger contracts. FGE has traditionally exposed to base metals and gold sectors, as Cimeco has commenced tendering larger more sophisticated construction packages with Clough as a partner in the oil and gas industry, any contract awarded will have significant implication to the group’s future earnings. The alliance with Clough is to allow FGE to cope with increasing operation size in terms of resources, expertise and management.

6. Further acquisition opportunities in the future. The company currently has net cash position of $45.6m (cash less borrowings) and healthy OCF. In addition, the land and building assets (Abesque) are now listed for sale (book value $6.9m), this will further add to the company’s net cash position. With such strong cash reserve, the company has indicated its intention to look for acquisition opportunities in engineering and construction businesses in Australia. The company has also proven its ability to integrate businesses to the group. Its ‘Forge Hub’ model can also be enhanced further via business acquisition.

7. The company’s current exposure is only limited to WA and West Africa. The positive is that the company enjoyed established position in those mining rich areas. However, if the company grows to a certain size it may need to seek to expand into other geographical areas. This is not a concern for now for me.

=================

Profitability

1. The group currently generates majority of its business through construction activities (88%) rather through engineering activities (12%). Majority of the revenue is contributed by Cimeco via its construction activities.

2. The group currently generates most of its revenue from Australia (mostly in WA), accounting 82%. West Africa operation only contributes 18% to the group’s revenue.

3. The group has $51.9m (cash and cash equivalents), $6.9m (non-current asset listed for sale), and $15.5m (undrawn credit). Total available fund is $74.3m. This means the group has the capacity to take up to $495m worth of order. (The group so far has $371m order book for 2011)

4. While the group is growing in size, with enhanced financial position the group is targeting to continue to increase its project size. The average size of contract is currently between $25m and $50m (2007-2010). After that, the group expects the average size may increase to $50m-$100m. If it turns out to be successful, it would further improve its margin.

5. Required investment for capital equipment and depreciation is not a concern. It accounts for a small portion of the group’s revenue.

6. My calculated ROE for the group is 53.2% (2007), 30.1% (2008), 46.4% (2009), 51.6% (2010), and 45.8% (2011E). My ROEs are adjusted figures.

7. Net profit margin improved from 3.6% (2007) to 11.8% (2010)

=================

Financials

1. It seems that these engineering services companies tend to carry significant amount of account receivables and account payables. It is good to see that the company also carry significant amount of cash (from $3.5m in 2007 to $51.9m in 2010) and healthy OCF. This will add more liquidity to the working capital.

2. The company has low level of debt. Net debt to equity ratio is 18%. That is one of the lowest among the peers.

3. A good cash position also enables the company to engage in acquisition if needed.

4. Off balance sheet commitment total $9.6m (ie. $5.8m hire purchase commitment and $3.8m operating lease commitment)

5. Usable credit line total $15.5m plus working capital $53m (2009: $17m)

6. Minimal doubtful debt expensed (2010: $84,000). $13m receivables past due but not impaired, this accounts for approx. 5% of the revenue.

7. Materials, plant, subcontractor costs account for 50% of the revenue; employee benefits expense 32%. There has been significant increase of employee benefit expense from $17.3m (2009) to $79.2m (2010), the number of employees increased from over 400 to 650. There is no explanation for this increase in the annual report but I assumed that it might partially be to do with office relocation or departure of some senior management persons.

=================

Valuation

1. With booming industry trading conditions and promising order book, revenue growth over the next 3 years should not be a concern to me. Therefore using a higher ROE is justified. However, longer term investor (5-10 years+) should use a lower ROE to indicate the sustainable return. I would use 45% for the former and 25% for the later.

2. I am willing to use high ROE is because (1) the company has shown a consistent ROE around this level; (2) there is no reasons to believe current robust mining sector will slow down significant in a foreseeable future; (3) Clough factor is also not factored in.

3. To factor in the foreseeable future (ie using 45% ROE), I would be using 13.7% for RR. My valuation for FGE is between $15.07 and $15.50.

4. To calculate the long term IV (5-10 year out), I would be using 15.1% RR and 25% ROE (assumed long term sustainable rate). My valuation for FGE would become $3.91-$4.23

=================

Risks or Factors for Investors to note

1. The current competitive advantage is not fully matured and sustainable. It will take time for the company to prove its model and increase its size in order the gain greater advantage. Given the fact that average project time is around 18 months, the long term revenue growth will eventually rely on the company’s competitive advantage to win contracts.

2. Market conditions may change, but I do not see anything to substantiate this speculation at the moment.

3. Availability of qualified labour and increasing labour costs.

4. Assessment of a suitable ‘pipeline’ of projects with correct costing. FGE currently takes on risk as a lump sum hard money contractor (an aggressive mode), therefore cost control and estimation skills are very important. But so far FGE has not made a loss making job in 3 years.

5. There is high level of shareholding concentration. 66 holders own 74.6% of total shares, most of them are non-institutional holdings (ie. passive investors). (1) Unless there is private placement, FGE is not likely to be bought by fund managers given its size and lack of liquidity; (2) this may partially explain why FGE share price is not fully priced in when the shares are not actively traded by professionals.

