Do these three companies represent the last of good value?

Fifteen months ago I was shouting it from the rooftops; “we will look back on this time as one of rare opportunity”. Since then, and as the All Ordinaries Accumulation Index rallied 61 per cent, there has been a fall in my enthusiasm for the acquisition of stocks.

Now, let me make it very clear that I have no idea where the market is going, nor the economy. I have always said you should never forego the opportunity to buy great businesses because of short-term concerns about those things. Even my posts earlier this year about concerns of a property bubble in China need to be read in conjunction with more recent reports by the IMF that there is no bubble in China. Take your pick!

My reluctance to buy shares today in any serious volume comes not from concerns about the market falling, or that China will cause an almighty slump in the values (and prices) of our mining giants. It comes from the fact that there is simply not that many great A1 businesses left that are cheap.

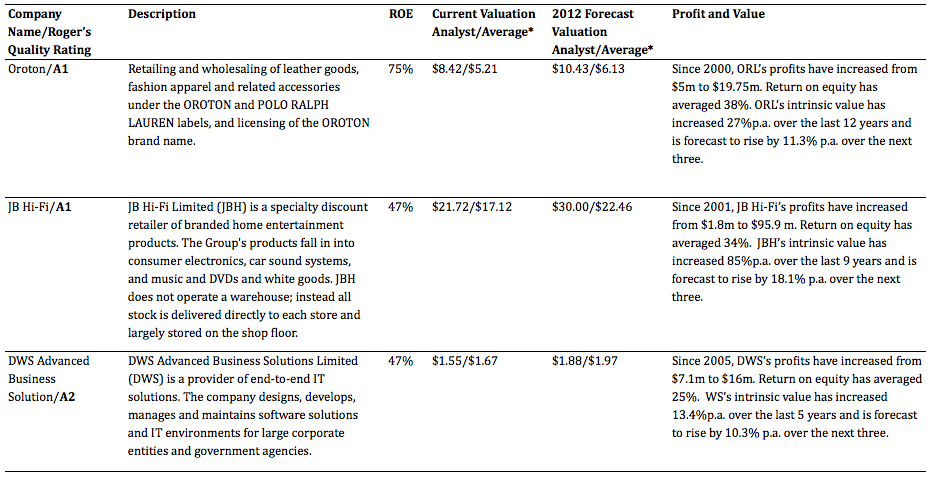

So here’s a quick list of companies that do make the grade for you to go and research, seek advice on, and on which to obtain 2nd, 3rd and 7th opinions.

* Note: Valuations shown are those based on analyst forecasts and a continuation of the average performance of the past.

In addition to these companies, investors keen to have a look at some lesser-known businesses, that on first blush present some attractive numbers, could research the list below. I have not conducted any in-depth analysis of these companies, but my initial searches and scans are suggesting at least a second look (I have put any warnings or special considerations in parentheses).

- CogState (never made a profit until 2009)

- Cash Convertors (declining ROE forecast)

- Slater&Gordon (lumpy earnings profile)

- ITX (trying to identify the competitive advantage)

- Forge (Clough got a bargain now 31% owner and a blocking stake)

- Decmil (only made a profit in last 2 years and price up 10-fold)

- United Overseas Australia (property developer).

What are some of the things to look at and questions to ask?

- Is there an identifiable competitive advantage?

- Can the businesses be a lot bigger in five, ten, twenty years from now?

- Is present performance likely to continue?

- What could emerge from an external force, or from within the company, to see current high rates of return on equity drop? For example, could a competitor or customer have an effect or are there any weak links in the balance sheets of these companies?

Of course I invite you again – as I did in last week’s post entitled “What do you know?” – to offer any insights (good, bad or in-between) that you have about these or any other company you know something about, or even about the industry you work in.

Posted by Roger Montgomery, 4 May 2010

Hi Roger

DWS has certainly done well of late, maybe the market has woken up to its true value. unfortunately i didn’t buy in as i was keen to wait for their annual report, given their guidance for the 2nd half wasn’t all that positive.

I would be keen to know what you think of another it stock, MLB, and a household goods supplier, MCP. Both have a bit of debt, but hopefully are a little safer if the market turns bad.

Looking forward to your book arriving!

Cheers

Simon

Hi Simon,

For the benefit of everyone else reading this, DWS has since moved up meaningfully since it was listed here as representing reasonable value and ticking the quality boxes. I will have a look at these other companies but as they have not jumped off the page that I use to identify value, I suspect they aren’t currently making the grade.

Hi Roger,

What is your Intrinsic Valuation of ORL? Should we follow the “analyst” or the “average” or are you somewhere in-between.

