Is it just Harvey Norman or bricks & mortar retailing generally?

You don’t normally expect to get investment tips from a mothers’ group get-together, but that’s what happened to me recently when the conversation turned to retail operations.

Relaxing with a glass of pinot gris the women, who have met regularly for a decade, were explaining why they spend less time in Harvey Norman stores than they used to. Why? Tired stores, tired layouts and uncompetitive prices have served the retailer only with the need to revamp its entire offering. And that, it hasn’t done.

Retailing in Australia has been in the eye of a perfect storm for some time. As I’ve written previously, the strong Australian dollar has encouraged overseas travel and online purchases from overseas businesses; and the two-speed economy has ensured that credit growth (the borrowing of more money to buy stuff) is muted.

I’ve always been suspicious of a company that issues a report to the market after the close of trade. On Monday 31 October, a major retail business in Australia did just that. After closing time, Harvey Norman released its sales and earnings for the first quarter of the 2012 financial year. Given its timing, the announcement was almost certain to be negative. Indeed, the stock fell 4% the next day.

Instead of focusing on the retailing offer, refreshing store designs and improving range, company representatives focus on property, horse racing (Gerry Harvey is one of the country’s biggest bloodstock owners), goading the Reserve Bank of Australia to cut rates in “the national interest” and campaigning to have Australians pay GST on items they buy overseas for less than $1000.

Harvey Norman’s first-quarter sales were down 3.8%, as were like-for-like sales. In Australia, like-for-like sales were down 2.8%, in New Zealand down 10.6%, down 8.9% in Slovenia and down 11.1% in Northern Ireland. A stronger currency against the New Zealand dollar, the Euro and the pound has exacerbated the results. Profit before tax – a very important measure to us when estimating intrinsic value – was down by … wait for it, 19.3%!

Harvey Norman claims the strong Australian dollar and the closure of 34 Clive Peeters stores contributed to the poor result. I would argue that a failure to reinvent the offering also contributed. More worryingly, this latter factor is unlikely to go away any time soon.

Compounding this problem is the very likely scenario that the declining iron ore price – recently at about $115 a tonne – will seriously crimp margins for the only sector that has been running at full capacity in this country. Australia’s stock market has become the tail that wags the dog. Its wealth-effect on Australians and the impact on sentiment are important determinants of activity and in particular, retail activity.

With the All Ordinaries index dominated by resource companies and financial services companies it is possible, if not probable, that a declining iron ore price leads to lower stock prices and lower economic activity. I am no economist, but I can understand some experts’ calls for further rate cuts.

Back to Harvey Norman, and like-for-like sales declines of 2.8% compares favourably with JB Hi-Fi’s decline of 3.5%. Indeed, if it became a trend, one would argue Harvey Norman is winning back market share from JB Hi-Fi.

But before you get too excited about this comparison, you have to realise JB Hi-Fi’s profits are higher than they were last year and last year’s profits were higher than the year before that. In Harvey Norman’s case, profits before tax are down 19.3% compared to the same time last year, and last year first-half profits were down 16.5% from the year before that! One retail analyst I know and respect made the point that at this rate Harvey Norman will produce an average profit slightly ahead of the first-half profit made back in 2004, when it generated sales revenue of 62% of today’s sales.