6. Maybe I haven’t done enough due diligence, but it seems that the company has offered no explanation for the following management changes:

(A) Stepping down of Andrew Ellison from executive role to a non executive role in Sep 2009. Andrew is believed to be instrumental to the group given his experience and being the MD of Cimeco which is the driving engine of the group. But it seems that the Board is having difficulty to find someone to fill in his shoe, because in 2010 report, Andrew becomes an executive director again. (no explanation) But one thing for sure, the group is planning to upscale the management skill from individual level to a corporate level.

(B) The departure (2009) of the CFO (Michael Kenyon). He is only 41 and has recently appointed as CFO and Company Secretary in March 2009. I suspect it may to do with performance issue?!. The position is yet to be filled.

Disclaimer: I currently do not hold this share, but I am planning to buy some. Not sure when, still looking. This is my own opinion only, not advice.

Hi Jack,

That is an extremely comprehensive first post. I hope you haven’t set the bar too high for yourself. Well done and I concur with many of your points. There are so many great companies being mentioned, the decision for me will have to be on the basis of a combination of biggest discount to intrinsic value and fastest expected growth in intrinsic value.

Hi Roger,

Whilst COH may not be a stock for this Christmas, it may well be a business for any occasion.

This article from earlier in the year was of interest to me:

http://www.theaustralian.com.au/business/cochlear-wont-hear-of-mergers-or-acquisitions/story-e6frg8zx-1225926428900

There are a few statements in the article, which if turn out to be true, are music to the ears. Here are a couple I liked…

“Mr Roberts, though, is not one for diversions, saying it will be “decades” before the company exhausts its opportunities around the world for organic growth.”

“Mergers and acquisitions is not everything it’s cracked up to be by investment bankers: growth by M&A is actually fraught with danger and often driven by ego.”

Merry Christmas Roger.

Regards,

Craig.

All,

FSA Group (FSA) is my contribution.

ROE (comsec) the last 5 years – 21, 35, 12, 29, 17 %.

First guidance this FY has been a 32% increase in 1st Qtr profit.

Barriers to Entry – an increase in the capital requirements for debt administrators will make it harder for smaller players to get into the Debt Management sector (this is from their 2010 Ann Rpt, but it won’t prevent larger players.)

Similarly, the proliferation of Non-Conforming home loan lenders prior to the GFC has been reversed, with increased capital requirements, the credit squeeze, and failures reducing competition.

Current Conditions suit – Their revenue is derived from 2 segments mainly, Personal Financial Services (Debt mainly), and Non Conforming Home Loans. Increased Interest Rates increase demand for the Debt Services, but would also impact on the ability to repay of some Home Loan clients. FSA are better able to manage this – than competitors – using the Debt Servicing facilities they have in place. The two segments compliment each other. Their Annual Report from 2010 states their average weighted LVR to be 67%, quite low by industry standards. The current robust employment outlook in Australia further strengthens their business by mitigating against Home Loan defaults, and allowing people to enter into debt servicing with the knowledge that a more secure income stream is available.

The current Equity of around 42M consists of approx 12M contributed capital and 30M retained earnings.

The Valuation comes out at above $1.20 using a RR of 10% and ROE of 20%.

Current Price circa 32-37 cents.

I won’t mention the low PE. Not on this site.

Merry Christmas indeed!

Pardon me, as my copy of Value-able appears to be in another state, and the relevant spreadsheet on another computer, but my ROE was more like 30%, with a payout ratio of 0%.

cheers

Craig, you may also note that FSA’s net asset value is 32c per share (and rising to forecast 40c in FY11) and that forecast NROE will be 25%, with 0% dividend (awesome!).

Therefore, you can currently buy a business at 1 x equity per share that returns 25% a year.

That’s Graham post-Depression valuation territory….

Disclosure: Have a position in SMSF and personally.

I would endorse Andrew’s comments about Oroton (ORL) and name it as my christmas stock. Roger has said that its competitive advantage lies in Sally McDonald. Having attended the AGM, seen Ms McDonald with Roger on Switzer and closely read the company reports, I can only agree. I would add three things: first, it showed great nouse for the Lanes to step back from management and bring in a new CEO (particularly such a good one); secondly, this advantage is being carefully entrenched through the addition of well-chosen individuals, for example, Mark Newman as head of the Ralph Lauren business and Eddy Chieng as a director. Both of these people have extensive retail experience in Asia, unquestionably an attractive growth prospect for a luxury goods retailer. Thirdly, one of four key management platforms of the company is retail innovation. This includes on-line stores in Australia and, more recently, developing a position on China’s most popular social network site (see http://www.asx.com.au/asx/statistics/announcements.do?by=asxCode&asxCode=orl&timeframe=Y&year=2010). The recent noise about online retailing has been foreseen and taken advantage of instead of being a surprise.

Finally, thanks to all the graduates on the site (and, of course, Roger) it has been a great year of education for me. Have a happy and safe christmas, hope to join you again next year.

This page was great to read. Thanks guys! :D

Hi All,

My pick is international, drum roll please… The Coca Cola Company.

When I eat at McDonalds drinking my coke I often say to my wife, “do you realise we’re sitting in the second best business in the world, and I’m drinking the best business in the world”.

I know I’m such a romantic with lines like these :\

I like the fact that Coke is ubiquitous, and has pricing power a key factor if, or should I say ‘when’, inflation becomes an issue. Also, it’s a unique and quality product preferred by *b*illions. I think emerging markets will keep growing as fast-food stores (KFC, Maccas etc) roll out across China, Brazil and other emerging nations.