Cheers,

Alf D

Hi Alf,

The valuation range is $5.78 to $8.40 currently and $6.13 to $9.70 in 2012 and those estimates are based on forecasts for ORL’s profit to rise from $22.75 million in 2010 to $28.17 million in 2012. In 2009, the company reported a profit of $19.4 million or $19.76 depending on your adjustments. The shares are currently trading in the middle of the valuation range. My earlier comments are based on the valuations that are in turn reliant on forward looking estimates which may or may not be reliable. Everyone reading the blog should keep in mind that the primary objective and goal of these valuations is a didactic one. Be sure to seek and take personal professional advice before engaging in any transaction and NEVER forget that I have absolutely no idea what the price of a share is going to do. Estimating a valuation is not the same as predicting the course of its shares. The shares could halve or they could double and I have no way of predicting that.

Hi Roger

Realize you’re comfort zone is with solid, quantitative-valued, income producing stocks, but have you analysed upcoming ones such as MineMakers (MAK) or Bounty (BUY) for example. I would like to know more about valuation methodologies of high JORC potentials. Ideas very welcome as these examples fail using your standard formula published in Money June 2010 page 113.

Basically my bias is examination of and assigning value of management, reserves, hurdles, demand and of course relevance to technological trends that will use resources.

Of course this is harder than looking at companies like JBH in 2004 – how would I apply my above to tech retailer startups?

Hi David,

Looking at Minemakers up to FY 2009, it hasn’t yet generated a full year profit. In 2007 they had about $4 million of equity. They have been given another $36 million and no profit yet. If you could supply some forecasts for 2010-2015, I could estimate valuations, but you would need to be pretty comfortable with the integrity of those forecasts because a profitable track record is not demonstrated. BUY on the other hand enjoyed its first positive valuation in 2009 but again I have no information for estimates for 2010 and beyond. Given my time restrictions, I hope you don’t mind if I ask you to go and have a look at the half yearly results and any outlook statements. Feel free to post them here and we can work through a valuation.

Hi Roger,

I’ve been considering CVN (carnarvon petroleum) as a good value buy at the moment. Not sure how much you know, but I believe them to be an exceptionally well run business. And now trading below book value!

Unfortunately for them however share price is taking a real hammering due to both the current global credit situation, and the Thailand unrest. All of their earning are from oil fields in Thailand, and so far completely unaffected by the turmoil. Do you have an opinion?

Hi Dan,

I don’t know Canarvon well however if what you say is correct, the current turmoil may indeed provide an opportunity. Everyone should have a close look. Perhaps Lloyd can offer some insights while I am travelling.

Hi Roger,

Just fyi. There seems to be a bug with your site. Your reply posts are visible but not the posts you are replying to. Also, I just wanted to say thank you for creating this blog, and for making the time and having the patience to answer questions – it’s fantastic!

Rob

Thank you Rob,

I will send your comments to someone more technically adept than I am. I have noticed the issue as well and cannot quite explain why it is occurring. If anyone understands how to prevent the answers from appearing anywhere other than immediately below the corresponding question, please let me know.

Hi Roger,

Following on from your valuation of healthcare stocks in March, and having seen Sigma fall to mid 30c, what are your thoughts on the company and do you see a turnaround?

Also interested in your thoughts on Miclyn (MIO). I did my own valuation using your equation assuming 10-13% RR, 21% ROE (based on meeting prospectus forecasts), 20-40% payout ratio. I get a range of $1.68-$2.27.

I posted that article on March 25th and Sigma’s share price was ninety cents. I estimated its value at 56 cents but noted that it was one of the lowest quality companies in the group and “I won’t be buying these at any price and their Returns on Equity are less than those available from a risk-free term deposit.” The company’s quality has not changed and therefore a lower price (for me) does not make it more attractive. Having said that some fund managers have a different view and believe that there IS a price at which everything can be made attractive. Such an approach can be successful, but I believe there’s also more risk. One has to decide on the strategy and process before investments are made and then that strategy needs to be applied with consistency and over a long period of time.

It may be that Sigma is cheap and it may be that the price rallies significantly on a shift in sentiment and amid the prospects of a turnaround, but that is not the type of investing I engage in. I simply like to buy the best quality companies when they are cheap. You tend to find very few companies that meet the criteria when the market in aggregate is expensive.

One response to that is to lower one’s standards to allow investments to be made. The other response is to make no more new investments. I subscribe to the latter for myself. That does not make it the right strategy and it certainly doesn’t make it the only strategy. It just works for me. How you invest is entirely up to you, but always seek personal professional advice.

Thanks for the posting Roger.

May I ask where you source the Current Value (Analyst/Average) figures from?

I ask because in the case of DWS for example, while the assumed ROEs are similar, there’s quite a disparity in the intrinsic value arrived at between your figures and those available elsewhere?

Hi Michael,

There are a number of third party services however I don’t use any of them. I use my own unique and original valuation model.

Hi Roger,

Wondering if you are familiar with SUL, or could please add it to your list?

Regards,

Craig.

Hi Craig,

I was looking at Supercheap Auto just the other day when they announced the capital raising, so its already on the list.