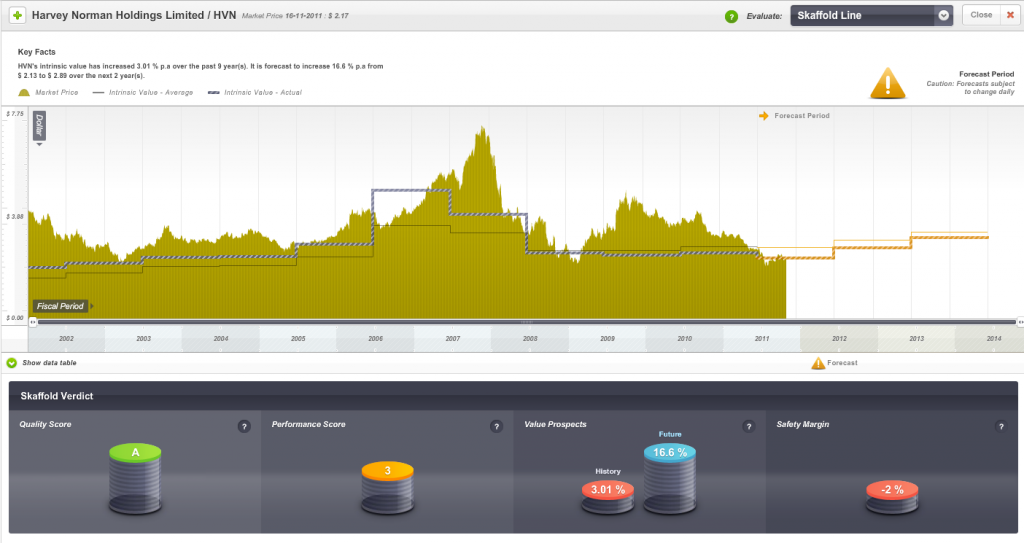

My intrinsic value estimate for Harvey Norman is about $2.00 a share against today’s share price of $2.17. However this is based on earnings per share of 23¢ for 2012 and that is, quite possibly, optimistic. Over the next few weeks, analysts will bring their earnings after tax estimates down for 2012 materially. This will have a negative impact on intrinsic values and I suspect we will discover a price above $2 is a premium to intrinsic value. Most interestingly, for followers of any rational approach to calculating intrinsic value, Harvey Norman’s updated intrinsic value is no higher today than it was nine years ago, in 2003.

This can be seen in the following chart, which plots the share price of Harvey Norman against its estimated intrinsic value. Generally, we look for companies that have a demonstrated track record of rising intrinsic values and are available at a large discount to the current year’s intrinsic value (see 2006 in the graph).

The lack of any real change in intrinsic value and prices (which follow intrinsic value in the long run) reflects the maturation of the business. You can see that in the short run (in 2007 and again in 2009-2011) prices can get ahead of themselves thanks to many factors including irrational exuberance.

In the long run, however, the market’s weighing machine will do its thing and prices generally revert to intrinsic value. That’s why having a rational method for estimating intrinsic value is so important!

The forecast change in intrinsic value may also decline now that Harvey Norman has provided lower guidance. And it’s not unusual for analyst forecasts to be “hockey-stick” optimistic at the commencement of the financial year.

But long-term, Harvey Norman is a mature business in a small country and it continues to swim upstream against the online retailing avalanche. This is a structural shift rather than a short-term trend and Harvey Norman will need to respond by convincing Australian women in mothers’ groups all round the country that it is fresh, new and competitive.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

Hi Roger, interesting comments re the bricks and mortar debate.

Owning a small business and also having an online component I can relate to the changes in place within the economy,however there appears to be a couple of points you failed to mention re the online experience.

Take for example the fact that small business,many of them retailers are the largest single employer group in Australia and at present are shedding jobs at the rate of about 150 jobs a day.

Whilst it appears fashionable to be flogging the bricks and mortar retailers as uncompetitive,old fashioned etc,the unfortunate reality is most online consumers are still relying on their bricks and mortar retail jobs to enable them to be able to buy anything online or otherwise but still appear to expect all the benefits a “real job” gives them..

The sad fact is by buying more online not only are they doing themselves out of a job but also in many cases,their life style also.

Buying from overseas basically takes money out of our own local economy (no GST,under $1,000) in many cases no taxes at all being paid by some online sellers.

The truth of it is with spending money locally,it gets spread around (ie if one business is doing ok,it buys products from others,employs more people,supports commercial real estate markets etc)

There is also no mention that us price gouging retailers are paying our staff (consumers)annual leave ,sick leave, superanuation,maternity leave and range of import duties and taxes on anything we retail.

All in all ,the consumer is in for short term gain and going to experience long term pain.

This has a two fold effect, less actual jobs for consumers thus less working opportunities for your friends kids, no money to buy anything online anyway.