I might just go get a coke zero out of the fridge. And remember, Coke is it!

Cheers,

Andrew

Well done AndyC. I like that you are eating your own cooking both ways!

I’m not sure that GXL fits the Xmas stocking status but it is in an industry that I know something about.

The veterinary industry is fragmented and cottage industry. GXL is an acquirer and consolidator of veterinary practicies and has been listed for about 3 years. They have overcome initial difficulties of industry acceptance plus the issue of aging sellers remaining in the business for the escrow period. Their growth will come from acquisition but also then training their systems into practices, standardised pricing and business intelligence. GXL now offers a number of franchise type options for vets who want to partner in the business in various ways thereby providing career paths for their vets. , as well as the traditional fire brigae type pratice. They will only acquire “small animal” practice as wellness and preventative health strategies can be introduced and developped. As pets become more and more important to families, this type of practice will grow and succeed. GXL has first mover advantage as the number of target businesses in Australia as a small percentage of total businesses.

I haven’t got the skills yet to produce valuations or ROE but thought it might be of interest.

Thank you for the contribution and thoughts Simon. Can you elaborate a little on why you believe pets will become more important to families (than perhaps they already are)? Are you referring to the companionship trend coinciding with aging baby boomers?

i do also operate within the pet industry marketing rspca pet insurance. i work with 2000 vets nationally and also with greencross vets (gxl). unfortunately vet practices may be profitable for their owners and very crucial for pet owners, but financially GXL does not seem enticing for an investment with ROE around 10% and lots of debt.

trust the vet with your dog but not with your wallet :-)

Please be v careful purchasing veterinary chains. They have worked in the US but have a poor history of survival in Aus. Although feminisation is occurring in the profession, vets tend to be independent workers.

Have a look at the low ROE for GXL

Look at the chart for GXL since inception.Compare the chart to ARB, FWD, ORL,MCE.

This company has lost a considerable amount of capital – not a good track record sadly.

Christmas Greetings, Roger. I’m getting close to the end of your book but was impressed enough to get each of my 3 kids a copy before Xmas (so we can discuss it when they’re all home). I don’t have access to Sky and my question is- will we be able to access your appearances re The Stocks of Christmas somewhere on the net?

Thanks to you and all your contributing graduates for the generous sharing of information.

Hi Greg,

Thank you for your support and a Happy Christmas to you too. I republish all of the Sky appearances on the youtube channel. Here’s the link http://www.youtube.com/user/RogerJMontgomery

Having read the following article:

http://www.chinadaily.com.cn/bizchina/2010-06/12/content_9971693.htm

I wondered if Roger you would consider having having a “annual” lunch put up for auction? Instead of say just one Value.able investor winning the pot, we could have say a table of ten (ten highest bids) booked at Rodger’s favorite restaurant in Sydney, with the proceeds to go to a charity of your choice. What does everyone think?

I would be delighted to participate and already have a cause in mind. I will have to hold back some of the best ideas to be revealed only at the lunch.

Hi Everyone,

Belated birthday wishes Roger! Sorry I am leaving this to the last minute, and is a bit half baked but I am travelling and not able to access my Spreadsheets and research, however:

My 12 stocks of Christmas nomination is Industrea IDL.

They have had a number of issues weighing on their share price over the past few years, and they are currently addressing all of them.

Debt is being repaid

The Convertible bonds have been redeemed, thus removing the overhang.

A 3:1 share consolidation has been completed, thus helping the share price look “like a real company” – this has no fiscal impact buy apparently has a significant sentiment impact.

On top of that there is all this:

Margins are improving.

Mine safety is flavour of the month.

$50ml capital raising completed

A $35ml order from BHP has been booked this quarter

They have specific patented technology in the mining equipment/ underground collision avoidance space.

They are now much more focused on NPAT growth, ROE growth and debt reduction.

This is all off the top of my head, for more details read the ASX announcements, there is plenty happening.

Disclosure: I hold IDL shares. Seek and obtain advice relevant to your personal circumstances.

Merry Christmas everyone, here’s to a great 2011.

MY CHOICE IS TRS

I recently lost 25% on this stock so please can you guys(above) start buying it so I can get my money back( I will sell as soon as I recover my loss)

If this is not one share for “MY CHRISTMAS” i dont know what is.

Cheers

Zoran

Hi Roger,

Great work throughout the year, youre book was well worth the read i’ve recommended it too many of our client’s. (I’m a financial planner.)

Could you please post an updated list with valuations soon for your current undervalued A1s you’ve been mentioning for a while, i.e. FGE, MCE, ORL, JBH. It would be great if you include actual intrinsic values rather than current dicount %, and also the next few years forcast valuations. I think these blog updates are invaluable, and the ones everyone looks forward to the most!

Adam

Thanks Adam,

Yes I appreciate they’re valuable!

My pick is CIL I think centrebet is is building strong roots in the online gambling world and have a good strong plan to take more market share. I currently value them at around $2.30. share price $1.43. Love to hear what you have to say Roger.

Cheers

I Have CIL valued at 1.85-1.93 (EQPS .70, payout approx 80, ROE 25%). Not enough of a discount.

