Is cash made from Sandalwood?

A number of Value.able Graduates have asked me to share my view on TFS Corporation Ltd (ASX:TFC), the owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia (an area I have visited and can’t wait to get back to).

A number of Value.able Graduates have asked me to share my view on TFS Corporation Ltd (ASX:TFC), the owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia (an area I have visited and can’t wait to get back to).

The first comment is from SI:

“I just had a look at TFS… wow is all I can say. I agree this is a monopoly in the making. They have control over customers with many signing up to a % of production years in advance and $$ to be set at point of sale. There appears to be medical interest developing, significant cosmetic and industry demand and cultural/religious needs not wants. So demand is very strong and lacking substitutes. On the supply side I see world supply is dwindling and TFS is really the only viable source – also natural/sustainable and green! There also appears to be huge barriers to entry for any competition and TFS is 15 years ahead of any rivals! So using Porters 5 forces: they have power over customers, power of suppliers, no realistic substitute, huge barriers to entry and a monopoly position… WOW they are also vertically integrated soil to end product! Also trading on a PE of approx 5, making money now growing trees, paying a dividend and yet to benefit from revenue from harvest….which appears to offer huge revenue flows starting in 2 years.”

And from James:

“… Their ROE is good, payout low and currently well under value.”

Putting aside the more than slight promotional tone of SI’s comments – thanks SI, it appears on first blush that TFS has several things going for it: bright prospects, possible competitive advantages, high levels of profitability and a valuation greater than the current price. Thanks SI for openly sharing your thoughts on the business.

To add my two cents worth, it would be useful to revisit a very important chapter of Value.able: Cashflow and Goodwill. I fear its importance may have been overlooked by readers. There are been precious few questions about, or discussion, of cashflow at my blog, even though it occupies a very large part of my time analysing companies. For TFS, in the current stage of its lifecycle, this chapter has many considerations for investors to take on board before jumping onto the Sandalwood bandwagon.

Let me start on page 147, third paragraph, bold font: “The cashflow of a company that you invest in must be positive rather than negative”. The reason I have emphasised this statement is because I want to make something very clear – reported accounting profits often bears little resemblance to the cash profits or cashflow of a company.

In business you can only spend cash. Indeed, cash is ‘king’. Try going to the local grocer, showing him an empty wallet and offering instead some accounting surplus to pay for the weeks fruit and veg. You will get just as far in business without real cash – unless the business has access to external funding to plug the gap. Please make sure you re-visit Chapter 9 of Value.able.

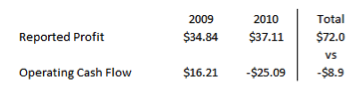

With re-reading from page 145 in mind, focus your attention to the profits and operating cash flows reported by TFS in 2009 and 2010.

TFS has not generated a single dollar of cumulative positive cash flow in the past two years. Despite reporting $72m in profits, TFS actually experienced a cash outflow of -$8.9m. In 2010, a record $37.11m in profits is matched by negative operating cash flows of -$25.09m. Remember page 147, third paragraph, bold font?

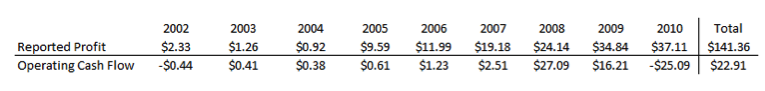

It could however be that the cash flow disparity is merely a timing issue. No problem; a longitudinal study will help. Turning our attention to the past 10 years, is the situation any better?

Total reported profits over this period equate to $141.36m, but this is money TFS cannot spend. The total of operating cash flows produced over the same period, money the business can spend, is significantly lower at $22.91m.

What if I now told you that over the same 10 years, the business had spent $77.43m on investments including property, plant and equipment, and paid $29.94m in dividends!

And all this from Cash Flow of only $22.91m? This is generally only achievable if a business has very accommodating shareholders and financiers – who, to date, have tipped in $61.14m in equity and $43.19m in debt to plug the hole.

Does this business meet Chapter 9’s description of a Value.able business?

Extraordinary businesses don’t have to wait for cash flow. Their already-entrenched competitive position ensures that cash flows readily into management’s hands to be re-deployed/re-invested (with shareholders best interests at heart), or returned.

TFS and many other businesses listed on the ASX are able to utilise various accounting standards to depict the appearance of a profitable business when they are in actual fact heavily reliant on external financing to fund and grow operations.

