Sweet as bro’

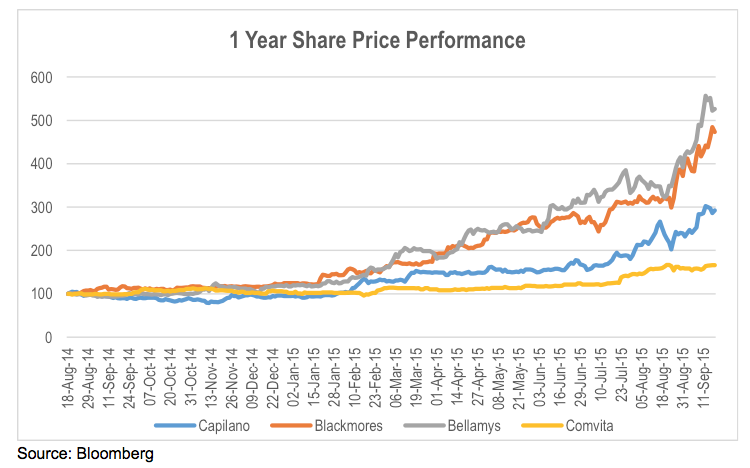

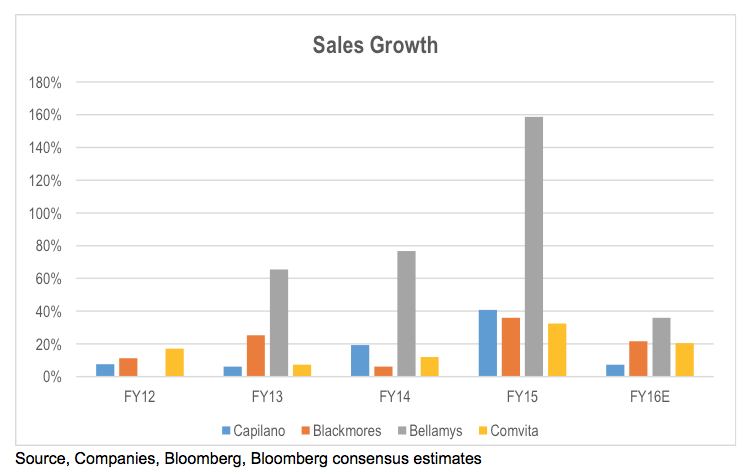

One of the themes that has driven some stocks in the last 6 to 12 months has been food quality and safety in China. Stocks such as Bellamy’s (ASX: BAL) and Blackmores (ASX: BKL) have experienced extremely strong share price appreciations recently on this theme as demand from Chinese consumers for premium international brands with perceived food safety has driven significant sales growth.

Water quality and access are major issues in China due to severe contamination. In 2009, The WHO and OECD estimated that 40 per cent of the surface fresh water in China was fit for industrial or agricultural purposes, but only if filtered.

At the same time, desertification is reducing China agricultural land base by 1 to 2 per cent a year. To offset this, Chinese agriculture has been improving its productivity through farm consolidation and increased use of mechanisation and chemicals.

Poor water quality, combined with increasing demands has resulted in increased awareness of food safety issues in the growing upper middle class.

Apart from highlighting that it is a very good idea to read the labels of food at the supermarket to be aware of the country of origin before making a purchase purely on the basis of a 5c saving, it does present some potential investment opportunities.

Blackmores and Bellamy’s have benefited from the Chinese consumer’s heightened focus on food safety and quality without the need to invest in direct distribution as a result of entrepreneurial secondary wholesalers buying the products from retailers in Australia and reselling them in China. This provides the added benefit for these companies in that these secondary wholesalers are effectively building their premium brand awareness in the Chinese market for them. These companies will in turn have the option to undertake direct distribution and sales themselves to capture the distribution margin and take greater control of the brand positioning and route to market.

Another strong performer has been Capilano (ASX: CZZ), a branded packaged honey company. Strong sales growth in the Australian market due to rising prices resulting from short raw material supply as a result of adverse conditions has been augmented by strong export sales growth into Asia, North America and the Middle East.

The performance of these stocks leads us to investigate whether there are other companies that have the potential to benefit from the food safety thematic.

One that shares a number of similarities to both Capilano and Blackmores is a small company listed in New Zealand called Comvita (NZX: CVT). Comvita is a vertically integrated (50 per cent internally controlled) producer of premium honey based consumption and health products. While its share price has performed well, it has tracked well behind the other three company’s mentioned above.

However, one difference between Comvita and Capilano/Blackmores is that Comvita has developed a direct route to market in China though a branded network of third party stores. It has also shown strong sales growth in its online channel.

However, one difference between Comvita and Capilano/Blackmores is that Comvita has developed a direct route to market in China though a branded network of third party stores. It has also shown strong sales growth in its online channel.

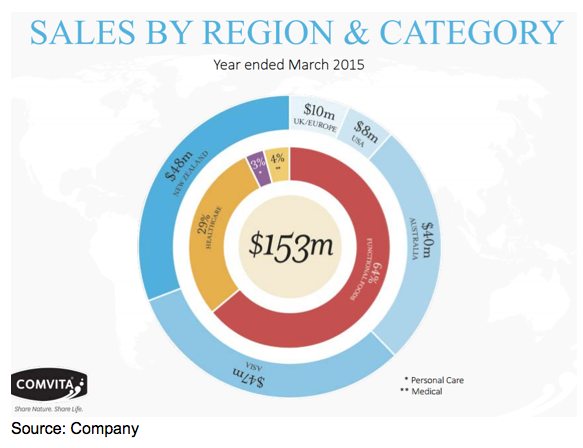

The Asian sales base is made up of Hong Kong, Taiwan, Japan, China, South Korea and Singapore. The strongest growth in revenue in the year to March 2015 came from New Zealand and Australia, while Asian revenue was roughly flat.

