Is it time to clean up your portfolio?

Stuart sent me an email yesterday that provides some insight into what investors are experiencing right now.

Stuart sent me an email yesterday that provides some insight into what investors are experiencing right now.

Stuart wrote “…each time the level at which I would like to sell has seemingly been within short striking distance, somewhere around the world there has been an earthquake, tsunami, nuclear meltdown, Eurozone bailout, currency fluctuation, credit downgrade, flood, famine, pestilence, war or some other extraneous event – that spooks the markets and triggers another backslide in the portfolio valuation. The investment headwinds just don’t seem to be letting up…”

I hear you [Stuart], but what is anyone doing about it? Many investors hold verrucose portfolios of A5/B4/B5/all ‘C’ MQR companies, waiting for the price to rise back to some psychologically relevant level – their purchase price, for example.

But the market does not recognise such nostalgia. By holding onto stramineous stocks, you not only miss out on hoped-for gains. You also miss out on the gains from companies you could otherwise own – an opportunity cost! At best, the existing portfolio thus produces occultation, if not obfuscation. What are you doing this weekend? Re-reading Value.able?

When I was young, I spent time on the land fox hunting, under the tutelage of my friend’s father. I remember I had a tough time pulling the trigger. John and Ray explained to me that a single feral cat can devour more than a 100 lizards, birds and native mice in a week. The destruction wrought on native fauna by the fox is not dissimilar.

John and Ray then explained; don’t think of the fox you are aiming at, think of the many thousands of other animals you are saving. It’s a harsh reality and surprisingly, it applies to your share portfolio.

Don’t think about a perfect exit from the rubbish in your portfolio. Think about the extraordinary companies you could own if you no longer held the rubbish. The best time to clean your portfolio is always ‘now’.

What would you prefer? A portfolio of A1 businesses whose value is forecast to rise from $170.00 today to $211.39 in 2013 (yielding $8.98 this year, rising to $12.41 in 2013)? Or a portfolio of so-called ‘blue chips’ whose value has decreased 30 per cent over the past ten years and is forecast to increase just five per cent over the next three?

Take a look at the following chart. It’s the A1 Index from January 2009 to today. The constituents are the 20 biggest A1’s listed on the ASX by market capitalisation. The red line is the poor old ASX 200. As you can see, there is genuine merit to sticking with quality.

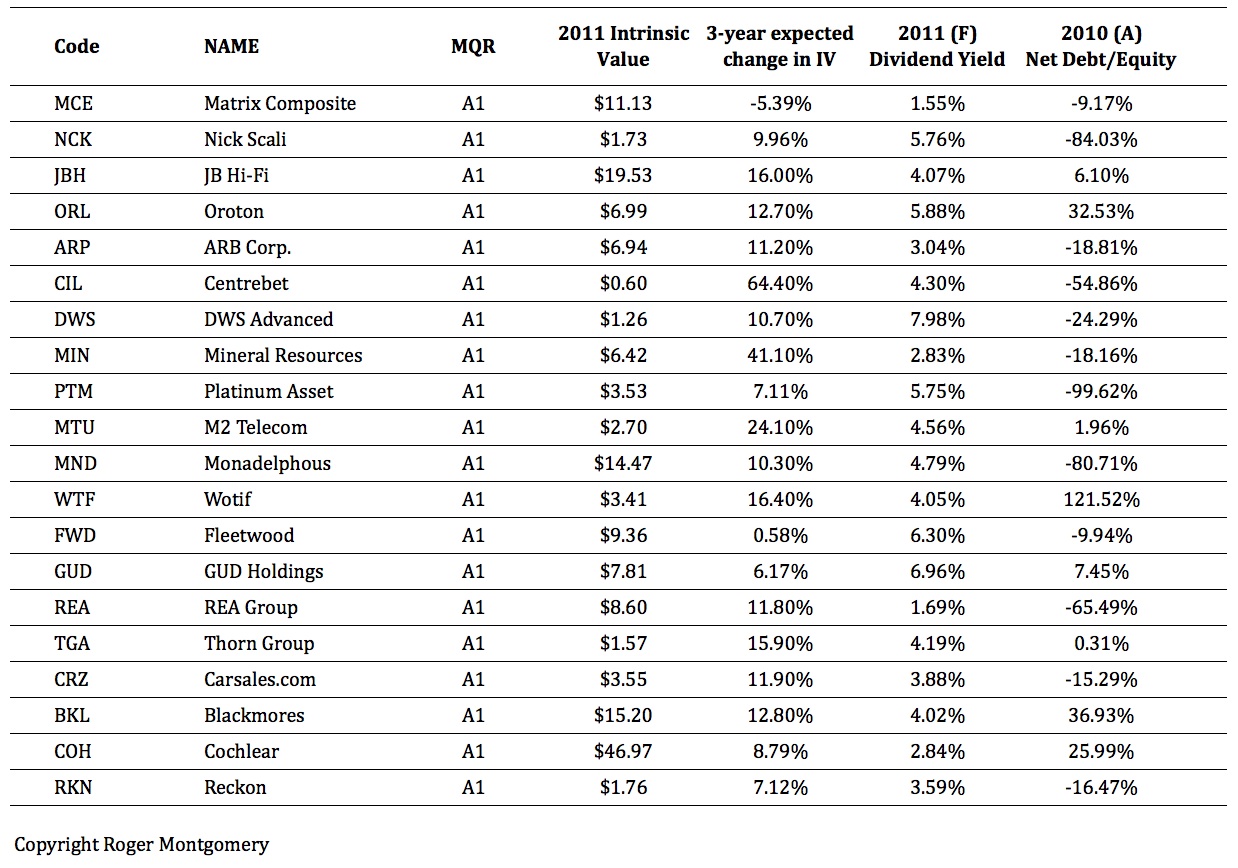

So who are A1s? It’s been a while since I last published a list of A1s with conservative valuations… Go and research the companies in this list, then return and share your comments with our Value.able community.

* MIN 2012 valuation substantially higher ($9.78). 2011 is low here because of the capital raising’s impact on ROE that year.

What makes Matrix Composite, Nick Scali, JB Hi-Fi, Oroton, ARB Corp., Centrebet, DWS Advanced, Mineral Resources, Platinum Asset Management, M2 Telecommunications, Monadelphous, Wotif, Fleetwood, GUD Holdings, REA Group, Thorn Group, Carsales.com, Blackmores, Cochlear and Reckon extraordinary?