I am not saying in any way, shape or form that TFS is a business that will head down the same path as many in the sector before it – remember Great Southern Plantations and Timbercorp? TFS may soon produce fruit (so to speak). And if SI and management are right, the business offers “huge revenue flows starting in 2 years”, is a “monopoly in the making” and 2011 will see a significant increase in positive operating cash flow as settlement of institutional sales occurs throughout the year. If this occurs, the business may achieve an investment grade Montgomery Quality Rating (MQR).

I prefer to see runs on the scoreboard – a demonstrated track record – and profits being backed up by uninhibited cash streaming through the door before I open my wallet. Yes, one will miss opportunities adopting this approach but those fish you do catch are generally very good eating.

So until such time as TFS’s cash starts to flow, there are other cash-producing listed A1 businesses to choose from.

This brings up an important point to consider; make sure reported profits are backed up by cash flowing into the business. If it isn’t, be very conservative in your assumptions. Better still, move on to valuing businesses that are extraordinary, those with an MQR of A1, A2 and B1. TFS is a B3.

I will watch this one from the sidelines for now, even if I miss out on returns in the meantime.

Posted by Roger Montgomery, 28 October 2010.

Leah

:

We invested in 2010 and have seen no money. Looking to sell it, don’t know how. The fin planner that was looking after us can’t be found.

Can you point me in the right direction.

luke-lee-731135

:

Hi Roger:

It’s the last day in 2014. And what do you think about this company now?

2011 Cash flow: 40.4m

2012 Cash flow: -60.5m

2013 Cash flow: 21.8m

2014 Cash flow: 7.2m

I always check CEO’s earning and salary.

Frank Cullity Wilson, his salary in 2014 is $715,928, Total is $1,015,907

his holding in 2014 is 46,801,493, according today’s share price $1.5, the value is $70,202,239.5, 70 times of his total annual income.

Does this give you a bit more confidence about this company?

BTW, I was concerning about the cash flow issue, I searched around on internet, and found your blog, very helpful, thanks.

Seany B

:

Hi Roger and all,

I remember a stong point in your book Roger and it said that the strength of management is a very important aspect to invest in a stock. I rate this very highly as a stock selection criteria now because I have been burnt over and over again with companies such as RAT, ASQ, NLX, RRT etc, etc. Yes, and there are five others that I have owned that have gone in to administration – yes nine in total.

If only Value-able was out years ago, I would have saved a fortune. Oh well, better late than never.

If TFS is managed well, you would think that they are aware of the cashflow issue. If they are, wouldn’t it be in thier best interest to explain the cashflow information to shareholders by stating that it is expected that cashflow will improve dramatically over the next 2-3 years. If they did, this would put a rocket in to the share price, which is exactly what they would want. Of course, if it isn’t going to be good, and they aren’t good management, they would stay quiet. Considering other failures in the sector it could be very timely. The management of this company try whenever possible to distance themselves from the management investment schemes failures as much as possible, and say TFS isn’t like the others. Wouldn’t this be the best way to prove it?

Come on TFS, show us if you are really a good management team!

Seany B

Mark H

:

Greg MC, David S,

Thanks for your views. Makes sense when you overlay the business context.

And if your better half can come out of it with a discounted online bag too, then the world has to be smiling at you!

Cheers,

Mark H

Matty

:

Hi Roger and Room,

What a very topical post. I started investigating some companies in Europe based on the FT Europe 500 list Roger posted earlier. One of the companies that caught my eye was Vestas. Their share price has been hammered recently and not without good reason from what I can tell; competition from big conglomerates on market share, expensive production facilities that need to be closed and rightdowns on closing facilities.

They are now trading well under their IV based on FY2009 but they have only just made a profit in Q3 2010 and will struggle to make a full year profit.

I held off on dipping in only because I was worried about 2011 orders and had a second look at cash flows and saw that from 2005 to 2009 the investing cash flow was -2086mEUR and operating cash flows of 1690mEUR. Operating cashflow for current year up to Q3 is 17mEUR.

The question is (as written in previous posts) when is it finally harvest time. When a company is investing alot of cash in the business to lay the foundation, there must come a time when the cash is flowing into the business owner’s pocket. The question with Vestas is whether there technology is enough of a competitive advantage even though the investment in PP&E is certainly a big barrier to entry. Any opinions out there?

Matt No. 10

Roger Montgomery

:

Hi Matty (Matt No.10),

Well done for expanding everyone’s horizons.