After a number of years in which its business was supply constrained, the acquisition of New Zealand Honey in July 2014, investments in its production capacity, as well as a JV with East Taupo Lands Trust have significantly increased its supply of honey. The removal of this constraint is expected to see earnings grow over 35 per cent in the 12 months to 31 March 2016 and sales to increase over 18 per cent to over NZ$180 million. The company has set itself a sales target of NZ$400 million in the 2020 financial year.

Importantly, these figures highlight that after a few years of investment in alleviating the company’s capacity constraint, the increased supply availability should drive margin improvement due to operating leverage.

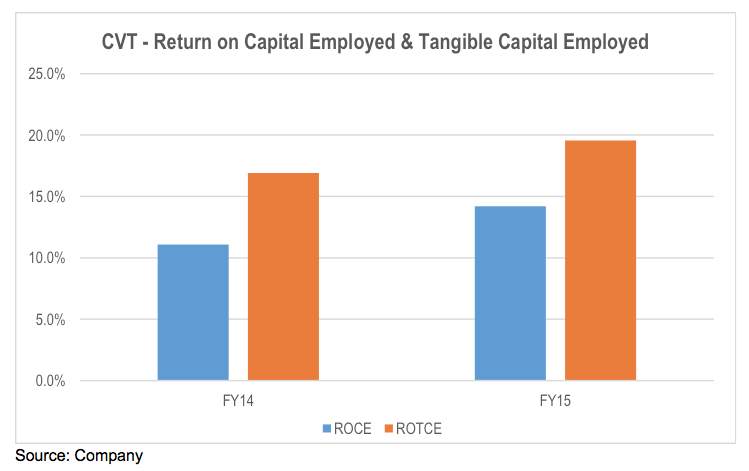

Comvita’s return on capital, while not high, is improving. The recent investments in raw material capacity growth should also deliver an improvement in return on capital employed and surplus capital generation in future years. Additionally, 50 per cent of its raw honey supply is now coming from its own or controlled hives, as opposed to Capilano sourcing 100 per cent of its raw honey from third parties. This means that Comvita should benefit in terms of rising margins and returns from appreciating raw honey prices resulting from supply constraints in the broader industry. For Capilano, this benefit will largely go to its suppliers.

Additionally, 50 per cent of its raw honey supply is now coming from its own or controlled hives, as opposed to Capilano sourcing 100 per cent of its raw honey from third parties. This means that Comvita should benefit in terms of rising margins and returns from appreciating raw honey prices resulting from supply constraints in the broader industry. For Capilano, this benefit will largely go to its suppliers.

Comvita has the potential to benefit from regional industry supply constraints, its premium product positioning in Manuka honey, and increasing Chinese awareness of international brands and food safety issues. While the limited liquidity of the stock rules out adding the stock to our funds, the company could be well positioned for medium term growth.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Luke Joseph

:

Hi Stuart

I note with amazement that Comvita reported strong results and yet dropped 6%. Laughably the reasons given by the press for the decline was that the company cut its dividend to reinvest in growth opportunities, thus making it less attractive to yield investors.

To me this seems like an opportunity.

Stuart Jackson

:

Thanks Luke. We are seeing some savage market reactions to outlook statements from high growth/multiple companies that do not meet the market’s expectations for growth. Reinvestment in critical to ensure ongoing growth. If the opportunity is there reinvest at high rates of return, shareholders should be rewarding companies for retaining capital. If the share price fell because the dividend was cut for this reason, then it provides more evidence of why current global monetary policy decisions could in fact be reducing business investment rather than stimulating it.

Michael

:

Thank you for sharing your views on CVT, was wondering when will they finally get noticed seeing how CZZ has done so well. ALU has also been a great investment thanks to your insights.

Just a side note, at the Montegomery Fund, does your valuation metrics/techniques forbids you from investing in companies that are not yet profitable? if so, could you potentially forego on opportunities such as REA, SEK and CAR during the early years when it was still loss making? even though the story was truly compelling and you could see the major theme of advertising dollars moving online from traditional media?

The stock I am investigating is Catapult Group International (CAT), I am sure there is nothing we have not heard before when it comes to blue sky forecasts. Therefore I am interested to know what the Fund’s approaches are regarding such an investment, after reading the recent post on SEN of which the business turned the corner late 2013 and hence the share price.

thanks you in advance.

Stuart Jackson

:

Hi Michael, we are not forbidden from investing in companies in unprofitable companies but the process makes it far less likely. This is designed to reduce risk in the portfolio and improve capital preservation

Michael white

:

I must disclose I hold capilano and Bellamy’s. How is the Montgomery fund positioned for the massive uptake of our agriculture and value added products. I see great growth prospects in some of these little Aussie battlers

Stuart Jackson

:

Hi Michael,

As rule, pure agriculture exposure tends to be very capital intensive and low return. While the outlook improves with the fall in the Australian dollar and increased Asian demand might resulted in improved economics, the industry is likely to remain relatively challenged from a pure commodity production perspective. The opportunity for real wealth enhancement are more likely to come from company’s that can develop real brand equity on a sustained basis. We hold both Isentia and SEEK, which are taking Australian intellectual capital to Asia. There aren’t a lot of company’s that are really leveraging those opportunities at present, particularly those with significant enough size and liquidity to make them investible for the funds. The two global funds can a far greater opportunity to benefit from this thematic through stocks like Apple and Alibaba.