Reflecting on Analyst Valuations

Reporting season is well underway now, and if you had to sum up progress to date in a single word you might choose something like “disappointing”.

Results for the financial year just ended haven’t been too diabolical, but more than a few companies have provided underwhelming guidance for FY16, and been sold down sharply as a result. Some notable examples include: Ansell, Flexigroup, Cochlear, Downer and Computershare. More broadly, the equity market has fallen more than 6 per cent since the start of August.

When a company provides guidance that falls short of market expectations, it’s interesting to think about whether it is the company that has disappointed, or whether analysts might have just been assuming too much, particularly in an environment where economic growth is a bit lacklustre and robust earnings growth hard to come by.

In considering this, it’s worth keeping in mind that one of the key drivers of analyst forecasts is share prices. That might sound like we have it back to front, but if you examine some historical data on analyst target prices and share prices, I think you’ll agree that target prices tend to follow – not lead – share prices.

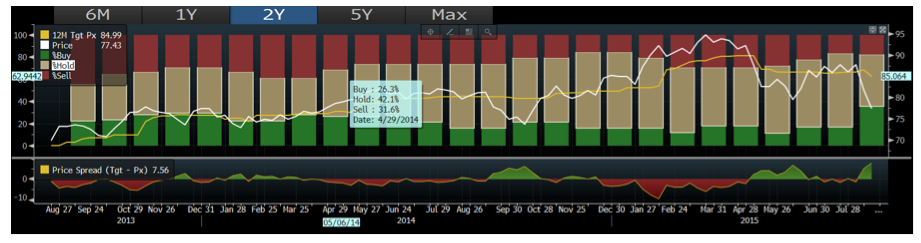

The chart below provides an anecdote to illustrate the point. The white line is the CBA share price, and the yellow line is the average broker target price for CBA for the last two years. Every now and then you’ll see the yellow line takes a step up or down. You’ll also see that those steps tend to occur when the share price has moved away from the target price, and the steps tend to bring the two more closely into alignment. One of the forces at work here is analyst career risk. It’s a very bad look to be a long way from consensus and be wrong, so analyst target prices tend to cluster together somewhere in the vicinity of the share price. When the share price moves too far in one direction, some repositioning of target prices will often follow.

One of the forces at work here is analyst career risk. It’s a very bad look to be a long way from consensus and be wrong, so analyst target prices tend to cluster together somewhere in the vicinity of the share price. When the share price moves too far in one direction, some repositioning of target prices will often follow.

So when we have a period of strong share price growth in the Australian equity market (as we have had since mid-2012), there is a need for target prices to….adjust. A good way for this adjustment to happen is for relatively favourable earnings growth assumptions to be incorporated into DCF models. In this way, you get a curious cycle of share price growth leading to higher consensus earnings expectations leading to greater potential for consensus disappointment.

It would be fascinating to see what broker valuations would look like if we could somehow hide the share prices from the analysts when they prepare their models. If you try this one at home you’ll quickly see that it can be surprisingly difficult to establish a valuation without knowing roughly what the answer should be.

You might also find that it can yield some genuine investment insight.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.

Hi Tim,

As an aspiring analyst, I wonder if you’d have any tips for me – I want to have a career, but I don’t want to fall into the same traps as others. Can I be truly independent in my views and valuations while working at a major research house or broker, or is this something I’ll have to reserve for when I am able to work for a more boutique manager?

Hi Patrick. I think it’s easier to be independent if you’re working for a funds manager and your work doesn’t need to be published to the market. There are a lot of good analysts working for brokers, but the realities of career management seems to limit their independence.

In response to Michael comment, you can’t pick all the winners!!

The ‘analysts’ are certainly in overdrive at the moment. I don’t like it when I see price targets in the mainstream press targeting novice investors. And often there is hardly any justification provided for the target price.

Best to turn off the noise and DYOR as you mention.

Hi Tim,

Many thanks for your post.

Just received my copy of Value.able. Would like to know something about how you came up with the idea of divesting from Resources Industry in 2012 at a time when nothing hinted at end time for the “Boom”. Roger briefly mentioned this on Switzer show last week.

Regards,

Brian

I wish the fund took a long term view and held dominoes, capilano honey and blackmores. trade on high p/e but extremely high quality businesses. Excellent results reported.

Hi Michael. We agree that taking a long term view is critical to value investing. It’s not for want of time horizon that we don’t own the businesses mentioned.