Matty

:

Hi Roger,

I didn’t see anyone bring up your idea in Chapter 9 Table 9.4 where you take away investment in PPE from the cashflow to get an idea of how the business might look if it stopped expanding. Is there a way of getting behind the PP&E number or is this just going on feeling that most of the cash into PP&E is going into expanding the business? Or are there certain business characteristics/industries where you can see that the cash is going into expensive equipment just to keep the business on two legs?

Working capital is another one where companies try and minimise this number but apart from it being linked to inventories and trade receivables I don’t really understand it in relation to valuing a business or if it is another hint that you are looking at a good business. I would love to apply this cashflow knowledge in finding a hidden gem and not just in hindsight on a great company like JBHi-Fi.

Roger Montgomery

:

Matty,

We are trying here to avoid scaring Value.able undergraduates. Lets just say working out what is growth capex versus maintenance capex is not easy and some experience with an industry or assistance from friends in it helps.

Mark H

:

Hi Roger,

Re: David’s q? on the ASX above, I see you considered that a takeover was possible back in Aug 2009 if regulatory changes were to come in (Valueline: ASX…).

That’s as close to crystal ball stuff as you can get! And proof the search button’s working well :-)

On Oroton, I think: great company and fantastic results. I just question the thinking around capital allocation (POR of around 80% for last few years). Given the very high ROE, this short changes shareholders in terms of long term capital growth (a learning for me from value-able).

Cheers,

Mark H

Greg Mc

:

I think you’re right in one respect Mark, that it would be wonderful if a company with ROE of 80% and little debt could retain its capital and still maintain that return on incremental equity. In fact, it would be a company virtually without rival if it could do that!

I doubt that they can though. From what I can surmise from the company announcements and presentations, they still think there is some room for new stores in Australia and certainly in Asia but they are proceeding with significant caution on the Asian expansion. I’m sure that if they were so inclined, they could retain that capital and aggressively march into Asia but who would be comfortable with that idea? It means therefore that they may not have a use for all of that extra dough at this time and are paying it out. I note that their debt was up a touch at the same time as increasing their dividend in their most recent report but at the same time the store refurbishment program will be winding down soon so there will be less expenditure on that front so the minor increase in debt is probably of no concern. My guess is that they’ll probably try to maintain their payout ratio roughly where it is and the cash that they are currently using to refurbish Australian stores will be applied to their expansion into Asia (providing it meets their hurdles). Their spend on new stores vs refurbishments was about 50:50 last year. It will be interesting to observe how they go as they step outside Australia given the experiences of many Australian companies trying to expand overseas.

On another note, it will be interesting to see their online sales figures when they are next reporting. Shareholders received a 25% discount offer on Oroton online purchases from Nov 1-28 with their dividend advice which Mrs Greg Mc latched onto like a starving leopard on an open tin of cat food. It may be a small test run for promotion of their online store (or maybe they are just being nice in a businesslike way without going the whole hog and sending out a discount card).

Roger Montgomery

:

Hi Greg Mc,

…and the Asia expansion has thus far cost less than a small hatchback. Your observations about slightly higher borrowings and payouts is correct and probably not permanent. Important to watch the trends though.

David Sinclair

:

Speaking only for myself, I am not too concerned about Oroton’s high payout ratio. Retaining earnings is only good for the business if the retained earnings can be invested at high rates of return and I would rather the company give me back any money that they don’t think they can invest productively. I will try to illustrate what I am saying with a few figures.

If a company with an ROE of around 75-80% retains 20% of their earnings that gives them an implied growth rate of about 15%, which is not too bad. If they retained 50% of their earnings the implied growth rate would be almost 40%, and I don’t know of too many companies that could grow at that rate for more than a few years without their ROE falling! I would prefer a high payout ratio to a falling ROE.

David S.

Roger Montgomery

:

You are right David,

implied growth rates of 40% are usually just that – implied. ROE does fall.

NIc Arena

:

HI Roger,

TFS looks like an A1 businness in every sense except for the cashflow. I have a value of $3.80 using ROE of 25, RR of 10 plus payout rate of 29. What is your estimation for this company? Does it drop significantly because of the cashflow or is your estimate around the same value but you just won’t invest until it reach the coverted A! or A2 status? Thanks Nic

Roger Montgomery

:

The cash flow is such that any valuation is redundant.