You should have a look at FSA – High ROE, No debt, retains all earnings back in business (i.e no dividends), has substantial shareholdings by founding director and key management. What you think?

Hi Adam,

There are a handful of companies in their space so perhaps I will write something up about all of them. You will have to give me a few weeks as there’s a bunch higher up on the list.

Hi Roger,

In light of the new 50% discount on savings income announced in the budget last night, will this mean you modify your RR, therefore changing the valuations? and if so, when would it be applied – If it is a certainty that it is going to happen on July 1st next year, then do you apply it now?

Hi Rob,

The impact on company valuations is zero. The change instead represents a change in the value of the alternative investment affected only.

G’day Roger,

I came across this interview with well known value investor Donald Yacktman.

http://www.cnbc.com/id/37023649

Great interview, It shows the mindset you need to be a great investor.

By the way he likes News Corp and it is his second biggest holding. What are your thoughts on News Corp at the moment?

Cheers.

Hi Darren,

I have a different view about whether News is good value simply because its in such a fast changing business sector, making it very difficult to value. I guess thats what makes a market – different opinions that is. I think Buffett was once quoted saying that he couldn’t grasp the prices Murdoch paid for some assets. Clearly Murdoch understands the fast changing nature of the industry than most.

Hi Roger,

Just wonderding if you have any opinon on SMS Management & Technology Limited? And what you thought of Mcmillan Shakespeare at the current price?

Regards

Simon

Hi Simon,

If you type MMS into the search box on the right hand side of this site, you should be able to find a couple of threads with various comments discussing MMS. Regarding SMS, I will have to have a look afresh and put it on the list.

G’day Roger,

I was looking for your valuation/thoughts on HVN, AMP, BBG, a little while back. I have since sold AMP, before the current pullback, as I was not impressed by declining Eq/share and EPS, and its interest in AXA.

What do you think about DJS, HVN and BBG, given business reputation, and longevity. ROE is reasonable and debt is low. Current pullback may provide opportunity to increase long term holdings. Thanks.

Hi Bruce,

I will put the stocks you mentioned on the list. I need to warn you that my comments on TV and here should not be relied upon because I am under no obligation to keep them up to date. They should be viewed as educational in nature only. See the column I posted entitled “Is the TV your investment strategy?” The link is here I would also warn everyone that falling prices doesn’t automatically mean that shares are cheap. It may mean they are cheaper but not always cheap in an absolute sense. Be sure to seek personal professional advice before transacting.

I have banged on about a Cellestis twice on this blog, so here goes for a third time.

This time I have copied the best of a blog by Forrestgump on why CST is a worthy share opportunity and I concur with his thoughts.

http://forrestthinks.blogspot.com/2010/05/why-are-we-invested-in-cellestis.html

1) I can understand the business that Cellestis is in. Essentially they are in the business of exploiting their Intellectual Property (IP) to build a complete business that generates profits. It’s easy to understand – they make stuff and then sell it. It may be that the specifics (eg Tuberculosis) require some research but, again, it’s not that hard to follow.

2) They have not “sold the farm” in the process of building the company. An awful lot of Australian biotech startups have taken what seems to be a shortcut to success by climbing into bed with big International pharmaceutical companies. In virtually all of these cases, the long time to commercial success has meant that when (if) commercial success is achieved, most of the profits go to the International pharmaceutical company, rather than the shareholders that were attracted to the initial company.

3) They have a financial structure that I can understand. No complex financing arrangements. No part owned subsidiaries. No bonds. No complex derivatives. Their financial statements are as easy to interpret as those of my own little company (was).

No borrowings. Borrowings are not necessarily a bad thing. However, for a startup biotech, borrowing during the development and early commercialisation phases can be a real weight around the neck. Unlike equity financing, borrowed finance imposes real timewise deadlines. Cellestis has taken much longer to reach the current commercial success than any of us initially thought. Had they had borrowings to service during that time our equity would have been put at severe risk.

3) Trust in Directors. This is probably one of my most important considerations in making and maintaining an investment. Whilst the directors of Cellestis may have made one or two mistakes along the way (in hindsight) they have never, to my knowledge, been dishonest to us, the shareholders. Furthermore, the directors have drawn quite modest salaries through the development phases of the Company. They have been very conservative in their expenditure of our money. This whole Company has been built on around $25m.

4) A definable market. We know what our market is and we know the potential size of our market. We know who our competition is and we know that the barriers to entry are large (not so much in terms of $ cost but in terms of time to market).

CST has patents over the current antigens that take them through to 2017 but with the in tube technology, QFT IT has patent protection until 2023. The Quantiferon Intube test is the key to testing for the largest part of the market for Tb testing – that is Latent Tb.

on selling the farm, I see that Biota exist on royalties from the big pharmas and are therefore at their mercy – which with 4 years of patent left will be hard to find.

I agree with all of the above comments, except that I do think that market potential has tended to attract greater attention than the quality of the management. Buffett warns against looking at annual reports and says to follow the trend over time and let the management earn the value.

