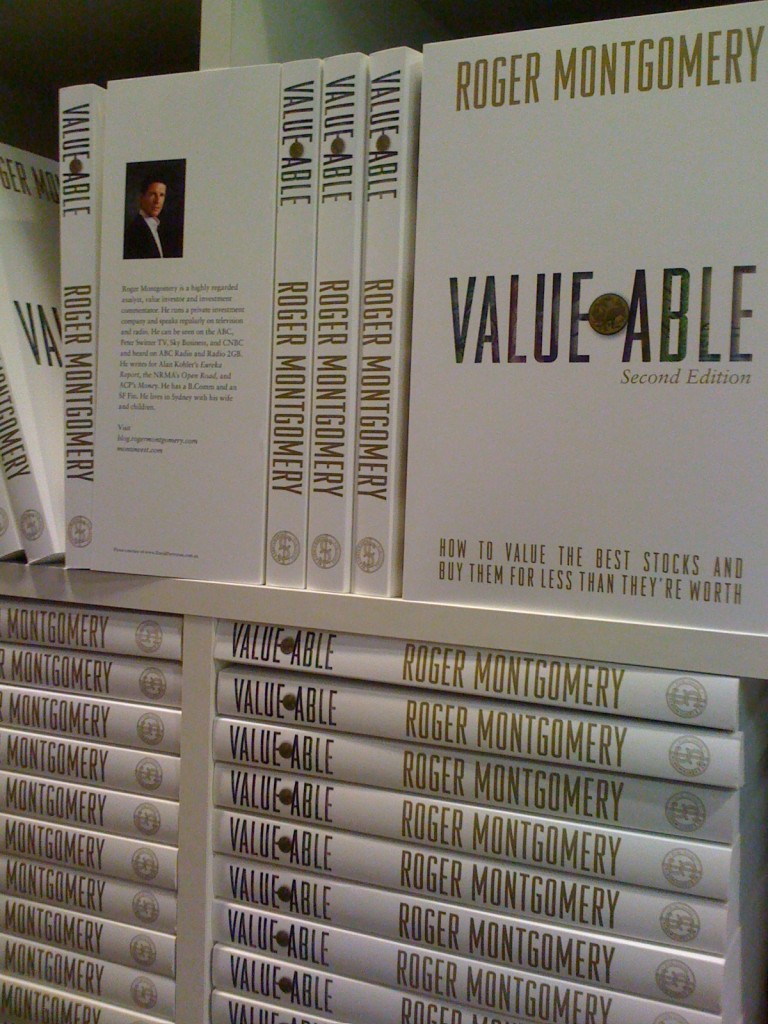

Is that the Second Edition of Value.able?

Walking into the stores of some of my ‘A1’ MQR companies lately, it is clear that Christmas is just around the corner. Here at Montgomery Inc, Value.able Second Edition has just arrived.

Walking into the stores of some of my ‘A1’ MQR companies lately, it is clear that Christmas is just around the corner. Here at Montgomery Inc, Value.able Second Edition has just arrived.

At under $50, Value.able is not only easy to wrap, it’s the gift that keeps on giving all year round (and you don’t have to brave the local shopping centre)!

Many First Edition Graduates have asked me the question “what’s new in the Second Edition?” Aside from an added Appendix, the Second Edition contains all the information of the First Edition that had such a positive impact on people like Graham, who wrote;

“I’m somewhat of a minimalist and love it when I get a book where it makes me feel like I can throw away all the other books I have on a subject – this is such a book!!”

Value.able Second Edition is $49.95. The price includes GST and postage to anywhere in Australia (allow 7 business days). You may be able to claim a tax deduction, although you’ll probably want to check.

Visit my website to purchase your copy. And after reading it, please share your thoughts about Value.able, at Leave a Comment here at the blog.

Posted by Roger Montgomery, 19 November 2010

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Walking into the stores of some of my ‘A1’ MQR companies lately, it is clear that Christmas is just around the corner. Here at Montgomery Inc, Value.able Second Edition has just arrived.

Walking into the stores of some of my ‘A1’ MQR companies lately, it is clear that Christmas is just around the corner. Here at Montgomery Inc, Value.able Second Edition has just arrived.