Justin

:

thanks again for your insights roger. The hardest lesson from your book is to leave the emotions at home. I have certainly been guilty of following “hot tips” in the past and have learned that the closer your source is to the company, the less objective his or her opinion is and the less weight it should be accorded. Thus, while there have been some good tips on your blog (such as FGE), this particular blog is a good reminder of how properly to deal with all tips.

i hope we get the chance to chat at the seminar tomorrow, though I suspect that a large number of your facebook fans will be in the queue.

David

:

Hi Roger,

I wonder if you could share us your views/analysis on ASX-SGX merger. Thanks.

Roger Montgomery

:

Hi David,

As I was quoted in the paper as saying, the fact SGX is willing to pay such a high price raises two concerns. The first is that they will control the price charged to Australian companies to list and therefore access to capital and in order to recoup their investment, they will have to raise that price. The second is that if they pay too much and, as it has been the case in almost all such instances, causes indigestion, then there is the very real prospect that Singapore is just a stepping stone to ultimately another owner. They will be forced to spin it off or they themselves are bid for by someone else. How do you protect the national interest if you cannot possibly anticipate who the ultimate owner will be?

Ian Bartley

:

Roger

Thank you for this practical application of your analysis to a current potential investment that returns what appears attractive earnings.

Just a query: from where did you extract your cashflow and profit figures? The company website has figures (in annual reports) only going back to 2004 (yours go to 2002) with slight variations in the 2004 and 2005 figures to your figures.

Roger Montgomery

:

Hi Ian,

Annual reports mostly and then wherever else I can find them. Remember accounting standard changes in 2005.

Matt

:

Hi,

Sorry for beginner question but just wanting to at least make sure I have the correct inputs for my estimates. To obtain a payout ratio which set of figures should I be using? For JBH, CommSec has the following DPS :

2009 44c = 15 (2009 Interim) + 29 (2009 Final)

2010 66c = 33 (2010 Interim) + 33 (2010 Final)

When I look at what was actually paid (and affecting the EOY equity), the JBH annual reports have the following DPS :

2009 31c = 16 (2008 Final) + 15 (2009 Interim)

2010 62c = 29 (2009 Final) + 33 (2010 Interim)

What’s paid makes sense to me…

thanks Matt

Matt 2

:

Hey Matt,

Not a beginners questions, many have asked elsewhere on the forum. Roger’s answer has been that you can use either, as long as you are consistent. Having said that i think most people prefer using what is actually paid as listed in the annual reports.

Matthew R

:

Hey matt and matt 2,

Matthew here. I was the one having that discussion with Ken earlier here: http://rogermontgomery.com/the-smsf-review-reviews-value-able/#comment-4774

I thought about it and decided to stay with my method of calculating the POR which is to use the interim dividend and the declared but not paid final dividend. This is different to what Roger Montgomery suggests! He has said he uses the actual dividends paid, ie the final from the last FY and the interim from the current FY. You are probably wise to follow Roger’s sage advice.

The two main advantages to my method are that

(1) this method meshes with forecast EPS / DPS figures and so a dividend is not “skipped” (for companies with rising dividends “skipping” a final dividend will result in a smaller rise (or even a reduction) in IV in the first forecast financial year)

(2) it is more conservative (even accurate) in it’s valuation of a company which is rapidly increasing it’s payout ratio (look at the last fews years of JBH as an example)

The two main disadvantages to my method as I see it (and there may be others I’m not aware of)

(1) ending (and starting) equity needs an adjustment for the dividend

(2) it takes longer to enter the info from the annual report because you have to go to the notes to find the value of that declared but not paid dividend

However, if you buy into a good quality company with a large margin of safety below the trend of the IV then none of the above matters!

Cheers,

Matthew R

Matt

:

We seem to have alot of Matts here!

Thank-you both for your thoughts, it’s much appreciated. Thanks for the link as well, I thought it had been discussed before and had been trolling through old posts trying to find something.

Cheers, Matt

David H

:

I enjoy reading your analysis and enjoyed the book. It just makes so much sense. I would love to know an adviser who uses your method. I am working too may hours to be able to do the research as thoroughly as required and would prefer to pay for someone else to do this. Knowing the method then allows me to check the advice and make a final decision on any investment. Do you or any bloggers know where this type of analysis is available for purchase?

Roger Montgomery

:

Hi David,

I am sure you will find some suggestions although to retain the independent theme of the site, I would rather not see any promotion here. YOu can of course send me an email and I can forward some of the suggestions that come through from the readers and contributors here.