Re-read Part Two of Value.able then come back and share your insights. Go right ahead and share whatever you know or think, but only about the companies in the above list.

Just as your portfolios need a clean out, so does my Insights blog.

Please refrain from posting any banter as comments on this post. Just your highest quality thoughts only.

1) Please keep your comments to the format below and we will build a useful library of insights.

2) Do not post any questions to me or other bloggers at this post.

Here’s the format to follow:

COMPANY NAME

Insights: If you work in the industry or have before, or perhaps you work for one of the companies or a competitor. Do you have a special or unique insight. ONLY comment if your insights are of the genuine industry variety.

Extraordinary prospects: Why does the future look bright for this business? Or if you don’t believe the future will be as extraordinary as the past, why not?

Competitive Advantage: What sets this business apart from its competitors? Don’t debate other’s comments, just post your own thoughts without reference to others.

Debt: How has management managed capital? What is your evidence?

Cashflow: Track record of cash flow?

The Value.able community, Graduates and I look forward to reading your insights.

Posted by Roger Montgomery, author and fund manager, 11 May 2011.

You need to create some discussion groups on your site that are not tied to any specific blog posting. This would be a place that Value*able readers could have ongoing discussions on relevant investing topics.

Is there a vendor who can deliver 10 years of financials for Australian companies in Excel format for under $500 per year? Morningstar does this for the US brilliantly. I have not found a vendor for Australia. Morningstar Australia is a very poor comparison against its US parent site.

Hi WIll,

Stay tuned…you will like it, a lot. Don’t go taking up an annual subscription to anything else until you see what’s coming. Seriously question the ‘take advantage of pre June 30′ deals or ‘beat the tax man’ savings. Just as in investing, patience will be rewarded.

WRT: I’m interested in your thoughts Roger regarding WRT and it’s future growth potential? I like the stock as a dividend generating defensive play but with the lacklustre property market was interested in your thoughts going forward on potential growth of their retail property assets.

I have alot of risk tolerance and would prefer to own their overseas portfolio, WDG … with the idea of exposure to an improving USD

What are your thoughts on intrinsic value etc?

hi Craig,

every time i hear the words “defensive play” on a particular stock, to me it means –

“you’re not going to make much money on this one any time soon and hopefully the dividends will cover for your capital losses!”

good luck. :)

I appreciate the reply Ron, I did think that investing was about making money not gambling it.. owning a stock that pays dividends and rises steadily year to year has 2 attractive attributes compared to placing your money in the bank for little interest and a tax bill. or the flip side of the coin buying into a stock that trades on hype not substance , but I’m only to happy to read opinions on stocks that “will” deliver cap gain.

Im a fan of the Galaxy (gxy) story and sustainable energy sources along with companies like CPU in the tech/services space.

Apologies if I was the one who tipped the scales on the banter front – totally self indulgent! I love the vast amount of coverage that the A1s get, but I feel somehow that the market is pricing a lot of this quality in (market darlings for a reason). Sometimes I think it would be a great idea for Roger to exclude these on the odd occasion to take a closer look at say A2-4’s to see if there is some bargain hunting to be done after a bit of further personal research when most of the A1s are fully valued. I know I’ve held 2 of them in CCV and CWP from before I started reading Value.Able. I’d also love to know what distinguishes an A1 business from say an A2. I am guessing that the emerging A1s can often move up the ranks, so this could be a good area to be looking at.

Interesting David,

…and when I have done that, others have observed a drop in quality tantamount to scraping the bottom of the barrel. Regarding difference between A1 and A2, I will make these available, but even if I launched a newsletter or some other service, I would never release the algorithms. That will upset some people and some simply wouldn’t join and thats ok. One argument might be that the fewer who join, the better for those who do.

HI Roger

When looking at the nett debt to equity %.

What % is good and what % is bad?

cheers

darrin

It doesn’t quite work that way. generally less is more and we also look at interest cover and cash flow, but I think its a good topic for a future post. Stay tuned.

My pick: Reckon Limited – RKN

Insights: I work in IT and look after a number of accounting practices. Majority use MYOB for accounting practice management but Reckon’s QuickBooks product is more widely used in small business accounting. Reckon also have an accounting practice management product called APS which is gaining popularity. MYOB still dominates this space and perhaps has a more mature feature set but APS is gaining momentum. At least one of my clients already changed to APS and almost all of them have considered it because of poor support and reliability from MYOB. Reckon’s APS product is better designed than MYOB (I am not going into technical details) whose practice management software can be unreliable and prone to outages and problems. Reckon also have a lead on MYOB in cloud services. Their clients can use QuickBooks over the internet without having to install software onsite and have the headaches associated with backups, upgrades and maintenance.

Extraordinary prospects: Unlike many software vendors, Reckon has no problems making customers pay for their products. Every year tax scales, laws, regulations etc. change and the clients pay to get those updates. The cost to business of getting the finances wrong is too high, so Reckon doesn’t have to convince its clients to update. Consider Microsoft Office on another hand and once you have product that works well, why go to the next version? Many of my clients still use Office 2003 which is almost 10 years old and have no plans to upgrade despite all the Microsoft marketing.

Competitive Advantage: Well known brand. Stranglehold on the small business accounting, plus the above mentioned ability to get the clients to gladly pay for their annual updates.

Debt: The company has no debt. Debt/Equity ratio is 0%. Long term debt was 0 for all bar one year in the last 10. (Ref: Commsec)

Cashflow: Cash position is down from the past but recovering: 2008 – $16m , dipped to $2,4m in 2009, building back up to $8m in 2010. Positive cashflow increasing every year in the last 9 years. (Ref: Commsec)

Hi Roger, I know you know that i know that you want to give me a free copy of Value.Able. And i have just dusted a spot next to my Bed to store it. Sincerely. C

Roger, where is the consistency? You allowing this banter but not other comments? Or r u being selective to ur friends? Keep it as it was before, I found it more interesting and full of ideas. Cheers

Not at all Ron,

We have received feedback that the number of posts has increased but the quality had declined. I tend to agree. Plenty of other blogs and forums allow everything including disparaging remarks about others! It is my desire to avoid a forum style developing here. I miss the high quality of the early comments, so I asked, in the most recent two posts, for specific comments related to the post and to refrain from anything else.