Hi Roger, I loved your book. and consider it to be the best I have read so far. However, I am getting much lower iv’s than you seem to be getting and can’t see why. Otherwise, great stuff! I shall wait for oppotunities to present themselves and try to follow your methodology. Kevin Woolfe

Hi Kevin,

Thank you for your kind words about my book. Feel free to throw up some examples with your inputs as others are doing and we can open a discussion.

Book arrived – unfortunately Australia Post appears to have run over it! Tyre marks on packing and book bent but still readable.They duly apologised in writing but as the packing was opened they asked me to advise if anything other than the book in there. i.e disc etc.

Perhaps you could ask them what course of action you can take to see they cover the relatively small cost of a replacement. I am sorry to hear Aus Post did that. …and to think that they want to start a bank!

Roger

Just got the book today, skimmed through it fast, read the intro,..but couldn’t handle it, had to skip straight through to the section on valuing a business (I’ve been to one of your presentations and listened to a few other podcasts, so I get the gist of basics. I’m going to take a piecemeal approach to your book)…got my spread sheet going already…the more I run the numbers the better I understand it.

I’ve read a bit on Ole Man Graham, and I guess its also Ole Man Buffett, but you’ve made the subject a bit clearer for me. Thank you for that.

Ty

Ed. I did say ‘today’…clearly I meant yesterday…Ty

Hi Ty,

Don’t do it!!!! The competitive advantage and cash flow chapters are more important.

As someone who has received and read the book, i completley agree with Roger. you will be doing yourself a great disservice in your development as an investor if you skip through to the calculating IV part.

That chapter although interesting and is obviously the sexy part of the book as it is the one most seem to focus on, the other chapters are the most informative, interesting and insightful chapters for those looking to develop as they go straight to the important part of identifying great businesses and will give you far more insight into what is and not a good investment than simply calculating IV.

My advice is to read the whole book first, take some notes down, then use the piecemeal approach if you must. I read and re-read the cashflow chapter over and over again and i am starting to improve in that area. However you do not in my opinion need to do this with the calculation part.

Calculating the IV is the end process, not the beginning. So start at the beggining and develop your skills in identifying great businesses. Focus on the ROE, Cashflow, Competitive Advantage and Debt chapters.

Learning these skills will help you far more than the ability to calculate IV will, as without these you will not be able to tell whether the inputs you are generating are an accurate reflection.

Is the ROE levels sustainable? how will hardtimes affect the company? Does this company have an advantage that puts it above their competitors and there for the ability to consistently do better than their competitors? Are the managers making decisions on the best interests of the shareholders or their bonus payments?

These questions are the heart of it all, it can’t be answered by calculating IV. Don’t be tempted into focusing on one part, looka t the whole picture and you will find yourself performing better as an investor than you can imagine.

You’ve got it Andrew. Well done. A small challenge for me now that I have historical and forward valuations for every single listed company is that its easy to look at the valuations first. Quality however comes first.

Yes, Andrew nailed it with his comments, I reckon. Once you’ve established that a business has a sustainable advantage, there are many ways to estimate its value (and Roger’s is certainly very sensible), but it is the earlier chapters in “Value Able” that are, for me, the most, er, valuable. These really focus on what’s important — the discipline of investing, if you like — by providing straightforward methods and “mindsets” to help identify better businesses. I’m very grateful to Roger for these well-articulated chapters. (Valuation methodologies are there mainly to put a choke-chain on my enthusiasm AFTER I’ve identified a fantastic business.)

(Just out of interest, Roger, do you ever short the shockers??? I know you warned us off iSoft.)

Cheers,

Brian.

Hi Brian,

Yes, Isoft was over 60 cents when I first suggested it was a candidate for collapse. I think it now trades at 6 cents. I have shorted stocks where I think the company is of inferior quality and absurdly expensive – the only thing I need that I don’t look for on the long side, is a catalyst. I like an event that is going to get other investors to reappraise the situation. The other things I like to see, in combination with low MQR and negative safety margin, can be summarised into four headings that other shortsellers have mentioned as well; This is because the downside risk from a short is – Booms that go bust (debt fuelled asset purchases where the assets will not produce enough income to service the debt), Consumer fads, Technological obsolescence and perhaps the easiest – flawed or inadequate accounting.