The main competing product lacks the ability to innovate and is inferior.

The barriers to entry in this market are gigantic. Therefore, the medium to long term risk of an over-the-horizon-competitor having an adverse impact on sales is slight.

The only new competitor is inferior.

The management is excellent, who, because of their personal investments and history, are unquestionably committed to making the company a success.

Cellestis has a leading product in a niche market that offers tremendous growth and likely high market penetration. The operating margin is spectacular. Increasingly, branding is also becoming a valuable asset.

Management is astute and have sensibly pursued a long-term objective when it comes to sales and marketing, rather than focus on short term sales targets. This will pay dividends in the long run. Despite the fact that we all would have liked sales to grow faster, the current sales growth is actually rather exceptional. This growth has been managed very well, with operating costs and inventory effectively contained.

CST has turned from a startup to a profitable business

Hi Terry,

Thank you for sharing your insights. Terry’s views of course represents his opinion only, so be sure to add it to your research but make sure you do your own.

Hi Roger,

I’m really keen to hear your opinions on valuations as the stock market continues to fall quite steeply. We know that you have felt the stock market has been overall quite expensive for some time and I believe you felt it needed to drop a few hundred points (?) or more to become closer to fair value. I’m hoping you have some appearances on Sky Business coming up soon – it would be great to get your insights right now! Very interested to know if we are approaching one of those rare times when it is a good idea to start buying again. Thank you!

Hi Steve,

Keep in mind that despite the apparent success at picking market direction, I have no ability to forecast markets. I will over the next few weeks revisit the estimate of the markets overall valuation. I do believe that the current level still requires a reasonably benign business environment in order to be justified. Of course I could be 100% wrong so don’t take my word for it.

Hi Roger,

Of the businesses you follow, how many currently have your A1 quality rating?

Regards,

Craig.

Hi Craig,

I have been asked this question recently. I will have to add them up, but I think we are talking about 50-70. Let me double check and come back to you.

CCV – my biggest portion fo my portfolio i value companies on buffets owners earnings. i would buy ccv up until 90c. it is so undervalued.

ORL – have picked it up on my stock scans. good company but too expensive (not big enough margin of safety)

JBH – obviously outstanding company but doesnt have a huge competive advantage. other stores can kill there rebate schemes and offer low prices. however would buy alot around 16$-17

TGR- very interesting company i would really like you to look at it i can value it because is has negative owner earnings but positive accounting earnings. roger i advise you look.

ANZ- looking cheap around $20

Thanks for sharing your suggestions for others to research. Nobody should buy or sell any shares without first seeking personal professional financial advice.

This might have been a little bit early, Roger! A lot of good quality names being sold off indiscriminately at the moment.

Hi JC,

The title of the post was “Do these represent the LAST of good value”. The implication of course being that everything else appears to be expensive. I thought the time was pretty good.

Roger,

I tried using the formula that you have suggested:

ROE/req. rate of return x Equity per share

According to my calculations ORL is valued at $3.20 based on:

ROE – 50%

Rate of return – 10%

Equity – 26.2 mill

No of shareholders – 40.9 mill

Similiarly JBH is valued at 7.50 based on:

ROE – 35%

Rate of return – 10%

Equity – 229 mill

No of shareholders – 107.2 mil

Are my calculations making any sense? Because they seem to differ greatly to the current price, and you seem to be saying that they are reasonably priced. Would appreciate some feedback. Thanks!

Hi FC,

The formula you are using, which is from Buffett’s 1981 letter to shareholders is only one half of the valuation approach – the portion of the earnings that are paid out as a dividend. The other half which is applied to the portion of earnings that is retained and compounded comes from a book written last century by an author with the initials R.S. All will be revealed in my book.

A brief comment on Cogstate:

This is a difficult and competitive market – and even thought I am medical – I find it difficult to work out who has the leading hand.

I can recall when CGS floated and have watched it intermittently. With this type of biotech – it is always good to look at the 5 year chart and see what has happened in the past. Biotechs are not easy.

Having said that – it does seem they are now in a position to move ahead, but they are not unique.

http://www.unitedbiosource.com/technology/computerized-cognitive-testing.aspx

The CDR system is one of their competitors that one of their strategic alliances bought (see October 2009 AGM) and in doing so sold their holding of 16% of CGS…

It is however hard to get these systems validated and accepted as a standard test so that does provide a bit of protection t keep newcomers out of the market, but aside from these 2 products there are others.

I cant work out the future market – they are good for trials of memory drugs – but are they ever likely to get used for clinical assessment of the aging population? I suspect that will be a very long time in the future (and even then I doubt doctors would pay to test their patients, or that the Aus Govt could for example say you have to use test A if there are several – if they did – you can bet that they would take the same approach they do with pharmaceuticals – a long negotiation and drive down the price).