The next post will be more open, but do read carefully because future posts may also request specific comments.

Hi Roger,

Not meaning to add to the banter and trying to be constructive. I could see that the number of posts, especially the same ones about IV and such, were gaining critical mass and something had to give.

I can understand your reluctance for a forum style site and my previous banter :-) has listed some of the problems. The advantage it has, is to separate forums and have different moderators for them to spread the workload.

I know you have intentions to improve the site and I know among other things you are looking at better search facilities, an FAQ etc.

One of the many big pluses about your blog is the homework you give us and that creates a lot of banter. The problem is the homework is sequentially intermingled with your other thought provoking posts. Perhaps the homework blogs can be on a separate blog referenced from the main blog so we don’t miss any. The reference blogs would be closed so comments about homework would only appear in the homework blog.

The other advantage of this idea is that all the homework blogs would be together. You may even be able to have a guru or other trusted person moderate the homework blog for you.

Roger, I love the book, love the blog and even love the banter but I can see that the popular the blog gets the more the workload will grow.

I appreciate the many hours you put in to this.

Cheers

Rob

Hi Rob,

I would like to thank you for your understanding and that of everyone’s. We are working on some very big improvements (I am hoping they’ll knock your socks off). All of the ideas you have suggested are on the wish list. I am writing a blog post for this week that will allow plenty of banter/discussion etc. Thank you again for your understanding. One thing won’t change – I simply will not be publishing anyone’s post that is directed personally at other visitors/bloggers or even third-party-would-be-competitors. To allow the publication of derisory comments about anyone would speak more about the person permitting the post than the writer and the target of the comments themselves.

Hi Roger and Rob,

I would just like to add that there is a core group who have been following you (Roger) for a long time.

We have all become cyber friends courtesy of this blog and we all like to have a laugh (banter) at each other.

Where would we be without the humour of a say Greg Mc (just as an example)

This to me this is a very enjoyable part of the blog and if it stops I will miss it very much.

I understand that some people have been on this blog to ramp a stock but baby and bathwater come immediately to mind.

Just my view

Thanks Ash,

We are working towards an amazing solution for everyone. Stay tuned.

Well, quite, Ash!

(Kind of you to say so. Maybe if I stopped posting, the average quality of material on here might actually bump up a notch!)

I look forward to seeing these changes you allude to Roger. For what it’s worth, my two cents….

– It’s Roger’s blog and he can do what he likes.

– Most of us have received an edumacation worth a fortune (potentially) for the cost of feeding the family at Hungry Jacks and should be eternally grateful.

– I can understand that Roger wants to maintain a high quality of material here, and as people’s knowledge of value investing improves, it is also not unreasonable to expect an improvement in the quality of postings, particularly given that influential business people are purported to visit at times.

– While we (especially longer term posters) might like to think of the blog as our personal value investing playground, the fact is that it is a part of Roger’s business and all posters should be respectful of this and conduct themselves accordingly.

– A continual focus on ‘serious’ posts would, though a good source of useful material, become heavy going over time. Would it lead to a corresponding decrease in contributions, and maybe become beyond the reach/understanding of many prospective bloggers?

– As one poster (Howard) noted, there are sometimes some really handy points of interest and insights contained within the general conversation. If there was a major trend towards fully justified 2000 word essays on topics then much of this would not occur or maybe lost in the depths.

– Some of the more light-hearted stuff makes the blog less dry to read and as long as it is in the right spirit and taken as such; and as long as everyone is respectful of our host’s wishes then I would like to see it continue, at least within sensible limits.

– Blatant ramping or aimless posts (eg. “What about XYZ, worth buying at present) would be better off stopped at the door.

Yes, that was worth about 2 cents. I’m sure our esteemed host has it all under control in any case.

Nicely articulated Greg Mc. Thank you.

Completley agree Greg

Hi fellow Value.Able beliebers… Justin Biebers radio advertising seems to be corrupting me. ;) going to order my book this week. anyone holding FSA? i brought a small parcel ater speaking with mgmt looks like some impatient holders have sold it down lately. From what i have been able to make out they are the largest provider of Debt agreements approximately 50% from memory.Plus they specialise in home loan lending, broking and mgmt, business consulting and factoring finance. based on mgmts guidance from my discussions they tend to believe they will achieve eps of at least 6cps seems cheap at the moment trading at 4x 2011 earnings. would i be right in saying that the current housing scenario might be affecting its share price? Sincerely C

You could b right. It is also a very illiquid stock. Their balance sheet is not great also. I do have to admit that this business on paper looks darn cheap! IV is almost double!

In my opinion they need to surprise mr market. And what does mr market likes the most……dividends!

Good luck with this one. There r some really really better things out there at the moment……keep digging!

Hi Chris (and Ron),

I launched into FSA (its all relative) in Sept/Oct last year. If you can find some of my previous posts they may (or may not) have something insightful to say.

Roger’s quality rating of B5 (from Feb or March I think) has on more than one occasion had me rattling through the Reports to find out why.

Of course this doesn’t mean they are bound for the sin bin (the one containing the charred remains of ABC Learning). It could mean the risks of a dilutory event are higher than average.

On this theme, in the outlook section, page 5 of the half year report this year, there are two references to a lack of funding to expand the lending activities in Home Loans and Factoring Finance. That being the case, it would be logical that management have to consider other arrangements. I doubt a firm of this size could raise enough equity capital to cater for all their targeted growth in Home Loan lending (loan book of 600M), but they certainly could meet the needs of the Factoring side that way.

(I raise an interesting point for myself here – how much equity capital do they need for each $100M in lending facility? What can a capital raising of $20M do in this respect?)

A quick look at the Announcements shows that Westpac increased the Home Lending facility to $235M in May last year, and renewed it (without an increase) in October. No announcements since February. Hmmm.

Anyway, those are my thoughts on the possible reasons for the B5. Happy to be enlightened. Will take questions from the floow now.

cheers

And good luck to the investor looking to buy 1.2 million odd shares at 20.5 cents. (Should we expect a letter in the mail?)

Blackmores

Insights:

– New production facility built and fully functional, allowing more units to be produced

– Blackmores recently launched their website last year, allowing them to strategically segment their customers in order to create products that they need. This had not been done previously.