Right, Got it…look for a moat around the business with a flowing river next it.

Hi Roger

Congratulations on the 2nd edition. If it went in bookshops the secret would be out! In the last 25 years I have only met 2 true value investors who became close friends. Lots of people profess an interest in value investing but very few understand, including many brokers and money managers. Your book is a bible to those new to the game. It represents the core values of true value investors. Whilst I got most of the way there over the years I was stumped at how to calculate IV. It was the final part in the jigsaw puzzle. As an example look at NVT with high ROE, low debt and rising stock price( I know you hate price and P/E) – I could not figure why it had such a low IV. Then the penny dropped ( in the middle of the night) it’s the E that is the problem. It’s so low. Many thanks and I wish we could all meet and have a party. Until your blog arrived I felt like someone that grew cacti and was the only one in the world with bandaids on my fingers. My library is full of Graham( thank you Janet Lowe), Buffet, Fisher, Neff, Lynch, Wroth, Soros, Train etc. and now MONTGOMERY who summarises the lot and adds IV. I just tell friends now to read value- able and live in hope they do. Keep up the good work.

Thanks Brian for those kind words. Let me remind of course that no valuation model is perfect and one has to make compromises in order to deal with things like infinity and perpetuity.

Roger,

I’m a big fan. And you are the only person outside of the entertainment business and sporting arena who I would say that about.

I finally got around to reading a Buffett bio a few years ago, in the midst of the downhill slide of early 2008. Despite the stock market doom and gloom everywhere at the time, the Buffett story compelled me to want to really hook into shares. And I started to dabble; in my naivety, I concerned myself very simply with book value as a way of valuing companies. But I was having a lot of fun researching and buying bits and pieces.

I started watching Market Moves and after a few weeks, got a bit of a feel for the regular guests. It became very apparent after seeing you on a few times, that you were the bloke I was most keen to listen to. I think the Buffettesque approach was resonating with me.

Then, after coming across your blog, etc, I realised I wasn’t alone in my fandom.

So, naturally, I had to get Value.able, and I worked my way through it like a fat kid on a cream bun. It is a great read. And it is like Graham said – the only book I now need on the subject. I have been developing my own spreadsheet using the book’s teachings and now have something up and running that can pump out a (very basic) current and forecast IV with only about a minute’s data input from a company’s Commsec page.

[I know there is much more research needed prior to a purchase, but it does put me in the ball park very quickly of whether a company looks cheap or not.]

And the book has answered a question that has haunted me since becoming a Buffett man: When should I sell shares in a company.

The answer? After reading Value.able! For it became very clear very quickly after reading your book, that it was high time to sell some of my holdings … and I have, confidently.

Thanks mate.

I look forward to keeping up with you here as I refine and grow my humble portfolio.

Nolan

Hi Nolan,

Welcome to the blog and thank you for sharing your journey. I am delighted to hear that you are conducting your own research and of course when in doubt always seek and take personal professional advice. Indeed, do so anyway. Welcome again and I look forward to hearing from you here again.

Sorry, I have to ask the question. What exactly does the second edition offer over the first ?. Some of us have only just purchased the first edition. The advantage of evaluating this new edition in a bookshop, is the ability to examine the book for new aspects. After all, we are all looking for value here.

Roger, not all of us with a hotmail account are of the “ïtinerant demographic”. I for one have had this account for a long while now and would find it difficult to form a new account and then distribute this address to all my contacts.

I feel there are too many “devotees” on this blog and the question re what is exactly new to this edition needs to be asked, that would allow us to make an informed decision re buying it.

Roger, you were very coy about releasing information about your first edition, understandably, but I think buyers of the first edition, need to know what is the value in the second. Is there going to be new edition each year with release of information in dribs and drabs ?. Again, if this book was in bookshops we could easily make that decision ourselves.

Now, I expect a lot of criticism from the blog members, if this comment is posted at all, but these questions need to be asked.

Hi Es,

I think its good of you to ask. If you refresh your browser you should be able to see that the question has been asked before too. The second edition has a new appendix but is otherwise the same. The first edition was a hard back but sold out in 14 weeks. I am absolutely delighted you asked and there’s no need to worry about any difference of opinion because every time I buy shares I have bought from someone who sold and therefore disagreed with me. The book will not be available in book shops. ENjoy your first edition copy – buy yourself a second edition if you enjoyed it so much and thought it was so value.able that you can think of family and friends who might appreciate the gift!