My problem is that I cant work out the future market and I cant value the company. It isnt only the competition that I cant work out but the uptake in different areas of the market. Perhaps one day it will replace the current 4 hour neuropsychological test that we send some younger patients for – but will that be in the next 3 years. The answer is No – at least not in Australia. Reimbursement isnt going to support it in the public or private sector – hopefully they are doing the trials to validate it and get it through the system.. and their current cash flow can support it.

If we said what is the market – most doctors test their patients using a simple memory test that scores out of 30 (Folstein). It was developed in the 1970s, and it is only in recent years that the company took a stance on its patent. Having said that, it is a single page of questions that takes less than 10 minutes. Between that and the CAMCOG – another relatively simple to administer test

http://www.camcog.com/camcog/default.asp

they form the basis of most clinical memory testing in elderly patients which is the market that these computer programmes will need to crack to make the big time market outside of drug trials.

http://www.unitedbiosource.com/technology/computerized-cognitive-testing.aspx

So we come back to Cogstate – they have a growing company with lots of employees (costs) and a new product they are pushing.

It has developed a niche.. but it is not unique and has a lot of work to do to stay competitive and become the best test.

All too hard for me to work out – if I was going to enter – then I would take my rules of setting a stop loss and watching the share very closely. It isnt a share I could put away for a few years and feel confident about –

Financially – apart from now being profitable, it is good the Chairman has lots of shares (19%) and a financial interest in his company. They do tend to have a lot of options floating around about 10m (with 55.7 m shares on issue) but are reasonable with their CEO pay and obviouly use those options to offset the direct costs, and provide incentive.

Thanks Peter,

Another excellent insight and worth everyone listening to because its coming from someone in the healthcare/medical space. Thank you once again for taking the time to share your conclusions.

Hi Roger,

In light of the recent announcement by McMillan Shakespeare regarding no material impact from the Henry Tax Review and their acquisition of Interleasing, I was wondering what your subsequent thoughts were to this company.

Hi Warton,

At $3.50 and lower, I believe you will find I said that the worst case scenario impact from the Henry Review, could be a wiping out of half the company’s business. A benign outcome would mean its shares were well below intrinsic value. Keep in mind my subsequent comments that the market seemed expensive overall (Last week I could only really find three companies that I believe were good quality and potentially cheap – the reason for the title of this post)

Roger,

Can I suggest that the competitive advantage of iTx is in its supplier relationships and their rigidity?

Quote …iTX is the sole distributor for all Oracle/Sun Microsystems sales in Australia including Hardware, Software and Services and is recognised by the industry as the leading distributor of IT software products in Australia….Unquote

Now the competitive advantage only accrues as long as iTX maintains and cultivates these relationships. This they do by by absorbing supplier cost increases in the short term to maintain market share. Ashley’s inquiry on gross margin in another post reflected this dynamic. That said, the strengthening Australian dollar has more than offset this short term (FY 2009) absorption of greater costs of sales since FY 2009 (by my estimate the collapsing AU dollar in FY 2009 was the sole driving force for the declining gross margin). So the way these guys manage forex volatility in the relationships is also a source of competitive advantage

Simple question that goes to the issue of competitive advantage of ITX: In Australia who do you turn to if you’re in business and want a major IT system with the hardware sourced from the world’s most reputable and competitive suppliers?

Regards

Lloyd

Hi again Lloyd,

Excellent post. I would however question FX management/trading being a source of competitive advantage (Perhaps Soros or Jim Rogers has this) but the exclusive agreements are a source of advantage of the monopolistic kind for the term of the contracted relationship. One needs to find out what the terms are. No doubt it will be found in the company’s annual reports or interim announcements.

Roger,

A small but potentially significant point is that I am not referring to a forex trading capability of iTX (which as far as I know does not exist), but rather the way iTX manages the forex volatility in the supplier relationship, the supply chain and its flow through to product pricing. As I said, “So the way these guys manage forex volatility in the relationships is also a source of competitive advantage”. In the long run forex is swings and roundabouts and managing the supply change arrangements with this in mind and accepting gross margin as a bit of a buffer means they keep both suppliers and customers happy.

In this context the company notes that “Exchange rate exposures are managed within approved policy parameters utilising forward foreign exchange contracts….. It is the policy of the Group to enter into forward foreign exchange contracts to cover specific foreign currency payments within 90% to 95% of the exposure generated. The Group enters into forward foreign exchange contracts to manage the risk associated with anticipated purchase transactions out to 2 months within 90% to 95% of the exposure generated.”

ITX major vendor relationships are summarised at a high level on pages 10-12 of the 2009 Annual Report. The major relationship with Sun Microsystems has been in place 10 years and as described has some characteristics that make it a reasonably entrenched relationship with high shifting cost.

Regards

Lloyd

PS Prompted by your lead post I looked at CGS for the first time. The lack of identifiable product, negligible performance history, lumpy earnings and high cost base in a small cap company make it impossible for me to have any confidence that the outlook for the company can be predicted in any meaningful way. Therefore not one for me, but thanks for the suggestion to have a look.

