Wonderful companies at wonderful prices?

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”1 This well-worn adage from Warren Buffett has guided our investment approach for over thirty years and is the title of a piece we published in 2018.2 Given recent market conditions, we’ve chosen to revisit this concept.

Our goal to invest in “wonderful companies” never changes. However, what can change in rare instances is that “fair prices” for these high-quality businesses can occasionally become “wonderful prices.” We have always accepted that premium companies, like the ones in which we invest, may command premium valuations because, in our experience, Mr. Market3 tends to be fairly efficient most of the time. We say “most of the time” because now and then, we believe Mr. Market can overreact, creating opportunities to invest in these “wonderful” companies, but at prices that we would view as not just fair but increasingly “wonderful.” We could potentially be amid such an opportunity.

The Catalyst for Compression

In November 2021, the U.S. Federal Reserve surprised the market by stating its willingness to tighten monetary policy “sooner than participants currently anticipated if inflation continued to run higher than levels consistent with the Committee’s objectives.”4 In other words, the Fed signaled that inflation might not be as transitory as it previously thought and, consequently, may have to raise interest rates quicker than expected.

Since then, many of what we view as wonderful companies with higher valuations have seen their price-to-earnings (P/E) multiples compress substantially. During calendar year 2022, 21 holdings across the three Polen Large Company Growth strategies5 saw their P/E next twelve months (NTM) contract by 30 per cent or more.6 This valuation contraction converged with decelerating revenue growth for many companies lapping the substantial growth rates they saw during the COVID-19 pandemic. Add on the macro fears around persistent inflation, and it’s been a rough go for the stock prices of some of our portfolio companies over the past few months. And while some level of underperformance is understandable, particularly in cases where growth rates have moderated, it’s starting to feel to us that Mr. Market is painting both the “wonderful” and the “fair” companies with an equally broad brush.

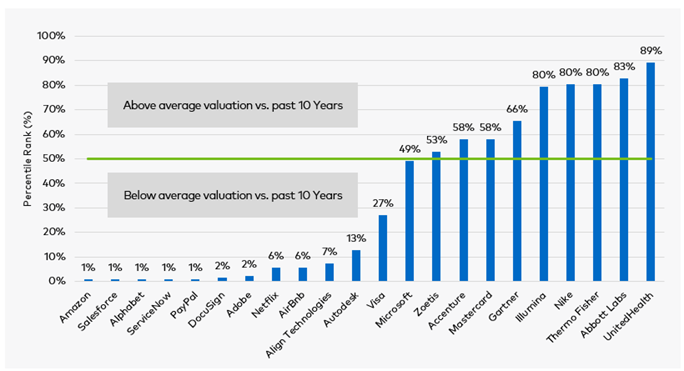

This observation is supported by the current valuations in our Focus Growth Portfolio. As shown in the chart below, at year-end 2022, ten holdings, representing approximately half of the portfolio by weight, were trading in the bottom decile of their 10-year forward P/E range and five holdings were trading in the bottom one percentile of this same range. This is despite the fact that the median EPS growth rate for 2023 of this same group of ten companies, per sell-side consensus from Factset, is currently 13 per cent, a level of growth that we view as attractive given recent concerns around a recession in the U.S. this year. And even if this consensus EPS forecast proves to be overly optimistic, we still view all of these businesses as having durable competitive advantages that we believe can enable each of them to generate annualized double-digit EPS growth over the next three to five years.

Forward 1-Year P/E, current vs. past 10 years (or IPO date) — percentile rank

Source: Polen Capital, Bloomberg. Reflects all Focus Growth portfolio holdings as of 12-31-2022. Chart shows how Fwd 1-Yr P/E on 12-31-2022 compares to monthly observations going back 10 years, or to a given company’s IPO date. Data is expressed as a percentile rank, where 0% would indicate the least expensive a company has been vs the past 10 years and 100% is the most expensive. Please note Airbnb goes back to 9-30-2021; PayPal goes back to when it was spun out of eBay, 7-31-2015; Zoetis goes back to 3-31-2013; and DocuSign goes back to 6-30-2018. All other securities go back 10 years. Please see the Disclosures section for additional information.

Key Lesson for Investors

We’ve witnessed the valuations of many high-quality growth companies compress over the past year, substantially in some instances. We’ve sought to look beyond today’s noise, using our fundamental, rational analysis to lean into our highest conviction ideas for the next three-to-five years. In the near term, significant P/E multiple compression can create performance headwinds and volatility, even for the high-quality businesses in which we seek to invest. But for patient investors, we believe this period is a reminder that Mr. Market can occasionally offer the unemotional investor “wonderful” types of companies at increasingly “wonderful” prices.

Past performance does not guarantee future results and profitable results cannot be guaranteed.

1 Buffett, Warren. Berkshire Hathaway Shareholder Letter, 1989. https://www.berkshirehathaway.com/letters/1989.html

2 The original article “Wonderful Companies at Fair Prices,” is available upon request.

3 “Mr. Market” is a term coined by another legendary investor, Benjamin Graham, in his 1949 book, The Intelligent Investor. It personifies the equity market as a hypothetical investor who can be driven by emotions at the expense of rational analysis.

4 “Minutes of the Federal Open Market Committee”, November 2-3, 2021. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20211103.pdf

5 Polen Focus, Global, and International Growth strategies.

6 We included Shopify, owned in the Polen International Growth portfolio, in this group of holdings. In this case of Shopify we utilized NTM Price/Sales instead of NTM Price/Earnings. This was due to the fact that Shopify’s EPS over the measured period is negative and thus skews its data. In our view, Price/Sales still properly captures the contraction in valuation for the stock price for the period.