Hi Roger,

I am not far from completing my aussie watch list. I could have done it in week or less but I have reno’s happening at home and have positioned myself in the market anyway. I am almost ready to research overseas company,s like crazy and would like a point to any research web sites that are equal or better than commsec.

A few friend’s of mine have gave me some which I have written down somewhere but haven’t had time to check out.

I would prefer 1 or 2 from you !

Thank you for all your help always!

I had 20,000 share’s of BSL @ about $ 3.00 before seeing and learning from you. BSL did not make my new watch list.

Roger,

Congrats on edition two and the spots on Sky Business at night

Thanks Roger. Received my copy today and now look forward to the third edition. Very nicely presented for a paperback edition too.

Peter

Thanks for your support Peter. Very much appreciated.

Hi Roger,

I want to get my hands on a copy ASAP, are they available at book stores yet? If so, which ones in Sydney?

Cheers

Tom

Hi Tom,

Your email address intrigued me. Do you really go by that one? Is it permanent or temporary? I have to admit I am not fond of responding to hotmail addresses generally. They tend to represent the itinerant demographic on the net. I am sure you have worked out where to get the book by now?

Hi Roger,

Just wondering if you have looked at the ERM float and any insights

Hi Roger,

I’ve been reading your posts and have ordered your book (2nd edition) but I’m in the US so I guess it will take a while to get here. I’m curious about your opinion on this, if you can answer this: do you think you should use income potential to value investment property, ie must an investment property be cashflow positive to grow in value and, if so, what rental yield should one target? many thanks, Jane

Hi Jane,

Thanks for your post,

please keep posting because we all like getting everyones veiws especially when they come from overseas.

That said, the answers are in the book. The valuation formulae in the book can be used to value every asset class.

i can’t comment on the US property market but there is no way I would Invest in the Australian propery market ever (Never say never i guess)

You will learn may skills in Rogers book particularly about leverage and return on equity.

We will leave it up to you to make up your own mind after that.

Happy reading Jane and I hope you get some insightful and invaluable momnets from reading the book

G’day Ashley,

The sort of circumstances that would result in property being an attractive class from a returns perspective would probably also see the stockmarket providing opportunities that are much better again. The only time I’d consider ‘investing’ in property (other than the family home which is more of a lifestyle proposition) would be for strategic purposes relating to my business….but even then, not at any price.

Hi Greg,

I agree entirely

Hi Roger

Once again a big thanks for time you gave me before and after the Newcastle seminar on forecast ROE. As you easily pointed out it was all under source info, as soon as I tried it I could not believe how easy it was. A special thanks to all those who also put time and effort of endless information on your blog. From the time I received the first edition back in June it has transformed me from a speculator to a value investor who is still in his early apprenticeship, but certainly starting to use the right tools of trade.

I do hope someday I can do something in return to show you just how grateful I am, as it is quite obvious to myself as well as others the amount of research and information you share is more then just value-able.

Loved the first edition and have just ordered a second edition,as have friends and family who will clearly benefit (and hopefully be hooked just like me) after indulging in it for the right reasons!

Thanks for the support Grant. I am delighted that more people will discover a rational approach to investing and turn away from blind speculation.

Hi Grant,

It was good to meet you after the Newcastle seminar. I knew you would work out the forecast ROE problem.

Congratulations Roger on the second edition. I am keenly awaiting its arrival. I have also had a huge transformation after reading and applying your insights.

Thanks a million Roger for all your time and effort and knowledge. You are really changing peoples lives for the better.

John M

A pleasure John M! Thanks for your support.

Hi Roger,

I was wondering your thoughts on Solco (SOO)

They are a very small company but have gone from a loss making position to a very profitable one in the past 3 years.

Their ROE is around 40% (has been increasing from 2% in 08 to 20% last year and 40% this year).

They are in the solar water/power business and look cheap.

Another good/cheap company I have looked at in the same space is AIR. Do you have any thoughts on either of these companies?

