You better believe it: the property price boom is over

After the frenzy comes the fall. With new apartments about to tip into oversupply, lower residential real estate prices could be on the horizon. And we’re not the only ones who think so. New research by UBS points to an end to the strong price growth of recent years.

In our blog of 19 May (“It’s the end of the world as we know it”) we wrote about a presentation by Stan Druckenmiller (former 2IC at George Soros’s Quantum Fund) at the 2016 Sohn Conference in New York.

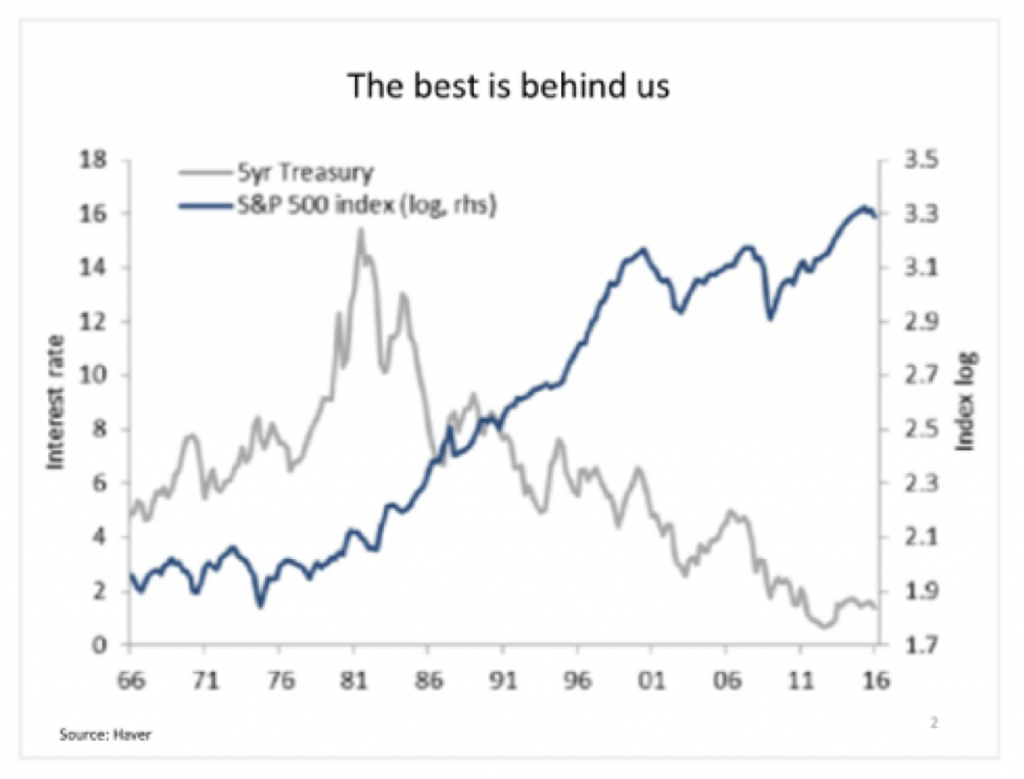

“Back in 1981, the risk free rate of return as represented by 5-year treasuries, was 15 per cent. Real rates were close to 5 per cent. Assets were priced very cheaply to compete with high risk free rates. What ensued was one of the greatest bull markets in financial history.

In addition the 15 per cent hurdle rate forced companies to invest capital wisely and where necessary restructure.

So how can precisely the opposite environment to that which existed in 1981 also be a great investment environment?”

The chart above illustrates the inverse relationship that exists between interest rates and stock market returns. This makes sense because lower interest rates increase the present value of future cash flows, the sum of which represents the intrinsic value of that asset. Interest rates do indeed act like gravity on the values of all assets. The lower the interest rate, the weaker the gravitational pull on asset values and prices.

