Sorry is the hardest word

As we head into another reporting season, we have taken a quick look at recent trading updates from companies and what this might tell us about what to expect from results.

The lead up to reporting season is often referred to as confession season. The confession season started earlier than normal this year with a few of the companies that downgraded market expectations ahead of results last year releasing trading updates in April and May. These included Woolworths, Nine Entertainment and Flight Centre. This brought forward some of the market’s disappointment.

In May 2016, there was almost twice as many trading updates that revised guidance compared to the prior year. The announcements were also spread across a range of industries such as insurance and financials with downgrades from AMP and IOOF, IT with SAI, retail with Flight Centre and Wesfarmers. Offsetting this, there were also upgrades from Bluescope and Nick Scali.

As we moved into June, the announcements dried up, with the main downgrade of note coming from Amcor.

In July, the announcements have been more balanced with downgrades from Primary Healthcare, AGL, Asaleo and Austal offset by upgrades from TWE, Fantastic Furniture and a second upgrade from Bluescope.

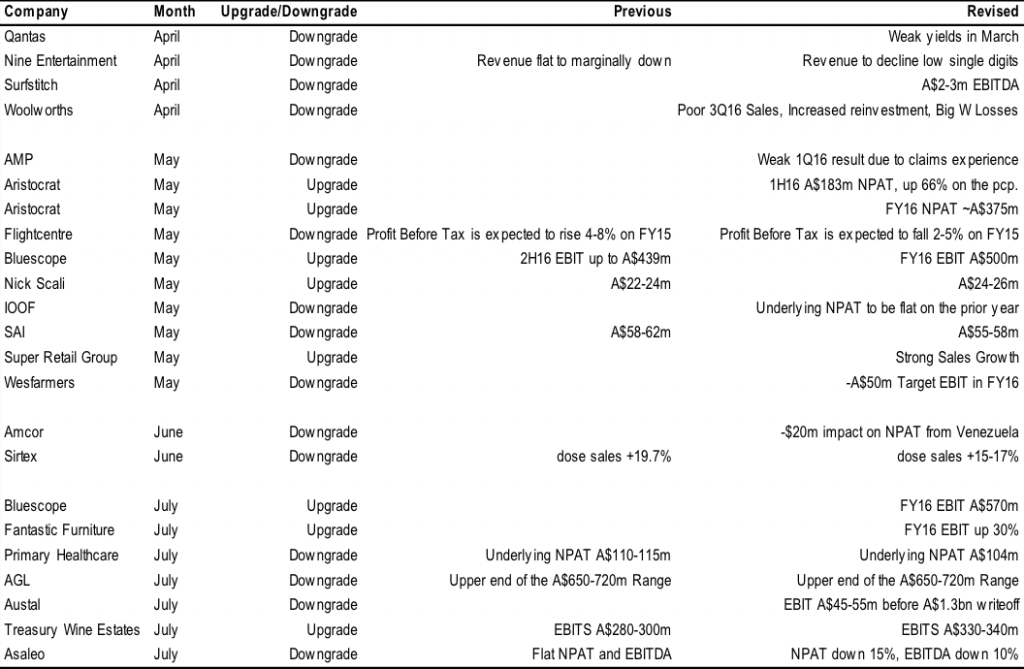

The table below provides a list of a number of the confession announcements over the last few months.

Overall there were fewer updates than in previous years. This could be due to business conditions being more stable, albeit with growth remaining at below trend levels. Alternatively, it could mean that we are in for more surprises than normal when the results are released next month.

The recovery in commodity prices in the 6 months to June are likely to have been supportive for the earnings of resource companies during the period. However, with expectations for further US Fed rate hikes having been deferred, a rising Australian dollar could result in more cautious outlook statements from these companies.

In the consumer segments, there are likely to be mixed results. Specialty discretionary retailers like Nick Scali and Fantastic Furniture appear to have generated strong revenue growth, as have the department stores. However, 2 of the 3 major discount department stores continue to struggle in terms of revenue and margins, while Kmart goes from strength to strength.

The market will be looking for any signs that Woolworths’ reinvestment in price is starting to gain traction with consumers. The signs to date have not been good.

The Asaleo announcement shows that it remains difficult to recover cost increases for suppliers to the major supermarkets as the increasing retail price competition in groceries is pushed up the value chain.

For the banks, we will be looking for signs of increased net interest margin pressure in the full year results of CBA and Bendigo as well as the quarterly trading updates of the other banks. The market will also be focused on asset quality issues to see if the May results represented a building of momentum or merely a one off spike.

The recent appreciation of the Australian dollar combined with increased uncertainty globally is likely to lead to more cautious FY17 outlook statements from management. It will be interesting to see if this causes some issues for the market given the recent rebound in share prices following the Brexit sell off.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY