Getting the best out of the team

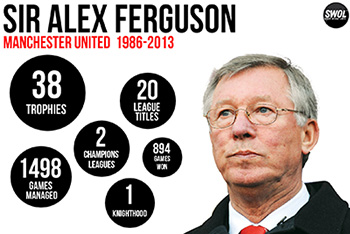

After 27 seasons at the helm of Manchester United Football Club, Sir Alex Ferguson has announced his retirement. Winning thirteen Premier League titles, five FA Cups and 2 UEFA Champions League titles in the ‘up-this-year, out-the-next’ world of professional sport is an extraordinary result.

Sustaining peak performance over not just years but decades may be the single most difficult challenge for executives.

In a recent case study entitled Sir Alex Ferguson: Managing Manchester United, Harvard Business School Professor Anita Elberse said of Ferguson, “He seemingly knows what to say when and understands what different players need . . . He holds everyone to the same high standards but will tailor his approach to different personalities”.

He is commanding when the situation requires. As Ferguson himself said, “You can’t ever lose control – not when you are dealing with 30 top professionals who are all (multi) millionaires. And if anyone steps out of my control, that’s them dead”.

Getting the best out of the team is every leader’s challenge and Australian business is no different. We believe that the business boat a manager gets into is arguably more important than how good a rower the manager is, but when a great business boat meets a great manager, the ride for investors can be as long and as enjoyable as it was for Sir Alex and Man U.

Fergie was big on finding talent early and training them up to play the way he wanted so that he could indoctrinate them, iron out the bad habits and develop a winning culture. Most high performing firms like the Big 4 Accounting Partnerships and McKinsey & Co. thrive on this culture which makes their staff highly sought after outside of the professional services realm (i.e. a lot of employers only want people with this background for certain positions because the the bar is set high and you have a reasonable idea of what you are getting). In fact McKinsey used to have a policy that prohibited employment of staff with external experience because they were “tainted” by poor process and work ethics – maybe that’s a little extreme. The development of the individual within the team environment mirrors Fergie’s approach. I know of graduates with 2-3 years experience in these firms who are hungrier and could manage certain business functions better than some highly paid department heads with 20 years in business, which is an enditement on business in this country. When you leave an environment like that and move into many of the country’s largest companies, you begin to see the ingrained mediocrity seeping through every level of management. Listed businesses need to do a lot more to recruit quality, raise the bar and appropriately train and develop staff. If you read between the lines of former United players who have gone elsewhere, you can generally pick up on the theme that the management and team environment at United was almost second to none (and this is coming from someone who does not support them).

Sir Alex knew how to tailor his message for individual players, it was not just ‘leading by fear’. But if that means he was ruthless about showing who was in charge, then that’s what made him successful in a world where every player is wealthy. For more on the man himself, see:

http://cuffelinks.com.au/leadership-lessons-from-sir-alex-ferguson/

Sir Alex also recognises when its time to go unlike some of our business and political leaders. As a Mancunian and City supporter I can’t help having mixed feelings about some of his success.

Or if things go really bad you could always throw/kick a boot at one of your more high profile players giving him a cut above the eye.

My opinion has been that he mainly led by fear, but perhaps in this case it was warranted considering the players, wages and egos under his control. He at least wasn’t afraid of making a change that would benefit the overall team even if people disagreed with him or pulling high profile players into line if they went outside it.

There are definitley some lessons to learn, i don’t think Alex Ferguson suffered from decision paralysis, he was ready and willing to change when the situation demands it and that is something a lot of businesses (hello DJ’s) do not do very well and could learn from.

Hi Roger, nice analogy. Be interested to hear your thoughts as to whether Man Utd – listed on the NYSE – is a good investment? Debt levels are far to high though. Cheers