Greg

:

Hi Roger,

Forestry Tasmania often made an operating loss but unbelievably made accounting profits by simply revaluing up their forest assets (non cash). Tas govt then demanded a debt funded divided (cash). I wonder if TFS are doing the same?

Regards Greg

Roger Montgomery

:

Thanks for that very intriguing information Greg.

Simon

:

Excellent review Roger! I myself have wondered why there has been so little commentary regarding cashflow and goodwill on this blog, (I came up with the view that IV is the new black and as such will be talked about at the expense of other criteria). Roger the views you’ve expressed can also be applied to rare earth miners that so many would be value investors (i.e speculators) have recently purchased, without first considering that not one company outside of China has mined commercial quantities of these metals, and in addition they all have negative operating cashflows, they are in actual fact so reliant on external financing to fund and grow operations that without it they wouldn’t operate! I hope I haven’t inadvertently stolen Roger’s Thunder by preempting his next thread, but if I had a $ for every question I’ve read or been asked about investing in rare earths over the last eighteen months, I could give up teaching and go trout fishin’ in Canda’s Great Lakes.

Roger Montgomery

:

Thanks Simon,

I am delighted you have ben able to articulate those facts about rare earth miners. A friend Howard shared one of those interesting little facts with me today, he told me that ‘Rare Earths’ used to be called ‘Rarely Mined Earths’ but the companies that intended to list didn’t think it was a good label under which to sell the float. And as I have mentioned before, they are not ‘rare’ at all.

Manny Sorbello

:

Look at your A1s like JBH and ORL their profits have grown way more than their book values and their ROEs have remained high with no debt. I could be wrong but I put on record in a few years I reckon their ROE will start to decline further. I wouldn’t classify it as an A1 and I wouldn’t be mislead by the reported numbers that on the surface look good but in reality are not backed up by Cashflows as you rightly pointed out.

Roger Montgomery

:

Hi Manny,

Agreed. As I have always warned, a small population in Australia will ensure that companies reach saturation point relatively quickly and then either retain profits at declining rates of return on equity or maintain the high rates but pay most of the earnings out until such time as funds are required for a facelift or brand ‘refresh’.

Andrew

:

Hi Roger,

I am starting to get more and more into the cashflow side of things with my analysis of companies. And this is quite timely article as i have a query on cashflow and one of the darlings on this board.

The company is Oroton.

I have been looking at the cashflow statements from 2006 onwards to 2010. I have to say after seeing this i am starting to go a bit cold on the company and hope yourself and the many members can maybe let me know what they think or if i am completley going off the wrong tree.

According to my analysis oroton have been spending more cash than what is coming into the business since 2008. With the total Net figure -1810. This is just that particular years operations and does not include any cash that was there already at the start of the year.

They are still ahead cumulititavley over this period when it comes to cash at EOFY when you take into account the money that was there at the start of the year and foriegn exchange gains thanks to some positive figures in 06,07 and 08 but even this has come back to negative in 09 and 10 and appears to be a bit of a trend.

They do obtain huge ROE’s but after looking at the cash flow statement and looking at the increasing gearing levels, I am thinking that maybe it is not the company i thought it was. Am i being to harsh, am i interpreting the data wrong or do people out there get the same feeling?

Yours truly

Cash Confused of Sydney

Roger Montgomery

:

Hi ANdrew,

I get about $89 million positive for that period. Have you noticed the decline in debt? It can only be paid back with cash. Have you included that in your calculations. I assume you have read the chapter on cash flow in my book and applied the same calculations?

Andrew

:

Hi Roger,

Thanks for the reply, as mentioned in some of my posts this is an area that i am having trouble with. Can i ask what method you used to come to the 89 so that i can see where i am going wrong?

Was it the company cash-flow, free cash-flow or balance sheet method?

The closest i have come to your figure is Operating cashflow+proceeds from borrowings- repayment of borrowings which gave me 89,644. However this was aimed at trying to see where you got your figures and looking at the borrowing after your hint. It does not as far as i can see match the company and free cashflow or balance sheet methods.

I get a company cashflow of by deducting the investing activities of $29,324 from the net operating figure of $101,809 which gave me $72,485.

Free cashflow i deducted total dividends for the period of $53,123, payments to PPE of $36,314, payments to intagibles of $396.00 i also included the payment for software which i consider part of PPE of $1514 and to even it out i added proceeds from sale of PPE $119 and intangibles $8781 from the operating cashflow of 101,809. This gave me $19362.