Thanks Lloyd,

Both for the clarification and for reaching what appears to be a similar conclusion to many of the other comments posted by others here.

Hello Roger,

My thoughts for what they are worth

1) JBH

We first became aware of JB back in the early to mid 2000’s. We had a part share in a business that housed an ABC centre and the major supplier for this segment of the business was Roadshow which distributed the ABC/BBC videos/dvd. We keept hearing from the roadshow reps how well JB were doing with them and if growth continued they would be their biggest account. We were a half decent business with good growth and some of the bigger people from roadshow came to see us as the owners, We made sure that we queried them regarding JB to try and find out info on a potential competitor. It was quite apparent that JB knew exactly what they were doing and had good stock control and knew exactly the margins and what was required. Coming from a finance background I pull the accounts and as they say the rest is history. This is a wonderful business and would like to add to our position at $15 if it get there.

2)Oroton

This stock is not covered by may brokers but on the current figures it looks very reasonably priced. We have held off buying as it is likely that rising interest rates will bring some big downgrades to the retail sector. We are very interested in this stock

3) DWS

On face value this stock looks pretty good but, the big but is where will we be in 10 years. This sector has changed dramactically in the last 10 years and we really dont know where it will be in 10 years time. For 100’s of years people have been shopping, banking and getting sick. They have not been using IT for that long. This would not preclude me from investing in the sector it is just that my margin for safety and required return are much higher. Based on this DWS is not expensevive but not particularly cheap either.

4) Cogstate

This business definately needs further investigation. It’s potential makes me shiver. What we need to research is whether they have a competitive advantage. Do they have any patents etc. If things look good this business could grow massivly. Any help from bloggers would be greatly appreciated.

5)Cash Converters

Declining Roe yes but probably due to expansion in UK. Rising Roe in 2011 on anayst expectations. Probably in a great space given the expectation in Europe and higher interest rates in Australia.

Note that I believe that even if Asia does not totalay tank our banks will be competing with Governments of the world for a limited supply of debt and therefore interest rates are likely to rise well above the RBA cash rate.

5) Slater & Gordon

Sorry I cant find a competive advantage. All the intrinsic value is in the staff and if they leave what is the value of the business.

6)ITX

Sole distributor for sun microsystems in Australia but still not sure whether this gives them a competitive advantage. Any blogger who know more than me please fell free to let us know,

7) Forge

Management has recently made Clough richer and the existing shareholder poorer. This leaves me with no confidence in future managemant,

8) Decmil

Sorry don’t like companies leveraged to the resource boom . I expect plently of bad news for the medium term.

9) United Oversea Australia

I don’t have the time nor the inclination to check out a property developer in Kuala Lumpa.

Hope it goes well for current and future investors but it is not for me.

Hope this help others and I appreaciate all other opions,

Thanks again Roger

Great stuff Ashley. Thanks for sharing your thoughts and opinions. Others will definitely benefit.

Thanks for the feedback, Ashley, particularly on CCV. If you compare annual reports between Slater & Gordon and IMF (Australia), you might notice a different work culture & vision. Not quite the same businesses but competing for the same clients nonetheless. One has the feeling that the IMF directors have built up something more lasting and meaningful for their staff, but that’s probably just my bias.

I would be very interested to learn what patents Cogstate holds, if any. I can say that their website is definitely tailored to the non-scientist because their explanations are just mumbo-jumbo to me, more psychology than neurophysiology. Their products are the figurative black-box and the business seems more a set of automated services than a difficult-to-replicate technology suite, i.e. not Cochlear. I can understand Cogstate’s market though, although I wonder at some of their justifications on the website. There are professionals who already carry out the sort of tests that Cogstate offers – perhaps Cogstate is simply more marketable, reliable, efficient, simpler to use and cost-effective? Scuttlebutt will be very much appreciated.

Information technology is a complex space to invest in and I remain terribly afraid to dip my toes in it because fortunes can change so quickly here. The industry in Australia, operating in such a small pool (vs the world), is very much about reputations and capitalising on personal connections where “someone who is anyone knows everyone”. Account managers are often very well paid and I know one with CIO clients who will only speak with him and not his boss. The senior executives who assign the lucrative contracts follow trusted connections within the vendor, not the vendor’s brand. Even bigger players like IBM make use of these “connectors” to land referrals (with some compensation “on the side”). The smaller clients frequently demand steeper discounts over all other considerations (and get it, given the competition), which is why some IT companies enjoy high profit margins and others do not. It also explains why the market is so fragmented, in Australia particularly.

Hi John,

Some really useful thoughts again John. Thank you. To everyone, don’t go “tipping” anything anywhere, without firs making sure you thoroughly understand the company and its prospects and seek advice if needed. Regarding Cogstate, have a look at Peter’s post.