Extraordinary prospects:

– Blackmores has recently tapped into Asian market successfully with plenty of room to expand.

– Acquisition into PAW allowed innovation into pet nutrition

– Partnership in asian allowing to tap into traditional chinese medicine market

Competitive Advantage:

– Australia’s and Thailand’s most trusted vitamin and supplement brand

– strong online presence and community, reinforcing the network effect and customer intimacy

I’ll need to look into financials before I comment

MTU M2 TELECOMMUNICATIONS

MTU was established in Dec 1999 and listed on the ASX in Oct 2004. In Mar 2010 MTU was added to the ASX All Ordinaries Index.

M2 is focused on two core markets: 1-SMB’s and 2- Telecommunications resellers and ISP’s via their wholesale division

Insights: NA

.

Extraordinary Prospects:

According to the 2010 annual report they have low penetration of the retail markets and are focused on organic growth. This leaves plenty of room for growth from existing strong cash flow. They have also demonstrated a capacity to make sensible core focused business acquisitions and successfully integrate the respective businesses into the collective.

Using my IV numbers and Roger’s forecast for 2011 I have MTU returning a CAGR on IV of over 28% pa over a 7 year period.

Hy11 report released 28 Feb 2010 showed NPAT up 40% vs. HY10 due mainly to organic growth, increase in internal operating efficiency and wholesale purchasing agreements. Organic growth is possibly sustainable but I wouldn’t count on continual improvements in operating efficiency as the business expands.

Analyst forecast earnings have increased on the back of the recent significant acquisition, Clear Telecoms as well as the acquisition of Edirect and Austar’s mobile assets. Also of note is the ACCC’s decision to lower the Wholesale line rental by $5/month which will mean and increased annualised EBITDA of $15M adding to analyst forecasts.

Competitive Advantage:

Having consistently achieved a respectable ROE is evidence that some form of competitive advantage exists. Being significantly smaller than the heavyweights of Telstra and Optus could not be a bad thing in terms of personalised customer service and the manoeuvrability of the corporate ship, so to speak.

MTU provides SMB’s with a “complete business telecommunications solution”. Counterpoint by Scuttlebutt – I recently asked a friend who runs an SMB, and in this particular instance, the business shops around for their IT, ISP and Telecommunication needs.

Debt:

Very conservative gearing. Debt/Equity of 22%

They have on average a POR of 70% yet issued over $20M worth of shares in 2010 to shareholders.

DRP in place with 5% discount.

Cash flow:

Negative cash flow for the last 4 years.

MTU remains “infrastructure light” which helps attain significant cash flows. Saying that, it has conducted many acquisitions which have caused a net negative cash flow for the last four years using the balance sheet method. The most recent acquisitions in 2011 were Edirect, Austar’s mobile assets, Clear telecoms; in 2010 were Clever communications and Bell Networks; and in 2009 People Telecom and Commander assets; in 2008 Unitel Australia; and in 2007 Orion Telecommunications and Wholesale communications group.

ROE dipped for the two years of 2008 and 2009 which coincided with the GFC as well as a few acquisitions. ROE has noticeably improved in 2010.

Last year $1.75M worth of options were granted to management.

Staff are encouraged to remain for the long term due to employee friendly conditions of employment – extensive staff training and development as well as complementary breakfasts, free gym membership and subsidised healthcare.

Points of Concern:

Receivables have significantly increased in $8M in 2007 to $56M in 2010.

Net profit margin has eroded from 7.7% in 2005 to 4% in 2010.

Operating margin has diminished from 11.9% in 2005 to 7.7% in 2010.

The most recent 1H11 report has stated that they have delivered on their plan to improve operating margins.

$70M Intangibles and Goodwill up $3M and amounting to a massive 44% of total company assets.

Good analysis. As an ex employee (I was very sad when I left, but got a better paying role somewhere else) I am a big advocate for this company. The management are conservative and committed to growth – but not at any cost. All acquisitions are in line with core strategy and have a very low payback period and for this reason I believe that they do better with my money than what I can do so I am in the dividend reinvestment program.

As a company, they are ‘infrastructure agnostic’ and the NBN rollout will have huge positives for them as they are now Optus’s MVNR (and largest wholesale customer) and I think they are also Telstra’s as well now.

Hi Roger

It seems like you are clamping down on the comments and thats ok, but in the past I have gotten some great tidbits of information from the other graduates from their random comments and that I will miss.

Company Name: JB Hi-Fi

Insights:

By trade I am a software engineer and work for the 3rd largest company in the technology sector. A few years ago, as a side hobby we decided to setup an online store from scratch to sell DVDs, Blu-rays, console and PC games. We ran it for about two years and turned over about 100k a year. This is from a small retailers point of view.

What I learnt from all that is there are seven major players in the DVD/Games space in Australia. They are EBGames, JB Hi-Fi, Big W, Target, K-mart, Dick Smith and the last one is a pseudo wholesaler that supplies to the rest as far as I can tell. They all source their products directly from the movie and games studios so in essence they have no middle men that they can cut out.

Unlike other sectors or industries the margins are paper thin, the products are for the most part are not unique outside of certain exclusive limited edition of DVDs/Boxsets or games that certain retailers negotiate for themselves. This is a low/no profit high volume business. All small players automatically have higher cost because they are going through the middle man wholesaler. Their ability to negotiate a discount is non existent due to their low volumes.

So where is the opportunity to make money in all this for the big boys? Cross selling and obscure or non popular products. The more hyped up or popular a movie or game is, the lesser the margins are. An example of this is when Avatar was released on DVD, it was $19 from JB Hi-Fi and Big W from the get go. No small retailer can buy it for themselves cheaper than that, let alone having to put their margins on top of it.

This is known as a loss leader, where they entice customers to come to the store for the popular items in the hopes that they will pick up something else which is much more profitable. iPhone screen protector for $20 anybody? I am betting more than a few people here have shelled out that amount for a small piece of plastic at some point.

JB Hi-Fi have branded themselves as the low cost retailer, this is true for the items that they have high visibility in the store (the hanging cardboard and posters), but dig a little deeper for something which they are not promoting and you will find they are selling for RRP. Let me just say no online store will ever sell anything at the recommended RRP, if any items goes for RRP, then you are doing very well.