They are all positive which is good, but i get the feeling that i am not quite working things out correctly and would appreciate anyones advice or feedback on this subject.

Roger Montgomery

:

Hi Andrew,

Hmmmmm. Let me have another look and get back to you. You should be able to replicate it easily.

Paul

:

I had a quick glance at TFS a while ago and noticed cash flow per share EPS first.

Mark H

:

This is a really useful post. Have to say, Cashflow and goodwill was an area of the book that I had to read 2 or 3 times before the penny finally dropped.

You make some very pertinent points here with clear examples.

Good luck with the share Investor seminars in Sydney tomorrow and the weekend!

Cheers

Mark H

Roger Montgomery

:

Hi Mark,

Thanks for reminding me! I appreciate the well wishes.

Lloyd Taylor

:

Roger,

I don’t know whether you’ve noticed how many of these sort of businesses have their origins in Perth. Is it something in the WA water?

I find that the WA factor in business is something to carefully consider. Hyperbole in the west is the norm, particularly when it comes to the size of testicles and brains. As a result, disappointment is not an infrequent occurrence.

Regards

Lloyd

Roger Montgomery

:

Hi Lloyd,

I will let one like that through but please keep it clean from here on in. Your insights are always thought provoking so please continue.

Lloyd Taylor

:

Apologies…said in the context of LTSBDP syndrome as detailed in the post “QR National $6 billion share float receives conflicting reviews from analysts”.

In this case, the Deep Pockets (DP) are those of the shareholders, to whom they say trust me, open your pocket wide wide and let me reach in deeply to extract what I want.

Ken Milhinch

:

Lloyd,

I think the white shoe brigade from Qld have moved to WA these days.

Regards, Ken

Ashley Little

:

Hi Ken

Good one mate

as a Qlder i should take offence but you are so right

Scott T

:

Roger,

Your ability to see issues that most others have missed, and then to describe those issues in such a clear and conclusive manner is just inspiring.

All the Best

Scott T

Roger Montgomery

:

Thanks for that great feedback Scott, I am delighted you are benefitting from and enjoying the posts.

Lloyd Taylor

:

Roger,

Postscript to my earlier post:

Is Si on the sell side of the investment industry for this stock?

It most certainly sounds like it.

In such a circumstance, I think it is only ethical and right that the potential conflict of interest should be overtly stated by the person making the post, as most other people appear to disclose when they own a stock subject to comment, or have a potential conflict of interest in making their assessment or position known.

I’d hate to see your blog/forum becomes corrupted by clandestine and conflicted sell-side parties, peddling distorted and less than objective assessments, motivated by potential self-interest.

Sadly, it maybe that you need to articulate a few rules regarding appropriate and ethical disclosure of interest by those posting on your board. Even if not applicable to this circumstance, it would give some of us more comfort to know that there is an expectation, indeed a requirement, of appropriate disclosure by people making comment.

Regards

Lloyd

Roger Montgomery

:

Thanks Lloyd,

Lets ask SI; Si, do you work with a broker and/or do you own the shares? Alternatively do you work for the company?

Ashley Little

:

Hi LLoyd and Roger,

My bet is on some peolpe trying to get the stock price up so the company can raise more funds from it’s shareholders.

After all by my calculations it will have very few coin in the bank after it payis it’s dividend in december.

Time will tell

Ashley Little

:

Hi Room

At Lunch today I was flicking though the October Issue of the smart Investor.

Something on pages 68 through 72 caught my eye.

I may have discovered who the mysterious SI is

I will quote Si’s view on one stock Isoft: “—– has strong market shre and revenue streams underpinned by long term contracts with governmnet clients. On forward price -earnings ratio of 12.8 times it’s trading at a significicant discount to it’s glogal peers which average a 2010 P/E of 23 times”

Sorry Si but to us on this blog those comments might need revisiting.

If I found the september issue of the smart investor, would you be the same author or have you simply cut and pasted these comments?

Lloyd Taylor

:

Ashley,

Well done. You’ve possibly nailed it – the identity of SI might be out.

Regards

Lloyd

Roger Montgomery

:

Hi Lloyd and Ashely,

It is of course entirely possible that anyone could have cut and pasted those very same words. I am working hard to encourage contributions here from new investors, experienced investors and even company CEOs. So lets go easy on those who may not appreciate the significance of failing to cite the source of their information. I cannot condone anything other than posts that encourage the writing of ‘original’ insights, thoughts and questions.