Also, Cogstate’s FY10 NPAT will be “in the range of a $0.2m loss to a small profit” so a buying opportunity may arise soon, if you believe in the growth story. From reading Taylor Collison & BIoshares’ reports, you can expect quite a bit of lumpiness in Cogstate’s profits as their contracts with clients are no guarantee of future work. Cogstate is also not what I’d call a low-cost “intellectual property” operation – have a look at its running costs relative to revenue.

Thanks John

Good thoughts after some digging around. I encourage everyone to do likewise.

I am in the legal industry.

You cannot compare IMF and Slater & Gordon (SG).

IMF is a funder, and takes a slice of outcomes based on percentage. The legal profession regulations in Australia prohibits a law firm eg SG from charging legal fees as a percentage of outcome (unlike USA). Therefore, law firms are mainly restricted to charging per hour (usual, but highly controversial and another subject entirely) or charging by fixed fee.

Essentially, IMF is a client which law firms services. IMF’s preferred firm is Maurice Blackburn. This created a schism between itself and SG, and SG now leans on a Nevada based funder to provide funding (an IMF competitor).

To value IMF, you must take into account its track record of success, and estimate the NPV of its present portfolio of funded cases, together with the value of the business as an ongoing enterprise. Assessing whether it has a competitive moat requires one to figure out whether it is just a financier, or whether it adds value to its investments through its operations.

SG is a plaintiff based law firm, having found early success in a major class action against BHP for pollutiion in PNG. Its business model is that of a law firm, but with emphasis on litigation. I see value in its brand, which will survive regardless of staff changes, therefore I disagree that there is no competitive advantage.

But is it the best firm? Well, that depends on what you are measuring. Firms such as Minter Ellison, Allens, Freehills, Clayton Utz, Mallesons, etc are much larger and much more established, and servicing areas of high margins such as corporate, banking and M & A. However, these players still have the old partnership model and the pains that come with that structure. Given a choice, if any of these firms are listed, then I would prefer them over SG any time.

However, our big firms are minor players in the global league. Major UK firms such as Clifford Chance, or US firms could swallow them up with barely a hiccup in their balance sheets.

If you wish to compare SG, the closest comparison in public listed sphere is Integrated Legal Holdings. And on that, my preferred business model is that of SG. An analysis of how legal firms work is too lengthy for this post, but I will point out that a legal firms earning stream, barring any major tarring of reputation, is actually quite a strong franchise.

Thank you Roger for your work.

Hi Peter,

Thank you for sharing your insights into why Law firms can be strong franchise and for letting investors know that IMF and SG are vastly different business models.

hi roger

regarding forge group you seem to think clough having a 31% stake is a disadvantage.

the ceo stated on one of his earlier reports that with the existing cash reserves and man power they could handle up to 400 millon of work on there books without a cornerstone investor.

forge have stated they currently have 300 millon of work on the books.

So reading between the lines you would have to think now that the alliance is complete there should be more projects coming up .

And with the extra project management skills clough can offer and the extra cash to cover risk ,forge projects will definately be larger in scale and revenue could jump as much as 50%

Remember clough has 1300 million of work on there books and forge is the contractor of choice , even if they get 5% of this work plus there own contracts this company is certainly going places

Remember clough has 1.3 billonof revenue on there books and forge will be the contractor of choice

Hi Joe,

I have previously written about how much I like the company. There may indeed be upside from the strategic alliance, but it is important to present both sides and the negative could be the blocking stake. Whether the stake is a benefit or a hindrance, the value of Forge is higher than the price. Remember that the estimated value is at least partly dependent on the economic outlook for China.

Roger,

Just wondering why Woolies isn’t on your list?

Michael

Hi Michael,

Just presented the largest margins of safety. WOW is a very high quality business.

Hi Roger, last week I asked about RFG, not sure whether you have had a chance to have a look at this and their intrensic value. The way I read the commentary from last week’s chatter about Buffett’s strategy of buying companies with value in their brands that is not fully reflected on the balance sheet and that obviously meet other characteristics that i am not professing to be an expert on…i know what i see and i simply see what is happening out there in the shopping centre food courts of Australia and the only consumers lining up for food/coffees is at Michels/Donut King. Brumbies i am not sure about. In the words of Buffett himself about a different company though, i sleep well at night knowing that there is a pie & coffee waiting for me at my local Michels, trite i know. But where do you see this company going? I see it paying down debt, increasing sites and growing to be a 1bn company in 3-5 years.

Hi DR,

I will have to get to it then…

I had a cursory glances – My 2 cents worth – It owns some good brands, had some good earnings growth since listing, with good ROE around 20%. Its EBIT interest cover is of concern to me. Its taken on more and more debt to finance all of those acquisitions it keeps making. You would hope that they don’t max out their credit facilities making too many more. There is always integration risks and risks of overpaying which could lead to a breach in debt covenants when the earnings stall then fall.

