It’s the End of The World (as we know it)

When Michael Stipe of REM wrote The End of the World as We Know It and penned the lyrics, “A tournament, a tournament, a tournament of lies, offer me solutions, offer me alternatives, and I decline.” He wasn’t thinking of the 2016 US Presidential Elections nor the resistance of consumers to lower and lower interest rates but he may as well have been.

As we discover lower interest rates are forcing up savings and pushing down consumption, and everything we thought we understood about the economy has been turned on its head, we must be nearing the end of the world as we know it.

The following is a selection of insights and comments paraphrased from the presentation given by former Soros Funds Management Managing Director Stan Druckenmiller* called The Endgame on Wednesday May 4, 2016 at the 21st Annual Ira Sohn Investment Conference in New York.

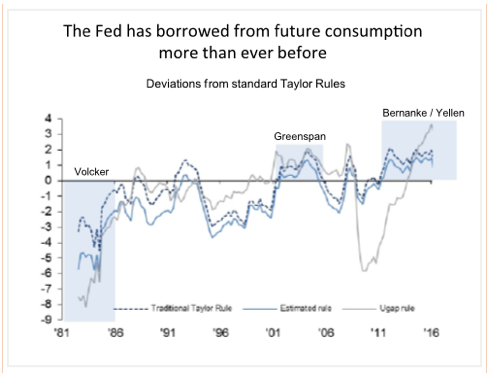

By way of background, at the 2005 Ira Sohn Investment Conference Druckenmiller looked at the Fed Policy setting deviation from Taylor rules and concluded Greenspan was sowing the seeds of a historical housing bubble. He was right then and in this presentation he suggests the deviation is even greater.

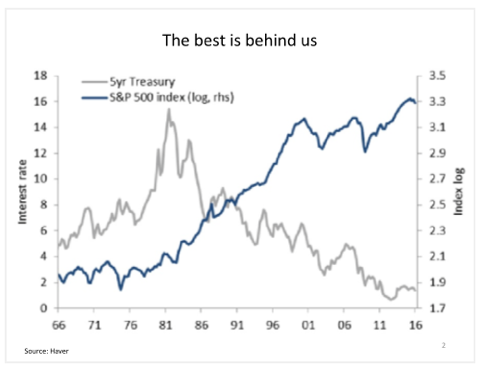

Back in 1981, the risk free rate of return as represented by 5-year treasuries, was 15 per cent. Real rates were close to 5 per cent. Assets were priced very cheaply to compete with high risk free rates. What ensued was one of the greatest bull markets in financial history.

In addition the 15 per cent hurdle rate forced companies to invest capital wisely and where necessary restructure.

So how can precisely the opposite environment to that which existed in 1981 also be a great investment environment?

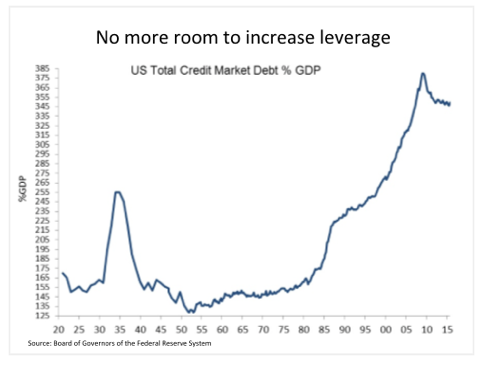

Not only were prices low in 1981 but financial leverage was less than half of what it is today. Back then credit-fuelled growth lay ahead. Today it does not. GFC-response policies have discouraged de-leveraging. In fact leverage has risen.

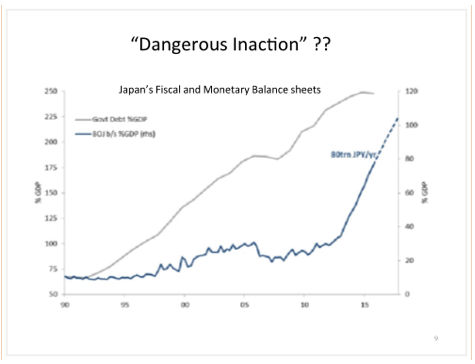

By most measures we are deeply entrenched in the longest period of excessively easy monetary policy ever. During the recession 08/09 rates were set at zero and the Fed expanded its balance sheet (QE) by US$1.4T. After the recession ended, the Fed expanded their balance sheet by another US$2.2T. Today unemployment is below 5 per cent and inflation is close to just 2 per cent. Yet expansionary settings remain in place.