Extraordinary prospects:

Looking ahead for the long term, the prospects I think cannot be better than what it has been in the past. We have already seen it with the music industry, CD sales have been in decline for some time now to give way to online downloads and piracy. Music was the first because the size of the files were small compare to the bandwidth available at the time that this trend started. With all the content providers wanting to move to an online download model, its only a matter of time before this will be adopted for DVDs, BluRays, console games and PC games.

Its already started to happen, right now you can “hire” your movies online and have them downloaded/streamed and be available for viewing for the next 24/48 hours. Steam is a big player in the PC games download market and major games developers like Blizzard offer a download option for their games cheaper than retail. As for the console games, alot of games these days post release have DLC (Downloadable content) that adds to the core game (extra maps, features, characters etc..along with bug patches). These can go for $2 to $15, and is download only, not available in retail shops. You can bet the studios will want to go with a pure download model, to save costs on shipping, packing, printing and storage. The only thing that is holding this back is bandwidth availability.

An average song converted to mp3 can be between 3 – 6 Megabytes, so a whole album is more or less only 50 megabytes or so depending on length and sound quality. A DVD is 4 gigabytes, a dual layered DVD is 8 gigabytes, a wii game probably averages out to be about 500 megabytes, xbox 360 games around 6 – 8 gigabytes, PS3 games around 4 – 15 gigabytes and Blu Ray movies between 13 – 40 gigabytes.

With the NBN in the pipeline, bandwidth will only increase and become cheaper. This means more people will have the option to download their digital entertainment. This can only spell doom for retailers in this space if they do not reinvent themselves or hop on the wagon themselves.

The rest of JB’s product line will also come under pressure from the high $AUD, online sales, intense price competition not only locally but overseas. Harvey Norman has pretty much fallen victim to this, JB hasnt yet because as long as there is enough of a market for bricks and mortar shops, they will survive ahead of the competition due to them being a better business.

Competitive Advantage:

Management has proven they are competent at running the business with their store rollout plans. They have marketed their brand to be the low cost one stop shop for all your hardware and software needs. They can price the small players out, and their marketing and focus have beaten the rest of the competition.

Debt: Little to none, they have no use for this as they have more cash than they can use to expand the business with, hence the high POR.

Cashflow: Currently this is a cash cow business, there is only 3 options for the excess cash, dividends, aquisition and shares buyback. We’ll see what the buy back price will be. This is a very enviable position for a company to be in, when others are struggling to make a dime.

Overall if I had to own a retailer especially in the electronics, digital entertainment space, you really cannot go pass JB, however if you are constantly looking for the high growth companies to hop on and trying to catch them when they are still small, then there is no reason to invest here.

Fascinating! Thanks Howard.

Company – ARB (ARP)

Insight:

I can provide no industry or insider insight into this company. The “Insights” that I provide are those I have gained studying the business. ARB sells 4WD OEM and aftermarket accessories.

Extraordinary Prospects:

-ARB has been established for nearly 30 years.

-Sales over the past 10 years have grown steadily from $65m to $250m. That is a 14% compound growth rate over the period. NPAT has grown at an annual compound rate of 19.6%.

-ARB has 41 stores around Australia and has the strongest distribution network of any 4WD accessory supplier.

-Growth of 4WD sales over the past 5 years has been about 46%. Today 33% of all vehicles sold in Australia are SUV’s or 4WD utilities.

-ARB has targeted new store openings in both WA and QLD to take advantage of growth opportunities in those areas.

-Sales growth shows ARB continuing to take market share from its competitors.

-Exports are up 10% despite the $AUD , however there is no denying that the higher dollar presents headwinds to the company.

-Increasing product demand has seen ARB open new warehousing and plant operations in Thailand where unskilled labor is still plentiful.

-The breaking drought will see an increase in demand for new 4WD’s and accessories into the medium term as will mining industry growth. The mining industry is a prolific consumer of 4WD vehicles all of which are fitted out with ARB products.

– ARB devotes significant capital to R & D ensuring it is able to bring to market a steady supply of new and updated products to suit the expanding range of 4WD vehicles. This includes products for emerging hybrids.

Competitive Advantage:

-ARB has focused on its core business for 36 years without distraction making it an instantly recognized brand.

-It has the strongest distribution network of any 4WD accessory supplier in Australia with growing warehouse and manufacturing capacity.

-ARB has a development pipeline of new and updated products for an expanding market.

-Exports account for a quarter of sales with 80 distribution points worldwide. It is also gaining market share in the USA, Central, and South America where vehicle sales are increasing. This is through the “Air Locket Inc” brand.

-Manufacturing plants are currently running at near capacity because of low margin high volume OEM sales.

-The high $AUD has improved margins on imported components that are now cheaper however export growth would be benefited by a lower dollar.

-ARB is the largest supplier of bull-bars in the world.

Debt:

-ARB is debt free. DPS has grown steadily over the years and special dividends have been paid in 2001, 205, and 2010.

-The company has a program of buying back some franchised stores whilst expanding into underrepresented areas and is increasing warehousing capacity out of existing working capital.

-The stated capital management directive is to maintain a dividend payout ratio of between 40% and 60% whilst generating cash for future growth.

Cashflow:

Cash 2009 – $2.79m 2010 – $20.9m

Borrowings 2009 – $1.5m 2010 – $0

Share Cap 2009 – $25.8m 2010 – $46.6m

Div paid 2009 – $10.3m 2010 – $12.6m (ex sp div)

Cashflow $20.2m

In summary I believe ARB is a class leader in its field and has a sustainable competitive advantage. It’s business management model shows it has excellent positive cash flow with those funds partly returned to shareholders and partly used for ongoing business expansion.

Stephen

Thanks Stephen. A great contribution to the insights library! Well done.

Nice post, I liked your fact about the sales growth and profit growth of arb. This indicates to me that profit is being driven by more than just sales growth and is a big tick for the current management, arb are obviously to me doing a good job of increasing sales but also creating a more efficient operating system that is reducing costs.

ARB is an excellent company just wish i had acted on my thoughts at $3

Ok everyone… time for a re-cap.

Just as your portfolios need a clean out, so does my Insights blog.

Please refrain from posting any banter as comments on this post. Just your highest quality thoughts only.

1) Please keep your comments to the format below and we will build a useful library of insights.

2) Do not post any questions to me or other bloggers at this post.