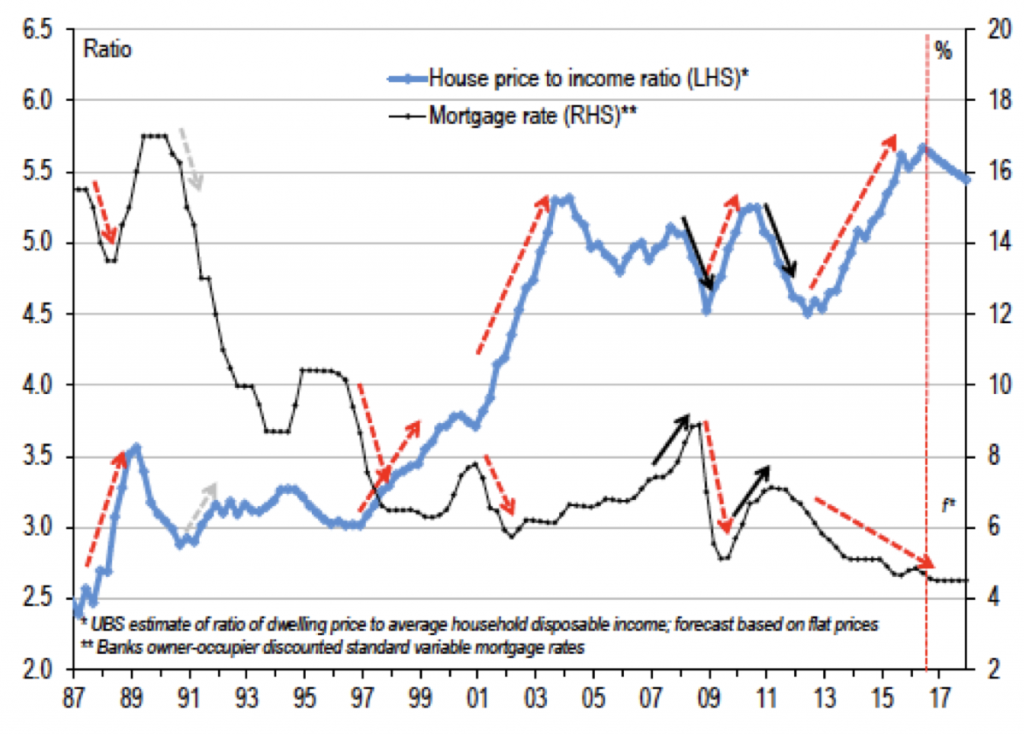

We thought the second chart, produced by UBS of the Australian property market was strikingly similar to that presented by Stan Druckenmiller.

As mortgage interest rates in Australia have declined from more than 18 per cent in the late 1980s to just on 4 per cent today (remember inverse relationship between interest rates and asset values and prices), house prices have become more expensive relative to incomes.