It may be that we are heading down the path of the US and UK but the big difference is the consumer population,us with our 23 million people versus 300 odd million consumers,we just don’t have the scales of economy or amount of consumers locally to support a healthy business model in both bricks and mortar and online.

Consumers make their choices and will eventually cop the results of those choices and perhaps one day the only way they will know what they are buying is by guessing the amount of digits on a computer screen as there may be no place to actually have a go and look at one before buying it !!!!!!!

I agree entirely. I have previously written that by exporting our assets and importing our consumption we will end up working in foreign owned stores paying off foreign owned debt. Some of Our bricks mortar retailers need to lift their offer and our govt needs to change some of its policies.

Yes Roger you are right, press releases after hours, hoping to slip attention or the media cycle often spell bad news

Hi Roger,

Will there be a revised I.V. for Matrix in Skaffold given their recent announcement? By the way I think Skaffold is great, it’s given me a completely new dimension through which to view the market. If it prevents me from putting money into rubbish it will save me the subscription many times over. My three year old daughter loves the coloured balls as well.

Cheers

Hi George,

If the announcement for any company results in upgrades or downgrades to earnings estimates, you will find the intrinsic value will automatically adjust daily.

Ray Kroc, the founder of the McDonalds Fast food chain once said his business is not hamburgers, but Real Estate development. By franchising his system to operators he turned vacant land into a valuable income producing asset. McDonald’s benefits primarily from the franchise fees as the brand owner.

Similarly, Harvey Norman’s is a Franchise retail system where each department (Furniture, Computers, Electricals) is owned by a separate franchisees.

This franchise limits its ability to respond to the market and even undertake the renovations and change of formats needed to refresh their stores.

This franchise structure has retarded its ability to offer an effective online sales presence unlike JB Hi-Fi’s company owned stores approach unfettered by franchisee politics.

From the Financial Highlights on p.4 of the Harvey Norman 2011 Annual report, since FY2007 Franchise stores were roughly static increasing from 192 to 195. Whereas company store numbers nearly doubled from 53 to 96.

Although HVN has been a staunch defender of Franchised retail model, it appears to be changing its structure to directly control more stores by the acquisition of failed competitors like Clive Peeters chain.

I think its probably a case of too little too late overcome the inflexibility of its franchise structure to cope with the online threat of more focussed Australian retail competitors (eg. JBH or WOW).

All excellent points Keith, thank you for sharing your insights with everyone.

Roger, I note matrix issued an announcement after market close. This was to advise of new sales but I was intrigued by the number – it was $61 m. Didn’t,t they have guidance for $160 mill for the year. They note they have around $100 m in unfulfilled orders so if I add to this the $61 million they announce today – arey now on track – albeit cash flow will lag some months behind?

Market announcement after close – maybe I am just skeptical

David

Even more interesting is the lack of disclosure about the timing of the cash receipts from the orders.

Capital raising coming soon……….. stay tuned

Hi Ash,

With $93m of current assets and $41m of liabilities at 30 June 2011, a capital raising is possible, but unlikely. Cycling poor cash-flow after a good profit leads to better cash-flow in the subsequent year, unless there is dodgy accounting going on, or very extended terms are being offered to customers.

Michael raises a great point about the cycle of profits and cash flow. Of course its not just dodgy accounting that can prevent that natural cycle occurring. Capex and poor capital management (e.g.: excessive dividends) can also soak up that expected cash flow

Ash – it won’t be at $8.50 a share though!

David

I am forecasting good cash-flow in the current year as they collect on orders from the prior year. With Hendersen completed capital expenditure will be lower and this will place less strain on cash reserves.

My main concern is the continuation of getting orders. They will still need more to come through to meet 2012 guidance, though I think the market is already factoring in an expectation that guidance won’t be met.

“Reading between the lines” – they aren’t saying there will be cash flowing form these ‘orders and commitments’ this calendar year or the next – just by February 2013 … some might be earlier, but they aren’t saying so if that is the case.

I reckon you are spot on Chris.

“Reading between the lines” – they aren’t saying there will be cash flowing from these ‘orders and commitments’ this calendar year or the next – just by February 2013 … some might be earlier, but they aren’t saying so if that is the case.