Hi Roger,

First time commenting… Reading through the comments, I see a lot of businesses with a competitive advantage, but I still ask myself, is this advantage durable?

As an owner of a couple of websites myself, I can’t go past online businesses. Wotif Holdings Limited (WTF), Seek (SEK), Carsales.com limited (CRZ) & REA Group (REA). All these companies have little or no debt, with high ROE.

In evaluating all these, which one has a durable competitive advantage?

In my opinion, SEK and REA have a durable competitive advantage, I say this because what’s the first thing that comes into your mind when you are looking to buy sell or rent a house, Realestate.com.au and what’s the first thing that comes into your mind when your looking for a new job or you have a need to advertise a position in your organisation? Seek.com.au

Shame there both over priced at the moment…

Merry Christmas,

Clint

Thanks Clint for the thoughts, insights and for writing. One of the risks of course is embedded in the latent power of the customers. In the case of carsales.com.au two customers make up a large proportion of the revenue – they can take their competitive advantage with them.

Hi Roger, Thanks for giving the amateurs an opportunity to put their

favourite companies up. Whilst I realise others may favour the growth

potential in CSL ORL MCE and so on, my favourite is FWD. It is from the

perspective of safety of capital, 10 year performance, good ROE, no debt,

right industry and sustainable advantage. I attended the AGM in Perth

recently and have not changed my view.

Here are some facts using Comsec.

Average annual return over 10 years 32% with 67% in the last 12 mths.

Zero debt – in fact they managed an acquistion this year using cash and

script without a discounted capital raising.

Over 10 years the ROE has steadily risen from 10 to 24.

There is a steady growth in earnings and dividends over 10 years.

Add to this

Proven management not dependant one one person. This was demonstrated

through the GFC and the rising Aussie dollar.

On the down side, the payout ratio is very high at 95% and it is overpriced

at present. I have a value of $9.50. In the last 12 months FWD have

fluctuated between $7.36 and $13.18.

Risks:

1.The danger of transportable homes being imported in containers from

Europe and China using the strong Aus currency, may well be negated by the

quality of the product offered here and the capacity to solve problems

quickly eg assembly of kitchen canteens etc.

2. Exposure to the commodity boom.

Just remember they are also in the caravan, mobile home market and so have

diversity in earnings from the baby boomers with wealth.

It has been a great performer where I have felt my money is safe, the

management is exceptional and the future is still bright but if you pay the

current price around $12.50 you are paying too much as a value investor.

Perhaps it will have a low under $9.50 in 2011.

Patience.

I must add my vote of support to Ken’s sentiment on ARB Corporation being a cornerstone investment in the 12 stocks of Christmas. This is truly a remarkably successful company which has not failed to deliver year-in-year out with regard to financial performance, importantly over a number of years.

Management has navigated this business expertly through a number of major impediments – including record high oil (fuel) prices affecting 4WD vehicle sales, skilled labour shortages in Australia, soaring steel prices (Input cost) and widely fluctuating exchange rates. Management’s vision to set-up the Thai manufacturing plant has proved very astute, and is the launching pad to grow sales in Asia. In this respect, the company may well be on the verge of exponential growth.

The clearest evidence to us all when espousing the success of this company is threefold:

1. Profits march upward year after year, and you can be virtually assured that they will continue to march upward.

2. They do not like to, and do not need to raise capital by issuing shares.

3. They are one of the few companies to pay very significant special dividends, this is real money being returned to shareholders with franking credits too!

When directors continually underpromise and overdeliver, you know you have a unique and wonderful company such as ARB.

ARB’s has strong and enduring competitive advantages:

1. Consumers know ARB to produce high quality products (reputation).

2. The company has deep relationship’s with 4WD manufacturer’s whereby they supply products designed specifically for vehicle models.

3. ARB have invested in research and development over many years, A number of their products have taken a considerable period of time and effort to develop, a process that is not easily dupilcated by competitors.

You really can’t ask for much more than this for Christmas, but you get more – because they just keep giving!

Nick’s comments on Phillip Fisher’s “Common Stocks and Uncommon Profits” prompted me to dust off my copy. I really enjoyed this book the first time round and must read it again. Chapter 2 “What to Buy” talks about the attributes that a company should have to provide the highest likelihood of a several hundred percent gain in a few years (or more over a longer period). Fisher lists 15 points, most of which should be met. I’ve quickly run this checklist over ARB Corporation. Just a tick or cross as no time for elaboration. Many of the points have been discussed in various posts here on this company.

1) Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years? Yes

2) Does the management have a determination to continue to develop products or processes that will still further increase total sales potentials when the growth potentials of currently attractive product lines have largely been exploited? Yes

3) How effective are company’s research and development efforts in relation to its size? Yes, strong emphasis on R&D.

4) Does the company have an above average sales organisation? Yes, strong emphasis on sales.

5) Does the company have a worthwhile profit margin? Yes

6) What is the company doing to maintain or improve its profit margins? The proof is in the pudding to a certain extent but a number of initiatives have been discussed in posts here.

7) Does the company have outstanding labor and personnel relations? Some scuttlebutt needed but I suspect yes

8) Does the company have outstanding executive relations? Ditto above

9) Does the company have depth to its management? Mmm good question..must look into that. I suspect yes.