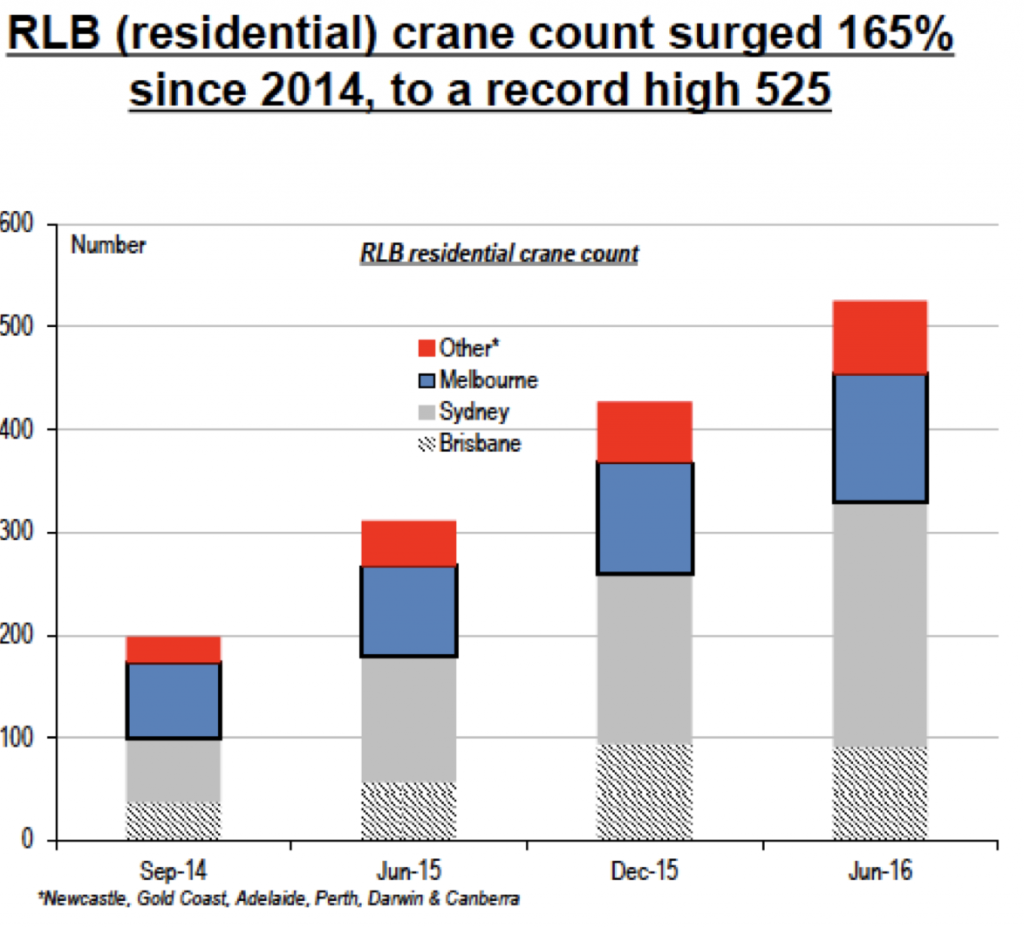

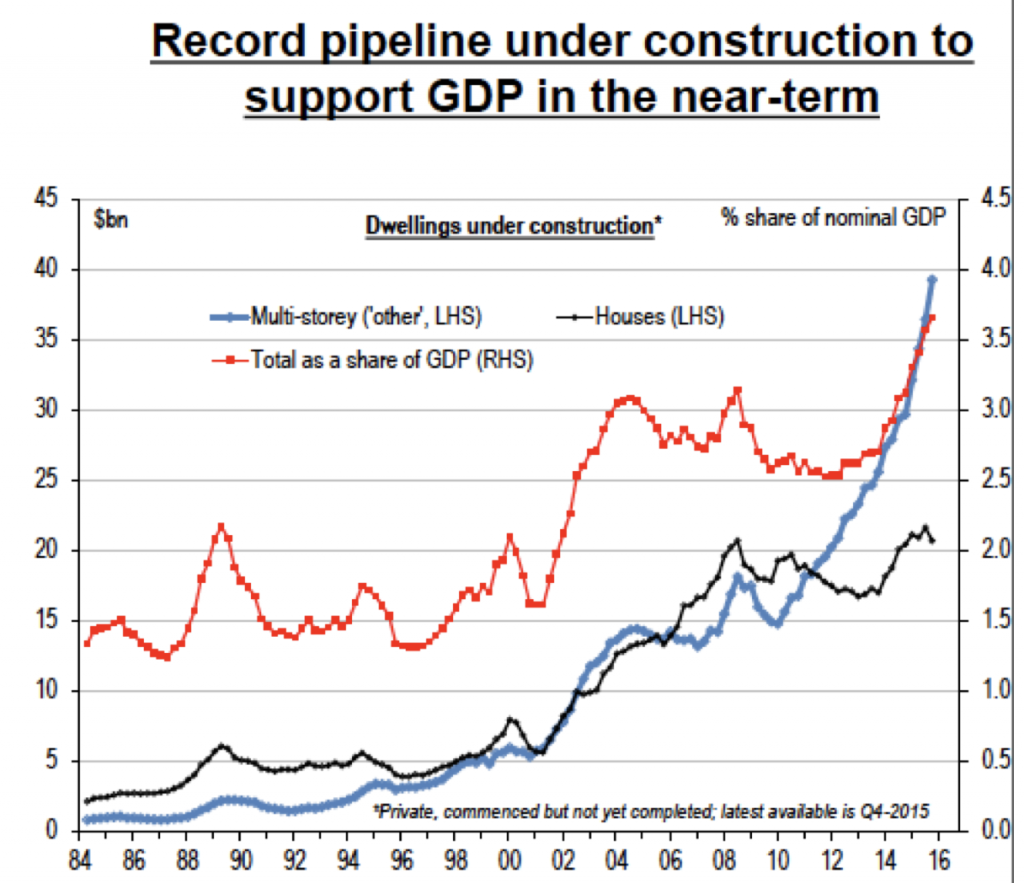

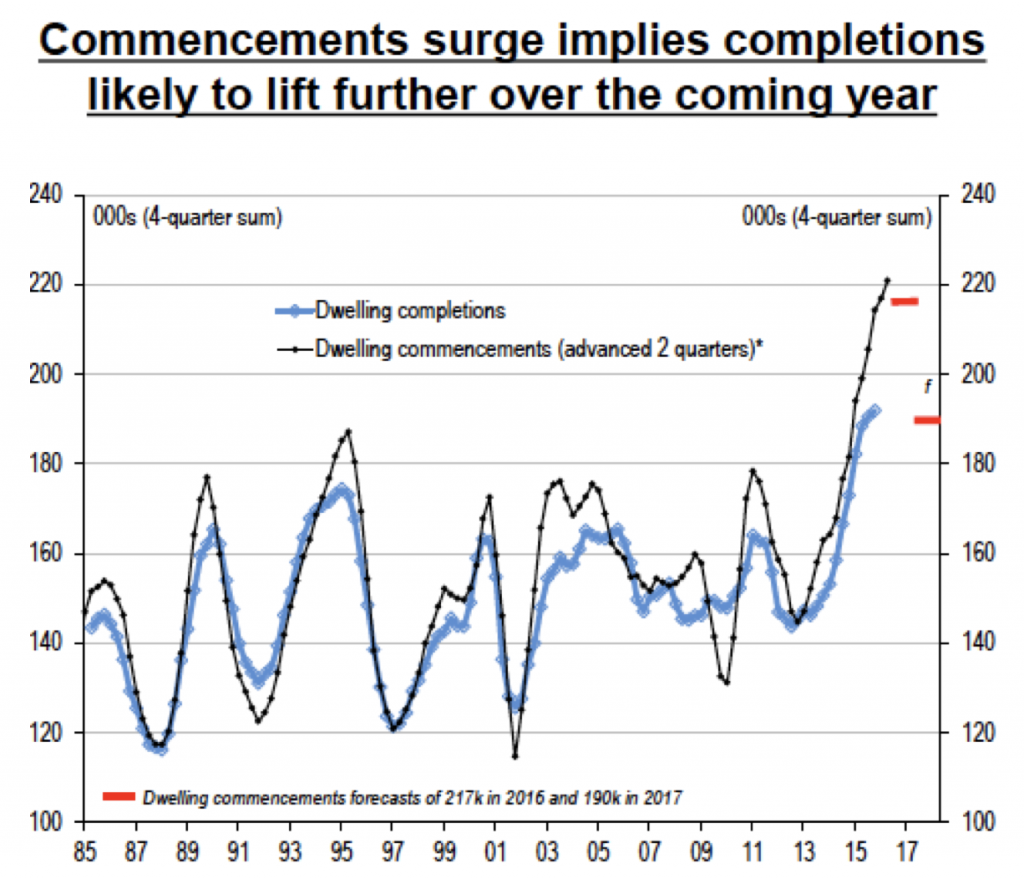

Our apartment oversupply thesis, combined with failed settlements, convinces us that it will be developers trying to move unsold stock to meet their own debt obligations that will cause lower apartment prices. The three final charts produced by UBS also suggest that the best is behind us when it comes to broad aggregate gains for residential real estate prices.

If you are genuinely interested in just how many apartments were pre-purchased over the last few years and are due to settle in the next 12 and 24 months, click here.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

Well put together article Roger, I assume most of the S&P 500 boom 1976-2001 was due to a credit expansion, which economic history would suggest the next 25 years would be flat. 15 years in and it looks that way.

Shame the Aus government cant work out how to smooth out the mining and property cycles, 3 years terms dont help, boom bust might be better for government and the high net worth people (who control media & government).

Just have to wait for the black swan trigger. Who knows what that event is though, and when it will come. Just get me a Tesla with autopilot mode and have dedicated lanes for driverless cars with higher speed limits. Could live anywhere if the commute was quick enough.

Great article on the Australian property market as always Roger.

What strikes me the most from the above charts is the substantial increase in crane count in Sydney over the space of only two years. Can the relative undersupply of apartments in Sydney v Melbourne justify a three to four-fold increase in crane count?

If that doesn’t look like a bubble I don’t know what does.