Here’s the format to follow:

COMPANY NAME

Insights: If you work in the industry or have before, or perhaps you work for one of the companies or a competitor. Do you have a special or unique insight. ONLY comment if your insights are of the genuine industry variety.

Extraordinary prospects: Why does the future look bright for this business? Or if you don’t believe the future will be as extraordinary as the past, why not?

Competitive Advantage: What sets this business apart from its competitors? Don’t debate other’s comments, just post your own thoughts without reference to others.

Debt: How has management managed capital? What is your evidence?

Cashflow: Track record of cash flow?

There are 40 banter-type comments and questions to me and others waiting to be approved, however I will only approve those comments that comply with the above.

Regarding VOC there is a new cable being laid between Singapore and Aus by no less than Leighton hope they price their contracts properly this time.Like other technologies fiber optic is improving better quality becoming cheaper therefore faster.This new cable has a supposed speed of 6400gbits/sec, Voc’s southern cross cable is 480gbits/sec.

This game is only beginning, with fiber to the home the possibility’s are enormous.

Hi Roger,

Is there any mistake in Net debt/ equity ratio for WTF = 121.52%?

If it isn’t , it is quite highly leveraged then.

Good pick up Lewis. The ‘-‘ was omitted from the spreadsheet.

Thank you very much for the list.

Although emailer Stuart is not quite getting to his selling point in the market, we don’t seem to be retracing to obvious buy areas either. I have sorted your list of A1s into descending order of margin of safety. Only 3 have any MOS, and really only MCE has satisfactory level of MOS to consider buying (as per your “rules” established in Valueable and on this blog). However MCE has a declining IV in 3 years – NOT GOOD.

With this list of stocks more than fully valued at present, it is obvious why your fund is sitting on cash. You have a “loaded elepahant gun” waiting for “big slow moving elephants”. These companies may be A1s but they are not SLOW MOVING – the wait continues.

Roger’s Closing Price MOS

2011 IV 11/05/2011

MCE $11.13 $8.22 26.15%

Nck $1.75 $1.65 5.71%

JBH $19.53 $18.96 2.92%

DWS $1.26 $1.43 -13.49%

ARP $6.94 $8.18 -17.87%

ORL $6.99 $8.25 -18.03%

GUD $7.81 $9.40 -20.36%

PTM $3.53 $4.31 -22.10%

FWD $9.36 $11.70 -25.00%

MTU $2.70 $3.39 -25.56%

TGA $1.57 $2.10 -33.76%

MND $14.47 $19.41 -34.14%

CRZ $3.55 $4.93 -38.87%

RKN $1.76 $2.54 -44.32%

REA $8.60 $13.60 -58.14%

WTF $3.41 $5.48 -60.70%

COH $46.97 $81.90 -74.37%

MIN $6.42 $12.42 -93.46%

BKL $15.20 $29.90 -96.71%

CIL $0.60 $1.79 -198.33%

Company- Oroton Group (ASX:ORL)

Insights:

None to add as all my opinions that would fit in this area could also verge on speculation and i don’t believe will be of any use but i will act upon it as i believe to be true.

Extraordinary Prospects:

I do believe that Oroton is at a form of fork in the road. Turning right will lead them to another period of good growth and turning left will take them to falling profitability and maturing.

In the medium term, alot will fall upon how the Asian expansion is received. If this goes well than i think it will lead Oroton to another period of good growth adn open up potential more opportunities.

Domestically, i think Oroton reached saturation point during last year on both of their brands and will find it hard to find new avenues of growth in Australia apart from maybe introducing new lines of products. So the asian expansion will hold the major say as to where oroton goes from here.

There is also the added risk that some overseas players might start seeing Australia as an opportunity and increase competition which has been next to non-existent in the past. I have heard rumours of companys that would fit the bill but nothing has appeared yet to be happening. The fact Zara is now in australia (although not a compeitotr to ORL) i think shows that Australia might become a potential place for these businesses to start operations in.

Some short term thoughts on prospects:

The high australian dollar means that buying similar products from more well known brands is now more affordable than ever and i do expect Oroton to take a hit form people using this as a chance to own som emore high profile american and european brands from US online stores. This will of course hit the top line. The good thing though is that the high aussie dollar will probably in my opinion have no to a positive impact on costs due to being able to potentially source materials at a cheaper price.

The threat of higher interest rates, higher petrol prices and other costs of living could also be a positive or a negative for this company. Negative as it would mean that their is less disposable income for people to spend on luxury needs as the cost of living pressures goes up. However, positive as it will play to Orotons strength of being a manufacturer and retailer of high quality products however at fairly acceptable prices mean that customers might see this as a more attractive option than buying a really cheap accessory or the really expensive one.

The fact that Orotons biggest selling store is the online one shows that there is a definite trend to buying online products and i expect this to continue in the future. The fact that they already have this infrastructure in place is a good thinkg and i expect mroe money to be invested into this than on store rollouts.

Due to the introduction of their products into Asia and the maturing of their australian business i am expecting that the immediate short term Oroton will suffer a fall in profitbaility, this will be in the form of a fall in ROE.

Oroton will continue to be a great company and highly profitable but the drain on resources from the asian expansion and the maturing of the aussie business i think will cause it to be just not as great as it once was. ROE will be high but not the >80% figures that they earned in their last reported figures.

So needless to say, i am still a fan of this company however i do think its prospects are a bit more clouded and hard to predict than they were before.

Competitive Advantage:

As mentioned above, Oroton have a great little niche working for them in the luxury fashion market. They are able to and have a reputation for making high quality products which they then sell through their own stores and dept stores at what are some pretty reasonable prices. Their brand and reputation is strong in the market place and they seem to know their market well. They also have set up a decent supply chain and manufacturing centres set up in asia that reduce costs even more to help live up to what i consider to be their niche.

management is a big advantage for them, the fact that the companys fortunes turned around so significantly upon the start of Sally MacDonalds reign cannot be a coincidence. This does however add risk if she decides to leave but this is speculation and there have not been any indications for this.

Debt:

In the last financial year ORL’s leverage took a decent sized leap up to 32.53% however they also had an interest cover ratio of around 40x so i am not too concerned with the levels at the moment. This when looked at in addition to a current ration of about 1.6 shows me that they are still in a pretty good financial state and that the debt should not be a problem.

Indeed the past history of this company has shown that whenever they do have debt they tend to pay it off reasonably quickly and has had a few years of a negative debt position.

