Treasury Wine Estates – Part 1

In this series of blogs, we will take you through an initial assessment of the investment case for a stock that potentially benefits from a particular investment theme. If the initial assessment warrants further investigation, we would then prepare a full investment case and valuation.

Like a number of stocks that have exposure to a falling Australian dollar (AUD), Treasury Wine Estate’s (TWE) share price has been a strong performer this year, rising 50 per cent since the start of the year.

The source of TWE’s benefit from a falling AUD is twofold. It generates a benefit from its California based wine production assets through translation of USD (US dollar) of its earnings and revenue in to AUD at a lower exchange rate. This is a proportional benefit, impacting revenue and earnings equally with little or no impact on margins.

The second and potentially more significant impact comes from the increased revenue and margins generated on wine produced in Australia and exported to the US, Europe and Asia. The foreign currency denominated unit prices charged result in higher AUD unit prices being realised when the AUD falls, producing increased margins due to leverage provided by the AUD denominated unit cost base.

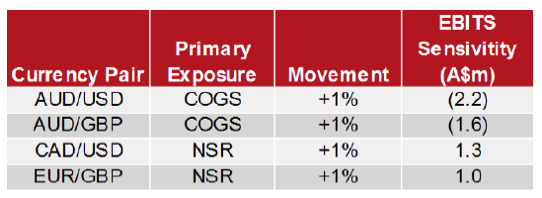

The company provides an earnings sensitivity to movements in the average AUD with EBITS* benefiting by A$3.8 for a 1 per cent decrease in the average AUDUSD and AUDGBP excluding the impact of hedging. The base of EBITS from the 2015 financial year was A$234.7 million when excluding A$9.6 million on FX hedging losses. Source: TWE

Source: TWE

Earnings should benefit significantly in the 2016 financial year even using current exchange rates relative to the average exchange rates from 2015 financial year of US$0.837 and £0.53.

Using the sensitivities above, and adjusting for the depreciation of the CAD, SEK and EUR against the USD and GBP, marking TWE’s FY15 EBITS to market at current spot rates would increase EBITS A$38 million to around A$269 million. This represents a 20 per cent increase on the FY15 reported figure. So at first look, TWE is likely to be a big beneficiary of the falling AUD.

In the next instalment, I will discuss valuation and what is already factored into the share price.

*EBITS – earnings before interest, tax and the accounting revaluation of vines and grapes known as SGARA.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Great response, thanks : )

Roger often talks about not trying to predict stock prices in the short term, but rather focusing on value and the assumption that over the long term price will follow value.

In other words, trying to predict short-term fluctuations in prices is a fools game.

Isn’t it a similar issue with trying to predict currency fluctuations? What is this prediction of a falling AUD based on? What are the fundamentals?

Hi Joe,

The re-examination of stocks with AUD exposure such as TWE is not about predicting the AUD. The depreciation of the AUD to date however has an impact on the investment case for a number of stocks in terms of the value of offshore assets and the economics of their businesses, whether it be from the competitiveness of their products in export markets or the competitiveness of imported substitutes in domestic markets. As such, the investment case for these companies needs to be updated for the new reality. Sometimes the market is efficient in repricing stocks for this impact and sometimes it is less so.

We don’t attempt to forecast the AUD, and as such, our investment case is not based on a currency forecast. Having said that, we believe that the risk to the AUD still lies to the downside given our view on the outlook for China and the likelihood that the RBA continues to cut rates to support the domestic economy. As such, this can be incorporated into our view of risk for stocks that are exposed to the AUD in either direction.