TPG expanding its reach

TPG Telecom (TPM) is set to become a major player in the Australian Telecommunications sector after announcing the acquisition of Telecom New Zealand Australia Pty Ltd and its subsidiaries, which include AAPT and PowerTel.

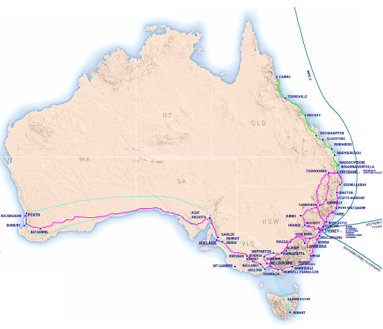

The acquisition, to be consummated on 28 February 2014, is highly complementary given it will add 11,000km of optical fibre, 254 Mid Band Ethernet exchanges, 1,500 directly connected premises and 15 data centres, servicing 300 wholesale customers and ~5,000 business customers, to TPG’s current infrastructure base.

TPG’s existing infrastructure includes 3,800km of optical fibre, 411 DSLAM Exchanges (ADSL 2+ broadband infrastructure), 1,600 buildings directly connected to the group’s fibre network and its own 6900km carrier-neutral submarine cable (PPC-1) which services 671k broadband, 358k home phone and 360k mobile subscribers.

Therefore, not only does TPG secure an expanded customer base to cross-sell products and services, the acquisition also represents the final piece in the puzzle for TPG given their largely metro focus has now been significantly expanded to include a fibre network that literally runs from Cairns to Perth.

It’s worth noting that both TPG’s existing infrastructure (through their acquisition of Pipe Networks), and now APPT’s fibre networks, largely pre-date the government’s anti-cherry picking legislation. With the acquisition, TPG now has an Australia-wide, metro and regional network that dovetails into the business’s Fibre to the Business (FTTB) roll out plan perfectly.

A competitive advantage?

TPG is now uniquely placed (for a limited time) to offer an unmatched, low cost, high-speed product range to consumers, businesses, and even their competitors. In our opinion, TPG will take market share as the ‘internet of everything’ gathers pace.

TPG’s significantly expanded infrastructure comes at a (wholly debt funded) cost of $450m, which seems, at first blush, to be a hefty price tag. If, however, one believes the company can repeat the success of its acquisition of Pipe Networks, large amounts of free cash should flow from the fixed cost base of its low cost model.

It’s worth also remembering that Telstra has a $62.3b market capitalisation and the NBN build cost is estimated at $43m billion. TPG’s fibre network effectively covers more than 50 per cent of the NBN’s points of interconnection and 70 per cent of third party data centres, and its market capitalisation is just $3.7billion. One way or another we would expect the relevant gap to be arbitraged away.

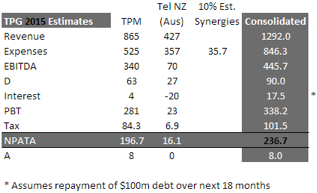

TPG had previously forecast FY14 EBITDA (Earnings Before Interest Tax Depreciation and Amortisation) between $290m and $300m. Adding AAPT’s pro-forma $70m EBITDA and an estimated 10 per cent in synergies, we estimate TPG’s 2015 numbers as follows:

As an aside, this puts the acquisition on a multiple of just ten times NPAT. With TPG’s 793.8m shares on issue, we estimate the business will likely generate earnings of 29.8c per share.

At the current share price of $4.80, this equates to a price to earnings ratio (PE) of 16.1x which compares the average industrial company (including Telstra) currently trading on ~16x forward earnings.

As we all know, over time, share prices tend to follow the earnings profile of a business. TLS’s earnings profile over the past five years looks like this:

And TPG’s like this:

If you were offered the option to invest in TLS or TPG today, which one would you choose?

We think it’s a relatively easy task to identify which business at 16x forward earnings is more attractive and which warrants a place in your portfolio. Our time and money is therefore invested in TPG.

In time we believe the market will begin to agree with us and begin switching from Telstra to TPG. Before you go doing likewise however be sure to seek and take personal professional advice and read our warnings and disclaimers.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I have only recently been doing some basic research into investment (just graduated) and my question is: that TPG have a Price to Book Value of 5.83 and Debt/Equity ratio of 5.49. Should I generally not be concerned with specifics like that or is it similar across the sector of telecommunications? Because from previous seminars you have done (which I have watched online) and various Buffet Philosophies it passes the rules of stable and understandable, long term prospects and diligent leaders however they don’t have a lot of equity and not cheap because the market is currently expensive. Thanks for all of the help ! And I will be buying your book soon !

What are the problems with cash converters if management believe the current new regulations are in the long term going to benefit the company?. I think this may be a good opportunity an would like the potential downsides.

Do you guys still hold Silver Chef in the fund?

Regards Dan

No. Haven’t owned it for a long time. Due more to good fortune than prescience we sold out before a downgrade. Of course we aren’t always so fortunate and have held companies amid downgrades too.