Seen it before with highly acquisitive companies, the returns diminish big time when they make 1 or more poorly timed or executed acquisitions, sometimes they just make a bad acquisition that loses them money. Then they start talking about EBITDA growth or sales growth instead of EPS growth. Watch the interest cover ratio in the next FY Report (divide the EBIT by the finance costs) If it drops below 3 times be alarmed (though couldn’t find any covenant in the 2009 Annual Report, no doubt one exists).

Good to see the payout ratio is low, they need it to pay down debt. Interested to see how you value this one Roger.

Hi Manny,

Thanks for the post. I am sure everyone would like to know which company you are referring to?

You were asked for your opinion & estimate of ROE for DTL. I have not seen your reply.

I enjoy your blog & appearances on Foxtel business shows.

Hi Mike,

Thank you. Projected ROE of 43% for the next two years. Thanks for the feedback.

JBHIFI ; I am cocerned that Rudd has badly wounded our mining industry and with the A$ being a resource based currency the A$ will weaken pushing up the landed cost of product to JBHIFI. Add to this a continuation of interest rates rises ( notwithstanding a possible pause for the next 2 months) and JBHIFI may find themselves in a whole new world. What do you think?

Hi John,

JB Hi-Fi aren’t as affected by the currency as you might think. Its the importer that carries the risk. I am surprised by the market’s reaction and suspect its a function of factors largely unrelated to a tax that will not be legislated after the next election – assuming it gets up.

JBH is a great business, but the key to the phenominal success of any retail business is store rollout. New retail offerings that can roll out a strong format always provide outstanding returns (think Reject Shop as well). And they are a classic Value investor play because you get a high ROE as well as a High ROA as each new store rolled out means the $1 you invested gets to be invested all over again at a high rate of return.

My question about JBH is, will the wind run out of the sails in the foreseeable future?

Once a high ROA/high network growth strategy tails off, the investor is left with sales growing at little over CPI and then the game changes to a defensive one. A lot less attractive as an investment, but not without merit, as the quality of the company is inherant in the difficulty for any competitor replicating the network quickly.

Another question mark was raised recently by the (early?) retirement of the CEO. While I know that retail management is a stressful 24/7 job and therefore cannot begrudge anyone stepping down after 10 years of exemplary service, you have to ask the question who is better to know the headwinds facing the company, the CEO or the investor?

Whatever is in store for JBH, I personally think the future will not be as rosy as the past. Therefore I would wait for the market to cotton on to the (Possible?) slowing of the store rollout and rerating of the stock into one with more defensive qualities before purchasing any shares. I could be wrong and have no inside knowledge, but imagine that store numbers are closer to saturation now than 10 years ago.

The more interesting question is, “Where is the next JBH or TRS?” Catching a store rollout early is the ticket to ride

Hi Tony,

I agree 100%. Getting in early on a store roll out works. At some point saturation does occur and if the relevant company can maintain its competitive advantage, returns on equity remain high but the company is forced to pay out a much percentage of earnings as a dividend. The valuation of such a company, then becomes like a bond. The alternative scenario is that the company retains profits and uses the capital to make acquisitions. These may be good or bad, and they will need to be examined at the time. Organic growth however, with a demonstrated track record of success is superior from a risk perspective for the investor, than growth by acquisition.

Hi Roger,

I work in the Alumina industry for a large diversified miner and there are a few key risks to our business in the coming years.

Alumina refining is a very energy intensive process and raw materials are also expensive. With a carbon tax over the horizon, and raw material prices rising, the ROE on alumina business’ is looking very bleak. The long term average is around 20% but has been around the 10-12% region for a couple of years now. Check out the BHP half yearly presentation graph on aluminium EBIT margins.

Aluminium prices are forecast to be around the $US2000 for some time as the developed economies slowly return to prosperity, I believe the outlook for the diversified miners alumina businesses is not looking great.

The is obviously not a good sign for the likes of Rio who do not have alumina businesses in the lowest quartile.

All in all, some insights which I have gathered, hope this gives yourself and other readers something to think about.

Regards

Ryan

Hi Ryan,

Thats a great insight. Thank you for sharing it as I have no doubt investment in the sector is something that has crossed the minds of a lot of visitors to this blog.

Good evening Roger,

My wife is also very keen on buying CCV however as a mortgage broker i am aware that there are some massive changes on the way that will relate to all providers of credit products going forward. From what i have seen, some of them are almost to the point of ridiculous in terms of the credit providers duty of care to the customer and responsible lending. It will be “criminal” for brokers and others to not take extraordinary steps to ensure that potential customers have every forseeable problem mitigated. I am all for responsible lending, but at the same time people need to be responsible for their borrowing also. The reason i mention this is what effect do you forsee this having on a pawn broker arrangement that Cash Converters specialise in????

Hi Chris,

If you type or into the search box at the right hand side of my site’s home page, you should find a post as well as associated comments that may be helpful.