10) How good are the company’s cost analysis and accounting controls? I would guess pretty tight.

11) Are there other aspects of the business, somewhat peculiar to the industry involved, which will give the investor important clues as to how outstanding the company may be in relation to its competition? Yes, discussed in previous posts

12) Does the company have a short-range or long-range outlook in regards to profits? Definitely a lot of foresight in their thinking.

13) In the foreseeable future will growth of the company require sufficient equity financing so that the large number of shares then outstanding will largely cancel the existing stockholders’ benefit from this anticipated growth? No. Annette makes this point above.

14) Does the management talk freely to investors about its affairs when things are going well but ‘clam up’ when troubles and disappointments occur? Not the case.

15) Does the company have a management of unquestionable integrity? Yes, with a good stake in the company.

Great addition Ken D. I am struggling to choose. The great thing about investing is you can build a fundamentally impressive portfolio out of the companies that have been listed here.

Hi Roger first of all I hope you had refreshing break and very happy 40th.

My choice for the Christmas stocking is Sirtex Medical (SRX) which makes SIR-Spheres microspheres used in the treatment of inoperable liver cancer.

From their website:

The primary objective of Sirtex is to research, develop and commercialise effective treatments for liver cancer using novel small particle technology. Liver cancer is a disease of the cell. It develops when cells in a part of the body begin to grow out of control. Cancer cells can form a mass of tissue commonly referred to as a tumour.

Sirtex has developed an innovative means of treating liver cancer. In cases where it is not possible to surgically remove the liver tumours, this product can be used to deliver targeted, internal irradiation therapy directly to the tumour. This new therapy is called Selective Internal Radiation Therapy also known as SIRT.

This technology was developed in the 1980’s in Perth, Western Australia. Many patients have been treated commercially and within a clinical trial setting all over the world (Australia, USA, Europe, Singapore, Hong Kong, New Zealand and India). Sirtex technology has TGA listing in Australia, PMA approval by the Food and Drug Administration (FDA) in the USA and BSI consent for Europe (CE Mark).

My thoughts:

Along with regulatory approval, insurers or healthcare authorities pay for the procedure in Australia, US, Germany and a few other countries. Currently the product is administered in late stage liver cancer but through trials underway the company is hoping to provide doctors with evidence that it should be used at an earlier stage. The trials are comparing the use of SIR-spheres in conjunction with chemotherapy as opposed to the use of chemotherapy alone for the treatment of liver cancer.

These trials are being conducted in various countries around the world and so therefore are affecting short-term profitability, with EPS expected to be down 20% next year. This has had an effect on the intrinsic value(IV) calculation for next year making the company look over-valued currently but when you consider the potential profits that will come from the success of these trials, the future IV is tantalising.

At the moment SRX sells less than 5000 doses a year for a NPAT of just over $16m. When you consider that worldwide each year 600,000 cases of this hideous disease are diagnosed their prospective market is enormous.

Now I prefer to invest in companies selling at large discounts to their IV and that IV increasing into the future, the proverbial virtuous circle. SRX has one part of this equation missing, the current margin of safety but I believe that by the time we see the profits roll in from the investment in these trials the price will be a lot higher than the current.

In FY10 EPS were 28.8 cents and EPS have grown at an average rate of 55 per cent over the past five years. Europe remains the fastest growing region, with dose sales up 31% to 1,288 and revenue of $21.5m. In the US, dose sales were up 8% to 2,490 delivering revenue of $40m. Sales in the Asia Pacific region grew 5% to 393 and revenue of $2.8m.

SIR-Spheres microspheres dose sales were a record for the first quarter, being up 16% to 1,181 with revenue of $17.8m, an increase of 8% but operating profit is down 15% to $4.6m due to the strong $A.

I calculate FY11 IV at @$4.20 but with analyst forecast of FY12 EPS of 42c, I calculate a ROE of 39% and IV of $12.50, rising further into the future. The company has net assets of $41m which is also the amount of cash on the balance sheet and no debt.

Other positive considerations are the new clinical study to assess the safety and tolerability of its targeted internal radiation therapy to treat primary kidney cancer.

The fact that Hunter Hall has a 30% investment in the company and Platypus AM has recently moved to 10%, a big vote of confidence.

A new manufacturing facility is being built in Singapore and is expected to open early 2011.

Negatives are that if the trials don’t prove SIR-spheres in conjunction with chemo are more effective than chemo alone, future growth will vaporize and downside is probably $4.00. I view this as unlikely because a trial published in Sept 09 showed that SIR-spheres and chemo combined was effective. Directors own very few shares and founder Robin Gray is selling and quite a shareholder agitator.

Competitors are Canada’s MDS Nordion and the UK ‘s Biocompatibles.

I hope you find their potential as enticing as I do and to finish off I see an investment in this company as not only monetary but also of a social benefit by assisting with a possible reduction in suffering of affected individuals. It’s also a chance to get behind a great little Aussie company taking innovation to the world.

Merry Christmas Roger and all the value.able graduates.

And a Happy Christmas to you too Craig.

Thanks Craig,

I have looked at this one a number on time.

Great to get you views on it

It looks like the valuable grads gathering wont be happening in 2010 so we will have to share a beer at the 2011 event should Roger think it suitable that we all get together.

Merry Xmas and all the best to you and your family.