I have recently bought a small parcel of AIR. Great ROE, but I am afraid I may be guilty of speculating re competitive advantage. I do however have a view on electricity prices increasing and solar being a solution with or without government subsidies.

Hi Hardin,

I was just chatting with the CEO of a solar array importer and distributor. While we were discussing the grant/rebate structure at state and federal level we both did agree that there is evidence of demand for solar power even in the absence of incentives. The difficulty from an investment perspective is, as you have noted, the absence of a sustainable competitive advantage. Barriers to entry are not high and competition is fierce. While labour is largely contracted, inventory can eat into margins. The view from the industry is that the threat of the emergence of superior technology is low. of course one shouldn’t ask the barber whether one requires a hair cut.

Hi James,

Barriers to entry and imitation?

To Roger’s questions add the implication of the pull back of Governments’ subsidies for solar installation. I’d say this horse has run its race!

Afternoon Roger,

Thankyou (x3) for value-able and your tremendous help through the year. Because of you I’m not exaggerating when I say my investment strategy has been transformed…along with the results…and I can’t thank you enough.

Re: the second edition, I’ve ordered 2 copies today for family members in the UK (they will have to fight over final ownership, but I think it’s worth the fight!).

Once read, I’ve no doubt they will know that Santa’s been extremely kind to them this year.

Cheers,

Mark H

BTW, Agree with the guys on here re: the great info on the Spizer show. Congrats on that.

Thanks for the support Mark H. I can confirm that Value.able has now travelled to more places around the world than me. And I couldn’t be happier.

Hi Roger,

I misread your opening paragraph and for a moment thought it was a photo of a bulk stack in a book shop!!

Good luck for the sales of this release, I hope it sells out as fast as the first edition.

By the way, when do we get our Christmas homework?

All the Best

Scott T

Not long now Scott but its not Christmas just yet. Did you sneak downstairs and open your presents early when you were younger?

Hi Roger,

Now that the second edition has hit the book shelves, how about arranging a graduation party. This way the regular bloggers can put a face to the peope they communicate with.

Hi Roger,

I had a chuckle when I read that “minimalist” quote. It reminded me of myself. In fact, just last week I removed several investment books from my library. Books that, after reading Value.able, I deem to be surplus to my future needs. Congrats on the 2nd Ed.

Regards,

Craig.

Thanks for that Craig. I am delighted to hear there are other ‘efficiency drivers’ around.

I would gladly post a positive review of this book. This is by far the best book on investing and value investing that i have read out of the vast number i have read.

Roger, as anyone who reads this blog will know, puts forward his vies in such an easy to understand manner that no matter what your experience in investing is, you will easily grasp the content and be able to put it into action.

The case studies are brilliant and has significantly improved my investing.

Buy It!

Hi Roger

I have the 1st edition and love the book. What is in the added Appendix of the 2nd edition? Should we buy the 2nd edition just to get the added Appendix?

Cheers

Dean

The Appendix covers my thoughts on pre tax and post tax investors required returns. Of course you should pick it up as a Christmas gift for that difficult to buy person. If you have adult children or parents who have been wayward in their investing, they will enjoy the Appendix.

Hi Roger,

In my eyes, Dean’s question is a measure of the integrity you are building via this blog. By comparison, I doubt anyone here would walk into a used car dealership and say “Should I buy this car”?

Regards,

Craig.

Thank you again Craig. I sincerely appreciate everyone’svery encouraging words.

Hi Roger,

Would you be interested in publishing the new appendix on your blog for those owners of the first edition?

I don’t mind buying another copy to read it and then giving it away but if many of the first edition holders buy for the appendix they might deny other people the chance to buy the book….

Hi Matthew,

Is that like buying a 2010 model car, subseuqnetly discovering the new 2011 model has air-conditioning and alloy wheels and then asking the car dealership to fit air conditioning and new wheels to the 2010 model you purchased? I have lots more to say, so drive the First Edition until the cover falls off (try to avoid taking into surgery with you again!) and then see whats available at that time. We can discuss when I am next in Adelaide.

