Looking to: US Tapering

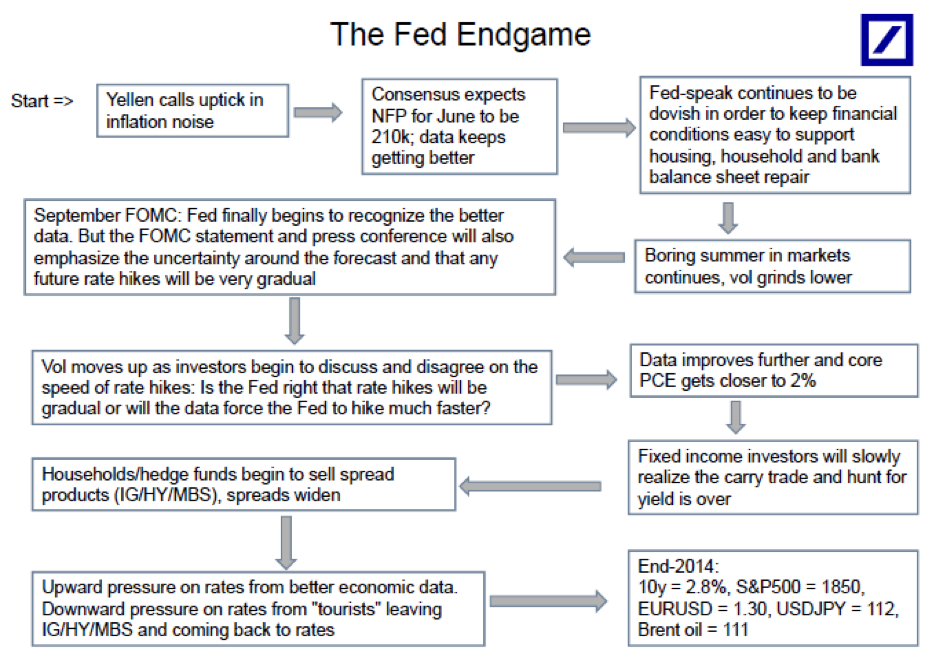

Deutsche Bank has circulated its predictions of Federal Reserve actions for the next six months.

While not discounting the impact the Fed has on global markets, our focus as value investors is identifying the underlying value of individual companies, which means that we maintain an active interest in Fed actions, but do not conduct deep analysis on policy decisions.

We do feel however, that an alternative scenario may play out over the next six months. You see, US GDP growth in the March 2014 quarter was anaemic and was unable to be explained away by the polar vortex. At the FOMC Meeting in June, the Fed revised down its 2014 GDP growth forecasts from a range of 2.8 per cent to 3.0 per cent, to a range of 2.1 per cent to 2.3 per cent. This makes us wonder if the underlying strength of the US economy is enough for the Fed to stop tapering.

A disconnect may also potentially develop between sluggish GDP growth and the improving unemployment rate. The current federal unemployment benefits system provides people who lose their jobs with 26 weeks of payment, in contrast to the 73 week window that was in place before December 2013. This results in an increasing number of people dropping out of the labour force which artificially lowers the unemployment rate (unemployment is defined as people without a job who are making efforts to find employment). This is an important consideration, given that the Fed has now tied itself to achieving a natural unemployment rate of 5.2 per cent to 5.6 per cent.

The current US 10 year bond rate is 2.5667 per cent.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Patrick Poke

:

This is a bit more specific than what im used to from you guys, but i agree wholeheatedly. Personally I’m avoiding yield assets (although theyre not generally a bit portion of my portfolio anyway) as i fear thats where the asset bubbles are forming. Hopefully if it all plays out as you suggest we might see the AUD revalue to a more appropriate level.