Hi Ashely and all,

We will put something on for 2011. Too much to do this year. Looking forward to some very exciting opportunities in 2011.

Merry Christmas everybody!

My stock for Christmas is still MCE. Although most of the value.able graduate are familiar with MCE, I still continue to believe that next year will be another good year.

Let’s start with the basic:

1) Is it a good quality business? Below are some stats for FY10:

-Gearing = 0% (cash on hand exceed debt)

-Revenue up 89% in FY10.

-EPS of 31.0 cents per share (from 6.3 cents in FY09)

-Order book $188m (from $136m FY09). Recent announcement states order book is approximately $170m by end of Oct.

When reading FY10 annual report, what draws my attention is that ‘Order Book’ is listed as one of the performance measure by management. This demonstrates that management is always focusing on securing future revenue/growth.

2) In terms of ‘sustainable’ competitive advantage, my view is that the one key ingredient is ‘constant innovation/ evolution’. What does Apple Inc & Roger Montgomery have in common? Apple Inc launches iPad (a new product in between laptop and smartphones) and changes its existing products every 18 months. Roger now has a class of value.able graduate (which I am proud to be part of).

In the same way, MCE is constantly improving its product and relaunching existing products. In FY10, $2m was spent in R&D which management believes it will place the business as a market leader with significant competitive barriers.

3) Lastly, considering our investment strategy is to buy

(a) good quality business

(b) with rising intrinsic value

(c) trading currently at a discount

MCE was attractive 6 months ago, and is still attractive now.

quote ‘Too much of a good thing is wonderful’

Thank Joab and Mae!

Can we add a big thank you to Roger for this interactive format? I love it.

Thank you Roger for making my purchases (yes plural) of Value.Able more valueable.

As one of your silent readers I thought I’d come and finally make a contribution. My number one stock for christmas may be a bit out of left field as it is not one listed on the ASX and thus you may not have a MQR for it but I’ll go ahead and post anyway.

The stock which is my favourite is Ebix (NASDAQ: EBIX). The company is basically a software company operating in the insurance industry. It is involved in cloud computing and its primary business is the operation and deployment of insurance exchanges. It’s goal is essentially to eliminate paper from the process of insurance (Similiar to what E*trade did with shares I guess).

I believe it has some extroadinary competitive advantages. Namely it’s CEO has turned the company around from a business which was losing millions of dollars to a company rated by Forbes as one of the fastest growing companies on the planet. Ebix’s average ROE over the last few years has been in the 30% range. Relatively little debt. The management owns a good chunk of the outstanding shares and the company has been purchasing its own shares back recently. It’s margins are phenomenal as they usually are in software where there are few competitors (Microsoft? Google?) up in the 38%-40% net profit range though this might not be sustainable long term.

The management seems very candid and the CEO has stated that he will not issue a dividend in the near future as he “can get better returns for shareholders by reinvesting their money back into Ebix”. That type of philosphy from a CEO is one I definately admire. As a self confessed Warren Buffett fan, the CEO of Ebix, Robin Raina, seems to recognise the economics of this business are similiar to the newspaper industry that Buffett recognised several decades ago. While there may be multiple exchanges eventually one will come to dominate it’s particular market and he is positioning Ebix to become that dominant player. Check the market share of Ebix in Australia and you will see what I mean.

Ebix has strong recurring revenues with a customer retention rate close to 98% so it’s earnings are relatively predictable. As aformentioned it has, and is growing, some monopoly like characteristics in some countries (such as Australia with it’s Sunrise exchange). After it recorded record earnings this year its share price is down from a high of $28.21 to it’s current price of $22.46.

Now I am not naive enough to think this stock comes without risks. It operates in the technology arena which, with the fast pace of progress, always poses a threat. It also has a “growth via aqcuisition” strategy which, depending on management, can be either a positive or a negative. It has a very high short interest ratio which could indicate something wrong with the underlying business (although with the CEO owning 4+ million shares I see this as unlikely, unless he starts selling heavily in which case I may do the same!). The other threat I see is similiar to ORL where the CEO may decide to jump ship.

Anyway just thought I’d throw in something a bit different. Merry christmas to all the value.able graduates!

Thnaks for the heads up Julian and for making your first contribution. There is indeed an exciting array of businesses when one turns their mind globally.

G’day Roger

I was your second book purchaser and love it !!!!

My stock is Thorn Group (TGA).

My intrinsic valuation seems to come in a bit higher than others at $2.17 – Book val .63 ROE 23.8 (I used 22.5) P/out 42%. What do you think?

Since their low on 4/5/10 at 96cents, they have steadily grown to a high of $1.89 on 6/12/10 – a level of high resistance but I’m confident. I originally bought in at 67.5cents on 29/05/10 and have bought a few since (especially armed with the intrinsic value confidence). They have a great business model with Radio Rentals, with a high level of cusomers on direct payments from Centrelink which means they have a very low level of bad debt. Their current 4.1% fully franked div is also very nice. Many people rent in bad times, this plus their rent-then-buy-at $1 plan I see a great future. Hope you and everyone else see the same and help them along!

Hi Bernie,

It will be in the final column for the year. Thanks for your sentiments about my book.

Hi Can anyone tell me how to “translate” the asx announcements of JB HiFi recently. Are they purchasing or selling shares?