With this data in mind, if the Fed was using an average of previous Fed Chairmen Volker and Bernake’s settings implied by so-called Taylor rules, the Fed Funds Rate would be closer to 3 per cent rather than today’s 0.50 per cent.

Druckenmiller describes the current policy as the “longest dovish deviation from historical norms I have seen in my career” and contrasts the [current] obsession with “short term stimuli with the structural reform mindset back in the early 80s.”

“The Fed’s objective seems to be getting by another 6 months without a 20 per cent decline in the S&P and avoiding a recession over the near term” compared to Volcker’s willingness to sacrifice near term pain to rid the economy of inflation and drive reform.

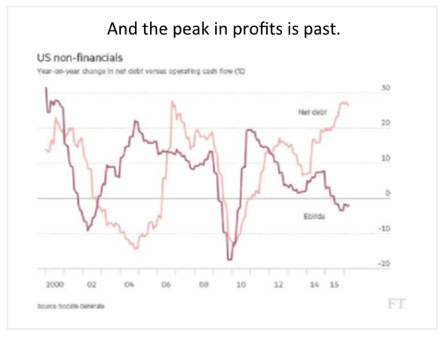

The peak in operating cash flow was five years ago in 2010 and has turned negative year over year even as net debt continues to grow at an incredibly high pace. Never in the post WWII period has this occurred. Even prior to the great recession they only diverged for two years. Today’s 5-year divergence is unprecedented.

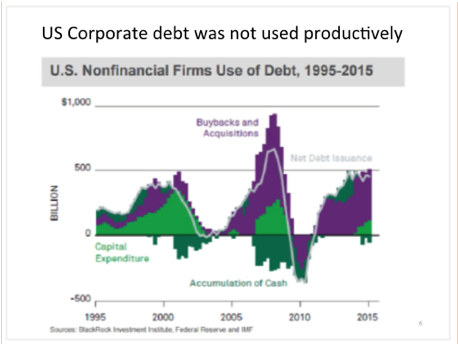

And the use of that debt in this cycle has changed. In the 1990’s the debt was used to finance the construction of the internet, but today its been used for share buybacks and M&A – financial engineering not productive investment. Despite no increase in interest rates, while growing borrowings by US$1.7T, the profit share of the corporate sector peaked in 2012.

According to Druckenmiller the corporate sector “is stuck in a vicious cycle of earnings management, questionable allocation of capital, low productivity, declining margins, and growing indebtedness. And we are paying 18X for the asset class.”

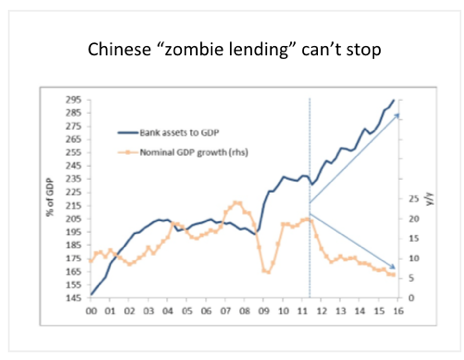

A second source of myopic policy settings is evident in China. In response to the GFC China embarked on a US$4T stimulus program. On top of ten years of infrastructure investment the stimulus aggravated overcapacity on the investment side of the economy. In 2012 Druckenmiller was worried about bank assets to GDP. Credit has increased by 70 per cent of GDP in the four years since then. The Chinese banking sector has allowed credit to grow by the entire Brazilian GDP per year! And all this credit growth has “been accompanied by a fall in nominal GDP from 15 per cent to 5 per cent.” Druckemiller suggests a large part of the growth in credit must have flowed to otherwise insolvent borrowers. How else can we describe the absence of non performing loans in industries hit by a slump in prices and sales growth?

A second source of myopic policy settings is evident in China. In response to the GFC China embarked on a US$4T stimulus program. On top of ten years of infrastructure investment the stimulus aggravated overcapacity on the investment side of the economy. In 2012 Druckenmiller was worried about bank assets to GDP. Credit has increased by 70 per cent of GDP in the four years since then. The Chinese banking sector has allowed credit to grow by the entire Brazilian GDP per year! And all this credit growth has “been accompanied by a fall in nominal GDP from 15 per cent to 5 per cent.” Druckemiller suggests a large part of the growth in credit must have flowed to otherwise insolvent borrowers. How else can we describe the absence of non performing loans in industries hit by a slump in prices and sales growth?