To everyone here, please refrain from republishing other people’s work. If you would like to post a comment that you have seen elsewhere please cite the source and I would be delighted to publish the post – giving credit to the author. I think we are building one of the best and friendliest communities for value investors here so thanks everyone for your help.

Frank

:

Your post actually reminded me of a company that was the buzz of the town last year. Nexbis (NBS) reported profits of over 40 million last year with only about 16 million in cash flow. This prompted analyst to question if the cash was indeed going to arrive. After a year, cash has not arrived and there were a couple more capital raising I think. Also, the nature of NBS was that it was a security business dealing with governments, so their typical announcment would entail little details as it was all confidential and a matter of national security. Another warning to beware of these sorts of companies.

Ashley Little

:

Hi Roger,

Very good article.

Balance Sheet first

Cash Flow second

Profit & Loss last

This is the order I look at when researching an opportunity.

For what it’s worth i think you can tell all sorts of porkies on the Profit and Loss but cashflow never lies.

Pete

:

Great article Roger, thanks very much. This really does highlight some traps that you can easily fall into without a thorough review of the complete financial reports. My spreadsheet for analysing companies has changed a lot since getting your book but on inspection just now, I was pleased to see that the highlighted sections in there were: Equity per share, Net Debt to Equity, Free Cash Flow, Return on Equity and Return on Incremental Capital Employed. As tempting as it is to include NPAT, I’ve been careful to not rely too much on that figure, using Free Cash Flow instead.

Keep up the great work Roger – the more people that can be educated about Value Investing and identifying good quality companies below intrinsic value, should only improve the quality of investment decisions in the future and consequently, the overall quality of companies / management available to invest in.

Roger Montgomery

:

Hi Pete,

Thank you very much for those encouraging words. It really keeps me going to know that you are benefitting from the effort.

Craig

:

Hi Roger,

Every so often someone produces a quote that is picked up and used by others for many years to come. Many of Buffett’s crop up here, but I suspect you have just created some gold of your own…

“Try going to the local grocer, showing him an empty wallet and offering instead some accounting surplus to pay for the weeks fruit and veg.”

Regards,

Craig.

Roger Montgomery

:

Thanks Craig, Glad you like it. I recently wrote a piece about the ASX, that I will post here soon and I think you will like another one: “When a dog that has outgrown its kennel, moves in with another dog that has outgrown its kennel, their problems are not solved, they are doubled!”

Gavin 2

:

Roger

Could you please let me know where CVN fits on your A to C rating

Thankyou

Gavin 2

Roger Montgomery

:

Hi Gavin 2,

B2 and very volatile swings in valuation.

Gavin 2

:

Thank you Roger

Gavin 2

fred

:

Hi room,

( CLO ) has had a hammering in the past few weeks, It may be a good time to put it on your watch list boy’s & girl’s.

see ya ( room RM )

Chris

:

Hi Fred,

Has anyone read CLO’s annual report and/or the article in today’s (29th’s) Australian? They might have some explaining to do.

Roger,

How long do you think it will be before we can tell whether CLO’s 30% stake in FGE has had any positive impacts for the performance of Forge?

Roger Montgomery

:

Hi Chris,

Six to twelve months or a trading update. Will depend on whether it has been something to be proud of or not one suspects.

Frank

:

Awesome post. Thanks for highlighting again the importance of cash flow. I think that is indeed something that a lot of us may have overlooked. The bad habit of concentrating on headline numbers are kicking in again. Cheers.

Roger Montgomery

:

Great stuff Frank. Thanks for your feedback.

Aaryn Nania

:

Spot on, good post Roger. The “value trap” lesson is invaluable!

Aaryn

Roger Montgomery

:

Thanks Aaryn. Delighted that its been a help. Of course if anyone reading wants all the calcs (not revealed above), be sure to pre-order the second edition.

Andrew

:

I have to thankyou for your chapter on Cashflow, it was an area i struggled to understand when i was looking through reports. I get the income statement and the balance sheet but for some reason couldn’t grasp my head around the cashflow statement. I intend to read it a few more times to really get it to sink in.

it also opened my eyes and made me wonder how some people can justify their wages when they were recommending ABC Learning. It all seemed so obvious after i read your book.

Now I pay more attention to the cashflow statement than the income statement.

Not going to be in the market for a while due to wedding saving commitments (these companies must have high ROE’s, some of their prices border on extortion) so just sitting on the fence analysing companies and coming up with my own rating system which will take into account the financial and competitive advantage side.Your cashflow chapter was an immense help.