Hey Roger! How are you? Good holidays? Mate, get some $$$$of the market and print my book!! Still haven’t got it !!

Have a nice Christmas!!

Take care

Thanks Tiago,

Send an email with your purchase confirmation information and I will have it looked into.

Roger, I’m sure you’ll be familar with Headline Group, and I would be interested in your current opinion.

Headline is an obscure retailer to most, and rarely hits the headlines, but had more exposure recently after buying the 13-store Babies Galore operation for $8.8m. One thing that interested me was the involvement of the private Myer Family Company, which is investing $5m in equity stake. I’m even more excited about the potential of Headline’s licence to build the successful British Mothercare brand in Australia, which is a quite prized brand in the UK. Mothercare also agreed to invest $12.2m in convertible notes, exercisable at 28c, terms the independent expert called “not fair, but reasonable”. The Babies Galore purchase puts Headline on course to roll out 48 Mothercare-formated stores by 2020, while lifting revenue from $40m now to $175m by 2014.

The rollout means Headline will dominate the specialist baby care sector, the only main rival being Baby Bunting. But when general retailers are taken into account, Headline will still account for only a fraction of what is a $4.1 billion market. Headline lost $3.3m last year. An $800,000 shortfall this year is forecast and a $6.4m profit in 2011-12, rising to $13m by 2013-14. Having 4 children of my own and witnessing my wife doing a first class job at draining our household finances on every piece of baby paraphernalia imaginable, I rate Headline a long-term buy. If it’s good enough for Myer, it’s good enough for me.

Great suggestion James, I am fully invested at the moment although am considering what I could possibly sell to purchase a small stake in this company. It appears a wonderful prospect.

my family friends were the founders of baby galore who sold the chain pre-crisis to private equity. private equity then thought they knew how to better manage it (including the guy who founded super cheap auto), when they failed big time, they sold it off to another private equity who ruined the business further and finally decided to pull out any cash that was left in the business, not pay suppliers and declare bankruptcy right after selling it for half of what they spent to the headline group.

Now, a lot of these suppliers are not happy and a lot of these stores have been badly managed. watch out…

also if my memory serves me right, the myer family were investors in some of the allco funds….and we all know what happened to those.

merry Christmas!

Roger, could you give me your latest ratings for QBE. Suncorp and

AMP. I have shares in all three and I’ve had advice to consolidate all the

funds into just one company. I’m part way through Value.able but have not

yet got the skills to do the ratings myself.

Thank you

OK Darrell,

Will get to it. Have a few deliverables ahead in the queue.

Hi Roger,

yet another of your appreciative students says first-time hello, also Season’s Greetings!

On a darker note, I am wondering what’s happening with JBH and TRS – hopefully it’s just transient retail weakness?

Is there some attitudinal change going on with JB? Today for the first time I noticed one of the funds unloading a percentage of their holdings in it.

My Xmas stock is MMl, Medusa (gold) mining in the Phillipines.

It has no debt, a high ROE the last two years since it started producing, the cheapest production cost of any gold miner and I’ve been happily (in my own small way!) swing trading it on its stellar 2010 rise.

Happy days,

AS.

Hi Andrew,

Welcome to the blog and thanks for writing. There’s lots of discussion here about those two stocks. Have a read of the comments under the last couple of posts.

Hi Roger,

One of my Twelve Stocks for Christmas would be ThinkSmart (TSM). TSM has a 51% compound annual growth rate over the last 4 years, a strong competitive advantage in Australia, and is rapidly growing its overseas business – particularly in the UK. As economic circumstances dictate, or people decide it’s better to lease/rent computers with full support services and upgrade after 2 years, rather than buy equipment that rapidly becomes obsolete, this company will continue to grow strongly.

Using an RR of 12%, I calculate TSM has an intrinsic value of $0.99, which currently represents a 31% margin of safety. TSM has little or no debt after a recent capital raising, a strong institutional list of shareholders, and its current ROE of 25% is forecast to rise. Much will depend on the Christmas trade which has been very encouraging in the UK, but TSM deserves some smart thinking as one of the Twelve Stocks for Christmas.

Pat T

Thanks for the ideas Pat.

Roger,

One of my Twelve Stocks for Christmas would be ThinkSmart (TSM). Currently rated an A3 stock, TSM has a 51% compound annual growth rate for the last 4 years, a strong competitive advantage in Australia, and is rapidly expanding overseas – particularly in the UK. As more people decide it’s better to rent/lease computers with full support services and upgrade every 2 years, rather than buy equipment that quickly becomes obsolete, this company will continue to grow strongly.

Using an RR of 12%, I calculate TSM’s intrinsic value at $0.99, which currently represents a 31% margin of safety. After a recent capital raising there is little or no debt and a very strong list of institutional shareholders.One analyst forecasts TSM will exceed its current ROE of 25%. Much will depend on the Christmas trade, which is already very encouraging in the UK. TSM deserves some smart thinking as one of the Twelve Stocks for Christmas.

Pat T

Thanks Pat T. I will have a good look at it.

Hi Pat,

I too like TSM.

We will have to keep a keen eye on the Yearly accounts to see if the money from the capital raising has been used well.

That is, incremental ROE etc

Hi Pat

I like TSM as well but not so certain of your valuation of .99 mine is closer to .65. What is yours Ashley. If you havn’t floated away in the floods. We should be selling tinnies with 20hp motors or bigger.