Cashflow:

Oroton is a company where the Net operating cashflow has been consistently higher than the reported net profits. In the last reported figures there cash position went up to $267 from $197, the debt did increase as well from $5644 to $9606, share capital remained the same and paid $19,214 in dividends. For those playing at home using the balance sheet method prescribed in value.able this results in a positive cash position of $15,332.

They have company cashflow for 2010 of $15,115. So the company has and has shown through the years that they have a lot of leftover cash if needed to pay down debt. One question i could have is if the debt was used to fund activities that would result in a high ROE than why didn’t they just reduce the payout ratio which is and seems to be their rule of having a POR of around 80-85%.

All other metrics i use to measure the strength of a company financially are all good as well including profit margins and return on equity and return on assets.

Conclusion:

I expect the company to have a not so stellar eyar this year (at least by their standards) but should still be a company whose value will be higher in 2-5 years time. If they get good results from asia than i think they have a great future for 10+ years.

Great stuff Andrew! Thank you. This is the kind of comment I will be publishing henceforth. Thank you again for demonstrating Andrew. Comment following below were approved earlier so I will keep them up, however its Andrew’s comment and others like it that the Insights Blog will be made great with.

Thanks for your comments on Oreton

I have a small holding and have kept an eye on the recent decline in price. Some recent statistics published in the SM Herald detailed the percentage of people who own a car or a house in China. Seems to me it has been a collosal increase. If ORL can get a share of that market their growth should be spectacular. I rate it at least as a HOLD.

HI Andrew,

Re: Oroton

Cashflow:

As long as the Lane family maintain their substantial shareholding in the company and the company maintains a high interest cover ratio and the ability to comfortably service its debt, I don’t expect the POR to reduce any time soon. On the contrary, I wouldn’t be surprised to see it increase in time.

Andrew this is good information. I have posted previously about my suggestions and thought about the Oroton push into Asian based on my years trading with that part of the world as well as my experience as an Export Adviser. So I won’t go back over my specific suggestion on how they should enter the market.

However I did note that just like we always see our car on the road, I am noticing a lot of Oroton product as I had considered putting some of my portfolio into ORL. I live in the Melbourne inner city, very large percentage of younger Asian people. I check their expensive bags and more often I now see they have Oroton and just this morning a very stylish young lady sat opposite me in the tram, her bag and umbrella both displayed the Oroton brand.

The Asian market are mobile, they move back across borders and the affluent students bring home new brands will already be helping to establish the brand in Asia, specifically China. I am sure Sally is watching the origin of purchase locations for the online sales. Even though I am not a shareholder I am always happy to see an Australian company step up and develop an export business.

I completley agree Scott and see the same thing on the streets of Sydney.

I have complete faith in the design team at Oroton so i don’t doubt the ability for Oroton to be successful as i think they supply a world quality product and at a very good price and it will be all up to how well they market themselves and the take up rate by people in these countries. The fact that Australia is a popular tourist destination for a lot of the asian population will make it a bit easier for them because, as you mention, people will buy the products in Australia and bring them back home where hopefully for Sally and co their friends ask where they got the bag from and who makes it.

I think for most other companys i would be very scared about what will happen in the overseas expansion but i do believe that Oroton has the product which could be successfull with some hard work. In the short term this will probably be a bit of a drain on resources and lead to what i mentiond,a reduction in profitability, but if successfull than in the long term they will be in a great position.

It seems to me that Oroton is trying to go it alone, ( without a BIG international designer ) usually a big marketing push, especially into new markets is coupled with a new range buy someone with considerable notoriety.

I beleve this is what Andrew was eluding to with the comment about the Oroton designers.

I’m not saying Oroton don’t have good design, but this is the nature of the fashion world, no matter how good the designers are, unless you can cut it with the social aspect of the scene you may encounter some obstacles.

Sure you may be seeing more of the brand on the busses/trams, but that could be attributed to the new shop on the trendy block of shops in Asia, I hope this new expansion/popularity is not just a flash in the pan, as the no major designer aspect will take a toll eventually ( people will talk and unless you can drop a ” Ohh mine is a Philip Stark” then you may be left a little wanting ).

Good luck Oroton.

Very interesting Kerry. Thank you for contributing. Time will tell. The track record so far has been satisfactory…

Hi Roger,

as a loyal acolyte (seeing it’s vocab time!) I must report that my valuations (I’ve only figured out how to do ‘current’ so far) for TGA ($2.54 with 11% rr), CIL ($1.93 with 11% rr) and MIN (quite stratospheric relative to its current price), on Morningstar data are well above your own.

Mine are a few months old; yours eg ARP seem to have contracted a bit?

Also how is COH in the Value.able group when its price is consistently almost double your valuation?

I should add that I’ve only been involved with shares for 9 months

and without your book I doubt I’d be doing any valuing at all.

Thank you.

This list is about quality Andrew. Its not a list of recommendations to buy. You must always do your own research and as I have mentioned many times, seek a large Margin of Safety.

Roger,

from what I have seen your A1/A2’s are the quintessence of quality.

I am 54 years old ie mostly and legally adult! I have always crosschecked your ideas with other sources eg the big broking house ratings provided free on the trading platform I use, two stockmarket subscription e-letters I’ve paid for, the Top 20 substantial shareholders of any stock that interests me, papers and magazines that can be browsed pretty freely in newsagents, and numerous other sources.

To me and scores of others similar, you are a prince among the men (and women) of the stockmarket and it pains me to see you have to so often reiterate warnings to cover your back in this often amorally litigious society. I guess that is one of the burdens of being ‘stockpicker extraordinaire’!

Also, despite having qualities that do not make me a superior investor eg lots of anxiety, impulsivesness, impatience and sometimes laziness, quite the opposite psychological characteristics Buffet suggests to the would-be investor, in a flukey market which is not floating all boats and where stockpickiing is essential, and being a newbie, I have (so far and only by low single digit percentages!) beaten the return any bank on this big island can offer.

Perhaps equally importantly, I have found the whole process deeply interesting, educative, challenging and satisfying. It has also helped me develop my stress management practices.

I was going to get rid of Foxtel – I’m glad I didn’t.