Yes it is :) thanks for eloquently answering what I’m sure a few are thinking

On a side note I went in to a Cash Converters store today – busy with customers, helpful staff, huge margins on their items, slow stock sell-off about every 3months (but they said other stores can be as often as every month), but what I found most interesting was that they have a strong repeat customer base because their items are turning over on a regular basis buyers come back every week to check what is new since their last visit

Note, this was a franchised store, corporate stores are likely to be different

My concern would be their inventory management & how they control their purchasing – I’m going back their later today & I’ll report

Thanks Matthew,

Long term competitive advantages are something to look for. I have referred to these previously for this company and wrote about such for Alan Kohler’s Eureka Report some time back.

LOL. But we are talking about the brakes in this instance!

Visit 2, sorry this took a while to post up:

Once again I was very eagerly greeted. The staff seemed to like working in their stores. The in-store staff said that inventory & purchasing decisions are very much store based with little to no corporate support (I was in a franchised store though, corporate stores may be different).

In some ways that makes it a bit like comparing Bendigo Bank franchised branches to the Big Four branches. Good&bad aspects to that model…

In my opinion only: Good is that it promotes performance ‘ownership’ by the store managers but bad in that it might result in less reliable performances. The example given by the store attendent that they have a garage sale every few months to clear slow stock vs other stores which have a sale every month illustrates the importance of a good buyer. If it was possible to set up, a structured company wide pricing system for purchases may assist in improving the reliability of stores purchases and inventory management. Maybe CCV have already realised this and the online store is one step in that direction to centralise the management of inventory. But that is a hope and dream at this stage.

Personally I prefer the concept that there are a few very smart people making the decisions & those good decisions are multiplied by a large (& growing) store foot print like JBH & TRS. I don’t believe “Cashies” will replicate that with the same success but I’m willing to be proven incorrect.

And on the numbers, my hunch appears to be correct. Their lumpy but generally declining returns on incremental equity (ROIC) play this out. Overall the average ROIC from 2005 to 2010 was just 12%. This does not bode well.

My figures are from CommSec as I don’t follow CCV closely (and therefore have their exact equity and profit figures from their annual reports), but it gives me a rough idea. Compare this with JBH and there is a chasm of difference.

In regard to competitive advantages, I have difficulty finding one.

They are not a competitor on price.

Their prices for an iPhone were exactly the same as what is available on eBay. eBay also has a better feedback process where sellers who get bad feedback are penalised because any one can see the bad feedback they have received. Thanks to the network effect that is where I and my friends buy (and sell!) things that are second hand. CCV will never catch eBay.

They do not compete on location.

Here in SA they seem to often be at the corners of very busy intersections where it can be hard to access them without doing a lot of u-turns and making a special effort. I have never seen a CCV inside a Westfield or equivalent sized shopping centre.

They do not compete on scale.

The business inherently has limited scale. They generally only buy a few items or less at a time from one customer at a time. Each item has to be checked that it works, has to be priced (they told me they normally price off of eBay!!), tagged, and placed on the shelf. There is no warehouse out the back with two hundred Sunbeam Toasters, made circa 1999.

They do however offer a unique offering for customers in that you can go there to buy an item on payment terms. If you do not make the payments they will re-possess the stock and then sell it in the CCV shop again. I don’t think that would be a greatly profitable business model but it is the one thing they do that nobody else does in volume. The problem I see is if the TV breaks the customer will quickly stop making their repayments, a month or two later CCV discover the TV is actually broken and with no chance of getting the TV or the loan back, hand over the debt to the debt collectors for a few cents in the dollar and CCV licks its wounds.

Humans are naturally aspirational – we want the best stuff for the least price and we inherently know (or at least in this post-GFC world are being repeatedly told) that debt is bad and personal debt is catastrophic. CCV is basically heading the other way on all of those highways.

I hope this isn’t taken too severely by CCV shareholders. CCV may turn out to be a great business, and they are certainly a unique business, but they don’t fulfil my investment criteria.

My two cents. Do your own research. Don’t listen to my ramblings!

Thanks,

Matt

Hi Roger,

I COULD NOT fully understand the way to true investing until I read your book. I will never forget how much you help me Roger.

Thank you always Roger.

Roger,

congrats on the second edition. I have already 2 copies. I am not sure if its just me but the system does not allow me to add qty to the cart. So I could only purchase 1 at a time. You may have to look at that.

Cheers.

Oops. just tried again. just ignore my previous comment. :)