I am thinking one of my ratings will be called McDonalds which is a company that appears attractive but is potentially hazardous to your health (or wealth).

Currently working on my own scoring system for companies

Roger Montgomery

:

Go for it Andrew,

Whatever makes sense for you. I have found my rating system an irreplaceable benefit in my own investing. I am delighted you have liked the book and thank you for sharing your feedback. Unlike you, so many people missed out on the first edition. If that’s anyone else reading Andrew’s feedback, be sure to secure the second edition by pre-registering or even pre-ordering!

Greg Mc

:

Roger,

A timely reminder to not get too carried away with multipliers and IVs based on accounting numbers without closer analysis of the cashflow behind those numbers.

By the way, speaking of fish, the fishing in the Kiewa River here is the best it has been in 10 years!

All the best.

Roger Montgomery

:

Hi Greg Mc,

I will be there soon. Be sure to leave some of those beautiful trout in the river for me. Better yet, go catch them and then ask Jerry to hot smoke them for me!

Greg Mc

:

Alas! Gerry is not here anymore. Alan in the same shop might do it if you ask nicely though though I think there may be some new obscure law about butchers smoking customers’ fish for them – probably something to do with not knowing where the fish has come from or how it has been looked after once caught. Of course I happen to know someone whose beloved wife bought him a smokebox for his birthday and smoking your trout is just so easy (and the rules that apply to butchers don’t apply to me). Pan size fish you can clean and chuck in, bigger fish you fillet and smoke. The smoking process takes about 20 minutes or so and that freshly caught, freshly smoked trout….there’s nothing like it.

Feel free to drop in when you’re down, I have a shopfront between the CBA and the supermarket….my location is one big competitive advantage for my little business (and though this post has nothing to do with sandalwood, I hope that the inclusion of the words ‘competitive advantage’ will make this post acceptable to publish!).

Roger Montgomery

:

Hi Greg Mc,

LIving in one of the best kept sectrets in Australia qualifies the post for publishing. Lest visitors however, think this site is anything but dedicated to the pursuit of investing in extraordinary businesses at large discounts to intrinsic value, may I politely suggest we refrian from any further discussions about fly fishing or trout. See you soon.

Greg Mc

:

Yes, Roger, I concur. It is after all pursuit of the financial and economic that provides the means to undertake the pursuit of the piscatorial and delicious.

The story of TFS and its cashflow vs reported profit brings me an uncomfortable reminder of the one problem child in my portfolio, one that I am unable to do much about now. I own a few WFLPA – the preference shares of Willmott Forests, now under administration. In my partial defence, I did not have Value.able when Willmott was suspended but I did have concerns about it, and did sell some of what I had. As a pref share holder, ultimately the biggest issue was not whether WFL would perform well, but whether the company would go under and I felt that it probably wouldn’t.

A glance at its historical performance though reveals warning signs – low ROE, rising debt only paid down by equity raising (and even then only partially), earnings that bore little resemblence to cash flow. And they were paying out ordinary dividends all through this time! Ouch. This experience means that I now have little time for companies like WFL and though TFS may turn out to be different, it appears to bear a fair few similarities too. Even if this one does start turning out some decent cashflow, I would still regard it with extreme suspicion and er….go after other fish.

Roger Montgomery

:

Hi Greg Mc,

Great post and comparison. I think visitors to this blog will genuinely benefit from that and while time remains, my suggestion would be to download the annual reports and have a look yourselves. Well done again!

Lloyd Taylor

:

Roger,

Great and telling analysis.

I never even bothered to go this far, given my knowledge of the amount of money that has been made out of growing and harvesting wood throughout history (i.e. a big fat zero and that is ignoring all the losses). Timber only works if the harvest is made on a “free” resource (i.e. no growth capital and expense).

When I read of the near monopoly position this business has on sandalwood, I was even more amused! How much sandalwood do you use in your daily life? Hmmm! What a barn burner of a business to be in? No thanks.

Regards

Lloyd

Mike King

:

Hi Roger,

Indeed cashflow is “king”. Looking at the historical cash flows for Great Southern and Timbercorp, you could see that their reported profits also bared no resemblence to the actual cash coming into the business.

Timbercorp reported profits every year from 1998 to 2008, totalling $433m. However, operating cashflow totalled just $66.8m, of which they paid out $683m in capital expenditure and $106m in dividends. And we all know where that business went.

Cheers

Mike