“As a result, unlike the pre-stimulus period, when it took $1.50 to generate $1.00 of GDP, it now takes $7.00.” This is reminiscent of the sub prime era in the US when debt needed to generate a dollar of GDP increased from $1.50 to $6.00.

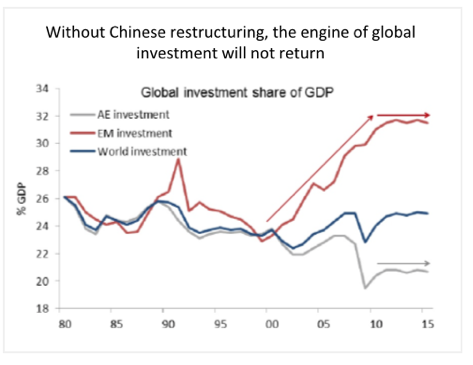

China doesn’t need more houses funded by investment focused debt stimulus.

This will remove a major cylinder from the engine of global economic growth.

This will remove a major cylinder from the engine of global economic growth. Short term fiscal and monetary stimulus only produces a short term “sugar high” and grows unproductive debt that impedes growth. This is exactly what Ray Dalio from Bridgewater describes as the end of the long term debt cycle. Despite unprecedented stimulus, global growth continues to decline which suggests Ray Dalio is right and we have borrowed from the future.

Short term fiscal and monetary stimulus only produces a short term “sugar high” and grows unproductive debt that impedes growth. This is exactly what Ray Dalio from Bridgewater describes as the end of the long term debt cycle. Despite unprecedented stimulus, global growth continues to decline which suggests Ray Dalio is right and we have borrowed from the future.

“Higher valuations, three further years of stimulus (since Druckenmillers previous forecast that stimulus at the time would propel prices higher – which it did), unproductive corporate behaviour, limits to further easing and excessive borrowing from the future suggest the bull market is exhausting itself.”

“If we have borrowed from the future and markets value the future, we should be selling at a discount, not a premium to historic valuations.”

In 1982 the market sold for 7X on depressed earnings and with dozens of rate cuts and productivity improvements ahead. Today we’re at 18X inflated earnings, with productivity (margins) declining, no further ammo on interest rates.

“While policy markers have no end game, markets do.”

*Stanley Druckenmiller is Chairman and Chief Executive Officer of Duquesne Family Office LLC. Mr. Druckenmiller founded Duquesne Capital Management in 1981, which he ran until he closed the firm at the end of 2010.

From 1988 to 2000, he was a Managing Director at Soros Fund Management, where he served as Lead Portfolio Manager of the Quantum Fund and Chief Investment Officer of Soros (1989-2000), and had overall responsibility for funds with a peak asset value of $22 billion. Early on in his career, Stan worked at Pittsburgh National Bank and The Dreyfus Corporation.

Mr. Druckenmiller is Chairman of the Board of the Harlem Children’s Zone; a Board member for Memorial Sloan-Kettering Cancer Center and the Environmental Defense Fund; a member of the Investment Committee of Bowdoin College and is Co-Founder and Board member of Kasparov Chess Foundation. He graduated magna cum laude from Bowdoin College with degrees in Economics and English, and thereafter earned graduate degree credits in Economics from the University of Michigan.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

Hi Roger

Fabulous article, many thanks. “The Chinese need to depreciate their currency, but won’t. The US needs to raise their interest rates, but don’t.” The Japanese have tried everything for a generation etc, etc. The most significant graph is 5 year treasuries vs S&P 500 log scale historical graph.

The circumstances remind me of an old Bugs Bunny cartoon…. mice don’t want to eat cheese and so want a cat to eat them. Cat has sworn off mice for life and so wants dog to massacre him. Dog sits in front of adding machine and concludes…”It just don’t add up” and sees a passing dog pound truck and tries to hail it. The truck is the bet on Gold.

Hi Roger,

I’m still amazed that lowest interest rates on record does not cause alarm bells. How do we infer that this is the sign of a strong economy that justifies high real estate and stock prices? I think the RBA needed to cut 3 or 4 % in 2008 to get things back on track before they raised a little bit and it didn’t take long before they started cutting again. We always talk about borrowing from the future but given the debt buildup over the last 30 years I would argue that most of the Western world don’t really know any other universe. Central bank pursuit of inflation / GDP growth has encouraged ever lower interest rates (we need another measure of GDP that differentiates between productive and non-productive uses of capital). At the moment we operate under the belief that any fall in asset prices will be met by further central bank easing. People must remember that once confidence has been lost further easing has no effect. Roger I know your thoughts on Gold, however I would say that we are presently in a very unique set of circumstances where most/every major economy is reaching peak (private & public) debt and at the same time looking to devalue their currency to increase competitiveness. Those two observations would point to lower asset prices and at some point in the near future a rush to safety. Will USD or JPY continue to maintain safe haven status with current policies?