You can say that again, Chris!

I am curious to know the difference between an ‘order’ and a ‘commitment’. A ‘commitment’ in this context sounds like being a bit pregnant.

I reckon the Matrix lads are still working out the communication thingo. They’ve learned about updating the market when something happens but haven’t realised that it is useful to relate it to past announcements and market expectations – eg. T what extent do these orders count in this year’s revenue?

In terms of Matrix’s revenue split, it’s approx. 70:30 for FY12:FY13.

FY12 total revenue is likely to be around $180M, so lower end of the recent guidance.

The $61M is part of the $105M latest revenue guidance.

Regards,

Mark H

I rang Aaron and left a message on his cell phone asking him about the timing of payments. He never called me back.

Booked – to -banked can take up to nine months depending on whether any retooling is required. And that presumes the customer (usually chevron et al) elect to pay on time.

The revenue info above came from Matrix’s acting CFO, so that’s his guide on where the revenue will land.

I emailed him late in the day last Monday and got a reply within 3 hours.

There was no clue on the level of future orders, over than estimating FY12 revenue will be at the lower end of the recent

0%-10% growth range.

Regards,

Mark H

I will never again visit a Harvey Norman, Domayne, or Joyce Mayne store while ever their screeching TV ads get me reaching for the mute button faster than a gunslinger for his Colt .45. But there’s another reason too. I have friends who have reported the most appalling stories of disappointment over broken promises re delivery dates, some stretching into months. I’m talking of reports over many years, echoing my own single experience so long ago i can’t remember when. I think the business is terminally ill, and I would hate to have the account for advertising or PR, because I would not know where to begin a campaign to save them. I’m not gloating over this. I’m sad to see any Aussie business go down, but a proportion always will I guess..

In the mid ’70s I had to frequently visit the Norman Ross head office in Homebush, Sydney. To obviate walking a few extra yards, one of the high-ups in the company used to drive his car through the entrance door, and park in the reception foyer. To my mind this screamed out “arrogance”, so I inquired, and I was told that the car belonged to Jerry Harvey. It’s odd that a small thing like that has induced in me a prejudice that lives on nearly forty years later.

In recent years an HVN executive has taken to opining on TV (I selected the word ” opining” because it rhymes with whining). I cannot imagine Julia Gillard and Wayne Swan being moved to introduce legislation to help poor HVN execs buy another thoroughbred. This whining has exacerbated my prejudice, as have the strident HVN advertisements.

As a rule, I admire people who make piles of money, and that includes Jerry, and that other chap who thinks his opinions should be heeded, Dick Smith – but I find both of them irritating to the point of wanting to do the opposite of whatever it is that they advocate. I wonder if these two people would do the businesses named after them, and the causes they advocate, a favour by simply fading from the media scene.

Some of my experiences with retail shopping.I recently purchased a new tv. I chose the brand (Sony) and model no from the internet. Next I went to the physical stores of JB Hifi, Harvey Norman, & Myers and shopped for that brand and model no. All three stores were within a couple of dollars of each other. I bought at Myers. I did the same exercise for a matching sound system. This time I bought at Harvey Norman.Comparing the staff attention to my needs.On buying the TV All three coys staff seemed to know their product. The most courtious was Harvey Norman, the salesman got a trolly and waited with me at the check out and then delivered the product to my car and loaded it for me. Then he thanked me for the business .How long has it been since someone has thanked you for your business?The Harvey Norman store was clean ,well lit , and well marked out. The JB high fi store was cluttered . Myers was some were inbetween. At both HV & Myers the staff were well dressed , at JB it was hard to tell the difference between the scruffy dress of the staff and most of their customers. A big negative for me was the security guard at the exit checking the bags.

At the end of the day it is the financial performance that counts. JB is the winner here.

Probably should say that I am getting a bit long in the tooth and others may have very different experiences at different locations.

I do hold some JB shares.

And Yes, those screeming adverts of HV drive me nuts.

Regards Tony Connellan

Thanks Tony for sharing your experience.