Dear Roger,

I have not posted for some time and nor have I pulled the trigger on those stocks in my porfolio that do not make the quality grade which you have for so long been advocating. It is because of the latter that your comments here have hit me between the eyes. When I recover, I hope to post some insights.

My hope, in posting my synopsis of ARB Co. late last year, was exactly as you have described here – that your Insights blog would build a useful library of insights on not just a few, but on ALL the companies which pass your quality criteria.

By again posting your list of A1s, you have taken (for some us) the pain out of the more difficult part of the process i.e. the detailed financial risk analysis. Thank you sincerely. By generously sharing this list, you have focused our task. If only we can now collectively focus our attentions to the task of better understanding these companies, how much we will collectively benefit.

I do not have the luxury of time to individually research, to the extent that I would like, all your A1s and A2s. Indeed I certainly would not have the particular insights that others may have here. So I will re-read Part 2 of ValueAble as you have suggested but, before I do that, I am going to create a 20×5 table ready to fill with comments posted here. That’s 100 boxes which, I hope, will each contain at least one snippet of information.

Sincerely Ken D

When you recover? Our best wishes are with you for a speedy return to full health Ken.

Thanks for your concern, Roger. I’m in good health. Your latest post couldn’t have been better targetted at my current situation. It gave me quite a jolt. We all need this at times and some processing (recovery) time afterwards! Apologies for misleading you.

My view of ARB is that they are trading very strongly at the moment. I believe both plants running close to full capacity.

I will be meeting them for interview next week.

This post was great. The sad thing though is that almost all these companies are trading well above their 2011 IVs. I was just wondering how to read the 3 year expected change in IV – is this an annual compounded rate or is it the total expected growth over the 3 years? I hold about half of these but unfortunately I bought them at levels above IV, so I am hoping that long term growth eventually delivers value.

Try not to use ‘hoping’ in the same sentence as investing David. The expected change my estimate of the total expected growth. Always remember: Margin of Safety.

Hey Roger,

Perhaps I have read incorrectly although do you really believe that Matrix will be worth less in 3 years time that it is today?

If you do I couldn’t disagree more.

Its extraordinary prospects are clear and well known. The upgrade to its Henderson complex, which if the company’s press releases are accurate, is the finest complex for manufacturing underwater buoyancy modules in the world. This complex will allow the company to double production at a cheaper per unit cost (being more automated than its Malaga complex.) If Malaga is utilised in the future the company could potentially triple its current maximum output.

The huge expenditure currently taking place in deap sea drilling for oil and gas.

New products, including an underwater insulation product for the gas industry (both Woodside and Chevron have already toured the new Henderson complex.)

It’s competitive advantage lies in its managerial experience within the industry, its superior product and reputation and its emphasis on R&D .

If I have read correctly and you really believe that MCE’s intrinsic value will fall over the next 3 years I’d really be interested to hear why given the extraordinary prospects and avenues of growth currently open to the company.

Best Wishes to you.

You have read the table correctly Nick. I’m more than happy for you to disagree with me – that’s what makes our stock market. You make very good points. They are well grounded. Thank you for sharing. Best wishes to you too Nick.

I assume Roger your IV for Matrix is decreasing in future years as you estimate the dividend payout ratio of the company will increase.

While the value of the company may not have as dramatic increases in IV over coming years we investors will benefit from a higher dividend yield especially when that dividend yield is based on our low purchase price thanks to your wonderful insights and comments.

I love the growth prospects of Matrix over the near term and look forward to continuing to build my wealth through these types of wonderful companies.

By the way FMG is my current standout stock pick for earnings growth over the next 3 years. While commodity prices may come off slightly I feel the market is not crediting the company for the superior margins it is and will continue to earn.

Greg,

I work in the iorn ore industry and so have watched it closely for some years now. I prefer AGO to FMG for three reasons;

1. AGO have consistently met or and exceeded targets, this should tell us something about their management. FMG on other hand claimed that they would be producing 45 mtpa from their Cloudbreak site in 2008. In 2011 they are yet to hit that run rate. It is therefore hard for me to believe that they will achieve future stated targets, it is about demonstrated performance for me.

2. AGO have DSO deposits that require suprisingly little capital for start up. FMG’s ore bodies require substantial pre strip, plant and equipment and therefore much more capital.

3. AGO has no debt, FMG has more than I am comfortable with and potentially more will be required to launch their Solomon project.

I believe that AGO will soon have an IV of over $5.00 and may even make Roger’s A1/A2 list after they post full year results.

Steve

A stock i purchased some time ago is Hansen Technologies – it was one of the first i applied the valuable technique to – it therefore has some sentimental value to me.

For conveneince i used a RR of 10% and from this came up with a value over around $1.05 and as it was trading at around .65 i bought some.

So far it has been good and through its ownership i have received a few fully frnked dividends so it has paid me quite well.

I note someone in the blog recently was concened about the business impact with the high AUD.

I remember in Feb reading an announcement when they declared their dividend and updated the market on its 1/2 yr results. I quote from that announcement:

In announcing the half year result Hansen’s Chief Executive, Andrew Hansen, observed, “As a result of our international expansion, 40% of revenue is now derived in foreign currencies. The appreciation of the Australian dollar has had an impact on our businesses performance. Revenues in the first half were a net

$1 million lower than for the previous corresponding period. However, as a significant part of our cost structure for labour and occupancy is now incurred in those same currencies, we have offsetting cost reductions which, together with ongoing investment in development efficiencies, has allowed us to achieve an improved operating result in spite of the net fall in revenues.

For what it’s worth i still hold but will be curious to see what results will be like when they next report.

I reckon the buisienss is bullet proof – no debt and a reasnable ROE although i am not convinced of its competative advantage.

David

Hi David,

I thought I would calculate HSN’s IV using Morningstar data off the Rivkin/CMC Markets trading platform I use. I came up with 0.69 and it closed today at 0.87.

My inputs (FY 2010) were eq.per.sh 0.32, ROE 20%, rq rtn 11%, p/out r/o 69%.

I used 20% ROE rather than last year’s 24% because 2 out of the previous 3 years’ ROE were less. If I use ROE 25%, IV HSN comes out at 0.92.

Hi Roger,

I had companies such as Blue scope, qantas, hastie and many others which would have really made some real damage. NOW I don’t hardly think about my holdings and if the market did close for 3 years ( like you say Roger ) I wouldn’t blink.

Thanks Roger ( always )