My view on Gold is that it is simply a bet on other peoples fear increasing, and that is very difficult to predict consistently.

The investment implications are that people are moving up the risk curve. Hence property bubbles and high valuations on shares worldwide. It’s all getting too hard for the common investor.

All this stimulus is a massive experiment. There has to be a reality check. When is the key.

Surely it is time for countries to start re-examining whether the price of money should be set by a central bank as opposed to the market.

This makes for sobering reading Roger, but it’s the type of conversation that’s missing from the conventional discourse at the moment. In a world where advances in technology are creating significant efficiencies which result in deflation, where is the next driver of growth supposed to come from? Is the RBA just responding to the new norm of low inflation and competing currencies? Perhaps high P/E ratios is the best we can reasonably expect for the foreseeable future.

History does suggest otherwise. or you have to believe ‘this time is different’.

Hi Roger,

How on Earth did you manage to decipher a Michael Stipe lyric??

http://www.azlyrics.com/lyrics/rem/itstheendoftheworldasweknowitandifeelfine.html

“Short term fiscal and monetary stimulus only produces a short term “sugar high” and grows unproductive debt that impedes growth”.

That’s the key line for me, Roger. That growing unproductive debt (added to by increasing recurrent social spending…and just wait until the NDIS gets cranked up) then results in increasing procurement of funds from ‘the productive’ to service/pay back this debt. The productive companies and individuals then have less capital to grow and then even if they succeed they get walloped by the tax man again and then have less to grow the next year than they would otherwise.

Result: high debt and unproductive government spending (which is most of it) => higher taxation => lower profits => anaemic growth which successive governments try to bolster by further stupid unproductive spending => higher taxation => lower profits etc etc.

Who knows if there’s going to be a crash but I feel reasonably confident that we will have an extended period of insipid growth at best. I think it will be difficult for the productive part of the economy to get going until there is tax relief and easing of the IR scene and good luck with that.

Might as well get used to it.

Great article Rodger, when you discribed the zombie lending in China I wondered how many other zombie companies and investment properties etc are out there in the rest of the world that survive solely because of rediculesly low interest rates and now in the U.S. they can’t even raise rates with full employment for fear of killing the zombies and triggering GFC mark2 it’s symptomatic of society’s long term drift to the left where we are all entitled to everything you can emagine and no one is responsible for anything, including a States economy. Although I do recall one politician recently who took on this foolish notion of responsibility and was quickly shown the error of his ways, Campbell Newman learnt his lesson. I think future generations will look back at us and see a bunch of spoilt brats who stole their opportunities and paid them with debt as a society we should be ashamed.

Regards Andrew

Roger thanks for posting. Any comments on druckenmiller and his gold comments ?

Go ahead and post them if you’d like to.

Dare I say it. Lowering interest rates does not make it better. It makes it worse. What more proof do we need than what is going on in the worlds economy right now. Not to mention the 25 years of proof accumulated from Japan. The central bankers fancy theorys are dead wrong. Further proof is their constant purchases of bonds. It does not stimulate anything other than lowering interest rates because the electronic creation of dollars never leaves their balance sheets. The money they created is still there. They have just swapped cash for cash that pays interest (bonds). Central banks buying bonds is actually deflationary as taxes have to be extracted from the economy to pay the principal and interest payments. Once the bond matures the money evaporates. It dissapears into the central bank which is not part of the economy. Money is only created when the government borrows. It is the bond that is created out of thin air. The more they borrow the more money that is created. However their borrowing capacity is nearing its limit and when rates rise that is the black swan.

I read here a while ago that governments know what they have to do, they just don’t know how to get re-elected after they do it. I fully expect that the debt that successive Australian governments have racked up in a mere 9 years will not be paid off in either my or my children’s lifetimes.

I hope we get Ray Dahlio’s “beautiful deleveraging”. We won’t. The market always wins.

Mark, I Googled and just viewed Dalio’s Economic Machine video – fascinating and simple.

The animation and Rogers commentary really questions about where we are in the cycle; country, individual markets (housing currently) and also in my small business. Evidence we are starting to see here in Perth and regional WA suggests there is still a lot more to pan out………

Thought provoking as always

Link to video for those that have not seen Dalio’s work http://www.economicprinciples.org/