I have an IV of .66 to .74 (EQPS .18, payout around 60%, ROE of 25%).

Thanks to everyone for their contributions.

Hi all,

I will have to nominate ARB Corporation (ASX:ARP). Why ARB? I outlined what I see as the merits of the company in my post under Roger’s “Are you drowning in a sea of complexity?” I ask that this previous post be considered along with the following additional comments.

What I didn’t emphasise in that previous post was ARB’s current international presence and future growth potential. ARB Corporation’s products have a truly global presence, with the company exporting to over 100 countries (hover cursor over the dark grey areas of map on http://arb.com.au/stores/worldwide.php) with 1300 authorised distributors in North America alone (see arbusa.com). Whilst ARB has benefited from growth in 4wd and utility sales in Australia over the last few years, the company’s future growth prospects aren’t limited to the Australian market. Judging by the company’s global distribution footprint, there are still untapped markets in Asia, the Subcontinent, Middle East and northern Africa (hover cursor over light grey areas of the map on http://arb.com.au/stores/worldwide.php – note the company is actively seeking distributors in many of these regions).

Rather than suggesting one purchase a share of ARB Corporation for Christmas, instead might I suggest putting ‘a little patience’ in the Christmas stocking (the greatest gift for an investor) and wait for an opportunity to arise through 2011 to purchase with a slightly higher margin of safety (if Roger’s calculations reflect my own below).

Roger has promised to update his numbers on ARB but, as a Value.able graduate, I should be prepared to have a go myself. I calculate an IV of just under $8.00 (margin of safety of 11% based on current shareprice). This calculation is based on: 1) a required rate of return of 12%; 2) forecast EPS of 49.1 cents/share for 2010/11; 3) an implied ROE of 32% on shareholders equity ($111.4 million as at June 2010); and 4) a dividend payout ratio of 45% (could be a little higher or lower). Using the same approach, for 2011/12, I calculate an IV of $8.70 given a forecast EPS of 55.3 cents/share and implied ROE of 30.6% on forecast equity of $131 million as at June 30 2011.

Although only one analyst has contributed to the above forecasts, over the last 13 years analyst’s forecasts have regularly surprised on the upside by an average of +4.3% (range -0.4% to +12.8% with -0.4% being the only negative surprise in June 1999). I see this history of positive earnings surprise as being a reflection of good management i.e. management being: 1) on top of the business; and 2) slightly conservative in making forward looking statements. So one can put some store in these forecasts, not to say that they may not change before June 30 e.g. based on new company guidance.

Implicit in the above calculations is a 17.5% increase in shareholders equity in 2010/11 and 16.8% in 2011/12. The calculated projected increase in IV is more modest. This is because: 1) based on forecast EPS, projected ROE will decline slightly all things being equal; and 2) I have assumed a small increase in payout ratio. If the share price was to rise to meet my calculated IV over the next 12 to 18 months, I calculate a return of 12-13% per annum (including dividends) based on the current share price.

Remember, one should not be greedy at Christmas time! Furthermore I would consider a share in ARB Corp to be the kind of gift that should keep on giving.

One should not be greedy at Christmas time but one should be safe, and keep one’s family safe. Hence I think it only reasonable that one demands a solid margin of safety, particularly at this time of year. So one might wait patiently for a dip in price, or even more interestingly, external forces leading to a hint of a wobble in that solid track record (see my previous post mentioned above) which, in turn, may lead to market ‘short-termism’ i.e. the market ignoring factors such as the company’s capable management, sustainable competitive edge, solid past track record and, more importantly, long-term future prospects.

I must state that I don’t have industry experience. However, I can disclose that my 4WD does sport an ARB bullbar! Folk at my work engage in extensive 4wd surveys in all sorts of terrain. New vehicles are always heavily accessorised from the ARB catalogue.

Merry Christmas to Roger and all

Ken D

Roger,

Happy birthday, Merry Christmas and thank you for sharing your knowledge over the last year. I feel privileged to be in your class of 2010. I have learnt many things since seeing you on Switzer for the first time in early Feb 2010, and am grateful in finally learning a valid approach to investing in companies. I still have a lot to learn however really value the foundations you have instilled with your education.

My stock is Seymour White Limited, (SWL) an infrastructure development company with 23 years of history in construction. They specialise in building bridges and roads in SE QLD /Northern NSW. They floated in May 2010 at $1.10 per share, and has since had a 70% increase in share price to be currently trading at $1.87. My 2010 intrinsic value is $3.10, the current price being at a 43% discount to intrinsic value. (2010 equity/share : 36 cents, ROE 50%, payout ratio 50%, RR 12% with multiplier of 13.05 from page 184).

They have a competitive advantage of being able to deliver complex engineering projects on time and cost, with a proven track record over the last 20 years. They have strong relationship with government authorities and understand their requirements and hence keep winning contracts.

They have an organic growth strategy, no debt, a strong order book going forward over 2011/2012 and have won a new contract on Friday 10/12/2010. They originally seemed to be thinly traded however recently there is enough liquidity for retail investors.

I think future prospects are positive in terms of winning future contracts. Roads, bridges and developments are going to continue.

Thanks again,

Brad S

Hi Roger